Updated April 14, 2023

A personal loan agreement outlines the terms of how money is borrowed and when it will be paid back. It is a simple agreement that includes the borrowed amount, interest rate, and when the money must be repaid. If the borrower misses a payment or doesn’t pay back the loan, they will be in default of their agreement with the lender and subject to late fees and penalties.

Table of Contents |

What is a Personal Loan?

A personal loan is a sum of money borrowed by an individual that may be used for any purpose. The borrower will be responsible for paying the lender back plus interest. Interest is the cost of a loan and is calculated annually.

The lender may be a bank, financial institution, or an individual – the loan agreement will be legally binding in either case.

5 Types of Personal Loans

- Co-Sign – When the borrower has bad or no credit and needs someone else to be liable in case they do not pay.

- Fixed-Rate – The interest rate remains the same during the course of the repayment period.

- Secured – The borrower is required to put collateral down in case of default. Often the collateral is a vehicle or a 2nd mortgage put on a home.

- Unsecured – The borrower is not required to place collateral as part of the loan agreement. Although, if the borrower does not pay their personal assets may still be confiscated legally.

- Variable Rate – When the interest rate is tied to a third-party such as the current Fed Funds Rate.

Important Provisions

This lending contract must include several key provisions:

- Loan Amount ($)

- Loan Date

- Borrower and Lender Information

- Interest Rate

- Re-Payment Terms

- Late Fees (if any)

- Default Terms (if the borrower doesn’t pay)

- Early Payment Penalty (if any)

- Security (collateral)

- Law of Governance (State)

- Co-Signer (if any)

- Assigning Rights

Personal Loan vs. Line of Credit

The main difference is the personal loan must be paid back on a certain date and a line of credit offers revolving access to money with no end date.

| Difference | Personal Loan | Line of Credit |

| Payment Period | Specific start and end dates. | Revolving, no end date. |

| Collateral Required? | No, in most cases. | Yes, in most cases. |

| Interest Rate | Fixed, in most cases. | Variable, in most cases. |

Personal Loan vs. Standard Loan

Unlike business or auto loans, whose terms prescribe how funds may be spent, personal loan money may be used for any purpose by the borrower.

Since personal loans are more flexible, and not tied to a particular purchase or purpose, they are often unsecured. This means that the debt is not tied to any real assets, unlike a home mortgage is to the house, or a car loan is to the vehicle. If a personal loan is to be secured with collateral, it should be specifically mentioned in the agreement.

Sample

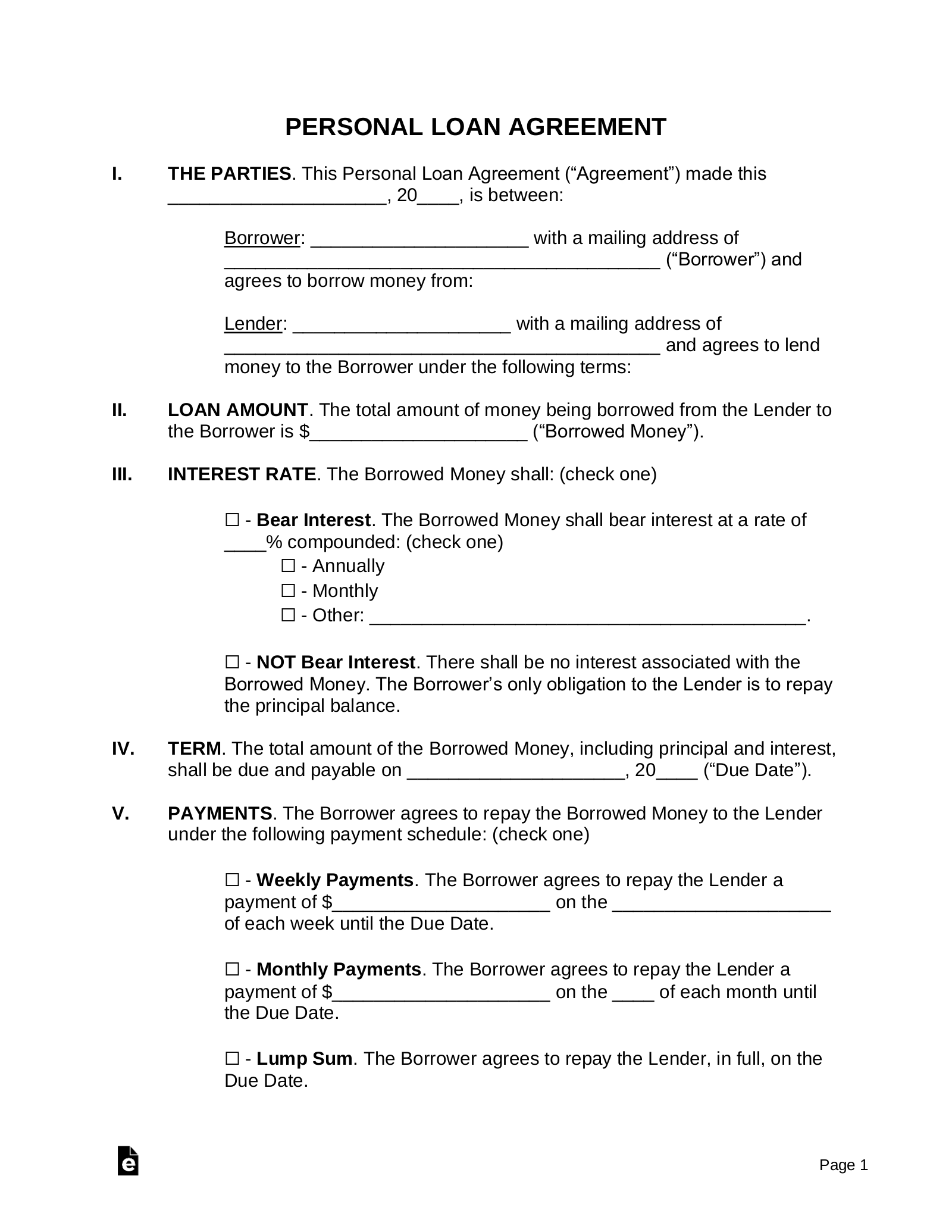

PERSONAL LOAN AGREEMENT

1. THE PARTIES. This Personal Loan Agreement (“Agreement”) made this [DATE] is between:

Borrower: [BORROWER’S NAME] with a mailing address of [ADDRESS] (“Borrower”) and agrees to borrow money from:

Lender: [LENDER’S NAME] with a mailing address of [ADDRESS] and agrees to lend money to the Borrower under the following terms:

2. LOAN AMOUNT. The total amount of money being borrowed from the Lender to the Borrower is $[AMOUNT] (“Borrowed Money”).

3. INTEREST RATE. The Borrowed Money shall: (check one)

☐ – Bear Interest. The Borrowed Money shall bear interest at a rate of [#]% compounded: (check one)

☐ – Annually

☐ – Monthly

☐ – Other: [OTHER]

☐ – NOT Bear Interest. There shall be no interest associated with the Borrowed Money. The Borrower’s only obligation to the Lender is to repay the principal balance.

4. TERM. The total amount of the Borrowed Money, including principal and interest, shall be due and payable on [DATE] (“Due Date”).

5. PAYMENTS. The Borrower agrees to repay the Borrowed Money to the Lender under the following payment schedule: (check one)

☐ – Weekly Payments. The Borrower agrees to repay the Lender on the [DAY] of each week until the Due Date.

☐ – Monthly Payments. The Borrower agrees to repay the Lender on the [DAY] of each month until the Due Date.

☐ – Lump Sum. The Borrower agrees to repay the Lender, in full, on the Due Date.

☐ – Other. [OTHER]

Hereinafter known as the “Payment Schedule.” All payments made by the Borrower shall be first applied to any accrued interest and second to the principal balance.

6. LATE PAYMENT. If the Borrower is late by more than [#] days for any payment due, it shall be considered late. If a payment is late, the Borrower shall be: (check one)

☐ – Charged a Late Fee. The Borrower shall be charged a late fee equal to: [LATE FEE AMOUNT]

☐ – Not Charged a Late Fee. The Borrower shall not be charged a late fee.

7. SECURITY. As part of this Agreement, the Borrower agrees to: (check one)

☐ – Pledge Security. The Borrower agrees to secure this Agreement by pledging the following collateral: [DESCRIBE] (“Security”).

In the event the Borrower defaults under this Agreement, the Lender shall obtain possession of the Collateral: (check one)

☐ – In its entirety and without discount to the amount owed.

☐ – Equal to the amount owed of which a sale may be required.

☐ – Not Pledge Security. This Agreement shall not be secured by any property or asset of the Borrower.

8. ACCELERATION. The Lender shall have the right to declare the Borrowed Money to be immediately due and payable, including interest owed, if any of the events are to occur:

a.) Late Payment. If any payment is late that is due under the Payment Schedule of more than 15 days;

b.) Default. If the Borrower should default on any of the conditions of this Agreement; or

c.) Security. If assets or property that are pledged as Security as part of this Agreement are transferred or sold.

9. SEVERABILITY. If any provision of this Agreement or the application thereof shall, for any reason and to any extent, be invalid or unenforceable, neither the remainder of this Agreement nor the application of the provision to other persons, entities, or circumstances shall be affected, thereby, but instead shall be enforced to the maximum extent permitted by law.

10. GOVERNING LAW. This Agreement shall be construed and governed by the laws located in the state of [GOVERNING LAW] (“Governing Law”).

IN WITNESS WHEREOF, Borrower and Lender have executed this Agreement as of the day and year first above written.

Borrower’s Signature: _____________________ Date: _____________

Print Name: _____________________

Lender’s Signature: _____________________ Date: _____________

Print Name: _____________________

GUARANTOR ADDENDUM

The Guarantor, known as [GUARANTOR’S NAME], agrees to be liable and pay the Borrowed Amount, including principal and interest, in the event of the Debtor’s default. The Guarantor agrees to be personally liable under the terms and obligations of the Debtor in this Agreement.

Guarantor’s Signature: _____________________ Date: _____________

Print Name: _____________________