Updated August 01, 2023

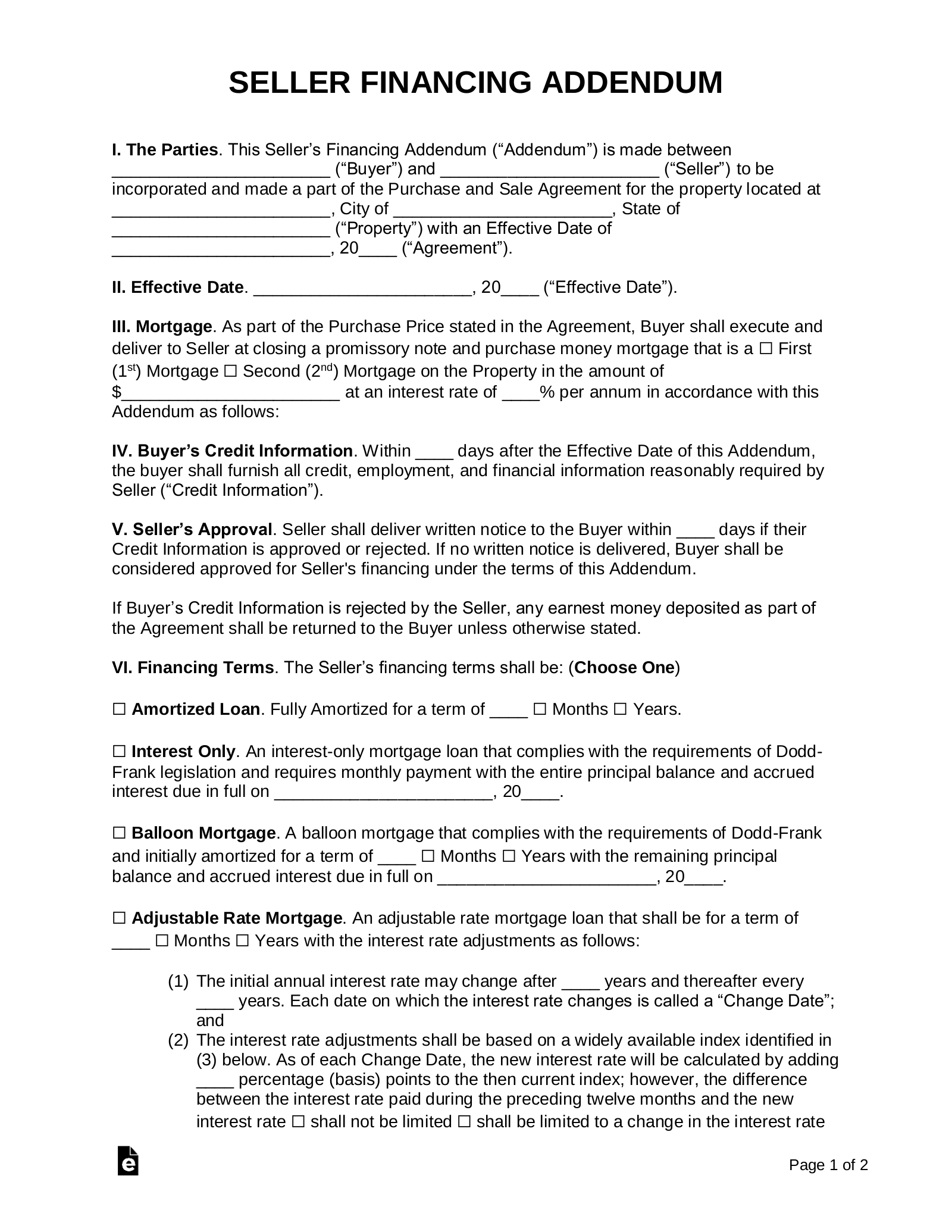

A seller financing addendum outlines the terms under which the seller of a property agrees to loan money to the buyer in order to purchase their property. The seller agrees to take either a first (1st) or second (2nd) mortgage on the property at an agreed upon interest rate with payments that are made either every month or in a balloon payment at the end of the term. Once complete, this addendum should be signed and attached to the purchase agreement made between the parties.

Third (3rd) Party Financing Addendum – If the buyer is going to be obtaining a loan through a bank or government insured source (e.g., FHA, VA, etc.).