Updated February 14, 2024

A loan agreement is a written agreement between a lender that lends money to a borrower in exchange for repayment plus interest. The borrower will be required to pay back the loan in accordance with a payment schedule (unless there is a balloon payment).

Table of Contents |

By Type (10)

How to Get a Loan (5 steps)

- Choose a Loan Type

- Obtain/Provide Your Credit Score

- Secured or Unsecured

- Sign the Agreement

- Borrower Receives Money

1. Choose a Loan Type

- Business Loan – For expansion or new equipment. If the business is new or in bad financial shape a personal guarantee by the owner of the entity may be required by the lender.

- Car Loan – Used to purchase a vehicle usually with a term of 5 years (60 months).

- FHA Loan – To purchase a home with bad credit (cannot be below 580). Requires the borrower to purchase insurance in the chance of default.

- Home Equity Loan – Secured by the borrower’s home in case the funds are not paid-back.

- PayDay Loan – Also known as a “cash advance”, requires the borrower to show their most recent pay stub and write a check from the bank account where they are paid by their employer.

- Personal Loan – Between friends or family.

- Student Loan – Provided by the federal government or privately in order to pay for academic studies at a college or university.

2. Obtain/Provide Your Credit Score

The first step into obtaining a loan is to run a credit check on yourself which can be purchased for $30 from either TransUnion, Equifax, or Experian. A credit score ranges from 330 to 830 with the higher the number representing a lesser risk to the lender in addition to a better interest rate that may be obtained by the borrower. In 2016, the average credit score in the United States was 687 (source).

Once you have obtained your full credit history you may now use it to entice prospective lenders in an effort to receive funds.

3. Secured or Unsecured

Depending on the credit score the lender may ask if collateral is needed to approve the loan.

Secured Loan – For individuals with lower credit scores, usually less than 700. The term ‘secured’ means the borrower must put up collateral, such as a home or a car, in case the loan is not repaid. Therefore, the lender is guaranteed to obtain an asset of the borrower in the event they are paid back.

Unsecured Loan – For individuals with higher credit scores, 700 and above. Does not require the borrower to provide collateral.

4. Sign the Agreement

Depending on the loan that was selected a legal contract will need to be drafted stating the terms of the loan agreement including:

- Borrowed amount;

- Interest rate;

- Repayment period;

- Late fee(s);

- Default language;

- Pre-payment penalty (if any)

Depending on the amount of money that is borrowed the lender may decide to have the agreement authorized in the presence of a notary public. This is recommended if the total amount, principal plus interest, is more than the maximum acceptable rate for the small claims court in the jurisdiction of the parties (usually $5,000 or $10,000).

Apply for a Loan Online

Most online services offering loans usually offer quick cash type loans such as Pay Day Loans, Installment Loans, Line of Credit Loans and Title Loans. Loans such as these should be avoided as Lenders will charge maximum rates, as the APR (Annual Percentage Rate) can easily go over 200%. It’s very unlikely that you will obtain an adequate mortgage for a house or a business loan online.

If you do decide to take out a personal loan online, make sure you do so with a qualified well-known bank as you can often find competitive low-interest rates. The application process will take longer as more information is needed such as your employment and income information. Banks may even want to see your tax returns.

Common Terms (Glossary)

Acceleration – A clause within a loan agreement that protects the lender by requiring the borrower to pay off the loan (both the principal and any accumulated interest) immediately if certain conditions occur.

Borrower – The individual or company receiving money from the lender which will then have to pay back the money according to the terms in the loan agreement.

Collateral – An item of worth, such as a house, is used as insurance to protect the lender in the event the borrower is unable to pay back the loan.

Default – Should the borrower default due to their failure to pay, the interest rate shall continue to accrue according to the agreement, as set forth by the lender, on the balance of the loan until the loan is paid in full.

Interest (Usury) – The cost associated with borrowing the money.

Late-Payment – If the borrower anticipates that they may be late on their payment, they must contact and make arrangements with the lender. Additional late fees may apply.

Lender – The individual or company releasing funds to the borrower which will then be paid back to their principal, usually with interest, according to the terms set in the loan agreement.

Repayment Schedule – An outline detailing the loan’s principal and interest, the loan payments, when payments are due and the length of the loan.

FAQs

How can I get personal loans for bad credit?

The lower your credit score is, the higher the APR (Hint: You want low APR) will be on a loan and this is typically true for online lenders and banks. You should have no problem obtaining a personal loan with bad credit as many online providers cater to this demographic, but it will be difficult to pay back the loan as you will be paying back double or triple the principal of the loan when it’s all said and done. Payday loans are a widely offered personal loan for people with bad credit as all you need to show is proof of employment. The lender will then give you an advance and your next paycheck will go to payoff the loan plus a big chunk of interest.

Subsidized loan vs Unsubsidized loan?

A Subsidized loan is for students going to school and its claim to fame is that it does not accrue interest while the student is in school. An Unsubsidized loan is not based on financial need and it can be used for both undergraduate and graduate students.

What is sharking?

An individual or organization practicing predatory lending by charging high-interest rates (Known as a “Loan Shark“). Each State has its own limits on interest rates (called the “Usury Rate”) and loan sharks illegally charge higher than the allowed maximum rate, although not all loan sharks practice illegally but instead deceitfully charge the highest interest rate legal under the law.

What does consolidate mean?

Put simply, to consolidate is to take out one sizable loan to payoff many other loans by having only one payment to make every month. This is a good idea if you can find a low-interest rate and you want simplicity in your life.

What is a parent plus loan?

A Parent Plus Loan, also known as a “Direct PLUS loan”, is a federal student loan obtained by the parent of a child needing financial help for school. The parent must have a healthy credit score in order to obtain this loan. It offers a fixed interest rate and flexible loan terms, however, this type of loan has a higher interest rate than a direct loan. Parents generally would only obtain this loan to minimize the amount of student debt on their child.

Video

Sample

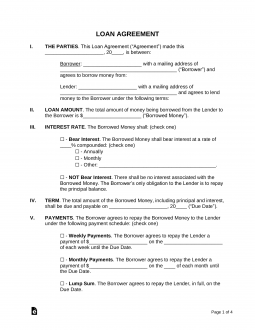

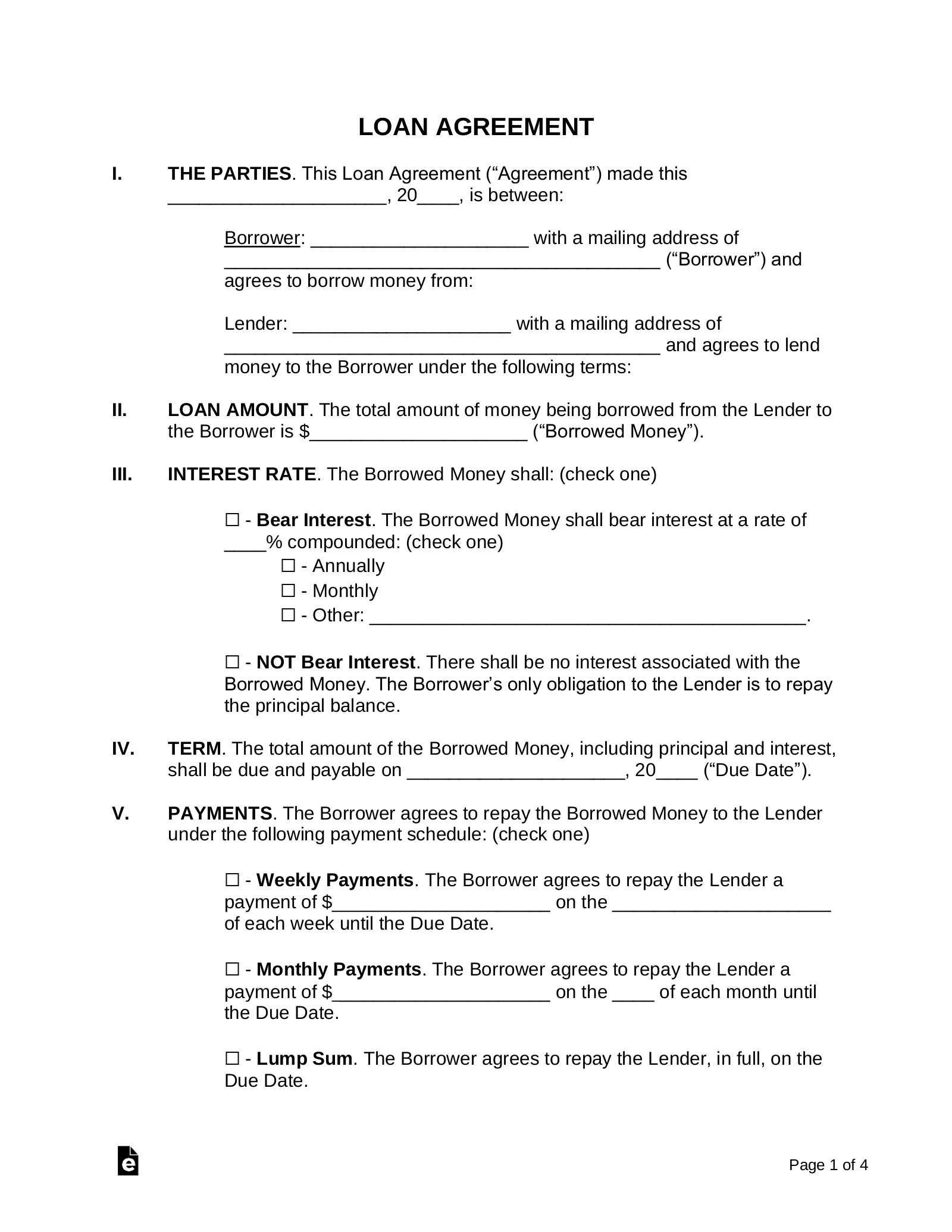

LOAN AGREEMENT

1. THE PARTIES. This Loan Agreement (“Agreement”) made this [DATE] is between:

Borrower: [BORROWER’S NAME] with a mailing address of [ADDRESS] (“Borrower”) and agrees to borrow money from:

Lender: [LENDER’S NAME] with a mailing address of [ADDRESS] and agrees to lend money to the Borrower under the following terms:

2. LOAN AMOUNT. The total amount of money being borrowed from the Lender to the Borrower is $[AMOUNT] (“Borrowed Money”).

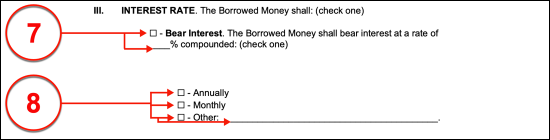

3. INTEREST RATE. The Borrowed Money shall: (check one)

☐ – Bear Interest. The Borrowed Money shall bear interest at a rate of [#]% compounded: (check one)

☐ – Annually

☐ – Monthly

☐ – Other: [OTHER]

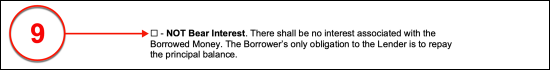

☐ – NOT Bear Interest. There shall be no interest associated with the Borrowed Money. The Borrower’s only obligation to the Lender is to repay the principal balance.

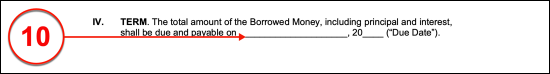

4. TERM. The total amount of the Borrowed Money, including principal and interest, shall be due and payable on [DATE] (“Due Date”).

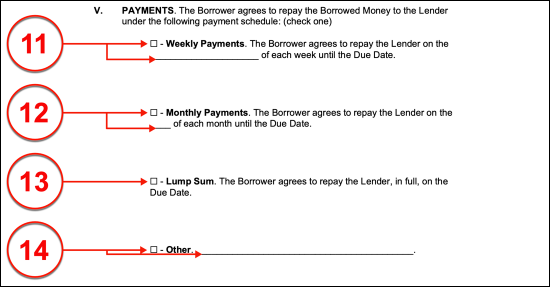

5. PAYMENTS. The Borrower agrees to repay the Borrowed Money to the Lender under the following payment schedule: (check one)

☐ – Weekly Payments. The Borrower agrees to repay the Lender a payment of $[AMOUNT] on the [DAY] of each week until the Due Date.

☐ – Monthly Payments. The Borrower agrees to repay the Lender a payment of $[AMOUNT] on the [DAY] of each month until the Due Date.

☐ – Lump Sum. The Borrower agrees to repay the Lender, in full, on the Due Date.

☐ – Other. [OTHER]

Hereinafter known as the “Payment Schedule.” All payments made by the Borrower shall be first applied to any accrued interest and second to the principal balance.

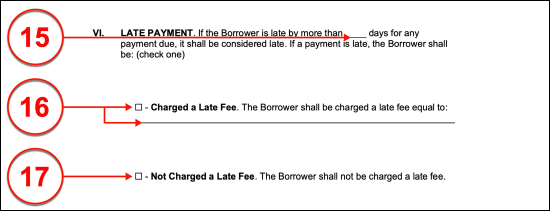

6. LATE PAYMENT. If the Borrower is late by more than [#] days for any payment due, it shall be considered late. If a payment is late, the Borrower shall be: (check one)

☐ – Charged a Late Fee. The Borrower shall be charged a late fee equal to: [LATE FEE AMOUNT]

☐ – Not Charged a Late Fee. The Borrower shall not be charged a late fee.

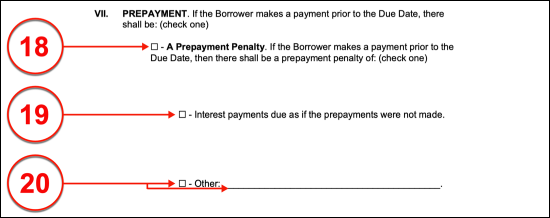

7. PREPAYMENT. If the Borrower makes a payment prior to the Due Date, there shall be: (check one)

☐ – A Prepayment Penalty. If the Borrower makes a payment prior to the Due Date, then there shall be a prepayment penalty of: (check one)

☐ – Interest payments due as if the prepayments were not made.

☐ – Other: [OTHER]

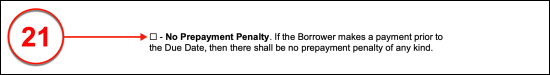

☐ – No Prepayment Penalty. If the Borrower makes a payment prior to the Due Date, then there shall be no prepayment penalty of any kind.

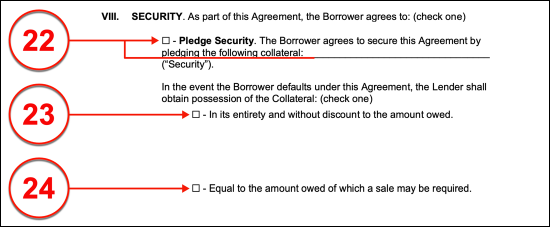

8. SECURITY. As part of this Agreement, the Borrower agrees to: (check one)

☐ – Pledge Security. The Borrower agrees to secure this Agreement by pledging the following collateral: [DESCRIBE] (“Collateral”).

In the event the Borrower defaults under this Agreement, the Lender shall obtain possession of the Collateral: (check one)

☐ – In its entirety and without discount to the amount owed.

☐ – Equal to the amount owed of which a sale may be required.

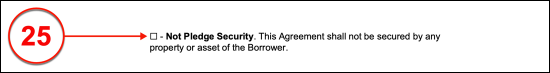

☐ – Not Pledge Security. This Agreement shall not be secured by any property or asset of the Borrower.

9. SUBORDINATION. The Borrower’s obligations under this Agreement are subordinated to all indebtedness, if any, of the Borrower, to any unrelated third-party lender to the extent such indebtedness is outstanding on the date of this Agreement and such subordination is required under the loan documents providing for such indebtedness.

Borrower’s Signature: _____________________ Date: _____________

Print Name: _____________________

Lender’s Signature: _____________________ Date: _____________

Print Name: _____________________

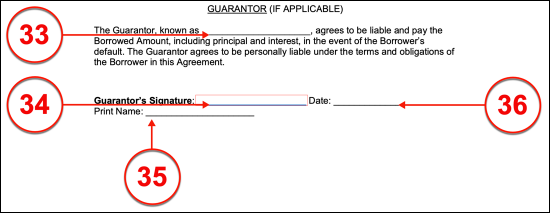

GUARANTOR (IF APPLICABLE)

The Guarantor, known as [GUARANTOR’S NAME], agrees to be liable and pay the Borrowed Amount, including principal and interest, in the event of the Borrower’s default. The Guarantor agrees to be personally liable under the terms and obligations of the Borrower in this Agreement.

Guarantor’s Signature: _____________________ Date: _____________

Print Name: _____________________

How to Write

Download: PDF, MS Word, OpenDocument

I. The Parties

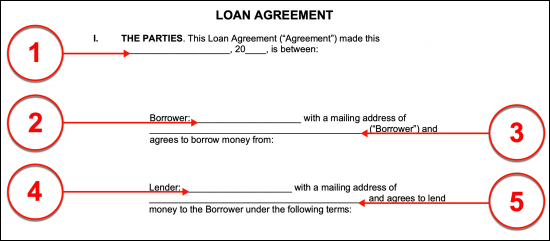

(1) Loan Agreement Effective Date. The First Section of this paperwork will seek to establish some basic facts regarding the concerned loan. Since the majority of loans made will be time-sensitive, it will be imperative to document the exact date when the Borrower and Lender will first be obligated to comply with this agreement. The first two lines in Section I have been formatted to accept the presentation of this agreement’s date of effect.

(2) Borrower Of Loan. The Party that will receive a loaned amount of money under the conditions set by this agreement requires identification. Therefore, furnish the Borrower’s full name to the first line located in the “Borrower” statement. If a Business Entity is the Borrower, then its exact legal identity, including status suffix, must be submitted to the space provided.

(3) Mailing Address Of Borrower. The address where the Borrower can be reached by mail regarding the loan being made must be documented in Section I. Record this mailing address on the second line of the “Borrower” statement.

(4) Lender Of Loan. The legal name of the Loan Provider must be supplied to the first line of the “Lender” statement. In many cases, the Lender will be a Business (i.e. a Bank). If so, then the entire legal name of the Business Entity lending money through this paperwork should be presented including any abbreviations, special characters such as numerals or punctuation, and the appropriate status suffix on the first space available in the area labeled “Lender.”

(5) Lender Mailing Address. The mailing address of the Lender is required on the second line of the “Lender” statement. If the Lender is a Business, then this address must include all the necessary information to reach the Party responsible for this paperwork and the loan agreement. For example, an “Attention” line may be included to define the Department or Party to who mail correspondence regarding this agreement should be directed.

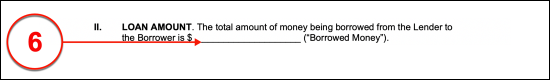

II. Loan Amount

(6) Borrowed Money. The amount that will be lent to the Borrower by the Lender should be documented in the Second Section as requested by the line following the dollar (“$”) symbol. This dollar amount must represent the exact amount of money that the Lender shall deliver to the Borrower and should not include any interest charges.

III. Interest Rate

Select And Complete Item 7 Or Select Item 9

(7) Bear Interest. If the Lender intends to charge interest on the owed amount during the lifetime of this loan, then the “Bear Interest” checkbox statement in Section III must be selected. Additionally, the interest rate that will be applied must be reported as a percentage on the blank space provided. The frequency of how often this rate will be applied must be discussed in the remainder of this statement.

(8) Interest Term. If the interest rate defined above will be compounded “Annually,” or once a year, then the first checkbox presented by the “Bear Interest” statement must be selected. However, if the interest rate will be compounded once a month (“Monthly”) then the second checkbox should be selected. If neither of these options applies, then select the “Other” checkbox and define how often the concerned interest rate will be applied to the unpaid amount.

(9) Not Bear Interest. Select the “Not Bear Interest” checkbox from the Third Section if the Lender does not intend to collect any additional money in the form of naturally compounded interest on this loan.

IV. Term

(10) Due Date Of Loan. As mentioned, loans will often be time-sensitive. Therefore, in addition to the effective date, this paperwork must declare a predetermined date for the completion of the Borrower’s repayment of the loan amount. This shall act as a final deadline for the loan amount and any owed interest to be paid in full. Section IV requires that the exact date when the final payment of the loan will be due is declared. Supply this date across the spaces provided as the date when the Borrower and Lender intend the full loan amount and any interest added will have been paid by the Borrower and received by the Lender.

V. Payments

Select Item 11 Or Select Item 12 Or Select Item 13 Or Select And Complete Item 14

(11) Weekly Payments. Naturally, the Lender will require that payments submitted by the Borrower are received regularly. How often the loan payments must be received by the Lender should be defined through the selection of one of the options available in Section Five. For example, if the Lender wishes the Borrower’s payments to be submitted once a week, then the “Weekly Payments” checkbox must be marked and the day of the week when each such payment must be received should be provided on the line preceding the term “Of Each Week.”

(12) Monthly Payments. The second checkbox, “Monthly Payments,” should be selected from Section Five if the concerned loan payments must be made once a month to the Lender. Additionally, the calendar date of the month (i.e. “01,” “02,”…”31”) when the loan payment will be due is required on the blank space available in this statement.

(13) Lump Sum. The third option available through Section V requires that the entire loaned amount as well as any interest charged will be paid in full to the Lender in one “Lump Sum.” This statement will also consider the “Due Date” named in the previous section as the calendar date when the entire dollar amount of the loan including any owed interest must be successfully submitted to the Lender. Keep in mind that a prepayment would be subject to any applicable penalties set through this agreement.

(14) Other. The frequency of the payments for the concerned loan may be set to any (legally allowed) increment of time the Lender and Borrower agree to. If the previous statements do not adequately define how often payments for the loan should be made, mark the “Other” checkbox, then provide specific details as to when and how often each loan payment must be submitted to the Lender.

VI. Late Payment

(15) Late Payment. At times, the Borrower may be unable to deliver payment in a timely fashion to the Lender. The number of days past a due date that marks when the Lender may first consider the Borrower’s undelivered payment to be late must be documented where requested.

Select And Complete Item 16 Or Select Item 17

(16) Charged A Late Fee. If the Lender will charge the Borrower a penalty fee for late payment, then mark the checkbox labeled “Charged A Late Fee” and, on the space provided, furnish the amount of money this penalty consists of or detail how the late fee will be calculated.

(17) Not Charged A Late Fee. If the Borrower will not be charged a late fee in the event he or she submits a payment that is considered late, then the third checkbox found in Section VI must be selected.

VII. Prepayment

Select And Complete Item 18 Or Select Item 21

(18) Prepayment Penalty. Often, a Lender’s finances may be tied to the proper payment of a loan. Thus, some difficulties may arise for the Lender should loan payments be submitted early. If a “Prepayment Penalty” will be imposed by the Lender as a response to the Borrower’s early payment of the entire loan amount, then the first checkbox statement in Section VII must be selected. Note that this statement will require some clarification using the available options it presents in order to be complete.

(19) Interest Payments Due. If the Lender intends to collect on the interest payments that were expected through this loan as calculated and scheduled at the time of this paperwork’s execution in response to the Borrower submitting payment early, then the first option in the “Prepayment Penalty” must be selected.

(20) Other. The Lender may prefer to impose a penalty for prepayment that differs from the one applied by the previous option. If so, then the “Other” checkbox must be selected. Additionally, the exact penalty amount and any relevant information regarding how this amount is calculated should be presented on the space available after the “Other” label.

(21) No Prepayment Penalty. If the Lender will not require a penalty to be paid in the event that the Borrower submit payment before its formal due date (see Section IV), then select the “No Prepayment Penalty.”

VII. Security

Select And Complete Item 22 Or Select Item 25

(22) Pledge Security. If this will be a secured loan and the Lender will require that the Borrower provide collateral against the loan amount, then the “Pledge Security” statement should be selected. When marking the first checkbox in Section VII, the collateral the Borrower volunteers against the loan must be defined on the blank line labeled “Security.” For example, suppose the Borrower is listing his or her automobile as the security for the loan amount. In such a case, the automobile’s Manufacturer, make, model, year, color, title number, and VIN (vehicle identification number) should all be listed on this line. This option requires further clarification therefore, one of the next two items must be selected so that this one may be completed.

(23) Lender Right To Seize Collateral. Occasionally, the collateral the Borrower may pledge as security may not be the exact worth of the loan made. If the Lender will be entitled to all the security listed even if that collateral exceeds the amount of the loan (and interest) then, the “In Its Entirety…” statement must be selected from the “Pledge Security” statement.

(24) Lender Entitled Only To Value Of Loan. If the Lender will only be entitled to seize the exact amount owed (plus the expected interest payments) from the security pledged by the Borrower, select the checkbox attached to the phrase “Equal To The Amount Owed…”

(25) Not Pledge Security. If the Borrower is not required to pledge any security (collateral) for the concerned loan, then mark the “Not Pledge Security” checkbox.

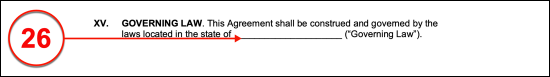

XV. Governing Law

(26) Governing Law. The name of the State that will expect compliance with its laws governing this paperwork and the loan made must be recorded on the line labeled “Governing Law” in Section XV.

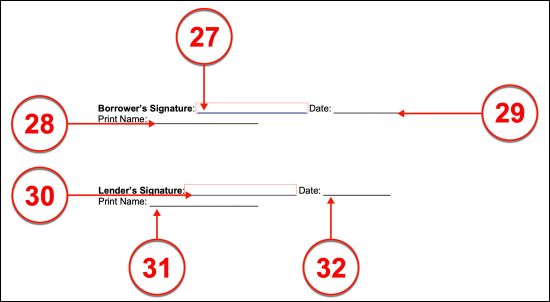

XVI. Entire Agreement

(27) Borrower’s Signature. The Borrower named in Section I must sign his or her name on the “Borrower’s Signature” line in order to satisfy the requirements of this agreement. If either of these Parties is a Business Entity then a Representative may be used. For example, if the Borrower is a Business, then the Owner of that Business may sign on its behalf or the ruling body of that Business should authorize a single Party to sign his or her name on behalf of the Borrowing Business entity on the “Borrower’s Signature” line.

(28) Printed Name. The Borrower must print his or her name below his or her submitted signature. Should a Representative have signed this paperwork on behalf of the Borrowing Business, then his or her full name must be printed as well as the title he or she holds with the Borrower.

(29) Signature Date Of Borrower. The date when the Borrower formally enters this agreement by signature must be documented at the time of signing. He or she must supply this date to the blank space labeled “Date.”

(30) Lender’s Signature. This agreement will only be considered valid when both Parties identified in Section I execute it properly. Therefore, the Lender must sign the “Lender’s Signature” line as well. As indicated earlier, a Signature Representative of the Lending Entity may sign on its behalf to formally execute this agreement.

(31) Print Name. The printed name of the Signature Lender or that of the Signature Representative of the Lending Entity must be supplied when signing this paperwork. If relevant, the Signature Representative should also document his or her title with the Lending Entity.

(32) Signature Date Of Lender. The Lender or the Signature Representative of the Lender must date his or her signature on the space attached to “Date” in his or her signature section.

Guarantor

(33) Guarantor Name. If the loan made through this agreement may only progress through the participation of a Guarantor who will pay the loan amount should the Borrower default then this Guarantor must be identified and must accept this responsibility by signature. To this end, the “Guarantor” statement must be supplied with the full name of the Guarantor.

(34) Guarantor’s Signature. Since the Guarantor will be held financially responsible for any owed amount (of the loan) that the Borrower would be unable to pay the Lender, he or she will need to review the “Guarantor” statement, then show his or her acceptance of this responsibility by signing the “Guarantor’s Signature” line.

(35) Guarantor’s Printed Name. The Guarantor should print his or her name after signing the statement provided.

(36) Guarantor’s Signature Date. The signature date of the Guarantor must also be submitted when he or she signs this statement