Updated September 13, 2023

A Nevada small estate affidavit is a legal document that can help people obtain property that once belonged to a person who died, without having to pass through the traditional and more time-consuming probate process. This option is only available for estates that do not contain real property, meaning land and fixtures, or an interest in real property. The estate must also be worth less than the state-established maximum. Small estate affidavits may be used regardless of whether the decedent had a will.

Laws

- Days After Death – At least (40) days must pass after the decedent’s death. (N.R.S. 146.080).

- Maximum Amount ($) – If the person claiming the property is the decedent’s spouse, then the estate may be valued up to $100,000; for any other claimant, the maximum is $25,000. (N.R.S. 146.080(7)) Motor vehicles and any wages owed to the decedent by a branch of the armed forces are not counted in this total.

- Signing Requirements – The form must be notarized.

- Statutes – Estates Not Exceeding Certain Amounts (Chapter 146, Section 80)

How to File (4 steps)

1. Notify Other Claimants

2. Wait Forty Days

3. Fill Out the Form

4. Collect the Property

Video

How to Write

Download: PDF

(1) County And State Of Nevada County Of Petition. This document must establish where it will be signed, notarized, and filed. In many cases, the Notary Public will wish to report the location in the header. However, if instructed to do so (by the attending Notary) the Preparer or the Affiant may present this information. The remainder of this form may be filled out by the Affiant issuing this petition or his or her Representative.

(2) Nevada Affiant. The Nevada Affiant is the Party seeking the property of the Decedent’s estate. The name of the Nevada Affiant must be furnished to the declaration introducing this paperwork.

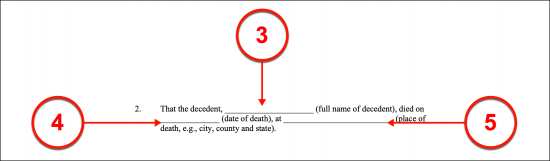

(3) Nevada Decedent. The name of the Nevada Resident who has passed away is needed in the second article. This Party, whose estate this petition focuses on, will need his or her identity supported with several more requested reports in this document.

(4) Date Of Nevada Decedent’s Death. The calendar date when the Nevada Decedent was pronounced deceased must be recorded from the death certificate issued.

(5) County Of Nevada Decedent’s Death. The town, city, or county and state where the Nevada Decedent passed away requires definition. Report this information where it is requested in the second article.

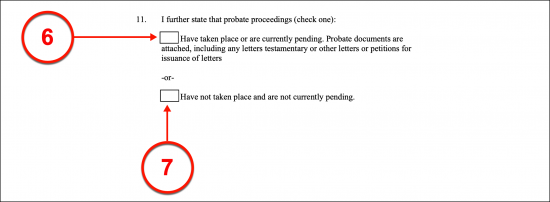

(6) Nevada Probate Process Paperwork. If any courts (whether in Nevada or otherwise) have completed or began probate on the Nevada Decedent’s estate, then a record of such actions must be included with this paperwork. Gather all documents relevant to any probate conducted by a legitimate court, attach them to this document, then select the first checkbox in the eleventh article.

(7) Affirming No Nevada Probate Process Engaged. If no probate has been conducted on the Nevada Decedent’s estate and none are currently underway, then this should be established using the language in Article 11. Thus, select the second checkbox statement from this section if the Nevada Decedent’s estate did not undergo probate or begin the probate process.

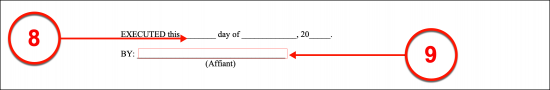

(8) Signature Date Of Nevada Affiant. Before the Nevada Affiant delivers his or her notarized signature, he or she must record the date when this act takes place.

(9) Notarized Nevada Affiant Signature. The Nevada Affiant’s signature should only be delivered under a licensed Notary Public’s direction. The Nevada Affiant will be expected to sign his or her name before the Notary Public upon his or her dating of this paperwork.

(10) Nevada Notary Public Action. The Nevada Notary will act to verify the Signature Affiant’s identity and notarize the signing of this petition.