Updated March 09, 2024

A living trust is a legal document that allows an individual (grantor) to place assets under the management of a trustee, who can be the grantor or another party. The trustee is responsible for safeguarding the trust’s assets during the grantor’s lifetime. The trust’s assets will be transferred to the beneficiaries upon the grantor’s death.

Also known as an ‘inter vivos trust.’

4 Roles

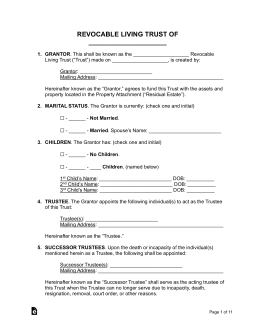

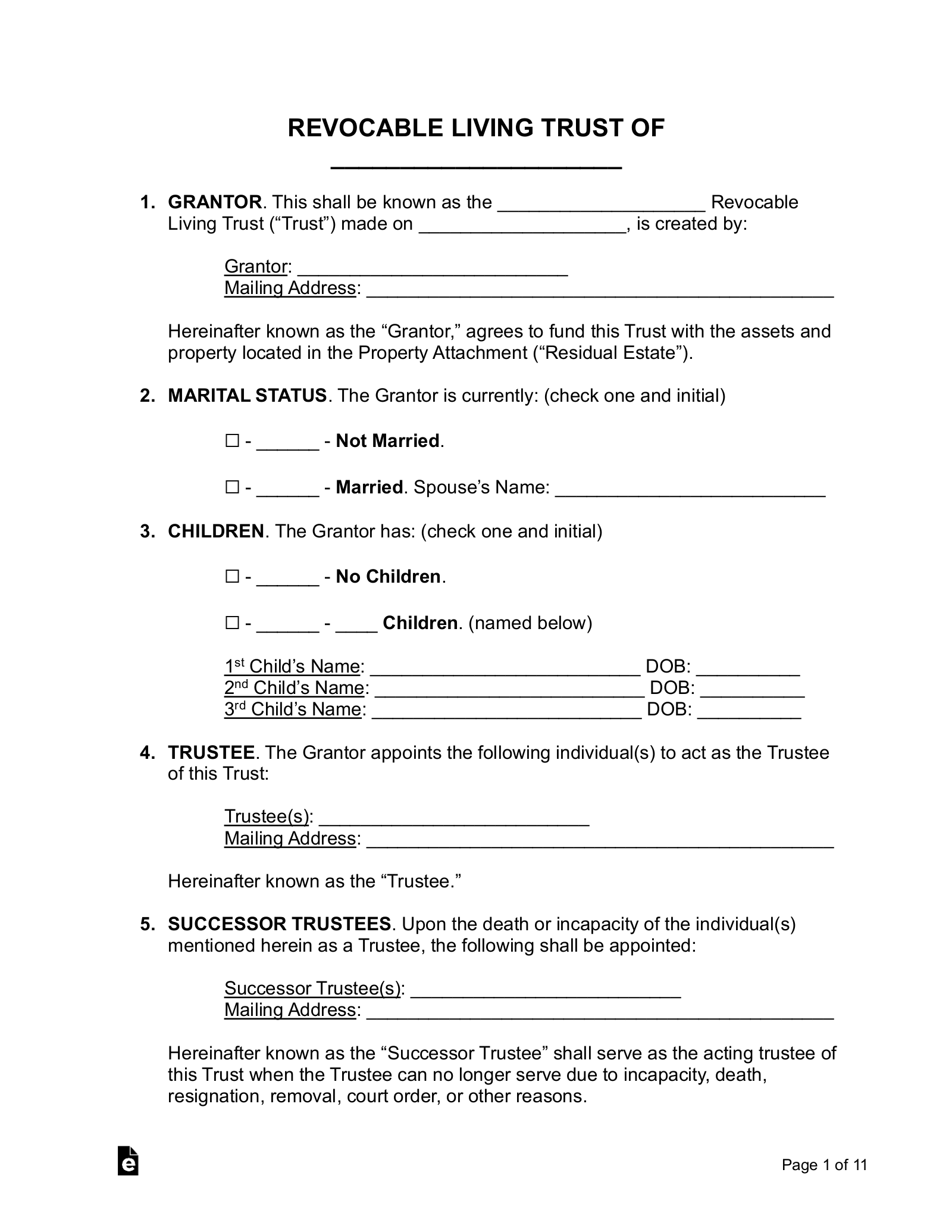

- Grantor. The individual creating and funding the trust.

- Trustee. Manages the trust’s assets during the grantor’s lifetime (often the same person as the grantor).

- Successor Trustee. Manages the trust’s assets if the trustee dies or becomes incapacitated. Commonly, the successor trustee’s role is to distribute and transfer the trust’s assets to the beneficiaries.

- Beneficiaries. Individuals (or organizations) that receive the trust’s assets.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

How to Create a Living Trust (6 steps)

1. Identifying Property

The grantor should take an inventory of the properties to be entered into the trust. This should include all real estate, personal property, retirement accounts, business interests, and any other valuables the grantor owns.

Property Must be SPECIFICALLY Mentioned

Unless property and assets are specifically entered into a living trust, they will not become part of it.

2. Choosing Trustees

A trust will commonly have two types of trustees:

- Initial Trustee: Manages the trust during the grantor’s lifetime. For revocable trusts, this is commonly the grantor.

- Successor Trustee: Manages the trust if the grantor becomes incapacitated or dies. They will be responsible for distributing the property and assets of the trust to the beneficiaries.

Successor Trustee (recommendation)

It is recommended that the successor trustee be a beneficiary of the trust. Therefore, if decisions need to be made prior to distribution, the motivation will be to make them in the best interests of the trust.

3. Selecting Beneficiaries

The beneficiaries are the individuals who will inherit the trust’s property after the grantor’s death. They are usually the spouse or family members of the grantor.

Who can be a Beneficiary?

A beneficiary can be any person (born or unborn) or organization legally permitted to hold an interest in property. If a grantor wants to give a portion of the trust’s property to a pet, a pet trust can be created within the trust document.

4. Signing

Most states do not have signing requirements. However, to prove a living trust was created, it is recommended to be signed by two witnesses and a notary public.

When signing, the grantor is recommended to use a self-proving affidavit.

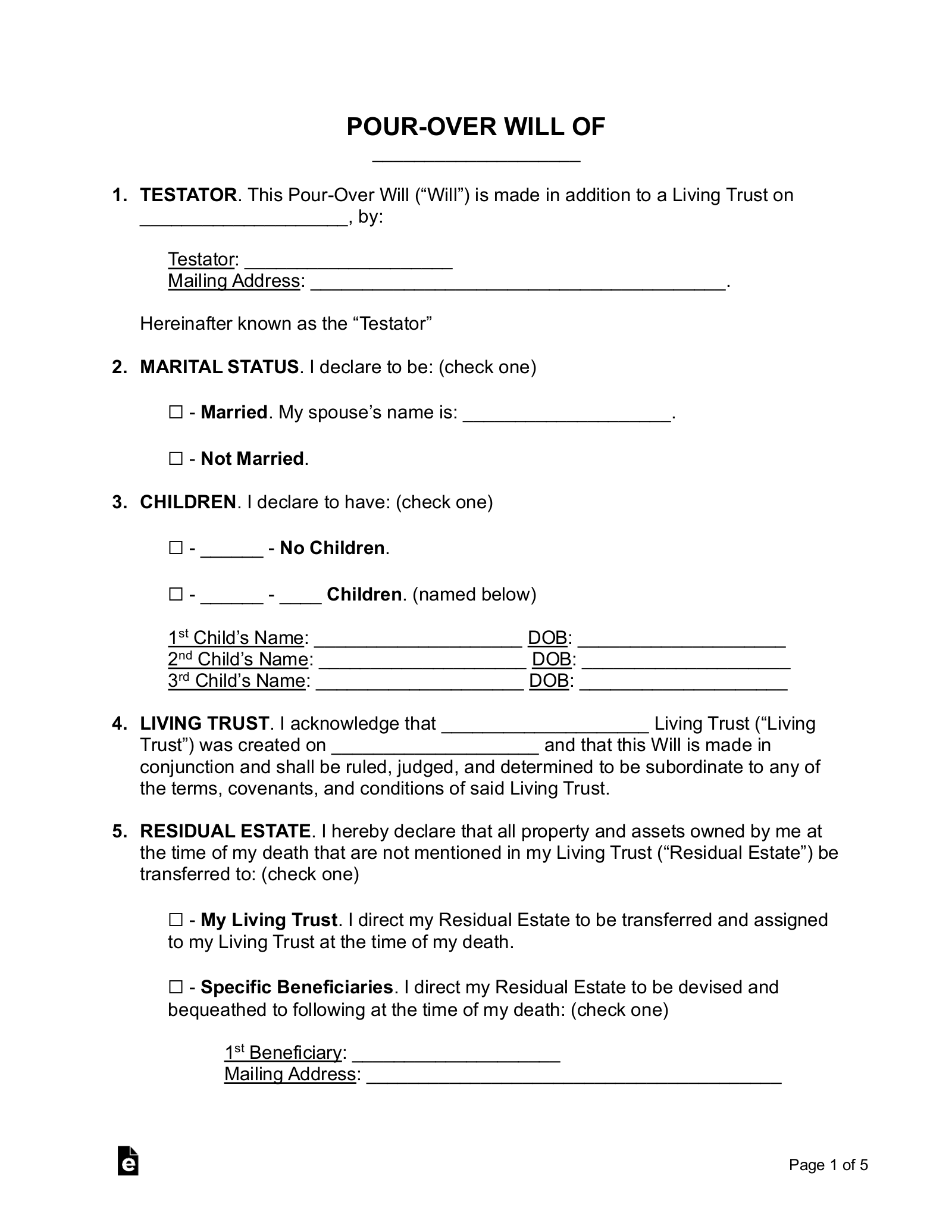

Pour-Over Will

It is recommended to authorize a pour-over will after completing a living trust. This allows for any assets not mentioned in the living trust to transfer to the same (or different) beneficiaries.

Trusts: Revocable vs Irrevocable

| Revocable Trust | Irrevocable Trust | |

| Does the Trust avoid the probate process? |  |

|

| Can amend or revoke the Trust? |  |

|

| Beneficiaries MUST pay estate taxes? |  |

|

| Grantor MUST pay income taxes during their lifetime? |  |

|

| Grantor is LIABLE for actions made by the Trust? |  |

|

Revocable Living Trust vs. Last Will and Testament

| Revocable Trust | Last Will and Testament | |

| Probate Process Required? | No | Yes |

| Create a Trust for Minors? | Allowed | Allowed |

| Choose a Guardian for Minors? | Not allowed | Allowed |

| Is this a public document? | No, unless there are registration requirements under State law that allows the document to be viewable. | Yes, when the probate process begins. |

| What happens when the creator becomes incapacitated? | The successor trustee steps in to handle the Trusts’s assets. | A court will have to appoint someone to oversee the Grantor’s assets (unless appointed in a durable power of attorney). |