Updated January 25, 2024

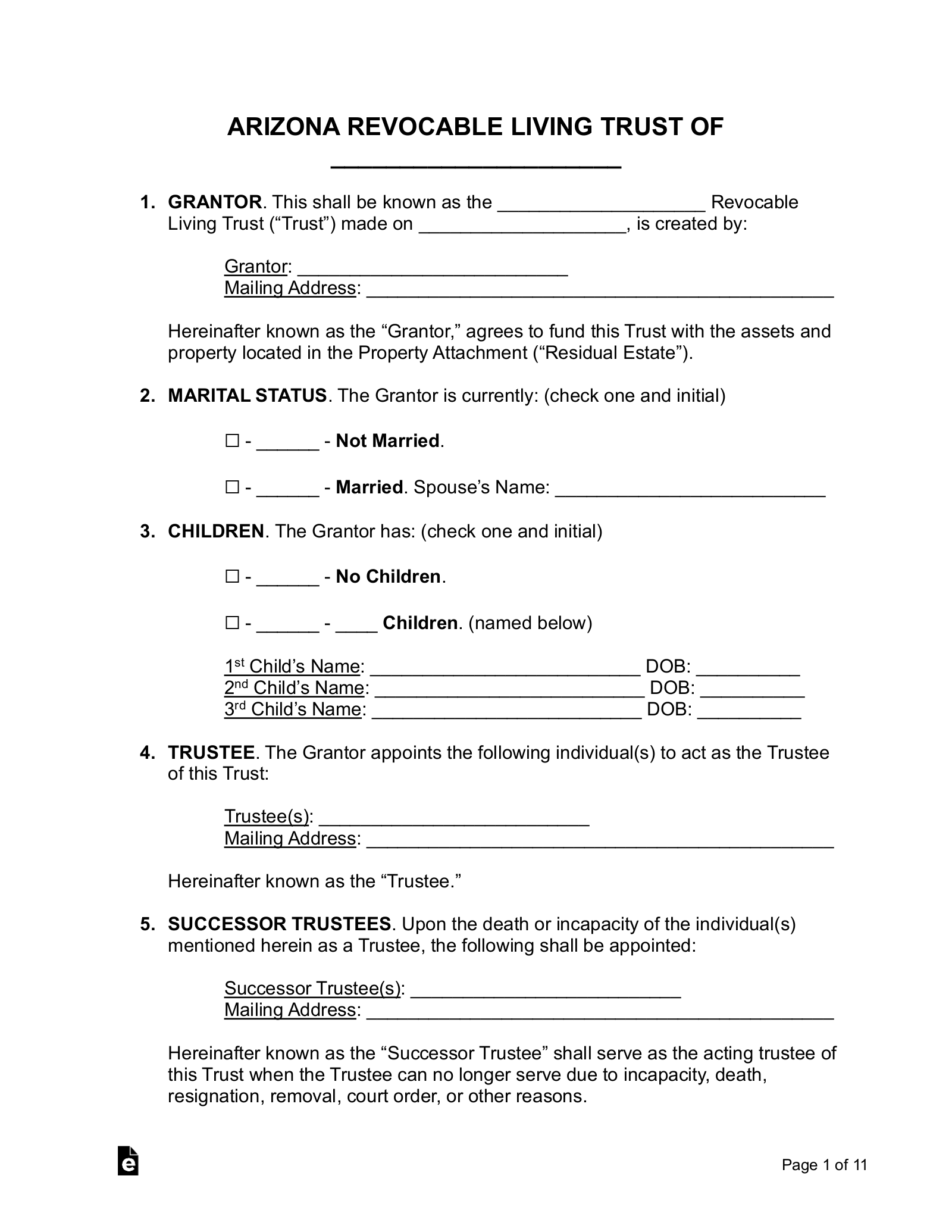

An Arizona living trust is a probate document that allows an individual (grantor) to place their assets in a trust managed by a trustee for the grantor’s lifetime. After death, the trust’s assets will be distributed to the beneficiaries by the named successor trustee in the document.

Requirements (4)

- Mental Capacity: A person creating a trust must have the mental capacity to do so;

- Named Beneficiaries: The trust must have a named beneficiary, such as individuals, charitable organizations, animals, or other 3rd parties.

- Trustee’s Duties: The trustee has duties to perform (such as managing the trust and distribution upon the grantor’s death; and

- Cannot be Same Person: The same person cannot be the sole trustee and the sole beneficiary.[1]

Registration

There are no registration requirements in Arizona.

Laws

Amending/Revoking – Unless a trust document specifically states it is irrevocable, a trust can be revoked or amended.[2]

Bond Requirement – A trustee is not required to obtain a bond unless the trust requires it or it is requested by a court.[3]

Duty to Inform – A trustee must inform the beneficiaries about the trust administration and information necessary to protect their assets. In addition, a trustee must inform beneficiaries within 60 days of accepting the trustee position and give their name, address, and phone number.[4]

Evidence of Oral Trust – An oral trust can be created with “clear and convincing evidence.”[5]

Penalty for Contesting a Trust – If there is language in a trust document that prohibits contesting the terms of a trust, such terms are unenforceable if probable cause exists for such a contest.[6]

Pet Trust – A trust is legally made for a pet to care for an animal. A person interested in the animal’s welfare can petition a court to confirm that proper care is being administered and remove the pet trustee if necessary.[7]

Trustee’s Compensation – Unless a trust specifically mentions the trustee’s compensation, a trustee is entitled to “reasonable” compensation given the circumstances of the trust.[8]

Trustee’s Duties – The trustee is responsible for administering the trust[9] and solely in the interest of the beneficiaries.[10]

Trustee’s Powers – Upon appointment and without permission from a 3rd party, a trustee has the authority to exercise the powers granted to them under the trust document.[11] Powers granted to the trustee include but are not limited to, the buying, selling, or managing of assets held in the trust.[12]

Trustee’s Reimbursement of Expenses – A trustee is entitled to be reimbursed from the trust’s assets, and with reasonable interest, for expenses related to properly managing the trust.[13] Such expenses include attorney’s fees and costs that arise from the trust’s management.[14]

Trustee’s Reporting – On an annual basis, a trustee must report the trust’s assets, liabilities, receipts, and disbursements to the beneficiaries.[15] Beneficiaries can waive the right to a trustee’s report if it is unnecessary.[16]

Trustee’s Resignation – If a trustee is to remove themselves from a trust, they must provide at least 30 days’ notice to the trust’s beneficiaries and the grantor (if living).[17]

Trust Certificate – Upon request by a 3rd party (other than a beneficiary), a trustee may create a trust certificate instead of providing a copy of a trust that mentions the following:

- The trust is valid, exists, and the date of execution;

- Grantor’s name;

- Trustee’s name and address;

- Trustee’s specific powers;

- If the trust is revocable;

- If more than one trustee is named, a description of how authority over the trust is managed; and

- The manner of taking title to trust property.[18]

Trusts Made in Another State – A trust made in another State is valid in Arizona.[19]

Sources

- ARS § 14-10402

- ARS § 14-10602(A)

- ARS § 14-10702(A)

- ARS § 14-10813(A)

- ARS § 14-10407

- ARS § 14-10113

- ARS § 14-10408

- ARS § 14-10708(A)

- ARS § 14-10801

- ARS § 14-10802

- ARS § 14-10815

- ARS § 14-10816

- ARS § 14-10709

- ARS § 14-11004

- ARS § 14-10813(B)(3)

- ARS § 14-10813(D)

- ARS § 14-10705

- ARS § 14-11013(A)

- ARS § 14-10403