Updated March 29, 2024

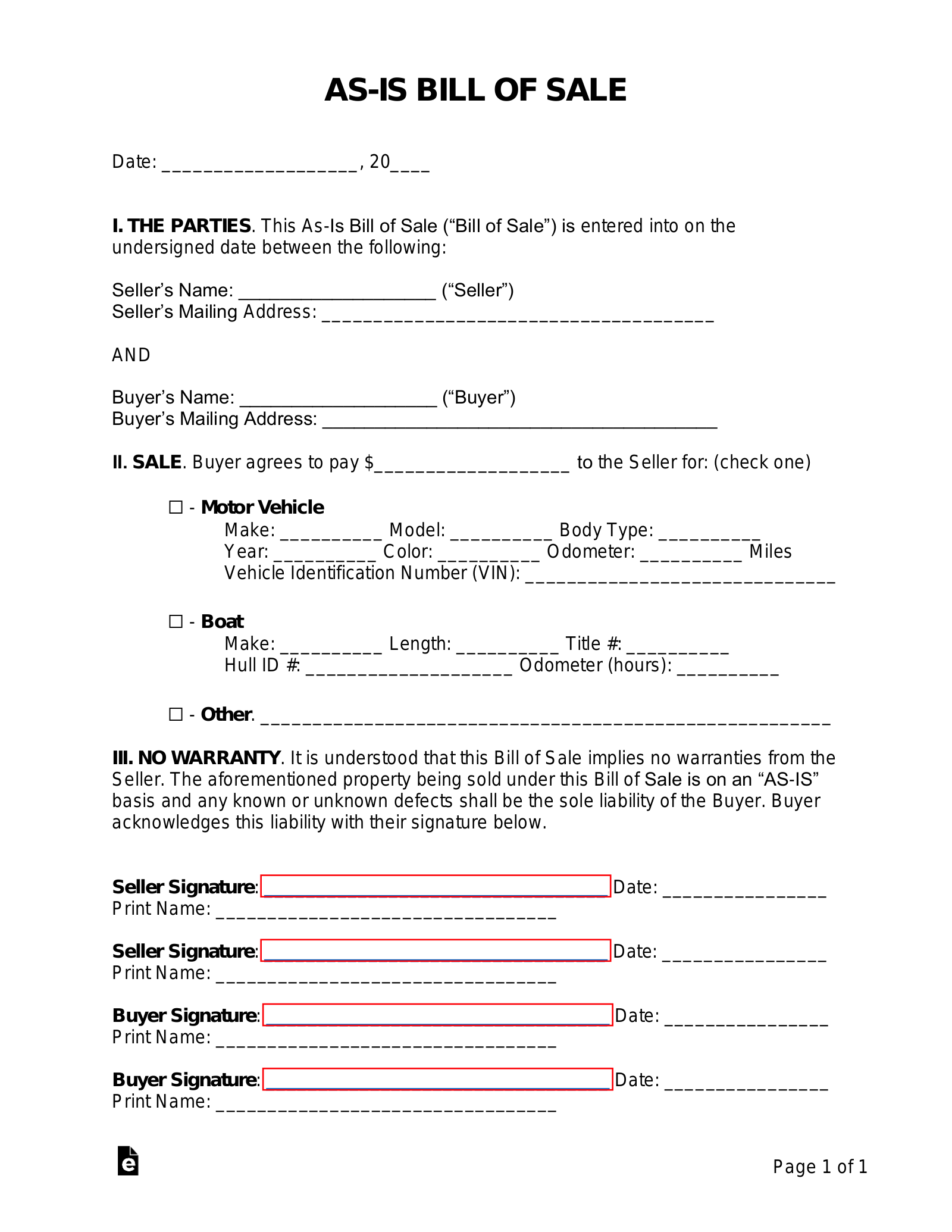

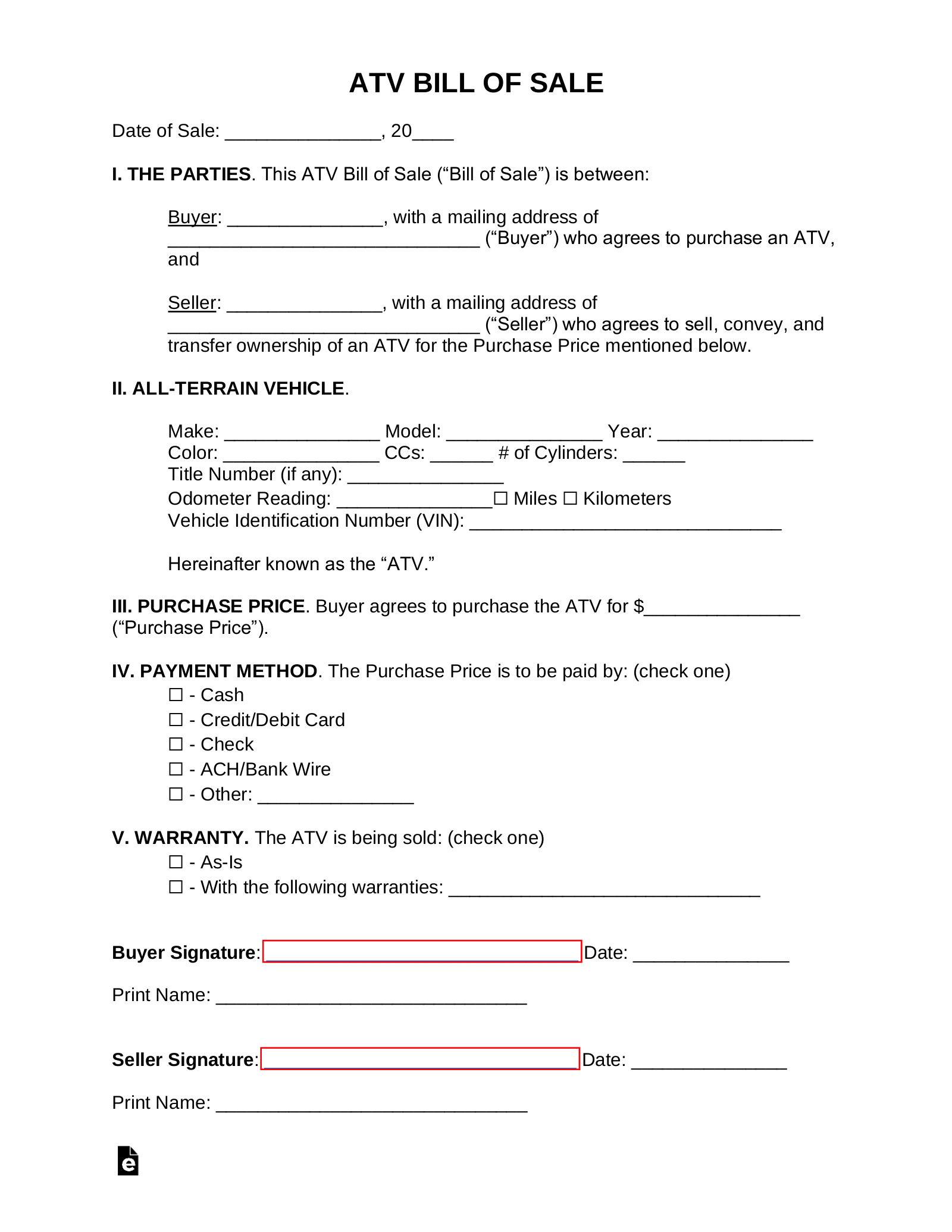

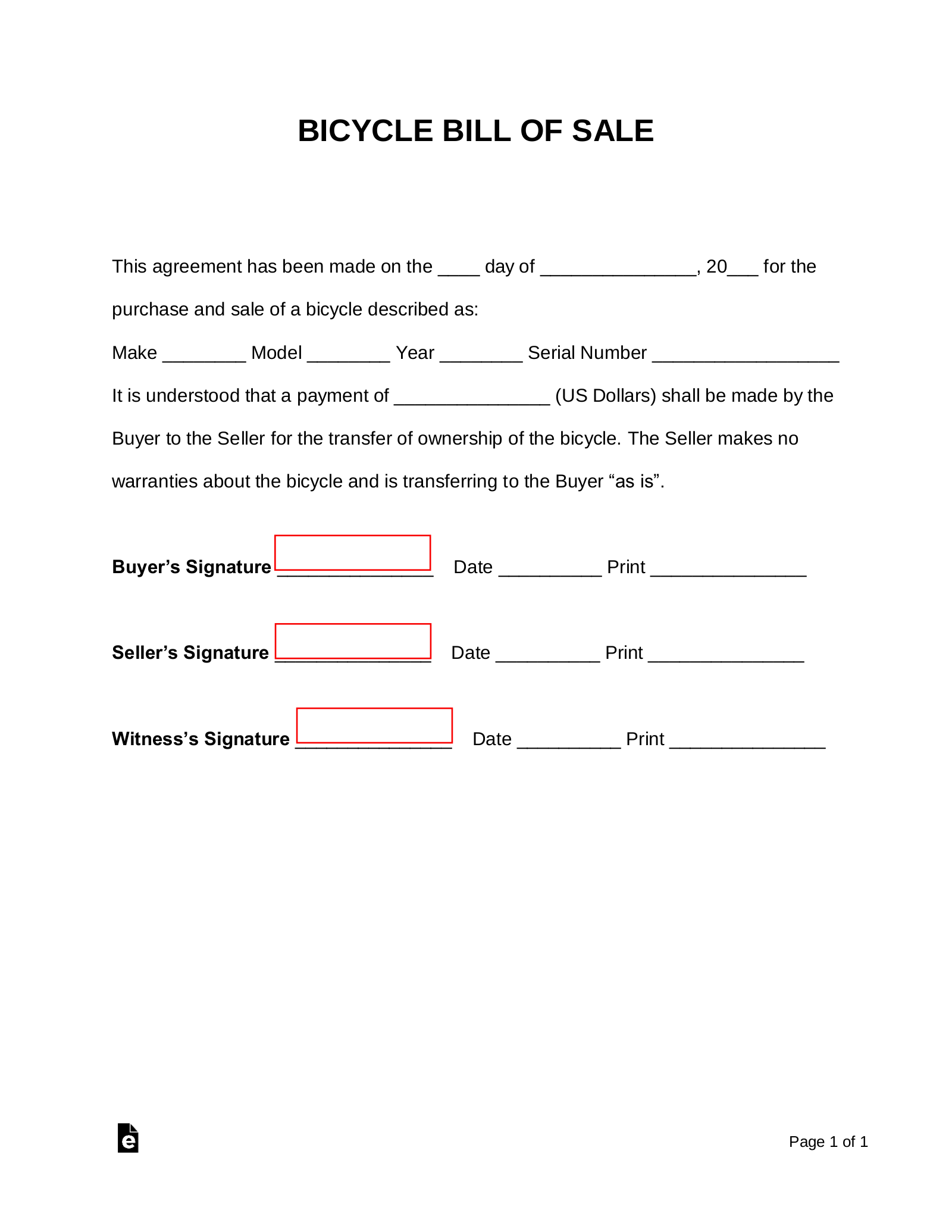

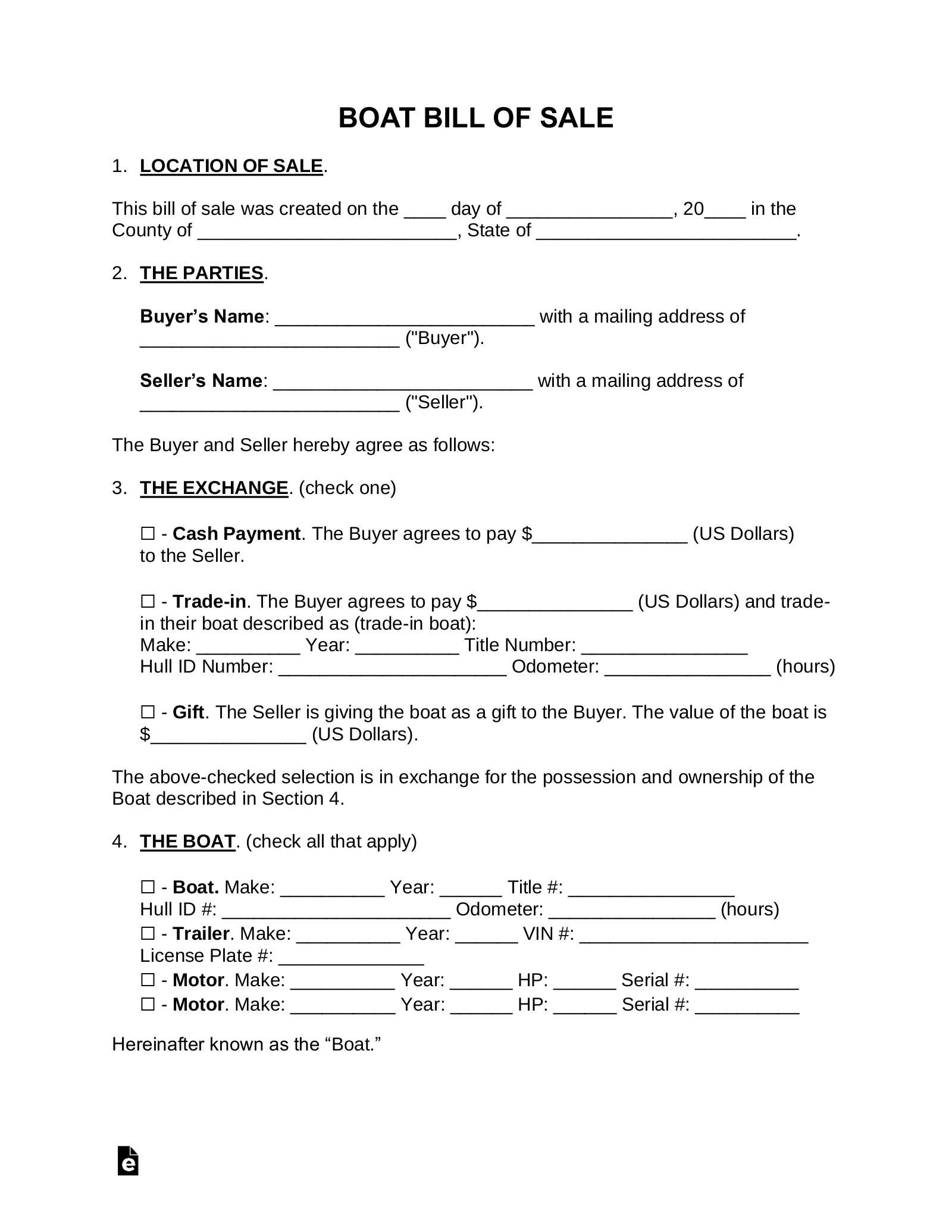

A bill of sale is a legal document between a buyer and seller for the purchase of goods in exchange for cash or trade. It should be signed after the transaction has been finalized and the exchange has occurred.

Motor Vehicles

If a motor vehicle bill of sale is being completed, the buyer must keep an original signed copy for registration purposes.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

By Type (24)

How to Privately Sell a Vehicle

1. Get a Vehicle History Report

The seller should present the vehicle’s accident history. If not, the buyer can pay for this using CarFax ($39.99).

While there are no specific rules or laws on what gets reported on a vehicle’s history report, a repair will commonly be recorded if an insurance claim is made.

Vehicle Inspection

A prospective buyer may still request to have the vehicle inspected by a 3rd party mechanic to confirm the vehicle’s condition.

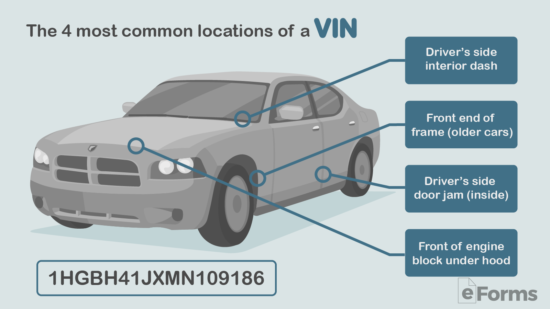

2. Gather Vehicle Documents

The seller will need to prepare the following documentation to sell the vehicle:

Required Documents

- Vehicle Title – The seller’s name should appear as the current owner.

- Odometer Disclosure – Required if the vehicle is under 10 years old (and under 16,000 pounds).

Optional Documents

- Lien Release – If an auto loan was recently paid off.

- Service Records – For any repairs or invoices paid for vehicle modifications.

- Vehicle Power of Attorney – If someone is selling a vehicle on the owner’s behalf.

4. Complete the Sale

The sale is finalized when both parties have completed the following:

- Bill of Sale – Each party has a signed bill of sale.

- Odometer Disclosure Statement – Signed by the seller and given to the buyer.

- Payment Made – When the funds have been verified and sent to the seller.

- Vehicle Title – When the title has been signed over by the seller to the buyer.

- Sales Tax Paid – Depending on the State, it must be paid by the buyer or seller.

5. Post-Sale Requirements

Seller’s Requirements

- Sales Tax – If the seller is required to pay, the amount must have been collected by the buyer and paid to the State DMV Office.

- Notice of Transfer – States such as California and Texas require the seller to notify the DMV when a vehicle is sold.

Buyer’s Requirements (registration)

- Bill of Sale

- Driver’s License

- Odometer Disclosure Statement

- Proof of Insurance

- Registration Fees

- Sales Tax (if applicable)

- Vehicle/Emissions Inspection (if appliable)

DMV Offices: By State

Sample

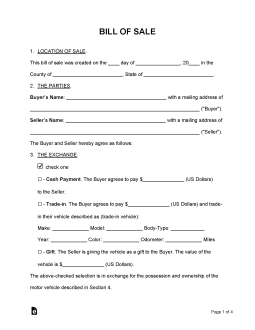

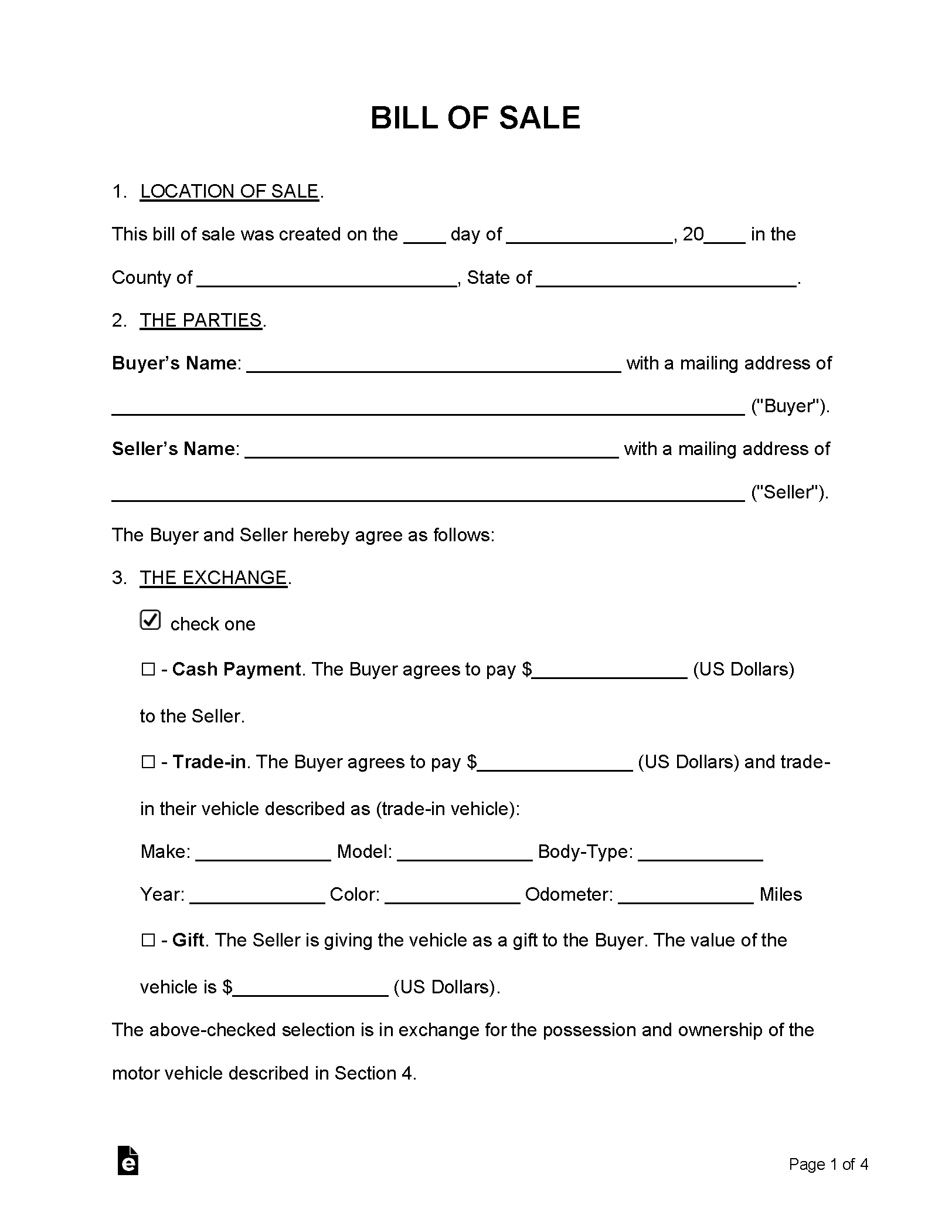

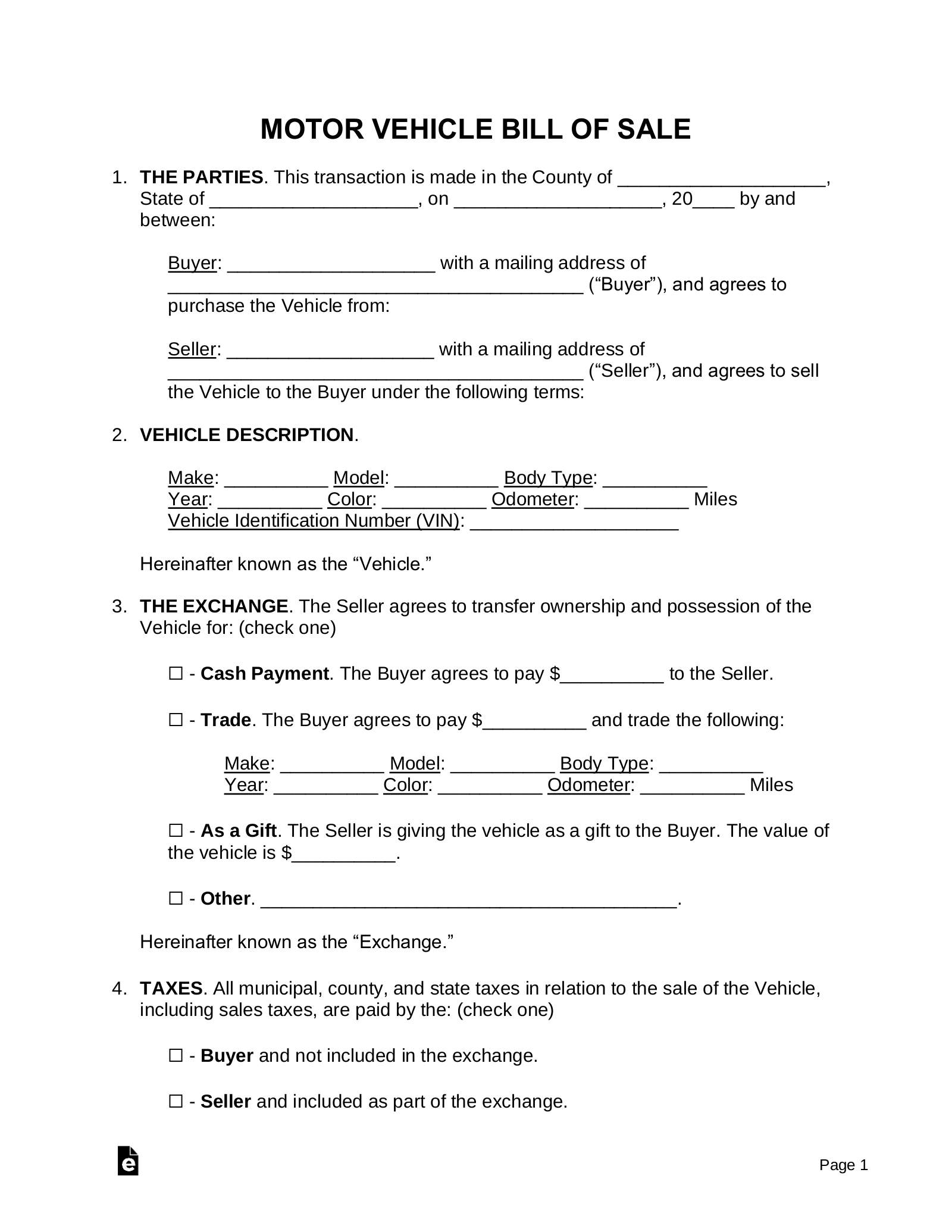

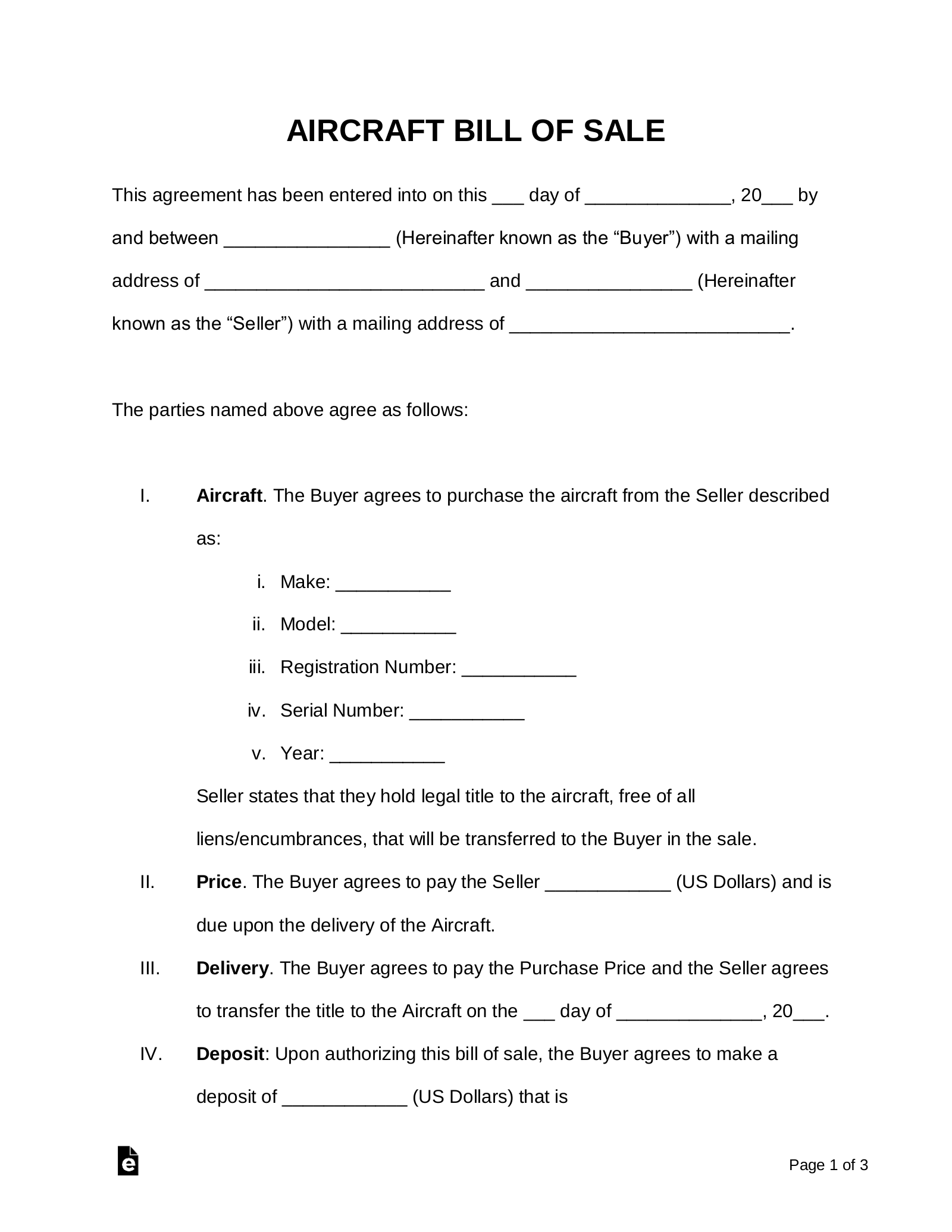

BILL OF SALE

Date of Sale: [DATE]

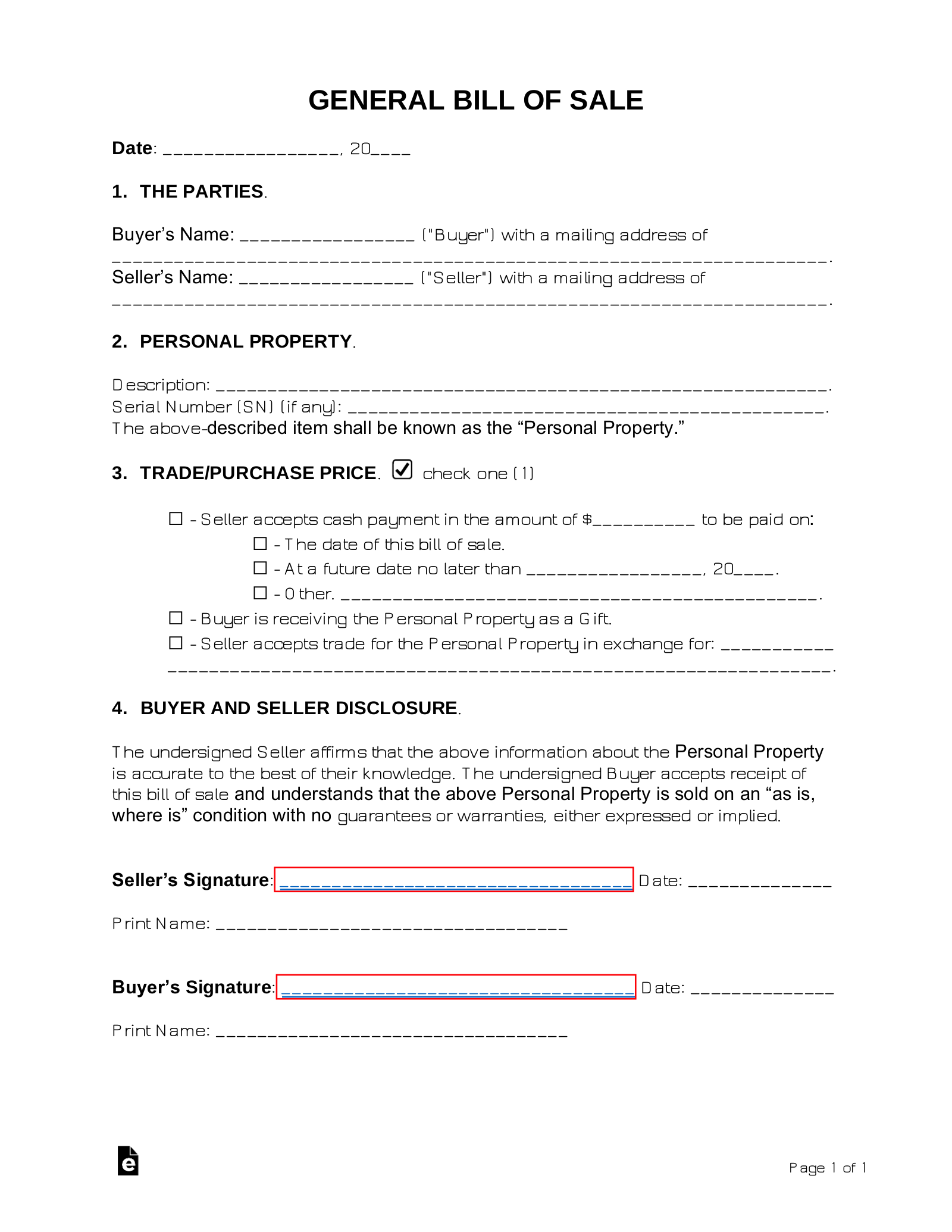

1. THE PARTIES.

Buyer’s Name: [NAME] with a mailing address of [ADDRESS] (“Buyer”) and agrees to purchase the Property from the Seller known as:

Seller’s Name: [NAME] with a mailing address of [ADDRESS] (“Seller”) and agrees to sell the Property under the following terms:

2. DESCRIPTION OF GOODS

Property Description: [DESCRIBE]

Hereinafter known as the “Property.”

3. TRADE/PURCHASE PRICE. The Seller agrees to sell the Property in exchange of: (check one)

☐ – Cash Payment. The Seller accepts cash payment in the amount of $[PURCHASE PRICE] to be paid on: (check one)

☐ – The date of this bill of sale.

☐ – At a future date no later than [DATE]

☐ – Other. [OTHER]

☐ – Trade. The Seller accepts trade for the Property in exchange for: [DESCRIBE TRADE]

☐ – Gift. The Buyer is receiving the Property as a gift.

Hereinafter known as the “Exchange.”

4. TAXES.

All municipal, county, and state taxes in relation to the purchase of the Property, including sales taxes, are ☐ included ☐ not included in the Exchange.

5. BUYER AND SELLER DISCLOSURE.

The undersigned Seller affirms that the above information about the Property is accurate to the best of their knowledge. The undersigned Buyer accepts receipt of this bill of sale and understands that the above-described Property is sold on an “as is, where is” condition with no guarantees or warranties, either expressed or implied.

Seller’s Signature: _________________________ Date: ______________

Print Name: ____________________________

Buyer’s Signature: _________________________ Date: ______________

Print Name: ____________________________