Updated March 09, 2024

A small estate affidavit is a court document allowing beneficiaries to bypass the probate process after someone’s death. Commonly for estates of lesser value, it allows the family members of someone who died intestate (without a will) to distribute any remaining assets without a court order.

Monetary Limit ($)

To qualify for this process, the total value of the decedent’s estate must not exceed the State’s monetary limit.

Death Certificate

A death certificate is commonly required to be attached to a small estate affidavit when filing.

Table of Contents |

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

State Requirements

| State | Maximum Amounts ($) | Time to Wait After Decedent’s Death | Signing Requirements |

| Alabama | $36,030 (figure adjusted for inflation) | 30 days | No Statute* |

| Alaska | $100,000 for vehicles only; $50,000 for other personal property | 30 days | No Statute* |

| Arizona | $75,000 for tangible personal property; $100,000 for real property | 30 days | No Statute* |

| Arkansas | $100,000 | 45 days | Local Probate Court Clerk (See List) |

| California | $184,500 | 40 days | Notary Public |

| Colorado | $70,000 | 10 days | Notary Public |

| Connecticut | $40,000 | No Statute | No Statute |

| Delaware | $30,000 | 30 days | No Statute, but Death Certificate must be notarized |

| Florida | $75,000 | No Statute | No Statute* |

| Georgia | None; $15,000 only when claiming funds in a bank account | No Statute | Notary Public |

| Hawaii | $100,000 (excluding motor vehicles) | No Statute | Notary Public |

| Idaho | $100,000 | 30 days | Notary Public |

| Illinois | $100,000 | No Statute | Notary Public |

| Indiana | $100,000 | 45 days | Notary Public |

| Iowa | $50,000 | 40 days | Notary Public |

| Kansas | $75,000 | No Statute | Notary Public |

| Kentucky | $30,000 | No Statute |

Notary Public or Judge/Clerk of the District Court |

| Louisiana | $125,000 | 90 Days (For Immovable Property Only) | Notary Public |

| Maine | $40,000 | 30 days | Notary Public |

| Maryland | $50,000; $100,000 for surviving spouses filing as sole legatee | No Statute | No Statute |

| Massachusetts | $25,000 (excluding the value of one vehicle) | 30 days | Notary Public |

| Michigan | $24,000 (figure adjusted for inflation) | 28 days | Notary Public |

| Minnesota | $75,000 | 30 days | Notary Public |

| Mississippi | $75,000 | 30 days | Notary Public |

| Missouri | $40,000 | 30 days | Notary Public |

| Montana | $100,000 | 30 days | Notary Public |

| Nebraska | $100,000 | 30 days | Notary Public |

| Nevada | $100,000 for spouse; $25,000 for other claimants | 40 days | No Statute* |

| New Hampshire | N/A | N/A | N/A |

| New Jersey | $50,000 for spouses, $20,000 for non-spousal heirs | No Statute | Notary Public |

| New Mexico | $50,000 | 30 days | Notary Public |

| New York | $50,000 | No Statute | Notary Public |

| North Carolina | $20,000 non-spousal heirs; $30,000 for surviving spouses who are sole heirs | 30 days | Notary Public or Court Clerk |

| North Dakota | $50,000 | 30 days | Notary Public or Court Clerk |

| Ohio | $100,000 for spouse, $35,000 for other claimants | No Statute | Probate Judge (once approved) |

| Oklahoma | $50,000 | 10 days | Notary Public |

| Oregon | $275,000 ($75,000 for personal property; $200,000 for real property) | 30 days | Notary Public |

| Pennsylvania | $50,000 | No Statute | Notary Public and |

| Rhode Island | $15,000 | 30 days | Notary Public and Probate Judge / Probate Clerk |

| South Carolina | $25,000 | 30 days | Notary Public and |

| South Dakota | $100,000 for personal property; $50,000 for real property | 30 days | Notary Public |

| Tennessee | $50,000 | 45 days | Notary Public or Deputy Clerk |

| Texas | $75,000 | 30 days | Notary Public and Two (2) Disinterested Witnesses |

| Utah | $100,000 | 30 days | Notary Public |

| Vermont | $45,000 | No Statute | Notary Public |

| Virginia | $50,000 | 60 days | Notary Public |

| Washington | $100,000 | 40 days | Notary Public |

| Washington D.C. | $40,000 | No Statute | Legal Branch of Probate Division |

| West Virginia | $100,000 for interests in real estate; $50,000 for personal property | 30 days (if decedent died testate); 60 days (if intestate) | Notary Public |

| Wisconsin | $50,000 | No Statute | Notary Public |

| Wyoming | $200,000 | 30 days | Notary Public |

* The person creating the affidavit is highly recommended to seek notarization in order to establish the document’s validity and prepare it for recording with their local governing entity.

How a Small Estate Affidavit Works (6 steps)

- Wait for the State-Required Time Period

- Calculate the Estate’s Value

- Gather Required Documents

- Complete the Small Estate Affidavit

- Contact Family Members (Heirs)

- File with the Probate Office

1. Wait for the State-Required Time Period

Every state requires that the family members wait a specified number of days before the small estate may be filed. Ranging from 15 to 60 days, the heirs can use this time to gather an itemized list of the decedent’s assets and property.

Every state requires that the family members wait a specified number of days before the small estate may be filed. Ranging from 15 to 60 days, the heirs can use this time to gather an itemized list of the decedent’s assets and property.

If the state does not have specific laws, then contact the probate court in the jurisdiction where the decedent died.

4. Complete the Small Estate Affidavit

It is best to use the state-specific version as this will give the petitioner the best chance of it being accepted by the probate court clerk’s office. When completing, be sure to include an itemized list of all the assets and property of the decedent that will be transferred to the heirs.

It is best to use the state-specific version as this will give the petitioner the best chance of it being accepted by the probate court clerk’s office. When completing, be sure to include an itemized list of all the assets and property of the decedent that will be transferred to the heirs.

When signing, the petitioner will be required to either sign the form in front of a notary public, witnesses, or both. The bottom of the small estate should have the signing requirements listed.

5. Contact Family Members (Heirs)

All heirs, family members, or anyone who could be considered entitled to the property must be made aware of the small estate filing. Therefore, the petitioner must contact them via certified mail with a return receipt and keep the receipts as proof that the individuals have been notified.

All heirs, family members, or anyone who could be considered entitled to the property must be made aware of the small estate filing. Therefore, the petitioner must contact them via certified mail with a return receipt and keep the receipts as proof that the individuals have been notified.

6. File with the Probate Office

The petitioner should attach all documents to the small estate affidavit along with the filing fee. If accepted, the clerk will take approximately five to 15 days to process and accept or reject the filing.

The petitioner should attach all documents to the small estate affidavit along with the filing fee. If accepted, the clerk will take approximately five to 15 days to process and accept or reject the filing.

If accepted, the property and assets will be transferred and the process is complete.

Affidavit of Heirship vs. Small Estate Affidavit

Affidavit of Heirship – Identifies the heirs to a decedent’s estate.

Small Estate Affidavit – Identifies the assets and debts of a decedent’s estate. The affidavit will include the names of the heirs if the affidavit of heirship is included in the form.

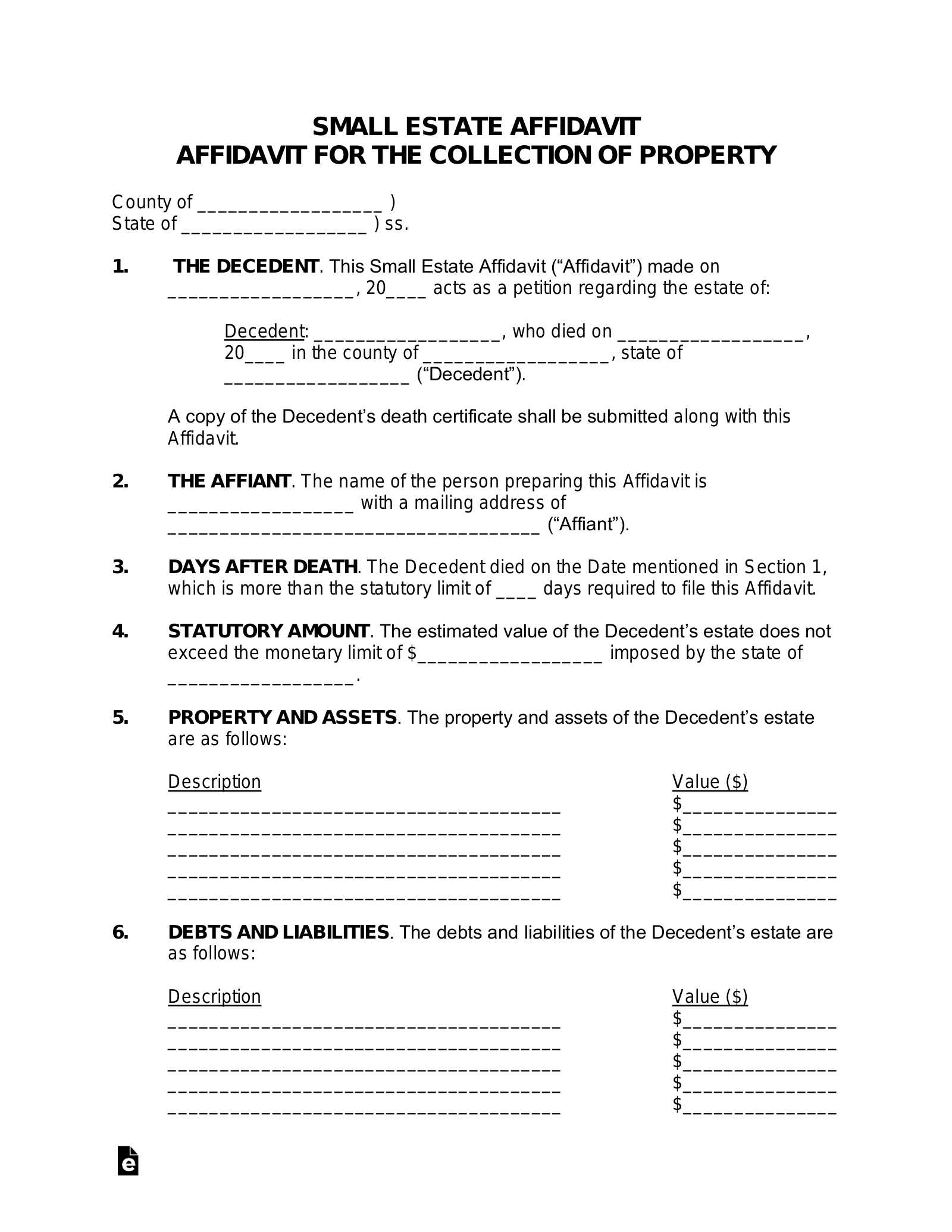

Sample

SMALL ESTATE AFFIDAVIT

AFFIDAVIT FOR THE COLLECTION OF PROPERTY

County of [COUNTY] )

State of [STATE] ) ss.

1. THE DECEDENT. This Small Estate Affidavit (“Affidavit”) made on [DATE], acts as a petition regarding the estate of:

Decedent: [DECEDENT’S NAME] who died on [DATE] in the county of [COUNTY], [STATE] (“Decedent”).

A copy of the Decedent’s death certificate shall be submitted along with this Affidavit.

2. THE AFFIANT. The person preparing this Affidavit is [AFFIANT’S NAME] with a mailing address of [MAILING ADDRESS] (“Affiant”).

3. DAYS AFTER DEATH. The Decedent died on the Date mentioned in Section 1, which is more than the statutory limit of [#] days required to file this Affidavit.

4. STATUTORY AMOUNT. The estimated value of the Decedent’s estate does not exceed the monetary limit of $[AMOUNT] imposed by the state of [STATE].

5. PROPERTY AND ASSETS. The property and assets of the Decedent’s estate are as follows:

Description Value ($)

[DESCRIBE] $[AMOUNT]

[DESCRIBE] $[AMOUNT]

[DESCRIBE] $[AMOUNT]

6. DEBTS AND LIABILITIES. The debts and liabilities of the Decedent’s estate are as follows:

Description Value ($)

[DESCRIBE] $[AMOUNT]

[DESCRIBE] $[AMOUNT]

[DESCRIBE] $[AMOUNT]

7. THE HEIRS. All heirs, devisees, or possible beneficiaries of the Decedent are listed below:

Heir’s Name: [NAME] Relationship: [DESCRIBE]

Address: [ADDRESS]

Phone: [PHONE] E-Mail: [E-MAIL]

Heir’s Name: [NAME] Relationship: [DESCRIBE]

Address: [ADDRESS]

Phone: [PHONE] E-Mail: [E-MAIL]

Heir’s Name: [NAME] Relationship: [DESCRIBE]

Address: [ADDRESS]

Phone: [PHONE] E-Mail: [E-MAIL]

Hereinafter known as the “Heirs” and shall be given notice of this Affidavit within 30 days of filing with the court.

8. TRANSFER OF PROPERTY. The following Heirs are entitled to the following property:

Property Heir’s Name

[DESCRIBE] [FULL NAME]

[DESCRIBE] [FULL NAME]

[DESCRIBE] [FULL NAME]

9. OFFICIAL STATEMENT. I, the Decedent, declare under penalty of perjury under the laws of the state of Governing Law that the information I have provided in this Affidavit are true and correct.

a.) Pending Administration. There is no pending administration of the Decedent’s estate.

b.) Probate. There is no reasonable expectation that probate of the Decedent’s estate is soon or ever shall commence.

c.) Governing Law. This Affidavit is governed under the laws located in the state of [GOVERNING LAW].

10. EXECUTION. This Affidavit is required to be signed under the requirements of state law which may require a notary public, two (2) disinterested witnesses, or both.

Affiant’s Signature: ___________________________ Date: _______________

Print Name: ___________________________

Obtain an itemized list of the decedent’s properties and assets, as well as any existing liens or debts.

Obtain an itemized list of the decedent’s properties and assets, as well as any existing liens or debts. The death certificate must be obtained (contact the Bureau of Vital Statistics or equivalent office) along with the title of all property owned by the decedent. For example, if a vehicle was owned by the decedent, the Certificate of Title will be required.

The death certificate must be obtained (contact the Bureau of Vital Statistics or equivalent office) along with the title of all property owned by the decedent. For example, if a vehicle was owned by the decedent, the Certificate of Title will be required.