Updated March 08, 2024

A rental application is a form landlords use to collect personal and employment information about a tenant to understand if they are a good fit for the property. The landlord commonly uses the information to run a consumer report (credit check) and verify any references.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

By Type (5)

- Assoc. of Realtors Version

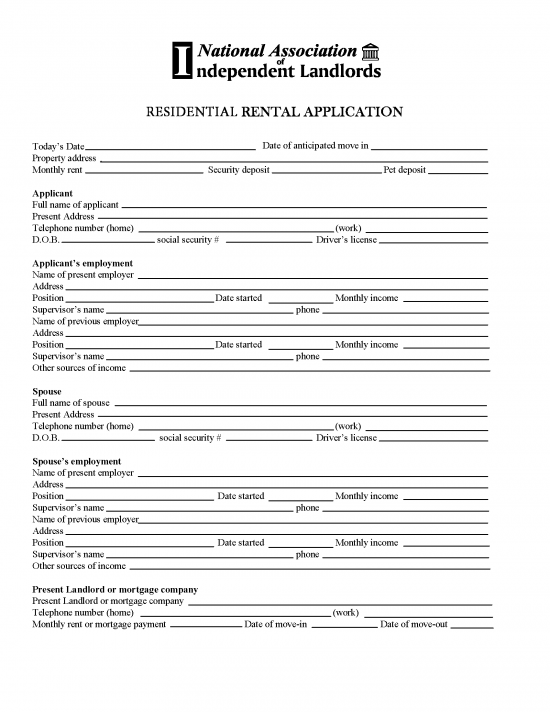

- National Landlords Assoc. Version

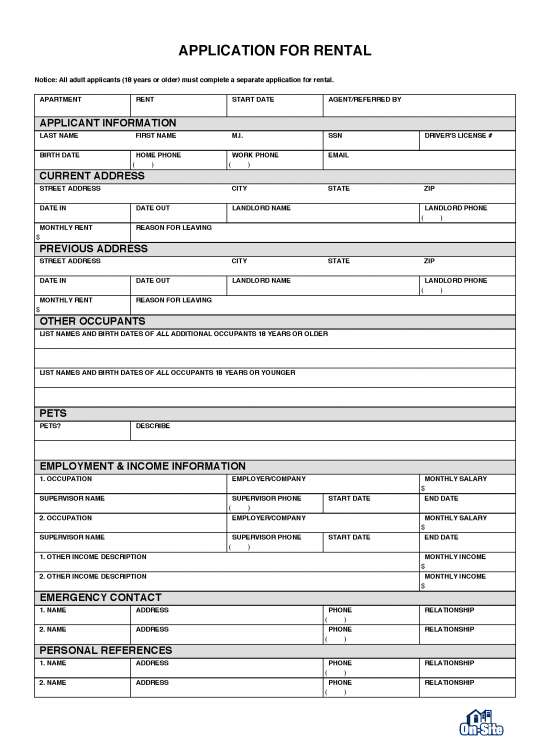

- On-Site Version

- Simple Version

- Zillow Version

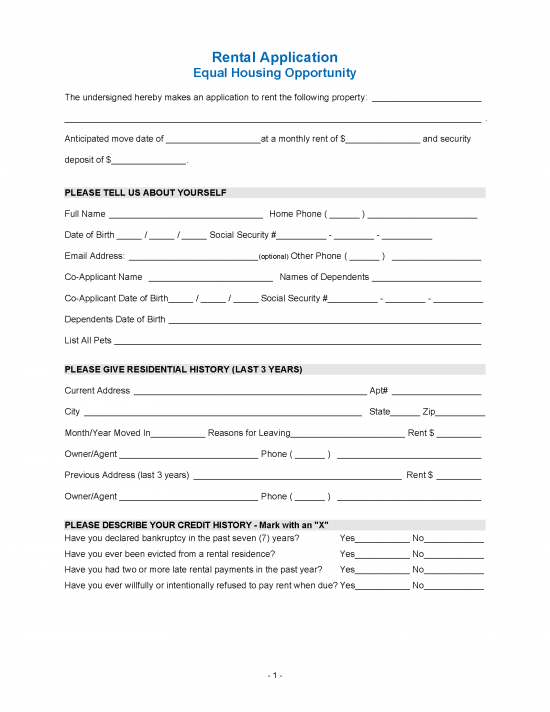

Assoc. of Realtors Version Assoc. of Realtors Version

Download: PDF

|

National Landlords Assoc. Version National Landlords Assoc. Version

Download: PDF |

On-Site Version On-Site Version

Download: PDF |

Simple Version Simple Version

Download: PDF |

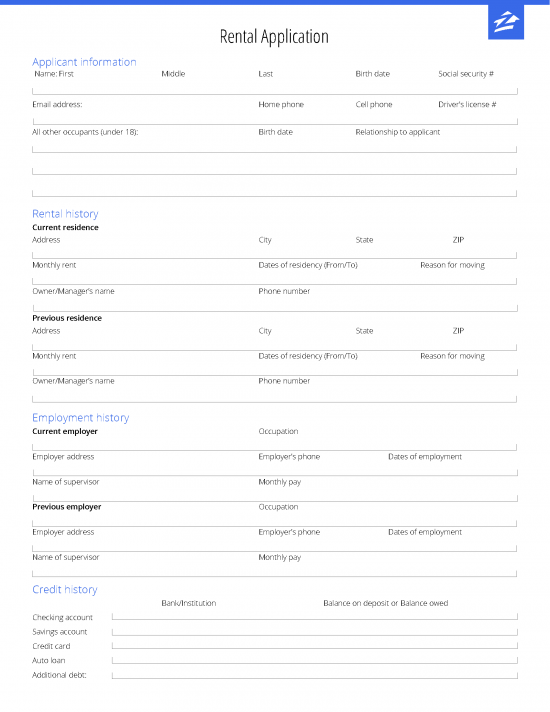

Zillow Version Zillow Version

Download: PDF |

How to Run a Background Check (6 steps)

- Tenant Completes the Rental Application

- Obtain a Credit Report

- Verifying the Tenant

- Communicate with Former Landlords

- Check the Sex Offender Registry

- Make a Decision

1. Tenant Completes the Rental Application

Download: PDF, MS Word, OpenDocument

The landlord should also attach the Fair Credit Reporting Act (FCRA) Disclosure, which includes the tenant’s rights.

Non-Refundable Fee ($)

A landlord is usually reimbursed for consumer reports generated to verify the tenant ($30 to $200[1]).

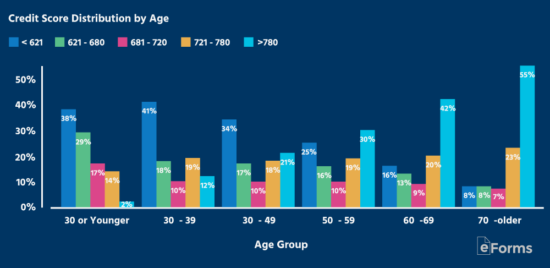

2. Obtain a Credit Report

In 2023, the average credit score was 715.[2] The landlord should consider the market conditions when deciding the tenant’s credit requirements.

Recommended Services

- Limited Consumer Report ($21) – RentPrep.com

- Detailed Consumer Report ($39.99) – MySmartMove.com

3. Verifying the Tenant

The landlord should verify the tenant’s work by contacting their supervisor or obtaining an employment verification letter.

Additional Documents

- Pay Stubs – Tenants can obtain from their employer or payroll provider.

- Tax Returns – To obtain IRS Form 1040 from the previous year.

4. Communicate with Former Landlords

It is common for tenants with a questionable history to contact their former landlords. If the tenant has multiple periods of under one year, it is generally a red flag.

Questions to Ask Previous Landlords

- Was the applicant ever late on rent?

- Was the applicant ever served a notice to quit or evicted?

- Was the applicant a loud tenant?

- Did the applicant leave the previous residence good standing?

- Was the applicant nice around co-tenants?

5. Check the Sex Offender Registry

Use the National Search Offender Database (or State Registry) to verify if a tenant is a former sex offender.

Cannot Reject due to Registry Status

Under federal law,[3] it is unlawful for a landlord to reject a tenant after finding out they are listed in a sex offender registry.

6. Make a Decision

The landlord must decide whether to approve or reject the tenant.

After Screening the Tenant

- If Approved – A lease agreement will be created.

- If Rejected – A rejection letter should be sent to the tenant that mentions where they can obtain a free copy of their consumer report.[4]

Maximum Rental App Fees ($)

| State | Maximum App Fee ($) | Laws |

| Alabama | No limit | No statute |

| Alaska | No limit | Landlord-Tenant Handbook Page 5 |

| Arizona | No limit | ARS 33-1321(B) |

| Arkansas | No limit | No statute |

| California | $52.46 | Cal. Civ. Code § 1950.6 |

| Colorado | No limit | Colo. Rev. Stat. § 38-12-903 |

| Connecticut | No limit | No statute |

| Delaware | 10% of the monthly rent or $50.00 | Del. Code tit. 25 § 5514(d) |

| Florida | No limit | No statute |

| Georgia | No limit | No statute |

| Hawaii | No limit | No statute |

| Idaho | No limit | No statute |

| Illinois | No limit | No statute |

| Indiana | No limit | No statute |

| Iowa | No limit | No statute |

| Kansas | No limit | No statute |

| Kentucky | No limit | No statute |

| Louisiana | No limit | No statute |

| Maine | The actual cost of a background or credit check | § 6030-H |

| Maryland | No limit (landlord must return unspent application fees over $25 within 15 days of receipt) | Md. Code, Real. Prop. § 8-213 |

| Massachusetts | Landlords may not charge (only brokers and agents permitted) | Mass. Gen. Laws ch. 186 § 15B(1)(b) |

| Michigan | No limit | No statute |

| Minnesota | No limit | Minn. Sat. § 504B.173 |

| Mississippi | No limit | No statute |

| Missouri | No limit | No statute |

| Montana | No limit | No statute |

| Nebraska | No limit | No statute |

| Nevada | No limit | No statute |

| New Hampshire | No limit | No statute |

| New Jersey | No limit | No statute |

| New Mexico | No limit | No statute |

| New York | Cost of background check or $20, whichever is less | N.Y Real Prop. Law § 238-A.1(b) |

| North Carolina | No limit | No statute |

| North Dakota | No limit | No statute |

| Ohio | No limit | No statute |

| Oklahoma | No limit | No statute |

| Oregon | No more than the average cost of screening applicants or the customary amount charged by tenant screening companies | Or. Rev. Stat. § 90.295 |

| Pennsylvania | No limit | No statute |

| Rhode Island | Not permitted, unless the tenant fails to deliver any provide their own reports | R.I. Gen. Laws § 34-18-59 |

| South Carolina | No limit | No statute |

| South Dakota | No limit | No statute |

| Tennessee | No limit | No statute |

| Texas | No limit | No statute |

| Utah | No limit | No statute |

| Vermont | Not permitted for residential tenancy | Vt. Stat. tit. 9 § 4456a |

| Virginia | $50.00 (not including extra expenses for performing background checks) | Va. Code § 55.1-1203(C) |

| Washington | No limit, but all costs must only be incurred in obtaining screening reports | Wash. Rev. Code § 59.18.257(1)(b) |

| Washington D.C. | No limit | No statute |

| West Virginia | No limit | W. Va. Code § 37-6A-1(2) |

| Wisconsin | No limit, but a landlord may only charge a maximum of $20 for a credit check | Wis. Admin. Code ATCP § 134.05 |

| Wyoming | No limit | No statute |