Updated March 19, 2024

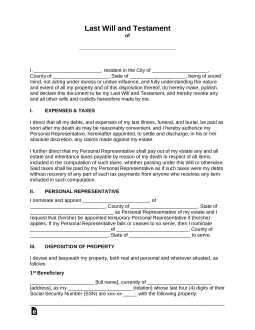

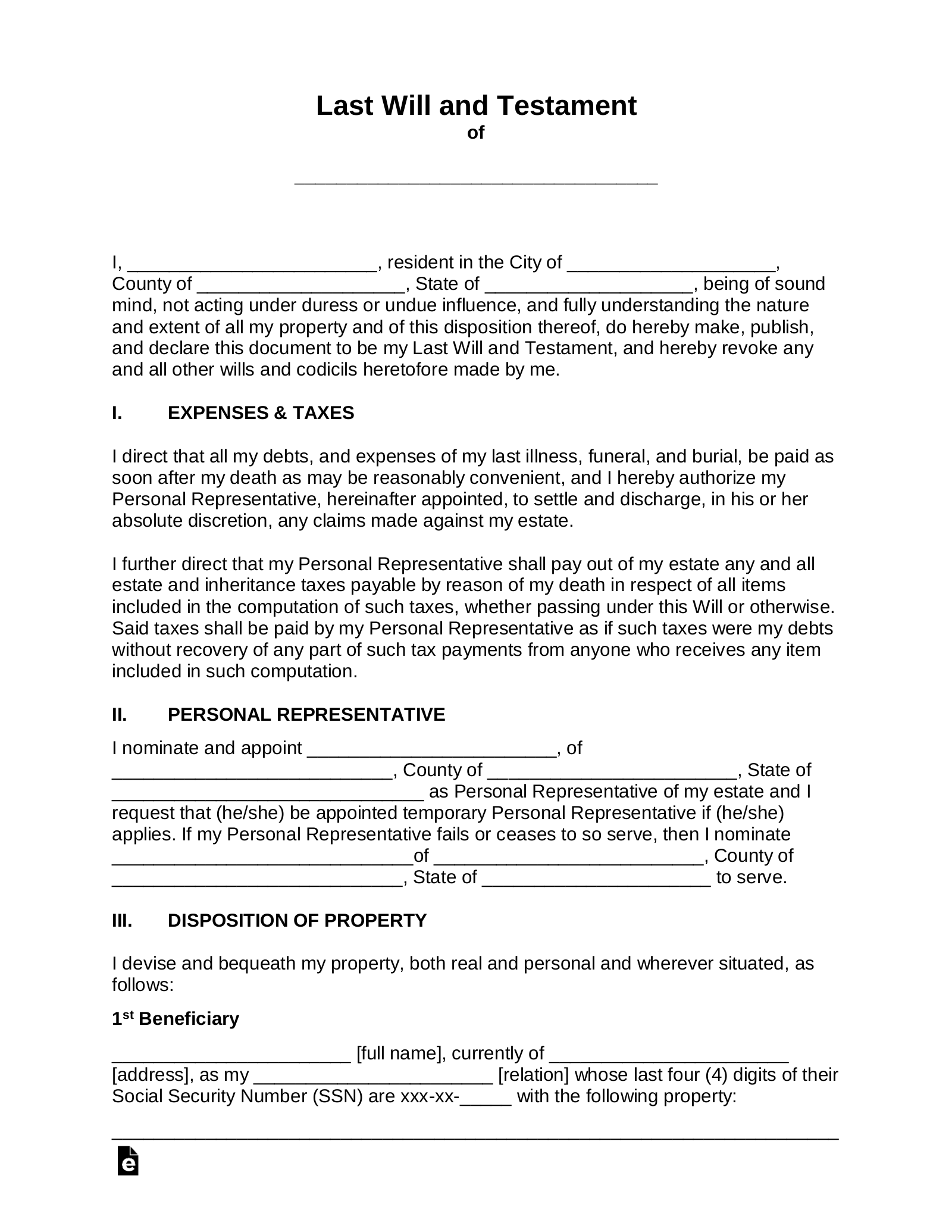

A last will and testament or will is a legal document outlining how an individual (testator) wants to transfer their assets after death. It also appoints who will manage the estate during the probate process (personal representative) and guardians for minor children and pets.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

How to Make a Will (5 steps)

- Identifying the Testator

- Appointing Individuals

- Decide ‘Who Gets What’

- Signing the Will

- Making Copies

2. Appointing Individuals

The testator should nominate and appoint the following 4 positions:

1. Personal Representative (executor) – Handles and transfers the estate’s assets to the beneficiaries. Their position is appointed immediately after the principal’s death.

2. Digital Executor – Commonly the same person as the personal representative, is designated with managing the testator’s digital profiles (e.g., bank accounts, social media, etc.)

3. Guardian for Minor Children – If the testator is the parent of minor children or caregiver of grandchildren, a guardian can be appointed to provide care until they reach 18 years of age.

4. Guardian for Pets – If the testator has pets, a pet guardian can be appointed to provide care for the remainder of their lives.

3. Decide ‘Who Gets What’

Decide ‘who will get what’ regarding the testator’s assets (also known as the beneficiaries). Anyone receiving a portion of the estate should be informed to avoid future disagreements.

Excluding Family Members – If a family member is being excluded, they should be specifically mentioned as not being a beneficiary to confirm the testator’s wishes.

Sample Language

I, the testator, being of sound mind hereby exclude [FULL NAME] from being a beneficiary or receiving any portion of my residual estate unless otherwise specified herein.

4. Signing Requirements

In 49 States, a will can be signed by two disinterested witnesses (Louisiana requires a notary public). However, it is recommended a will be notarized to have a 3rd party acknowledge that the testator was competent when signing the document.

5. Making Copies

A will is meant to be kept in a safe place with original copies provided to the beneficiaries and a family attorney. At the option of the testator, they may register the will with the probate court in their county (if applicable).

52% of adult children do not know where their parents’ estate documents are located.[5]

Signing Requirements: By State

| State | Signing Requirements |

| Alabama | § 43-8-131 Two Witnesses |

| Alaska | AS 13.12.502 Two Witnesses |

| Arizona | § 14-2502 Two Witnesses |

| Arkansas | § 28-25-102 Two Witnesses |

| California | 6110 Two Witnesses |

| Colorado | § 15-11-502 Two Witnesses or Notary Public |

| Connecticut | Section 45a-251 Two Witnesses |

| Delaware | DE Title 12, Chapter 2 § 201 & 202 Two Witnesses |

| Florida | FL Section 732.502 Two Witnesses |

| Georgia | GA Section 53-4-20 Two Witnesses |

| Hawaii | HI Section 560:2-502 Two Witnesses |

| Idaho | ID Section 15-2-502 Two Witnesses |

| Illinois | Section 755 ILCS 5/4-3 Two Witnesses |

| Indiana | IC 29-1-5-3 Two Witnesses |

| Iowa | Section 633.279 Two Witnesses |

| Kansas | Section 59-606 Two Witnesses |

| Kentucky | Section 394.040 Two Witnesses |

| Louisiana | Art. 1577 Two Witnesses and a Notary Public |

| Maine | Section 2-503 Two Witnesses |

| Maryland | Section 4-102 Two Witnesses |

| Massachusetts | Section 2-502 Two Witnesses |

| Michigan | Section 700-2502 Two Witnesses |

| Minnesota | Section 524.2-502 Two Witnesses |

| Mississippi | Section 91-5-1 Two Witnesses |

| Missouri | Section 474.320 Two Witnesses |

| Montana | Section 72-2-522 Two Witnesses |

| Nebraska | Section 30-2327 Two Witnesses |

| Nevada | NRS 133.040 Two Witnesses |

| New Hampshire | Chapter 551 Two Witnesses |

| New Jersey | Section 3B:3-2 Two Witnesses |

| New Mexico | Section 45-2-502 Two Witnesses |

| New York | Section 3-1.1 Two Witnesses |

| North Carolina | G.S. 31-3.3 Two Witnesses |

| North Dakota | 30.1-08-02. (2-502) Two Witnesses |

| Ohio | ORC 2107.03 Two Witnesses |

| Oklahoma | 84 OK Stat § 84-55 Two Witnesses |

| Oregon | ORS 112.235 Two Witnesses |

| Pennsylvania | Title 20 § 2502 Two Witnesses |

| Rhode Island | Section 33-5-5 Two Witnesses |

| South Carolina | Section 62-2-502 Two Witnesses |

| South Dakota | Section 29A-2-502 Two Witnesses |

| Tennessee | Section 32-1-104 Two Witnesses |

| Texas | Sec. 251.051 Two Witnesses |

| Utah | 75-2-502 Two Witnesses |

| Vermont | 14 V.S.A. § 5 Two Witnesses |

| Virginia | § 64.2-403 Two Witnesses |

| Washington | CW 11.12.020 Two Witnesses |

| Washington D.C. | § 18-103 Two Witnesses |

| West Virginia | Section 41-1-3 Two Witnesses |

| Wisconsin | Section 853.03 Two Witnesses |

| Wyoming | Section 2-6-112 Two Witnesses |

Video

Sources

- 2021 Gallup Poll – How Many Americans Have a will?

- 2021 Study – SenoirLiving.org (Estate Planning Report)

- Cambridge Trust – Bridging the Gap: The Importance of Estate Planning Through Generations (Page 3)

- Cambridge Trust – Bridging the Gap: The Importance of Estate Planning Through Generations (Page 2)

- Cambridge Trust – Bridging the Gap: The Importance of Estate Planning Through Generations (Page 3)