Updated June 02, 2022

A New Hampshire tax (Dept. of Revenue) power of attorney (Form DP 2848), otherwise known as “New Hampshire Department of Revenue Administration Power of Attorney Form,” is a document that can be used to appoint someone to represent you with the New Hampshire Department of Revenue Administration as well as other tax entities operating under New Hampshire jurisdiction. This form allows your agent to make filings, obtain information, and generally represent your interests in such matters.

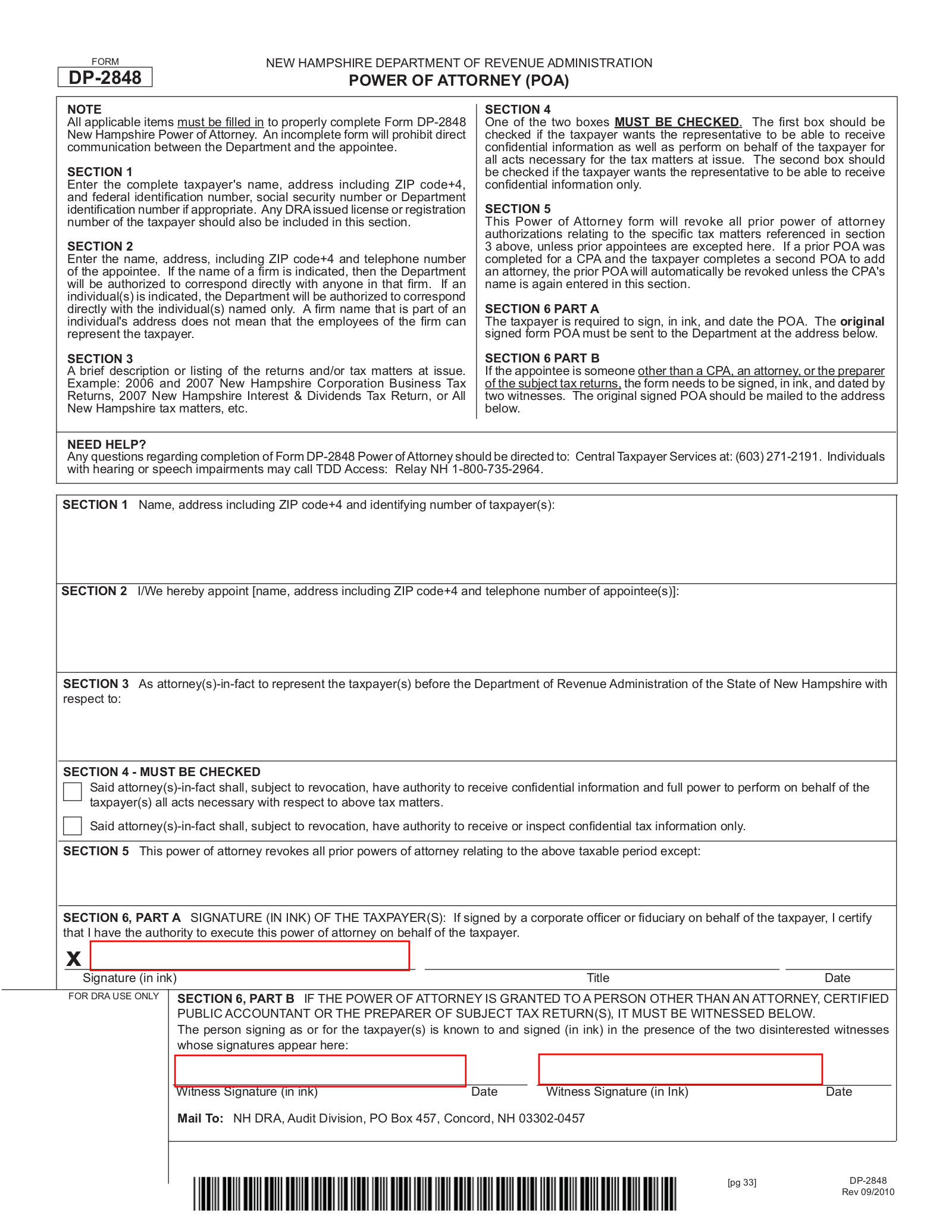

It is generally recommended to review this form before filling it out. The information requested on this form must be up-to-date and painstakingly accurate. Any discrepancies may cause a delay when filing this paperwork or even result in rejection. The authority the principal designates to the agent through this paperwork may be revoked (terminated) whenever the principal believes it is appropriate or when a newer appointment is made in the same tax matters.

How to Write

1 – Select The Button Beneath The Image To Download This Paperwork

A Taxpayer can name an Attorney-in-Fact as his or her Representative or Agent when dealing with some or all of his or her Tax Matters. To do so, he or she will need the form on this page to delegate such Principal Power. Find the preview image then select the button labeled “PDF” to open and download this document as a PDF file.

2 – The Taxpayer Granting Power Must Be Identified As The Principal

After downloading this form and reviewing the instructions, turn your attention to Section I. This box will have several requirements. You will need to completely identify the Principal Taxpayer granting Principal Authority by supplying the Principal’s First Name, Middle Name, and Last Name. Continue this documentation by entering the Principal’s Physical Street Address. This should be his or her Residential Address. Then, supply the Principal’s Daytime Telephone Number. Once these tasks are complete provide the Principal’s Social Security Number, Taxpayer Identification Number, and/or any other I.D. Number Tax entities associated with the Principal.

3 – The Attorney-in-Fact Must Be Positively Identified To Assume Principal Authority

The next section will allow the Principal Taxpayer to specify the individual or firm he or she wishes to appoint with Principal Authority regarding his or her Taxes. The box in section 2 will require the Attorney-in-Fact’s Name, Street Address, City, State, Zip Code (+4 digit), Contact Telephone Number, and any Identification Number he or she is known as privately and professionally. Keep in mind that while a Firm can be named, a firm possessing an Attorney-in-Fact’s Name will not be considered part of this appointment unless otherwise indicated.

4 – Record The Purpose Of Appointing Principal Authority To the Attorney-in-Fact

In section 3, we will focus on the reason the Attorney-in-Fact is being granted Principal Power. That is, what Tax Matters does the Principal wish the Attorney-in-Fact to represent him or her. List the Tax Matters (i.e. Payroll, Bankruptcy, etc.) and any Tax Form the Attorney-in-Fact may effect in this box. Make sure you specify the time period(s) or year(s) the Attorney-in-Fact will be able to wield Principal Power in as well. This should be a concise but complete description of where the Attorney-in-Fact can wield Principal Power.

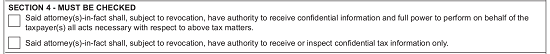

5 – Indicate The Level Of Principal Power To Be Assigned To The Attorney-in-Fact

It is imperative to this form’s purpose the extent of the Attorney-in-Fact’s Principal Power is definitively reported. Two check boxes have been provided in Section 4 to accomplish this task. It the Attorney-in-Fact may receive confidential information, make decisions, and take actions regarding the Tax Matters defined in Section 3 in the name of the Principal then mark the first check box. If the Attorney-in-Fact may only receive or inspect the Taxpayer’s Confidential Information but not take action, then mark the second check box.

6 – Specify The Status Of Previous Powers At This Appointment’s Execution

In many instances, there may be other documents issued to delegate the Principal’s Authority to an Agent or Attorney-in-Fact. Generally speaking, this document’s execution will automatically revoke any such appointments regarding the Tax Matters named above. If the Principal wishes a previous Power of Attorney to remain in effect despite this document’s execution, the Title of that Power Document must be recorded in Section 5. A copy of the previous Power of Attorney to remain unaffected by this document should be attached to this form.![]()

7 – The Principal Taxpayer Act of Signing Is Required To Execute This Form

The Principal Taxpayer must provide a solid verification of this form’s authenticity. This can only be achieved with his or her Signature. The Principal Taxpayer must sign the blank line labeled “Signature (In Ink),” report any “Title” considered part of his or her Name, and record the Calendar Date he or she has signed this form (at the time of signing).

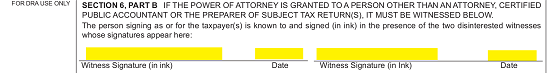

If the Attorney-in-Fact is not a licensed professional (Attorney, CPA, or Preparer Of Subject Tax Returns”), then two Witnesses will need to sign Section 6, Part B, and provide the Date of Signature. Each Witness must sign and date a unique line.