Updated September 24, 2023

A purchase and sale agreement is a contract between a buyer and seller for transacting a property in exchange for a specific price. After it is signed, an earnest money deposit is paid by the buyer and is non-refundable if their contingencies are met.

When does it become legally binding?

A purchase agreement becomes legally binding after both parties have signed and the buyer receives notice of the seller’s acceptance (usually by e-mail or phone).

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

By Type (2)

Download: PDF

Comprehensive Version (10 pages)

Comprehensive Version (10 pages)

Download: PDF, MS Word, OpenDocument

How to Buy Real Estate (10 steps)

- Finding Homes for Sale

- Get a Pre-Qualification Letter

- Attending Open Houses

- Schedule a Private Showing

- Write the Purchase Agreement

- Review the Seller’s Disclosures

- Get the Home Inspected

- Obtain Financing

- Schedule & Attend the Closing

- Record the Deed

1. Finding Homes for Sale

According to the 2017 Profile of Home Buyers and Sellers, the following are the best resources to find a home for sale:

According to the 2017 Profile of Home Buyers and Sellers, the following are the best resources to find a home for sale:

- Online Search – In 51% of home sales, buyers found the property online. The top three websites to find a home are:

- Real Estate Agent – In 30% of home sales, buyers found the property through a licensed real estate agent. There are approximately 1.6M Realtors in the United States. The top three real estate brokerage companies are:

- Other – In 29% of home sales, buyers found the property through friends and family, seeing a yard sign, a newspaper listing, and other methods. It’s best to have the mindset of keeping your eyes and ears open at all times when searching for a home.

2. Get a Pre-Qualification Letter

Unfortunately, in real estate transactions, a buyer will find it much easier to make appointments and get private showings if they have a pre-qualification letter. This is a statement from the bank that shows that the buyer can obtain financing under their current financial status.

Unfortunately, in real estate transactions, a buyer will find it much easier to make appointments and get private showings if they have a pre-qualification letter. This is a statement from the bank that shows that the buyer can obtain financing under their current financial status.

In other words, a pre-qualification letter certifies the buyer is able to afford the property.

4. Schedule a Private Showing

A buyer or their agent schedules a private showing. They will contact the seller or the listing agent and meet at a specific time.

A buyer or their agent schedules a private showing. They will contact the seller or the listing agent and meet at a specific time.

When arriving at the residence, the seller and their agent commonly leave the property and give the buyer 15-20 minutes to preview the home.

5. Write the Purchase Agreement

If the potential buyer likes the home, an offer in the form of a purchase agreement is written.

If the potential buyer likes the home, an offer in the form of a purchase agreement is written.

After finalizing and sending it to the seller, they will have the choice to accept, reject, or make a counter-offer. If the seller accepts, the purchase agreement will be signed, with acceptance given to the buyer immediately.

If earnest money is part of the agreement, it commonly must be deposited into an escrow account within 3-5 days.

6. Review the Seller’s Disclosures

If an agreement is made, the seller must complete and put forth disclosure forms to the buyer. These forms will notify the seller of any issues or repairs needed in the home and if there are any hazardous substances on the property.

If an agreement is made, the seller must complete and put forth disclosure forms to the buyer. These forms will notify the seller of any issues or repairs needed in the home and if there are any hazardous substances on the property.

- Earnest Money Receipt – Issued to the buyer after an escrow payment.

- Lead-Base Paint Disclosure Form – A federal requirement for any residence built before 1978.

- Property Disclosure Statement – Completed by the seller to inform the buyer of the current status of the home, such as the roof (leaks), flooding, electrical, plumbing, heat, etc.

7. Get the Home Inspected

No matter what the seller tells you, get the residence inspected by a certified inspector in your area. A certified inspector will be someone who will most likely have an understanding of the issues with homes in the area and will be able to articulate any issues on the premises.

No matter what the seller tells you, get the residence inspected by a certified inspector in your area. A certified inspector will be someone who will most likely have an understanding of the issues with homes in the area and will be able to articulate any issues on the premises.

- Find a Certified Inspector (epa.gov) – If the residence was built before 1978, it may be worth getting the property inspected by a lead paint specialist who can tell you if there are any issues with the interior. The main hazard with lead paint is that it can chip and crack over time, leaving a powdery-like substance that is extremely toxic, especially to children.

Inspection Tips – It is also best for the buyer to walk around the home and perform their own inspection by:

- Walking around the home looking for cracks in the foundation

- Check the rafters for holes (due to termites) or general rotting

- Walk the outside premises after a rainfall

- Pay attention to ceiling details and anything that may show past flooding, leaks, or any repair that is needed

8. Obtain Financing

If financing was a condition of the purchase agreement, the buyer must go to a local financial institution to apply and secure funding for their home. This is commonly known as a “mortgage,” and depending on market conditions, may require up to 20% for a down payment along with other financial commitments.

If financing was a condition of the purchase agreement, the buyer must go to a local financial institution to apply and secure funding for their home. This is commonly known as a “mortgage,” and depending on market conditions, may require up to 20% for a down payment along with other financial commitments.

Appraisal – When obtaining financing, a professional known as an “appraiser” will be required to justify the price the buyer is paying. This will give the financial institution providing financing the comfort and security they need if the buyer can no longer afford the mortgage payment.

Once financing is finalized, the closing may be scheduled.

9. Schedule & Attend the Closing

Scheduling the closing will need to be done with a local title company. The title company will pull the deed and conduct a deed search and ensure that ownership to the buyer is legally feasible. All documents and attorneys will be coordinated with the title company, and after all the due diligence is completed, the closing will be scheduled.

Scheduling the closing will need to be done with a local title company. The title company will pull the deed and conduct a deed search and ensure that ownership to the buyer is legally feasible. All documents and attorneys will be coordinated with the title company, and after all the due diligence is completed, the closing will be scheduled.

At the closing, all documents, disclosures, and funds will be transferred to the respective parties. This may sound simple, but a typical closing can last from a couple to several hours, depending on the complexity of the property. After the closing has concluded, a deed with the buyer’s name will be produced.

10. Record the Deed

The deed is the legal title to the property, which states who is the owner. This will usually be signed at the closing, as a notary public is required in most states, and afterward can be filed at the Registry of Deeds in the county where the property is located.

The deed is the legal title to the property, which states who is the owner. This will usually be signed at the closing, as a notary public is required in most states, and afterward can be filed at the Registry of Deeds in the county where the property is located.

Transfer Taxes – If there is a real estate transfer tax, this is usually paid at the time of recording the deed. If payment for the transfer taxes was to be split by the buyer and seller, which is common, the payment should have been made at the closing.

After the deed has been filed with the county recorder, the sale is complete.

Disclosures

A disclosure is a statement or attachment to a purchase agreement that reveals information about the property. A disclosure form is usually mentioned if required by local, state, or federal law.

- Lead-Based Paint Disclosure – Federal law requires the owner of a property constructed prior to 1978 to identify if there has been any chipping, peeling, or deteriorating paint on the premises. Due to the paint particles being hazardous to a person’s health, this is a required disclosure to be attached to any purchase agreement.

- Property Disclosure Statement – Required in every state, but if the state is considered “buyer beware,” the seller is not legally liable for the information provided.

Addendums

An addendum is commonly attached to a purchase agreement to detail a contingency in the agreement. A contingency is a condition that must be met, or the terms of the entire agreement may not be valid.

Below are the most common addendums and attachments added to purchase agreements.

- Purchase Agreement Addendums

- Closing Date Extension Addendum

- Condominium Assoc. Addendum

- Earnest Money Deposit Receipt

- Escrow Holdback Agreement Addendum

- Estoppel Certificate Addendum

- Inspection Contingency Addendum

- Release of Earnest Money

- Seller Financing Addendum

- Short Sale Addendum

- Termination Letter to Purchase Agreement

- Third-Party Financing Addendum

Buyer Beware

Buyer beware, or “caveat emptor,” is a term used when the laws in the state do not require the seller to mention the material defects on the property. Therefore, the buyer purchases the property on an “as-is” basis.

The following states are considered buyer beware: Alabama, Arkansas, Colorado, Florida, Indiana, Massachusetts, Missouri, Montana, New Hampshire, New Jersey, Virginia, West Virginia, and Wyoming.

Sample

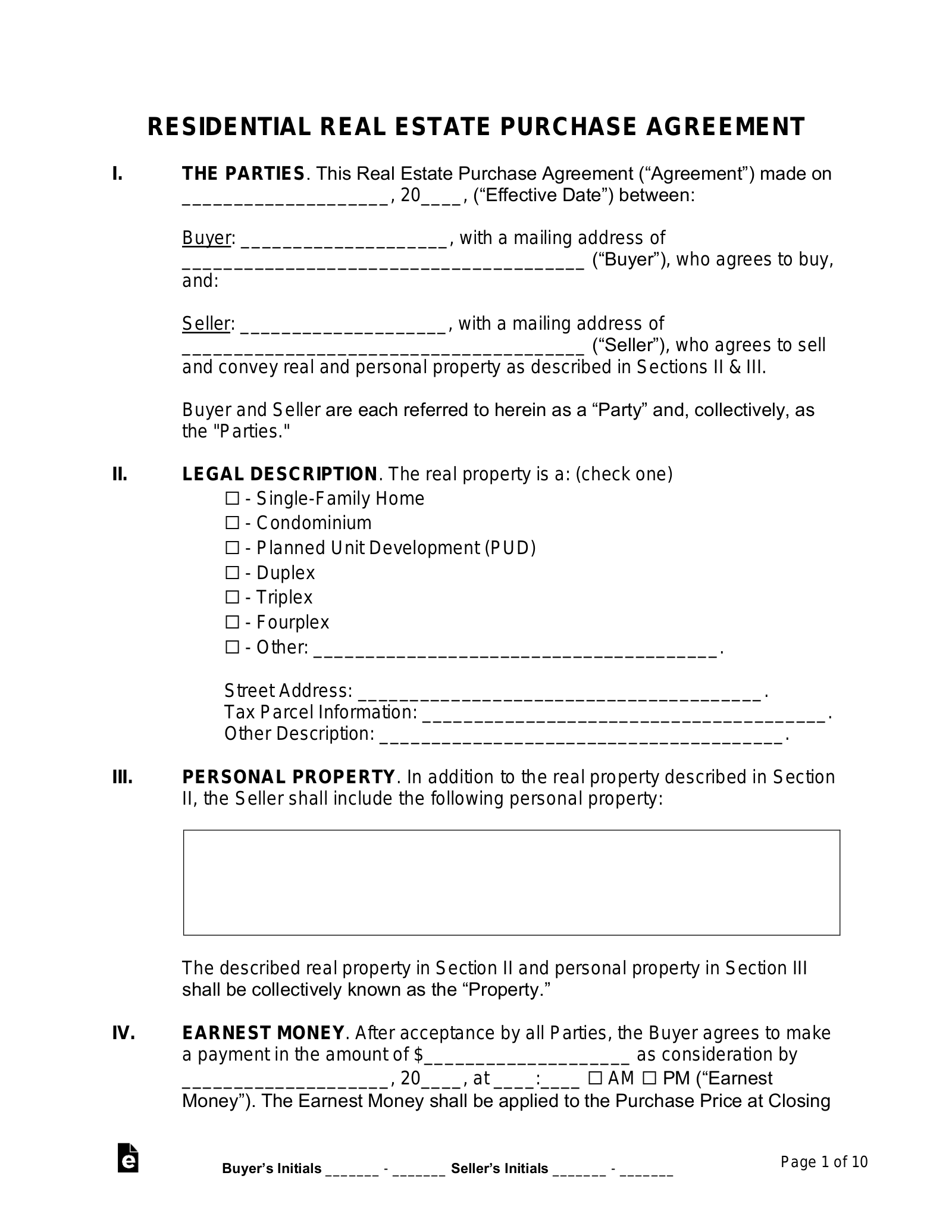

RESIDENTIAL REAL ESTATE PURCHASE AGREEMENT

I. THE PARTIES. This Real Estate Purchase Agreement (“Agreement”) made on [DATE], (“Effective Date”) between:

Buyer: [BUYER’S NAME], with a mailing address of [MAILING ADDRESS] (“Buyer”), who agrees to buy, and:

Seller: [SELLER’S NAME] with a mailing address of [MAILING ADDRESS] (“Seller”), who agrees to sell and convey real and personal property as described in Sections II & III.

Buyer and Seller are each referred to herein as a “Party” and, collectively, as the “Parties.”

II. LEGAL DESCRIPTION. The real property is a: (check one)

☐ – Single-Family Home

☐ – Condominium

☐ – Planned Unit Development (PUD)

☐ – Duplex

☐ – Triplex

☐ – Fourplex

☐ – Other: [OTHER].

Street Address: [PROPERTY ADDRESS]

Tax Parcel Information: [TAX PARCEL INFORMATION]

Other Description: [OTHER DESCRIPTION]

III. PERSONAL PROPERTY. In addition to the real property described in Section II, the Seller shall include the following personal property: [PERSONAL PROPERTY]

The described real property in Section II and personal property in Section III shall be collectively known as the “Property.”

IV. EARNEST MONEY. After acceptance by all Parties, the Buyer agrees to make a payment in the amount of $[AMOUNT] as consideration by [DATE], at [TIME] ☐ AM ☐ PM (“Earnest Money”). The Earnest Money shall be applied to the Purchase Price at Closing and subject to the Buyer’s ability to perform under the terms of this Agreement. Any Earnest Money accepted ☐ is ☐ is not required to be placed in a separate trust or escrow account in accordance with Governing Law.

V. PURCHASE PRICE & TERMS. The Buyer agrees to purchase the Property by payment of [PRICE IN TEXT] US Dollars ($[AMOUNT]) as follows: (check one)

☐ – All Cash Offer.

☐ – Bank Financing. The Buyer’s ability to purchase the Property is contingent upon the Buyer’s ability to obtain financing under the following conditions: (check one)

☐ – Conventional Loan

☐ – FHA Loan (Attach Required Addendums)

☐ – VA Loan (Attach Required Addendums)

☐ – Other: [OTHER]

a.) On or before [DATE], the Buyer will provide the Seller a letter from a credible financial institution verifying a satisfactory credit report, acceptable income, source of down payment, availability of funds to close, and that the loan approval ☐ is ☐ is not contingent on the lease, sale, or recording of another property;

☐ – Seller Financing. Seller agrees to provide financing to the Buyer under the following terms and conditions:

a.) Loan Amount: $[AMOUNT]

b.) Down Payment: $[AMOUNT]

c.) Interest Rate (per annum): [#]%

d.) Term: [#] ☐ Months ☐ Years

VI. SALE OF ANOTHER PROPERTY. Buyer’s performance under this Agreement: (check one)

☐ – Shall not be contingent upon selling another property.

☐ – Shall be contingent upon selling another property with a mailing address of [MAILING ADDRESS] within [#] days from the Effective Date.

VII. CLOSING COSTS. The costs attributed to the Closing of the Property shall be the responsibility of ☐ Buyer ☐ Seller ☐ Both Parties. The fees and costs related to the Closing shall include but not be limited to a title search (including the abstract and any owner’s title policy), preparation of the deed, transfer taxes, recording fees, and any other costs by the title company that is in standard procedure with conducting the sale of a property.

VIII. CLOSING DATE. This transaction shall close on [DATE] at [TIME] ☐ AM ☐ PM or earlier at the office of a title company to be agreed upon by the Parties (“Closing”). Any extension of the Closing must be agreed upon, in writing, by Buyer and Seller. Real estate taxes, rents, dues, fees, and expenses relating to the Property for the year in which the sale is closed shall be prorated as of the Closing. Taxes due for prior years shall be paid by Seller.

IX. SURVEY. Buyer may obtain a survey of the Property before the Closing to assure that there are no defects, encroachments, overlaps, boundary line or acreage disputes, or other such matters, that would be disclosed by a survey (“Survey Problems”). The cost of the survey shall be paid by the Buyer. Not later than [#] business days prior to the Closing, Buyer shall notify Seller of any Survey Problems which shall be deemed to be a defect in the title to the Property. Seller shall be required to remedy such defects within [#] business days and prior to the Closing.

If Seller does not or cannot remedy any such defect(s), Buyer shall have the option of canceling this Agreement, in which case the Earnest Money shall be returned to Buyer.

X. TITLE. Seller shall convey title to the property by warranty deed or equivalent. The Property may be subject to restrictions contained on the plat, deed, covenants, conditions, and restrictions, or other documents noted in a Title Search Report. Upon execution of this Agreement by the Parties, Seller will, at the shared expense of both Buyer and Seller, order a Title Search Report and have delivered to the Buyer.

Upon receipt of the Title Search Report, the Buyer shall have [#] business days to notify the Seller, in writing, of any matters disclosed in the report which are unacceptable to Buyer. Buyer’s failure to timely object to the report shall constitute acceptance of the Title Search Report.

If any objections are made by Buyer regarding the Title Search Report, mortgage loan inspection, or other information that discloses a material defect, the Seller shall have [#] business days from the date the objections were received to correct said matters. If Seller does not remedy any defect discovered by the Title Search Report, Buyer shall have the option of canceling this Agreement, in which case the Earnest Money shall be returned to Buyer.

After Closing, Buyer shall receive an owner’s standard form policy of title insurance insuring marketable title in the Property to Buyer in the amount of the Purchase Price, free and clear of the objections and all other title exceptions agreed to be removed as part of this transaction.

XI. PROPERTY CONDITION. Seller agrees to maintain the Property in its current condition, subject to ordinary wear and tear, from the time this Agreement comes into effect until the Closing. Buyer recognizes that the Seller, along with any licensed real estate agent(s) involved in this transaction, make no claims as to the validity of any property disclosure information. Buyer is required to perform their own inspections, tests, and investigations to verify any information provided by the Seller. Afterward, the Buyer shall submit copies of all tests and reports to the Seller at no cost.

Therefore, Buyer shall hold the right to hire licensed contractors, or other qualified professionals, to further inspect and investigate the Property until [DATE], at [TIME] ☐ AM ☐ PM.

After all inspections are completed, Buyer shall have until [DATE], at [TIME] ☐ AM ☐ PM to present any new property disclosures to the Seller in writing. The Buyer and Seller shall have [#] business days to reach an agreement over any new property disclosures found by the Buyer. If the Parties cannot come to an agreement, this Agreement shall be terminated with the Earnest Money being returned to the Buyer.

XII. SELLER’S INDEMNIFICATION. Except as otherwise stated in this Agreement, after recording, the Buyer shall accept the Property AS IS, WHERE IS, with all defects, latent or otherwise. Neither Seller nor their licensed real estate agent(s) or any other agent(s) of the Seller, shall be bound to any representation or warranty of any kind relating in any way to the Property or its condition, quality or quantity, except as specifically set forth in this Agreement or any property disclosure, which contains representations of the Seller only, and which is based upon the best of the Seller’s personal knowledge.

XIII. APPRAISAL. Buyer’s performance under this Agreement: (check one)

☐ – Shall not be contingent upon the appraisal of the Property being equal to or greater than the agreed upon Purchase Price.

☐ – Shall be contingent upon the appraisal of the Property being equal to or greater than the agreed upon Purchase Price. If the Property does not appraise to at least the amount of the Purchase Price, or if the appraisal discovers lender-required repairs, the Parties shall have [#] business days to re-negotiate this Agreement (“Negotiation Period”). In such event the Parties cannot come to an agreement during the Negotiation Period, this Agreement shall terminate with the Earnest Money being returned to the Buyer.

XIV. REQUIRED DOCUMENTS. Prior to the Closing, the Parties agree to authorize all necessary documents, in good faith, in order to record the transaction under the conditions required by the recorder, title company, lender, or any other public or private entity.

XV. TERMINATION. In the event this Agreement is terminated, as provided in this Agreement, absent of default, any Earnest Money shall be returned to the Buyer, in-full, within [#] business days with all parties being relieved of their obligations as set forth herein.

XVI. SEX OFFENDERS. Section 2250 of Title 18, United States Code, makes it a federal offense for sex offenders required to register pursuant to the Sex Offender Registration and Notification Act (SORNA), to knowingly fail to register or update a registration as required. State convicted sex offenders may also be prosecuted under this statute if the sex offender knowingly fails to register or update a registration as required, and engages in interstate travel, foreign travel, or enters, leaves, or resides on an Indian reservation.

A sex offender who fails to properly register may face fines and up to ten (10) years in prison. Furthermore, if a sex offender knowingly fails to update or register as required and commits a violent federal crime, he or she may face up to thirty (30) years in prison under this statute. The Buyer may seek more information online by visiting https://www.nsopw.gov/.

XVII. GOVERNING LAW. This Agreement shall be interpreted in accordance with the laws in the state of [STATE] (“Governing Law”).

XVIII. OFFER EXPIRATION. This offer to purchase the Property as outlined in this Agreement shall be deemed revoked and the Earnest Money shall be returned unless this Agreement is signed by Seller and a copy of this Agreement is personally given to the Buyer by [DATE] at [TIME] ☐ AM ☐ PM.

XIX. LICENSED REAL ESTATE AGENT(S). If Buyer or Seller have hired the services of licensed real estate agent(s) to perform representation on their behalf, he/she/they shall be entitled to payment for their services as outlined in their separate written agreement.

XX. DISCLOSURES. It is acknowledged by the Parties that: (check one)

☐ – There are no attached addendums or disclosures to this Agreement.

☐ – The following addendums or disclosures are attached to this Agreement: (check all that apply)

☐ – Lead-Based Paint Disclosure Form

☐ – [TITLE OF ADDENDUM/DISCLOSURE]

☐ – [TITLE OF ADDENDUM/DISCLOSURE]

☐ – [TITLE OF ADDENDUM/DISCLOSURE]

XXI. ADDITIONAL TERMS AND CONDITIONS. [ADDITIONAL TERMS]

XXII. EXECUTION.

Buyer Signature: _____________________________ Date: ______________

Print Name: _____________________________

Buyer Signature: _____________________________ Date: ______________

Print Name: _____________________________

Seller Signature: _____________________________ Date: ______________

Print Name: _____________________________

Seller Signature: _____________________________ Date: ______________

Print Name: _____________________________

Agent Signature: _____________________________ Date: ______________

Print Name: _____________________________

Agent Signature: _____________________________ Date: ______________

Print Name: _____________________________

For the comprehensive document, please download the free form or hit “create document.”

How to Terminate a Purchase Agreement

Unless the buyer or seller breaches or fails to perform under the purchase agreement, it cannot be canceled unless both buyer and seller agree.

Most purchase agreements are terminated due to the following:

- Failure to pay a deposit

- Material defects found during the inspection period

- Cancellation during the inspection period

- Failure to obtain financing

- By mutual agreement

Notice to Terminate a Purchase Agreement

Download: PDF, MS Word, OpenDocument

An open house is how a buyer “gets a feel” for the market conditions in their area. It is recommended to view houses within their price range. Once an idea of what the buyer is looking for is discovered, the search can be narrowed.

An open house is how a buyer “gets a feel” for the market conditions in their area. It is recommended to view houses within their price range. Once an idea of what the buyer is looking for is discovered, the search can be narrowed.