Updated November 14, 2023

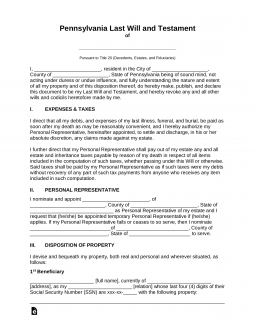

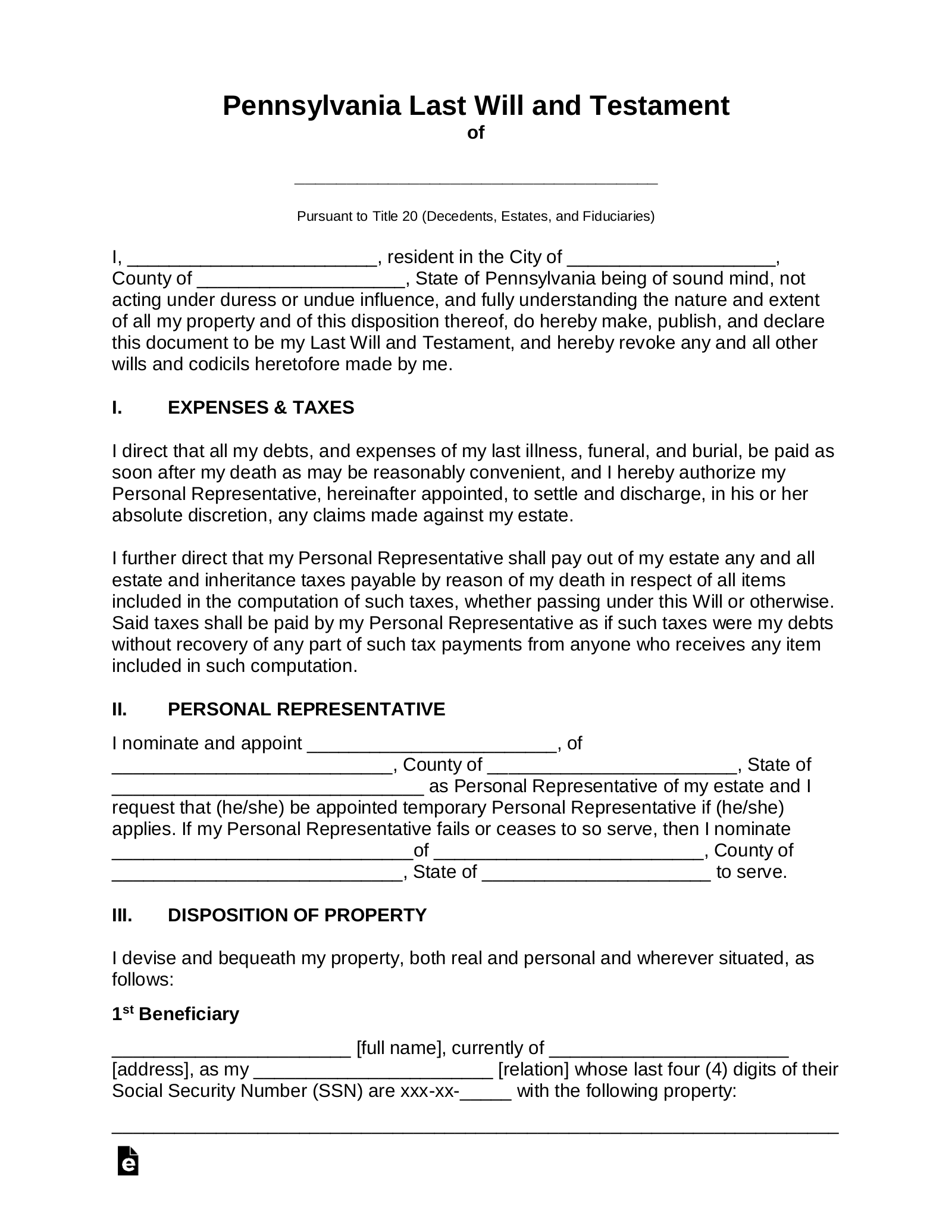

A Pennsylvania last will and testament is a legal document used by an individual (“testator”) to outline their wishes for how their assets will be distributed after their death. Designated beneficiaries are typically family, friends, children, and even charitable organizations, but the testator can name any individual or entity as a beneficiary of their estate.

Signing Requirements

There must be at least two witnesses to attest the testator’s signature and sign the will in the testator’s presence. If the testator is unable to sign their name, leaving any kind of mark as a substitute will suffice.[1]

State Definition

“Will” means a written will, codicil, or other testamentary writing.[2]

Related Forms

Download: PDF

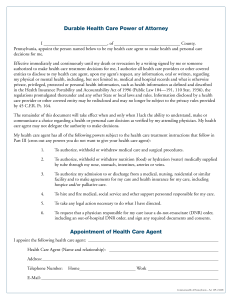

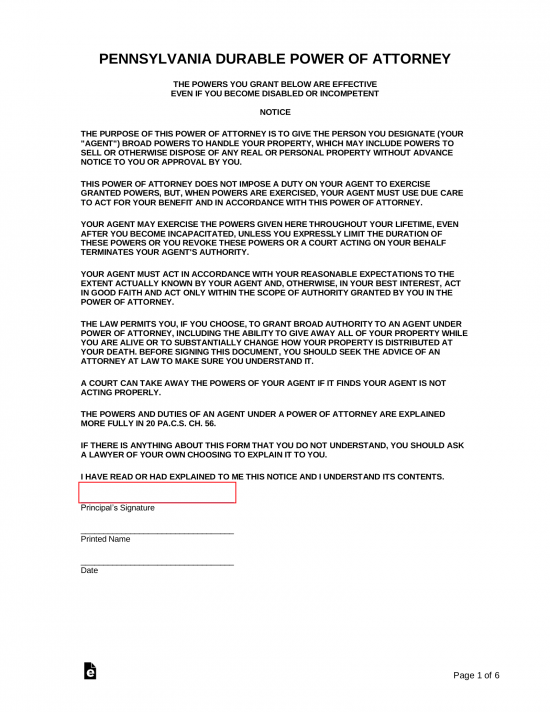

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney