Updated April 16, 2024

A power of attorney (POA) form is a legal document that authorizes an individual (principal) to appoint someone else (agent) to make decisions and handle affairs on their behalf. Once signed, an agent can legally handle financial, medical, guardianship, and tax-related matters.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

By Type (12)

- Durable (Financial)

- Advance Directive

- General (Non-Durable)

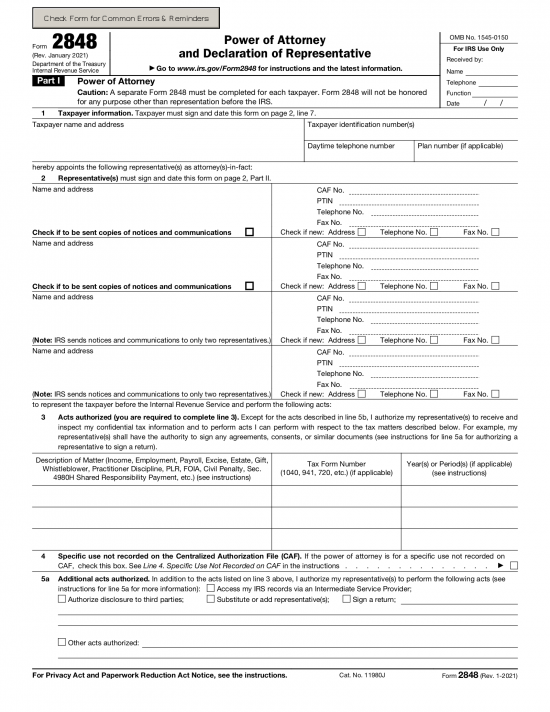

- IRS (Form 2848)

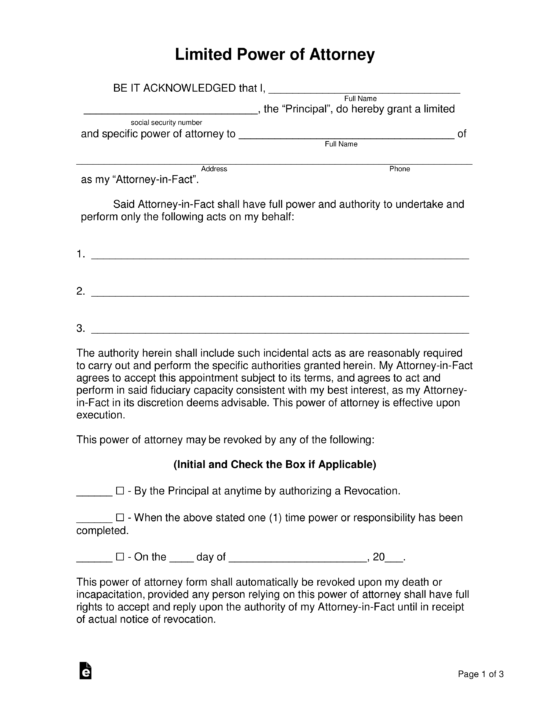

- Limited (Special)

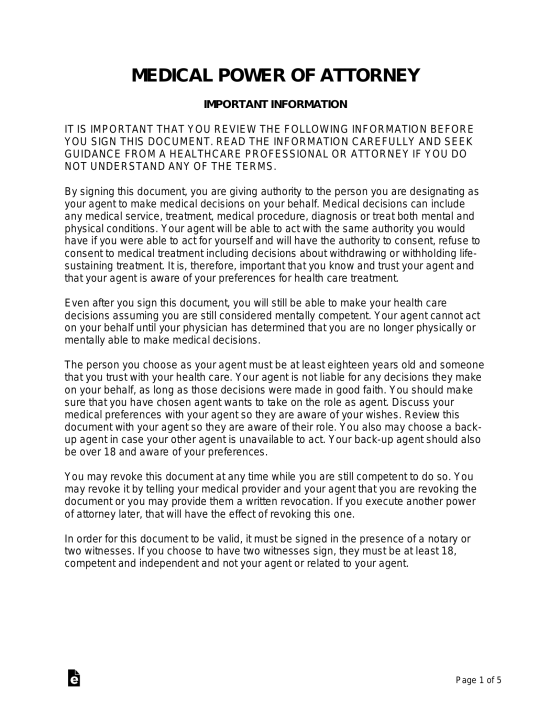

- Medical (Health Care)

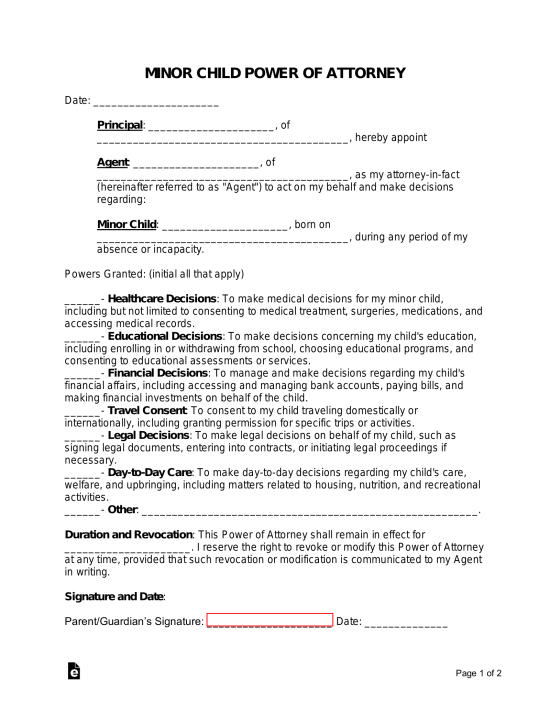

- Minor (Child)

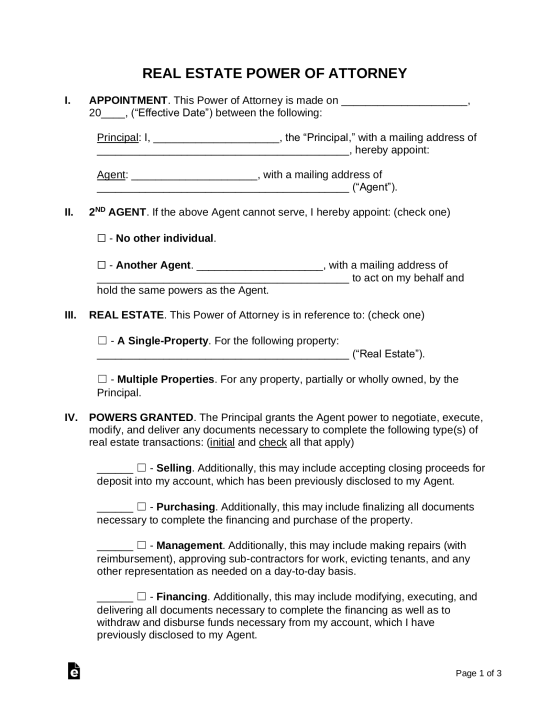

- Real Estate (Property)

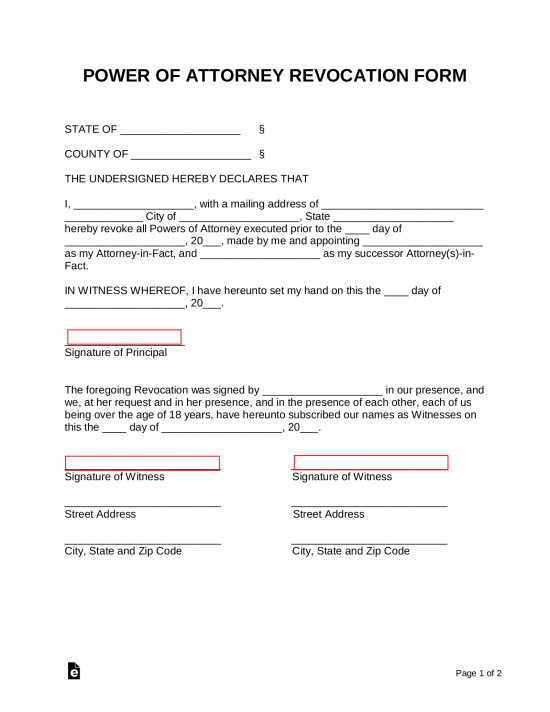

- Revocation (Terminate a POA)

- State Tax (POA)

- Uniform Power of Attorney Act (UPOAA)

- Vehicle

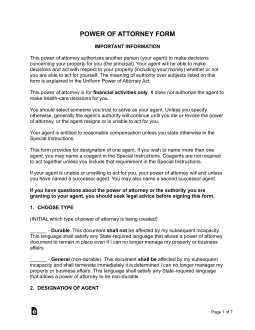

Durable (Financial) Power of Attorney – The most common type of power of attorney. It allows a person to give financial responsibility to someone else and continues if the principal becomes incapacitated. Durable (Financial) Power of Attorney – The most common type of power of attorney. It allows a person to give financial responsibility to someone else and continues if the principal becomes incapacitated.

|

Advance Directive – Used for health care planning and combines a medical power of attorney and a living will. Advance Directive – Used for health care planning and combines a medical power of attorney and a living will.

|

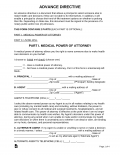

General (Non-Durable) Power of Attorney – Grants the same financial powers listed in the durable form except that it does not remain in effect if the principal becomes incapacitated or mentally disabled. General (Non-Durable) Power of Attorney – Grants the same financial powers listed in the durable form except that it does not remain in effect if the principal becomes incapacitated or mentally disabled.

|

IRS Power of Attorney (Form 2848) – Revised in Jan. 2021, allows an individual or business entity to elect a party, usually an accountant or tax attorney, to file federal taxes on their behalf. IRS Power of Attorney (Form 2848) – Revised in Jan. 2021, allows an individual or business entity to elect a party, usually an accountant or tax attorney, to file federal taxes on their behalf.

Download: PDF |

Limited Power of Attorney – Permits a person to carry out a specific activity on the principal’s behalf either as a one (1) time occurrence or for a specific period of time. Limited Power of Attorney – Permits a person to carry out a specific activity on the principal’s behalf either as a one (1) time occurrence or for a specific period of time.

|

Medical (Health Care) Power of Attorney – Used by an individual to select someone to handle their health care decisions in the chance they are not able to do so on their own. Medical (Health Care) Power of Attorney – Used by an individual to select someone to handle their health care decisions in the chance they are not able to do so on their own.

|

Minor (Child) Power of Attorney – A parent can give temporary custody of their child to someone else (typically 6-12 month maximum). Minor (Child) Power of Attorney – A parent can give temporary custody of their child to someone else (typically 6-12 month maximum).

|

Real Estate Power of Attorney – For a buyer or seller of a property that would like to hand over their rights in relation to handling the negotiation and transaction at closing. Real Estate Power of Attorney – For a buyer or seller of a property that would like to hand over their rights in relation to handling the negotiation and transaction at closing.

|

Revocation of Power of Attorney – To void a current power of attorney arrangement. Revocation of Power of Attorney – To void a current power of attorney arrangement.

|

State Tax Filing Power of Attorney – Used to elect a tax preparer to handle a filing on behalf of an individual or entity. Can be used for State or Federal filings. State Tax Filing Power of Attorney – Used to elect a tax preparer to handle a filing on behalf of an individual or entity. Can be used for State or Federal filings.

Download: (State Specific) |

Uniform Power of Attorney Act (UPOAA) Version – A standard (statutory) version used in 32 States. Uniform Power of Attorney Act (UPOAA) Version – A standard (statutory) version used in 32 States.

|

Vehicle Power of Attorney – Hands over authority over a vehicle. Allows an agent to handle DMV activities and transfer ownership. Vehicle Power of Attorney – Hands over authority over a vehicle. Allows an agent to handle DMV activities and transfer ownership.

|

What is Power of Attorney?

Power of attorney designates an individual (agent) to handle someone else’s affairs (principal) for a fixed or indefinite time period.

“Durable,” the most common type, allows an agent to remain active if the principal becomes incapacitated.

A principal can appoint any person they want to be their agent. Once selected, the agent can do an innumerable amount of tasks for the principal as long as permission is granted in the power of attorney document.

Legal Definition

Power of attorney” means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used.

Source: Uniform Power of Attorney Act (UPOAA), Section 102(7) (page 8):

How to Get Power of Attorney (5 steps)

- Choosing a Power of Attorney

- Selecting an Agent

- Writing the Form

- Signing with Witnesses

- Storing and Availability

1. Choosing a Power of Attorney

Choose the power of attorney document based on the principal’s needs. It is common to complete multiple types to cover financial and medical related decisions.

End-of-Life Decisions

For handling end-of-life decisions, completing a Durable Power of Attorney and an Advance Directive is recommended.

3. Writing the Form

A power of attorney document can be completed by the principal or with a lawyer (recommended).

Estate Planning

It is common to complete other estate planning documents while making a power of attorney, such as creating a last will and testament or living trust.

Signing as the Agent

When the agent signs documents on behalf of the principal, they should sign in the following manner:

[Principal’s Name], by [Agent’s Name], Attorney-in-Fact

Sample

POWER OF ATTORNEY

I, [PRINCIPAL’S NAME], residing at [PRINCIPAL’S ADDRESS], hereby appoint [AGENT’S NAME], residing at [AGENT’S ADDRESS], as my attorney-in-fact (hereinafter referred to as “Agent”) to act on my behalf in the following matters:

(initial all that apply)

- _____ – Financial Matters: To manage, control, and make decisions regarding my finances and property, including but not limited to banking transactions, investments, real estate transactions, and tax matters.

- _____ – Healthcare Decisions: To make decisions concerning my medical care, treatment options, and healthcare services, including the authority to consent to or refuse medical treatment, surgery, or hospitalization on my behalf.

- _____ – Legal Affairs: To handle legal matters and represent me in legal proceedings, including signing legal documents, contracts and agreements, and engaging legal counsel on my behalf.

- _____ – Personal Affairs: To manage and make decisions regarding my personal affairs, including accessing and managing personal records, obtaining government benefits, and handling day-to-day matters as necessary.

- _____ – Other Powers: [DESCRIBE]

This Power of Attorney shall remain in effect in the event of my: (check one)

☐ – Incapacitation. Therefore, this form is not durable.

☐ – Death. Therefore, this form is durable.

Signature and Date:

Principal’s Signature: _____________________ Date: ______________

Witnesses:

Witness #1 Signature: _____________________ Date: ______________

Witness #2 Signature: _____________________ Date: ______________

Agent Acceptance:

I, the aforementioned Agent named herein, accept the responsibilities and duties as the attorney-in-fact for the principal under this Power of Attorney.

Agent’s Signature: _____________________ Date: ______________