By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

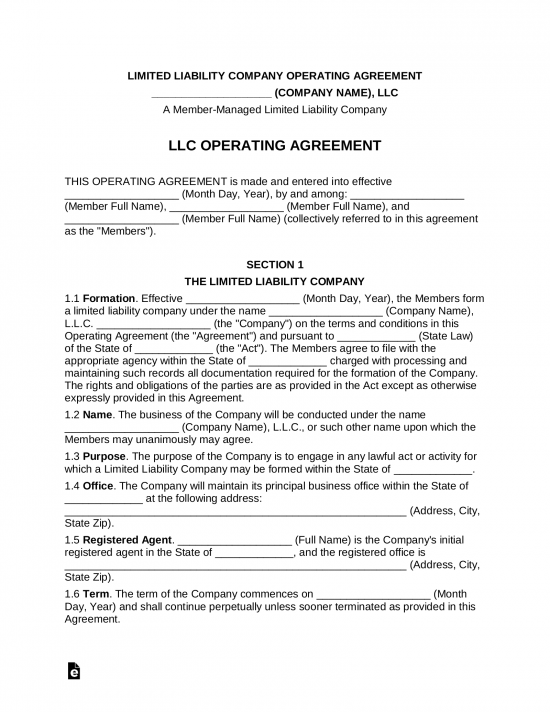

By Type (2)

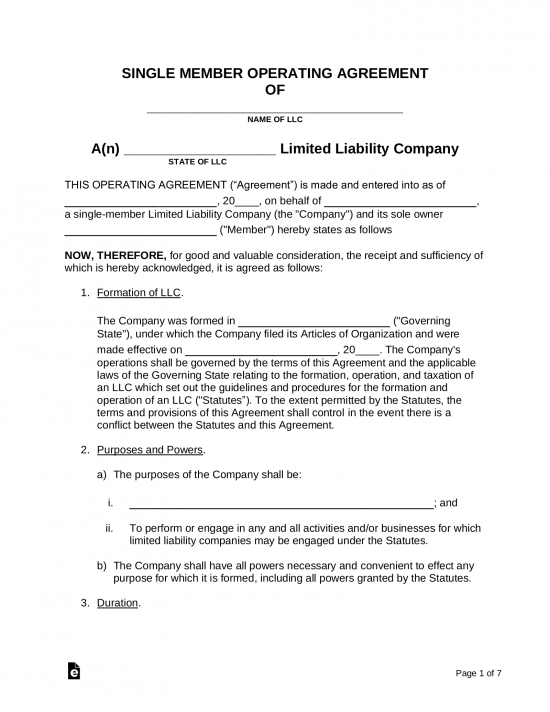

Single-Member Operating Agreement – To be used by an LLC with only one owner.

Single-Member Operating Agreement – To be used by an LLC with only one owner.

Download: PDF, MS Word, OpenDocument

Multi-Member Operating Agreement – To be used by an LLC with more than one owner.

Download: PDF, MS Word, OpenDocument

What is an LLC Operating Agreement?

An LLC operating agreement is a document that governs and outlines a company’s ownership structure, management rules, and operational guidelines.

It is commonly a required document when conducting financial activities to show members who own 25% or more of the company (beneficial owners).[1]

Is it Required?

An operating agreement in Alabama[2], California[3], Delaware[4], Maine[5], Missouri[6], or New York[7][8].

In the other 44 states, it is not required but highly recommended to be recorded among the members of an LLC.

Definition (Cornell Law)

Governing contract adopted by members of a Limited Liability Company (LLC). It may be used to regulate nearly all aspects of the LLC’s affairs, including how the business is managed, how assets are used and how revenues are shared. An operating agreement will override any default rules presented by a state LLC statute, which controls in the absence of an operating agreement.[9]

Video

What to Include? (9 items)

1. Business Details

Enter the details of the business, such as:

- Name of LLC;

- Principal office address;

- Business purpose;

- Registered agent;

- State of formation; and the

- Date of formation.

2. Member’s Ownership

List each member’s name and their ownership interest. This should be expressed as a percentage (%) or units.

If ownership can change in the future, such as raising money, the terms for such a change must be mentioned.

3. Management (2 ways)

Decide whether the LLC is managed by its members (more common) or a manager. In either case, decide the roles and responsibilities of each individual.

4. Member Contributions

A capital contribution is a member’s initial or subsequent investment into the LLC that may increase their ownership or interest in the entity. Examples include cash, property, or services given to the entity.[10]

A loan to the LLC is not usually considered a capital contribution.

5. Tax Classification

Enter one of the following tax classifications:[11]

- Partnership (default) – By default, an LLC will be taxed as a disregarded entity (if one member) or partnership (if two or more members). This means that profits of the LLC “pass-through” to each owner’s personal income based on ownership.

- S-Corporation – Allows the members to be paid salaries as an expense to the LLC, which helps reduce self-employment taxes. To qualify, IRS Form 2553 must be filed within the first 75 days after formation.

- C-Corporation – Allows the entity to offer multiple stock classes for investment and allows for more than 100 shareholders (S-Corporation is limited to 100). However, a C-Corporation is subject to double-taxation of profits (at the corporate level and at the personal level for each owner). To qualify, IRS Form 2553 must be filed within the first 75 days after formation.

6. Decision-Making Process

Decide how business decisions are made by choosing the voting process. Most companies will choose one of the following:

- Majority Vote – When over 50% of the members agree.

- Super-Majority Vote – When a higher threshold of the members must agree, such as two-thirds (66%) or three-quarters (75%) of the members.

- Unanimous Vote – All members (100%) must agree.

Also, an LLC can choose to have different decision types depending on the business matter.

7. Meetings & Voting Rights

Depending on the State, an LLC may be required to have at least one meeting per year. An operating agreement should mention how meetings can be requested by members and how votes will be cast (which are recorded in the meeting minutes).

8. Transferring Ownership Interest

Describe the rules for a member’s ability to sell their ownership. For example, it is common to allow other members an option to purchase a member’s interest if a member decides to sell to an outside party.

9. Disputes

Create a process for settling disputes between the members. A popular arrangement requires the parties to negotiate for a specified number of days. If that doesn’t resolve the issue, the parties will go to mediation, arbitration, and litigation (as a last resort).

Disputes often disrupt an ongoing business. Therefore, it’s best to have a process that motivates each party to resolve quickly.

Sample

Download: PDF, MS Word, OpenDocument

LLC OPERATING AGREEMENT

OF

[NAME OF COMPANY], LLC

I. THE COMPANY. This LLC Operating Agreement (“Agreement”) is made this [DATE], for the following:

Name: [NAME OF COMPANY] (“LLC”)

Date Formed: [DATE]

State of Formation: [STATE]

II. THE MEMBERS. The LLC is a: (check one)

☐ – Single-Member LLC. The sole owner of the LLC shall be:

Member: [NAME]

Mailing Address: [ADDRESS]

Ownership: [#]%

☐ – Multi-Member LLC. The owners of the LLC shall be:

Member #1: [MEMBER’S NAME]

Mailing Address: [ADDRESS]

Ownership: [#]%

Member #2: [MEMBER’S NAME]

Mailing Address: [ADDRESS]

Ownership: [#]%

Member #3: [MEMBER’S NAME]

Mailing Address: [ADDRESS]

Ownership: [#]%

Hereinafter known as the “Members.”

III. TERMS.

a.) Principal Place of Business. [ADDRESS] shall be known as the principal place of business of the LLC.

b.) Registered Agent. [NAME] shall be known as the “Registered Agent” with a mailing address of [ADDRESS]. The Registered Agent shall hold the rights and responsibilities granted to them allowed under state law.

c.) Management. The management of the LLC shall be decided by its Members to handle the following matters:

i.) Managers. To decide if a Manager or which Members shall run the day-to-day activities of the LLC;

ii.) Dissolution and Liquidation. Any dissolution or liquidation of the LLC’s assets or property;

iii.) Accounting. Accurate books and records of the LLC that includes providing necessary documents for the Members iv.) to file taxes in a timely manner;

iv.) Distributions. Any disbursing of money from LLC profits or cash accounts to the Members;

v.) Annual Meeting. The Members of the LLC agreement to meet on an annual basis with the details of the meeting to be made with 30 days’ notice;

vi.) Withdraw. To decide whether Members can withdraw themselves from the LLC;

vii.) Assignment. To admit new Members of the LLC;

viii.) Amendments. To alter, amend, or change this Agreement.

d.) Purpose. The purpose of the LLC is to engage in lawful business activity for the benefit of its Members and the general public.

e.) Governing Law. The LLC shall operate and run its business activities in accordance with the laws located in the state of formation.

f.) Indemnification. None of the Members shall bear the responsibility, obligations, or liabilities of the LLC or others who may act on the LLC’s behalf.

g.) Capital Contributions. Any capital contributions made shall be attached to this Agreement and signed by the Members.

h.) Term. The LLC shall operate on a perpetual basis with no end date unless decided upon by the Members.

i.) Severability. If any provision of this Agreement shall be invalid or unenforceable, such invalidity or unenforceability shall not affect the other provisions of this Agreement, which shall remain in full force and effect.

This Agreement sets forth the entire and sole agreement between the Members hereto with respect to the subject matter hereof and shall be considered legally binding upon execution.

Member Signature: _____________________________ Date: ______________

Print Name: _____________________________

Member Signature: _____________________________ Date: ______________

Print Name: _____________________________

Member Signature: _____________________________ Date: ______________

Print Name: _____________________________

Sources

- 31 CFR 1010.230(d)(1)

- Section 10A-5A-2.01(d)

- CORP § 17701.13(d)(5)

- § 18-201(d)

- § 1531(1)(B)

- § 347.081

- Ch. 34, Art. 4, § 417

- Dept. of State (Forming an LLC in NY)

- www.law.cornell.edu/wex/operating_agreement

- www.law.cornell.edu/wex/contribution

- www.sba.gov/business-guide/launch-your-business/choose-business-structure