Updated April 22, 2024

A lease agreement is a legal document between a landlord who rents property to a tenant in exchange for payment. Both parties must fulfill their responsibilities until the end of the lease term. The first month’s rent and security deposit must be paid before the tenant can take occupancy.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

By Type (15)

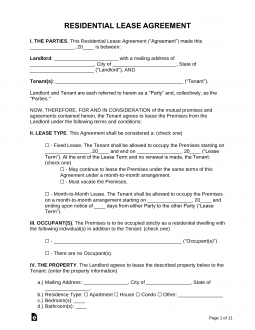

Standard Residential Lease Agreement – Typically for a one-year period but can be for any fixed period. Standard Residential Lease Agreement – Typically for a one-year period but can be for any fixed period.

Download: PDF, MS Word, OpenDocument

|

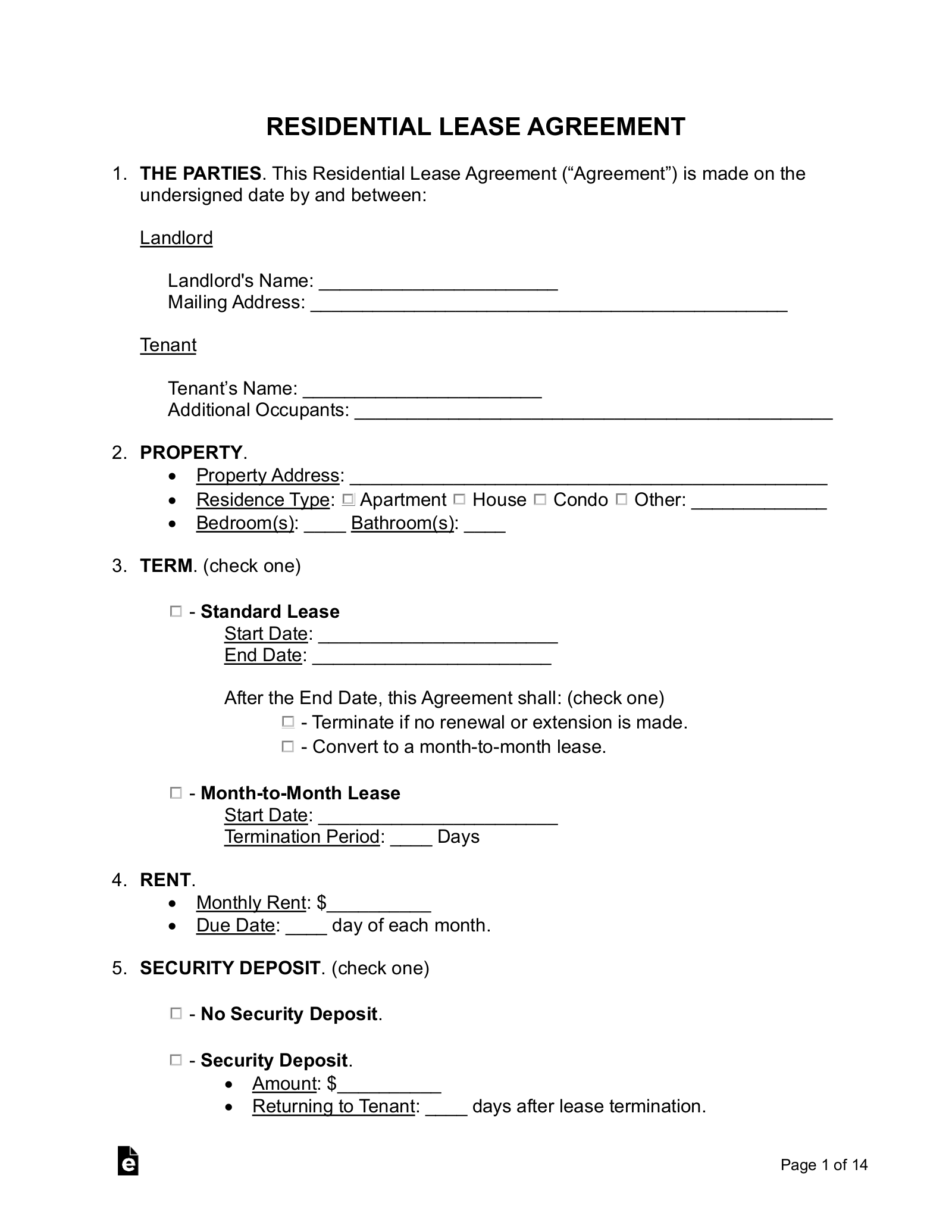

1-Page Lease Agreement – For residential use, it is a simple agreement between a landlord and tenant. 1-Page Lease Agreement – For residential use, it is a simple agreement between a landlord and tenant.

Download: PDF, MS Word, OpenDocument |

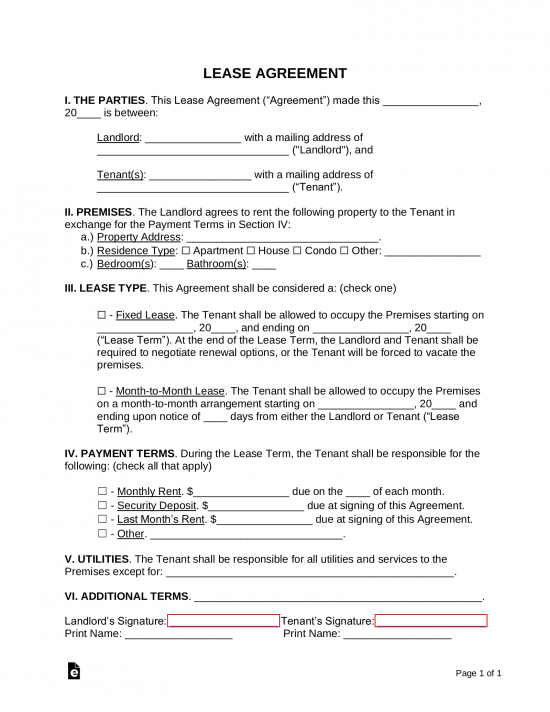

Commercial Lease Agreements – For the use of retail, office, or industrial space. Commercial Lease Agreements – For the use of retail, office, or industrial space.

Download: PDF, MS Word, OpenDocument |

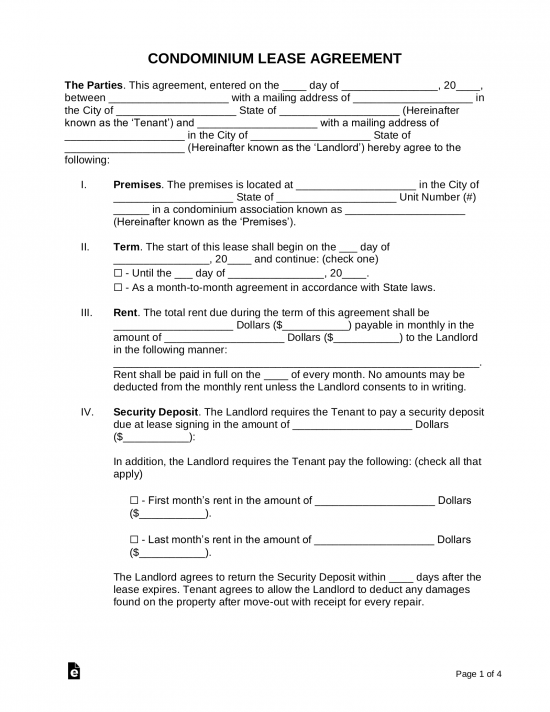

Condominium (Condo) Rental Agreement – Between an owner of a condo and a tenant. Condominium (Condo) Rental Agreement – Between an owner of a condo and a tenant.

Download: PDF, MS Word, OpenDocument |

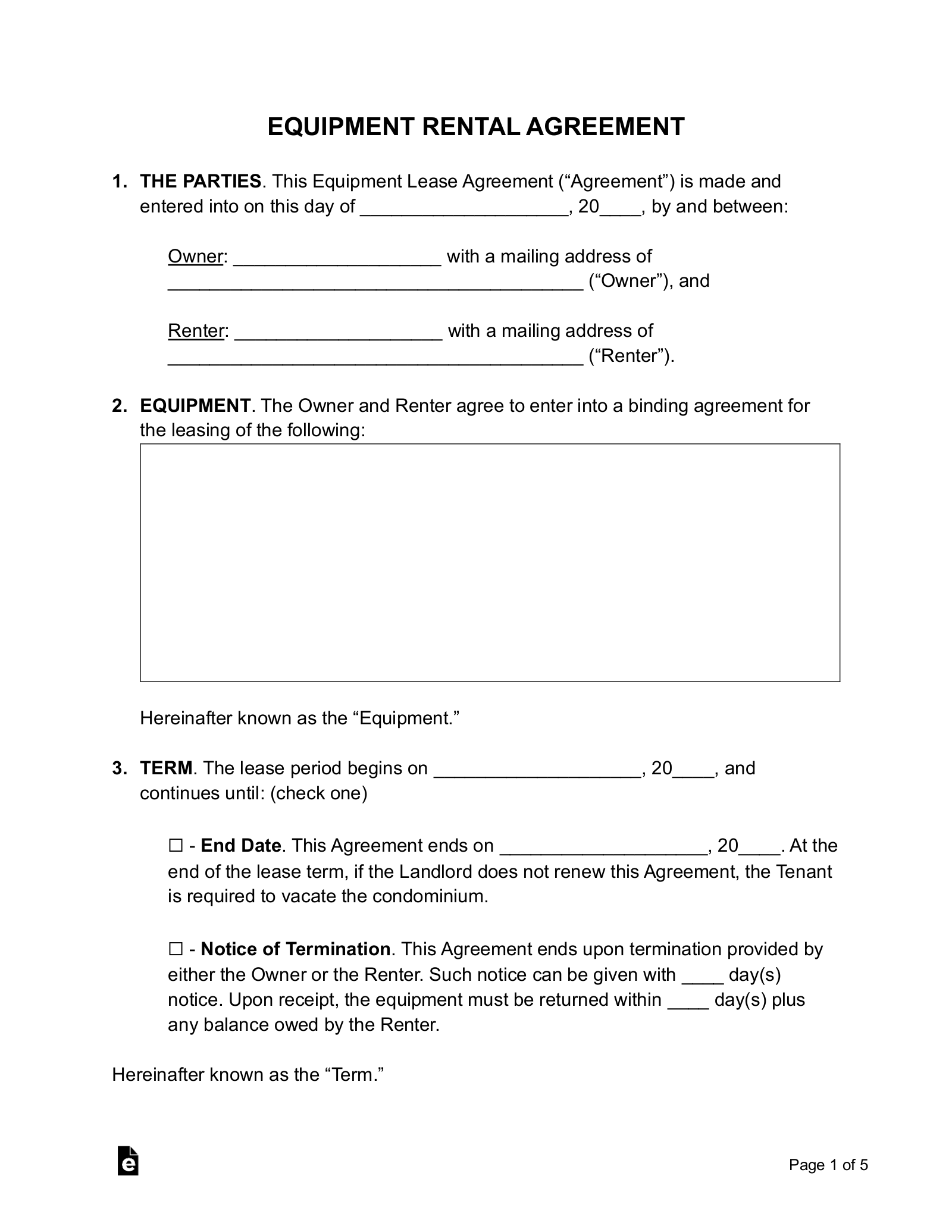

Equipment Lease Agreement – To rent tools, appliances, hardware, or other construction items. Equipment Lease Agreement – To rent tools, appliances, hardware, or other construction items.

Download: PDF, MS Word, OpenDocument |

Family Member Rental Agreement – When a relative comes to live in the same home as a family member. Family Member Rental Agreement – When a relative comes to live in the same home as a family member.

Download: PDF, MS Word, OpenDocument

|

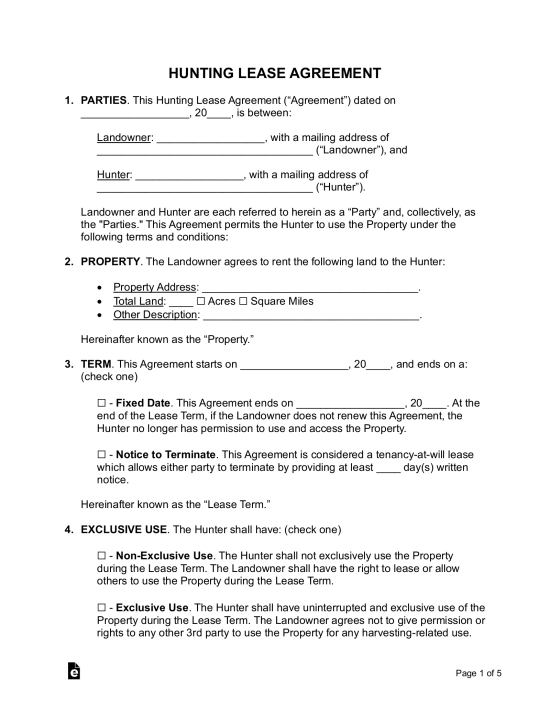

Hunting Lease Agreement – Between a landlord that allows an individual to hunt on their property. Hunting Lease Agreement – Between a landlord that allows an individual to hunt on their property.

Download: PDF, MS Word, OpenDocument

|

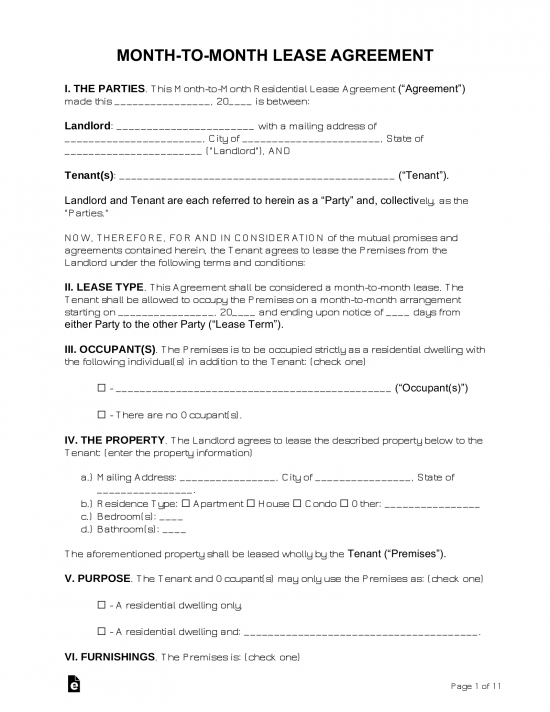

Month-to-Month Lease Agreement – Or “tenancy-at-will,” allows the tenant and landlord to have a binding arrangement that may be changed or terminated with 30 days’ notice. Month-to-Month Lease Agreement – Or “tenancy-at-will,” allows the tenant and landlord to have a binding arrangement that may be changed or terminated with 30 days’ notice.

Download: PDF, MS Word, OpenDocument

|

Parking Space Rental Agreement – To lease a parking space for a motor vehicle. Parking Space Rental Agreement – To lease a parking space for a motor vehicle.

Download: PDF, MS Word, OpenDocument

|

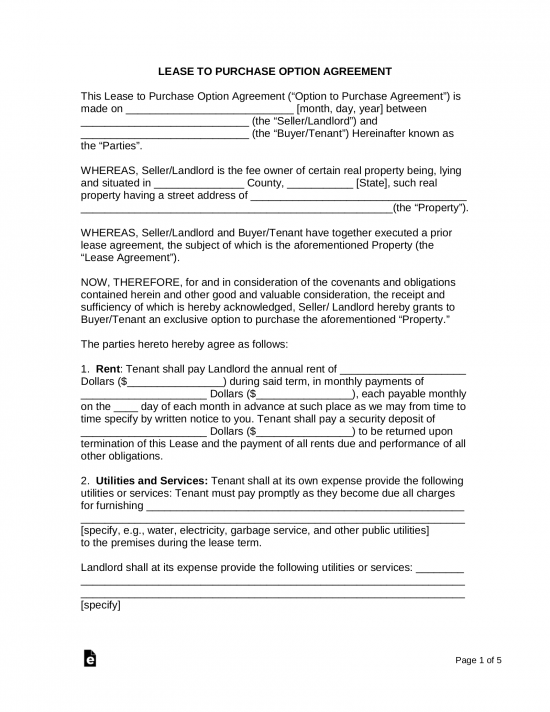

Rent-to-Own Lease Agreement – Includes rental payments with the option for the tenant to purchase the property. Rent-to-Own Lease Agreement – Includes rental payments with the option for the tenant to purchase the property.

Download: PDF, MS Word, OpenDocument

|

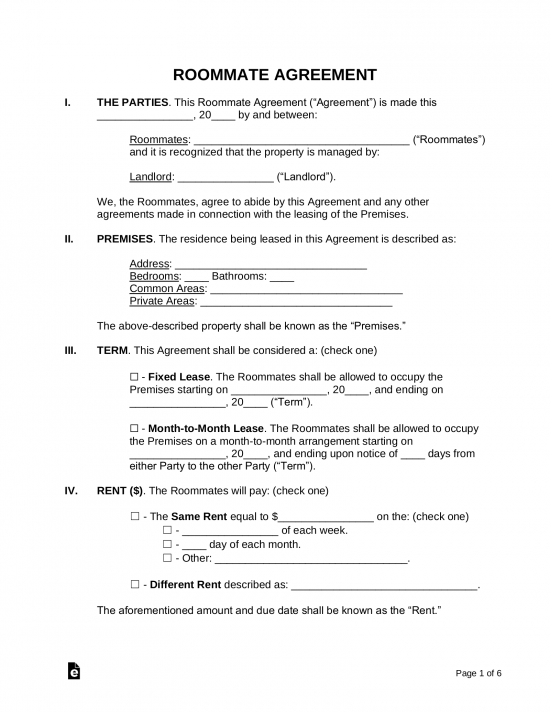

Roommate (Room Rental) Agreement – For a shared living arrangement amongst roommates. Roommate (Room Rental) Agreement – For a shared living arrangement amongst roommates.

Download: PDF, MS Word, OpenDocument

|

Storage Space Lease Agreement – For space used exclusively for storage purposes by a tenant. Storage Space Lease Agreement – For space used exclusively for storage purposes by a tenant.

Download: PDF, MS Word, OpenDocument

|

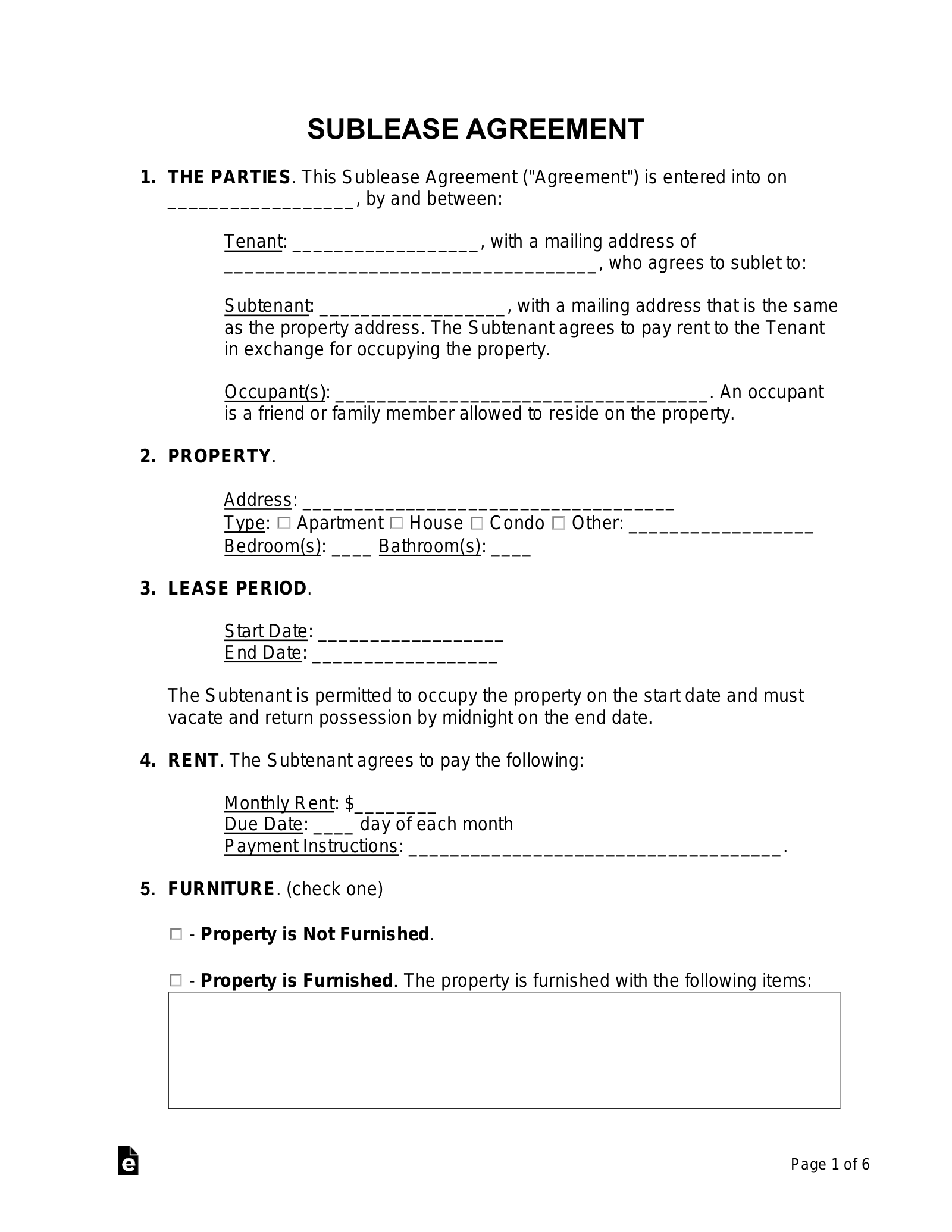

Sublease (Sublet) Agreement – When a tenant rents a portion or the entire space to someone else (subtenant). Sublease (Sublet) Agreement – When a tenant rents a portion or the entire space to someone else (subtenant).

Download: PDF, MS Word, OpenDocument

|

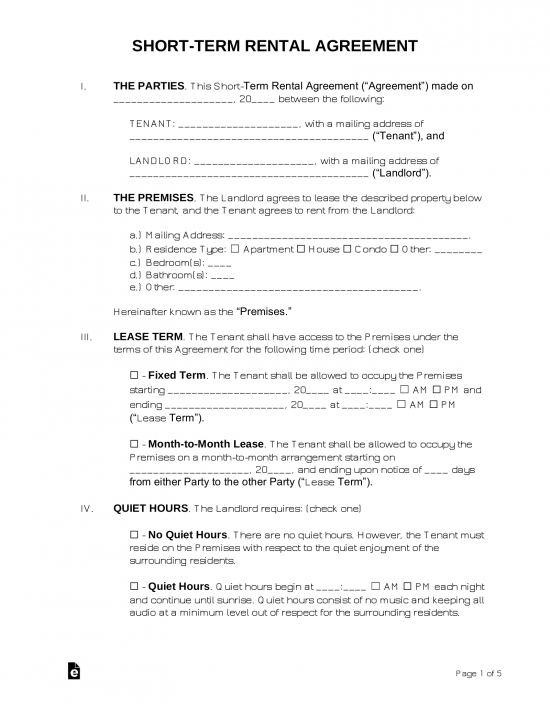

Vacation (Short-Term) Rental Agreement – For tenancies under 30 days. Vacation (Short-Term) Rental Agreement – For tenancies under 30 days.

Download: PDF, MS Word, OpenDocument

|

Weekly Rental Agreement – For a tenant that pays rent on a weekly basis. Weekly Rental Agreement – For a tenant that pays rent on a weekly basis.

Download: PDF, MS Word, OpenDocument

|

The Leasing Process (8 steps)

- Tenant Views the Space

- Rental Application

- Landlord Runs a Consumer Report

- Verify References

- Negotiating the Lease

- Lease Signing

- Taking Occupancy

- End of the Lease

2. Rental Application

Before an offer is accepted, the landlord may request the tenant to complete a rental application and pay a small fee (see maximum amounts ($) by state).

In addition to providing the tenant’s employment information, it gives consent to the landlord to legally perform a credit and background check.

3. Landlord Runs a Consumer Report

The rental application should be reviewed by the landlord and used to generate a consumer report. A consumer report will include publicly available information about the tenant and provide a credit report.

Recommended Services

- Limited Consumer Report ($21) – RentPrep.com

- Detailed Consumer Report ($39.99) – MySmartMove.com

6. Lease Signing

When both parties sign the lease it becomes legally binding until the end of its term. The most common ways to sign are in-person or electronically.

Tenant’s Obligations (4)

- Paying Rent on Time;

- Maintaining the Property;

- Complying with Lease Terms; and

- Noise Control (quiet enjoyment).

Landlord’s Obligations (4)

- Keeping the Property Habitable;

- Making Repairs;

- Providing Access to Utilities; and

- Respecting Tenant’s Privacy;

7. Taking Occupancy

Access to the property is granted on the 1st day of the lease term (unless otherwise agreed). If the tenant moves in before the start of the term, the tenant pays rent based on the pro-rata number of days entering early on the property (ex. if the tenant moves in 10 days early and the rent is $1,500/mo, the tenant is obligated to pay $500).

8. End of the Lease

At the end of the lease term, the landlord must either:

- Renew the Lease – By sending a Lease Extension.

- Not Renew – By sending a Non-Renewal Lease Letter.

Landlord-Tenant Laws

- Security Deposits Laws

- Landlord’s Access

- When is Rent Due? (grace periods)

- Late Rent Fees (maximum allowed)

Security Deposit Laws

| State | Maximum ($) |

Returning |

Statute |

| Alabama | 1 month’s rent | 60 days after the termination date and delivery of possession | § 35-9A-201(a), 35-9A-201(b) |

| Alaska | 2 months’ rent, except for units renting for more than $2,000 | 14 days if the tenant leaves on-time, 30 days if not | § 34.03.070(a), § 34.03.070(g) |

| Arizona | 1.5 months’ rent | 14 days from move-out inspection (excl. weekends and holidays) | § 33-1321 |

| Arkansas | 2 months’ rent | 60 days from termination of tenancy | § 18-16-304, § 18-16-305 |

| California | 2 months’ rent (unfurnished), 3 months’ rent (furnished) | 21 days from the move-out date | 1950.5 |

| Colorado | 2 months’ rent (excluding pet deposits) | 1 month if mentioned in the lease, 2 months if not | C.R.S. § 38-12-102.5 |

| Connecticut | 1 month’s rent is 62 years or older, 2 months’ rent if younger | 21 days from the move-out date or 15 days from receiving the tenant’s new address | § 47a-21 |

| Delaware | 1 month’s rent for leases of one year or more. No limit on all others types | 20 days from the termination date | Title 25 § 5514 |

| Florida | No limit | 30 days if deductions, 15 days if no deductions | § 83.49(3)(a) |

| Georgia | No limit | 30 days from the termination date | § 44-7-34 |

| Hawaii | 1 month’s rent (excluding pet fee) | 14 days from the termination date | § 521-44 |

| Idaho | No limit | 30 days if stated in the lease, 21 days if not | § 6-321 |

| Illinois | No limit | 30 days if deductions, 45 days if no deductions | 765 ILCS 710 |

| Indiana | No limit | 45 days from the termination date | § 32-31-3-12 |

| Iowa | 2 months’ rent | 30 days after the tenant has vacated | § 562A.12 |

| Kansas | 1 month’s rent (unfurnished), 1.5 months’ rent (furnished) | 14 days after making deductions or 30 days from the termination date | § 58-2550 |

| Kentucky | No limit | 60 days from the lease termination date | § 383.580(6) |

| Louisiana | No limit | 1 month from the termination date | Revised Statute 9:3251 |

| Maine | 2 months’ rent | 30 days if the lease is fixed-period, 21 days if tenancy-at-will | § 6032, § 6033 |

| Maryland | 2 months’ rent | 45 days from the termination date | § 8–203 |

| Massachusetts | 1 month’s rent | 30 days after the tenant has vacated | Chapter 186, Section 15B |

| Michigan | 1.5 months’ rent | 30 days from the end of occupancy | § 554.602, § 554.609 |

| Minnesota | No limit | 3 weeks from the termination date | § 504B.178 |

| Mississippi | No limit | 45 days from the end of tenancy | § 89-8-21 |

| Missouri | 2 months’ rent | 30 days from the termination of tenancy | § 535.300 |

| Montana | No limit | 30 days if deductions, 10 days if no deductions | § 70-25-202 |

| Nebraska | 1 month’s rent (excluding pet fee) | 14 days of move-out | § 76-1416 |

| Nevada | 3 months’ rent | 30 days from the end of tenancy | NRS 118A.242 |

| New Hampshire | 1 month’s rent or $100, whichever is greater | 30 days, 20 days if the property is shared with the landlord | RSA 540-A:6, RSA 540-A:7 |

| New Jersey | 1.5 months’ rent | 30 days from the termination date | § 46:8-21.2, § 46:8-21.1 |

| New Mexico | 1 month’s rent for leases under one year. No limit for residential leases of one year or more | 30 days from the termination date | § 47-8-18 |

| New York | 1 month’s rent unless the deposit or advance is for a seasonal use dwelling unit | 14 days after the tenant has vacated | Emergency Tenant Protection Act 576/74(f), § 7-108 (e) |

| North Carolina | 2 months’ rent for tenancies of more than 2 months; 1.5 months’ rent for month-to-month tenancies | 30 days if no deductions, if deductions then an additional 30 days | § 42-51, § 42-52 |

| North Dakota | 1 month’s rent (excluding pet deposits) | 30 days from the termination date | § 47-16-07.1 |

| Ohio | No limit | 30 days from the termination date | § 5321.16 |

| Oklahoma | No limit | 45 days from the termination date | § 41-115(B) |

| Oregon | No limit | 31 days from the termination date | § 90.300 |

| Pennsylvania | 2 months’ rent | 30 days from the termination date | § 250.511a, § 250.512 |

| Rhode Island | 1 month’s rent | 20 days from the termination date | § 34-18-19 |

| South Carolina | No limit | 30 days from the termination date | § 27-40-410 |

| South Dakota | 1 month’s rent | 14 days if no deductions, 45 days if deductions | § 43-32-6.1, § 43-32-24 |

| Tennessee | No limit | 30 days from the termination date | § 66-28-301 |

| Texas | No limit | 30 days after the tenant has vacated | § 92.103 |

| Utah | No limit | 30 days from the termination date | § 57-17-3 |

| Vermont | No limit | 14 days, 60 days if a seasonal property | § 4461 |

| Virginia | 2 months’ rent | 45 days from the termination date or the date the tenant vacates the dwelling unit, whichever occurs last | § 55.1-1226(A) |

| Washington | No limit | 30 days from tenant’s move-out date | § 59.18.280 |

| West Virginia | No limit | 60 days after tenancy ends or 45 days after another tenant moves in, whichever shorter | § 37-6A-2 |

| Wisconsin | No limit | 21 days from tenant’s vacancy date | § 134.06 |

| Wyoming | No limit | 30 days from lease termination or 15 days from receiving the tenant’s forwarding address, whichever is lesser | § 1-21-1208(A) |

Landlord’s Access

Give the tenant a notice to enter prior to accessing the property. It can be given to an occupant, posted or placed under their door, or mailed to them (6 days before the entry date).

| State | Required Notice | Statute |

| Alabama | 2 days | § 35-9A-303 |

| Alaska | 24 hours | § 34.03.140 |

| Arizona | 48 hours | § 33-1343 |

| Arkansas | N/A | N/A |

| California | 24 for non-emergency, 48 hours for the move-out inspection | § 1954 |

| Colorado | *N/A | *N/A |

| Connecticut | Reasonable notice | § 47a-16 |

| Delaware | 48 hours | Title 25 § 5509 |

| Florida | 24 hours | § 83.53 |

| Georgia | *N/A | *N/A |

| Hawaii | 2 days | § 521-53 |

| Idaho | *N/A | *N/A |

| Illinois | *N/A | *N/A |

| Indiana | Reasonable notice | § 32-31-5-6 |

| Iowa | 24 hours | § 562A.19 |

| Kansas | Reasonable notice | § 58-2557 |

| Kentucky | 2 days | § 383.615 |

| Louisiana | *N/A | *N/A |

| Maine | 24 hours | § 6025 |

| Maryland | *N/A | *N/A |

| Massachusetts | Reasonable notice | Sanitary Code (410.810) |

| Michigan | *N/A | *N/A |

| Minnesota | “Reasonable notice” of no less than 24 hours | § 504B.211 |

| Mississippi | *N/A | *N/A |

| Missouri | *N/A | *N/A |

| Montana | 24 hours | § 70-24-312 |

| Nebraska | 24 hours | § 76-1423 |

| Nevada | 24 hours | NRS 118A.330 |

| New Hampshire | Reasonable notice | RSA 540-A:3 |

| New Jersey | 1 day | § 5:10-5.1 |

| New Mexico | 24 hours | § 47-8-24 |

| New York | *N/A | *N/A |

| North Carolina | *N/A | *N/A |

| North Dakota | Reasonable notice | § 47-16-07.3 |

| Ohio | 24 hours | § 5321.04 |

| Oklahoma | 1 day | § 41-128 |

| Oregon | 24 hours | § 90.322 |

| Pennsylvania | *N/A | *N/A |

| Rhode Island | 2 days | § 34-18-26 |

| South Carolina | 24 hours | § 27-40-530 |

| South Dakota | 24 hours | § 43-32-32 |

| Tennessee | 24 hours | § 66-28-403 |

| Texas | *N/A | *N/A |

| Utah | 24 hours | § 57-22-4 |

| Vermont | 48 hours | § 4460 |

| Virginia | 24 hours | § 55.1-1229(A) |

| Washington | 2 days for repairs, 1 day for showings | § 59.18.150 |

| West Virginia | *N/A | *N/A |

| Wisconsin | Advance Notice | § 704.05(2) |

| Wyoming | *N/A | *N/A |

When is Rent Due? (grace periods)

A grace period protects the tenant from being charged a late fee or being evicted during such time period. Although, the rent is still considered late and may reflect negatively on the tenant’s rental history.

| State | When is Rent Due? | Laws |

| Alabama | On the due date (no grace period) | § 35-9A-161(c) |

| Alaska | On the due date (no grace period) | AS 34.03.020(c) |

| Arizona | On the due date (no grace period) | ARS 33-1314(c) |

| Arkansas | On the due date in the lease, but there is a 5-day grace period before a late fee may be imposed | § 18-17-401(b)(1), § 18-17-701(b) |

| California | On the due date (no grace period) | CIV Code 1947 |

| Colorado | Not defined, but there is a 7-day grace period before a late fee may be imposed | C.R.S. § 38-12-105 |

| Connecticut | 9-day grace period. | § 47a-3a(a), § 47a-15a |

| Delaware | On the due date in the lease, but there is a 5-day grace period before a late fee may be imposed | Title 25, § 5501(b), Title 25, § 5501(d) |

| Florida | On the due date (no grace period) | § 83.46(1) |

| Georgia | Not defined | No statute |

| Hawaii | On the due date (no grace period) | § 521-21(b) |

| Idaho | Not defined | No statute |

| Illinois | Not defined | No statute |

| Indiana | Not defined | No statute |

| Iowa | On the due date (no grace period) | 562A.9(3) |

| Kansas | On the due date (no grace period) | § 58-2545(c) |

| Kentucky | On the due date (no grace period) | § 383.565(2) |

| Louisiana | On the due date (no grace period) | La. Civ. Code art. 2703(1) |

| Maine | 15-day grace period | Chapter 710, §6028(1) |

| Maryland | On the due date (no grace period) | § 8-401(a) |

| Massachusetts | 30-day grace period. | Chapter 186, Section 15B(1)(c) |

| Michigan | On the due date (no grace period) | § 554.131 |

| Minnesota | Not defined | No statute |

| Mississippi | Not defined | No statute |

| Missouri | On the due date (no grace period) | Rev. § 535.060 |

| Montana | On the due date (no grace period) | § 70-24-201(2)(c) |

| Nebraska | On the due date (no grace period) | § 76-1414(3) |

| Nevada | On the due date (no grace period) | NRS 118A.210(1) |

| New Hampshire | Not defined | No statute |

| New Jersey | 5 business day grace period | § 2A:42-6.1(1) |

| New Mexico | On the due date (no grace period) | § 47-8-15(B) |

| New York | 5-day grace period | Housing Stability and Tenant Protection act of 2019 |

| North Carolina | 4-day grace period | § 42-46(a) |

| North Dakota | Not defined | No statute |

| Ohio | Not defined | No statute |

| Oklahoma | On the due date (no grace period) | § 41-109(B) |

| Oregon | On the due date in the lease, but there is a 4-day grace period before a late fee may be imposed | |

| Pennsylvania | Not defined | No statute |

| Rhode Island | On the due date (no grace period) | § 34-18-15(c) |

| South Carolina | On the due date (no grace period) | § 27-40-310(c) |

| South Dakota | Not defined | No statute |

| Tennessee | On the due date in the lease, but there is a 5-day grace period before a late fee may be imposed | § 66-28-201(c), § 66-28-201(d) |

| Texas | Not defined | No statute |

| Utah | Not defined | No statute |

| Vermont | On the due date (no grace period) | 9 V.S.A. § 4455 |

| Virginia | On the due date in the lease, but there is a 5-day grace period before a late fee may be imposed | § 55.1-1204(C)(4), § 55.1-1204(C)(5) |

| Washington | 5-day grace period | RCW 59.18.170 |

| West Virginia | Not defined | No statute |

| Wisconsin | Not defined | No statute |

| Wyoming | Not defined | No statute |

Late Fees (maximum allowed)

The late fees or the maximum amount a landlord may charge for late rent is not defined in most states. This does not mean that late fees are not allowed, rather, it suggests that the landlord is able to charge as much as desired as long as it is written in the lease.

| State | Late Rent Fees (maximum allowed) | Laws |

| Alabama | Not defined | No statute |

| Alaska | Not defined | No statute |

| Arizona | No maximum, although it must be stated in the lease. | ARS 33-1368(B) |

| Arkansas | Not defined | No statute |

| California | Must be a “good faith estimate of the damages likely to be suffered by the landlord in the case of a late payment.” Also, the late fee must be written in the lease. | Orozco v. Casimiro, 121 Cal. App.4th Supp. 7 (2004), CIV Code 1962 |

| Colorado | $50.00 or 5% of past due rent | C.R.S. § 38-12-105 |

| Connecticut | Not defined | No statute |

| Delaware | 5% of the monthly rent amount | Title 25, § 5501(d) |

| Florida | Not defined | No statute |

| Georgia | “All contracts for rent shall bear interest from the time the rent is due” | |

| Hawaii | 8% of the monthly rent amount | § 521-21(f) |

| Idaho | Not defined | No statute |

| Illinois | Outside Chicago – Not defined

Chicago only – $10.00 per month for the first $500.00 in monthly rent plus five percent per month for any amount in excess of $500.00 in monthly rent for the late payment of rent. |

No statute |

| Indiana | Not defined | No statute |

| Iowa | If the rent does not exceed $700/month, the late fee cannot exceed more than $12/day per day or $60/month.

If the rent is greater than $700/month, the late cannot exceed more than $20/day or $100/month. |

562A.9(4) |

| Kansas | Not defined | No statute |

| Kentucky | Not defined | No statute |

| Louisiana | Not defined | No statute |

| Maine | 4% of the monthly rent amount | Chapter 710, §6028(2) |

| Maryland | 5% of the monthly rent amount | Md. Code, Real. Prop. § 8-208(d)(3) |

| Massachusetts | Not defined | No statute |

| Michigan | Not defined | No statute |

| Minnesota | 8% of the monthly rent amount | |

| Mississippi | Not defined | No statute |

| Missouri | Not defined | No statute |

| Montana | Not defined | No statute |

| Nebraska | Not defined | No statute |

| Nevada | 5% of the monthly rent amount | NRS 118A.210(4)(a) |

| New Hampshire | No defined | No statute |

| New Jersey | Outside Jersey City – Not defined

Jersey City only – $35 |

No sstatute |

| New Mexico | 10% of the monthly rent amount | § 47-8-15(B) |

| New York | $50 or 5% of the monthly rent amount, whichever is less | Housing Stability and Tenant Protection act of 2019 |

| North Carolina | $15 or 5% of the monthly rent amount, whichever is greater. | § 42-46(a)(1) |

| North Dakota | Not defined | No statute |

| Ohio | Not defined | No statute |

| Oklahoma | Not defined | No statute |

| Oregon | 5% of the monthly rent amount, charged once for each succeeding 5-day period | ORS 90.260(2)(c) |

| Pennsylvania | Not defined | No statute |

| Rhode Island | Not defined | No statute |

| South Carolina | Not defined | No statute |

| South Dakota | Not defined | No statute |

| Tennessee | 10% of the monthly rent amount | § 66-28-201(d) |

| Texas | ||

| Utah | Not defined | No statute |

| Vermont | Not defined | No statute |

| Virginia | 10% of the monthly rent amount | § 55.1-1204(E) |

| Washington | Not defined | No statute |

| West Virginia | Not defined | No statute |

| Wisconsin | Not defined | No statute |

| Wyoming | Not defined | No statute |