Updated August 14, 2023

An Arkansas bill of sale describes a transaction between a buyer and seller for the purchase of personal property. Commonly used for vehicle transactions, the document should be signed by both parties and can be used for registration purposes by the buyer.

Forms (5)

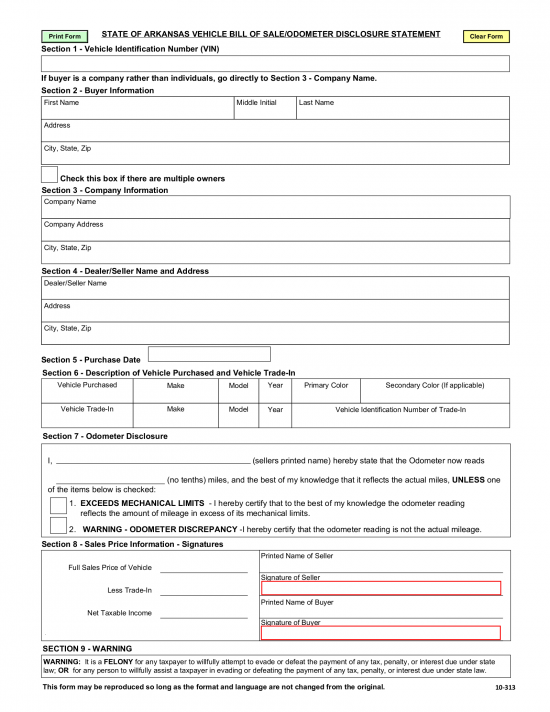

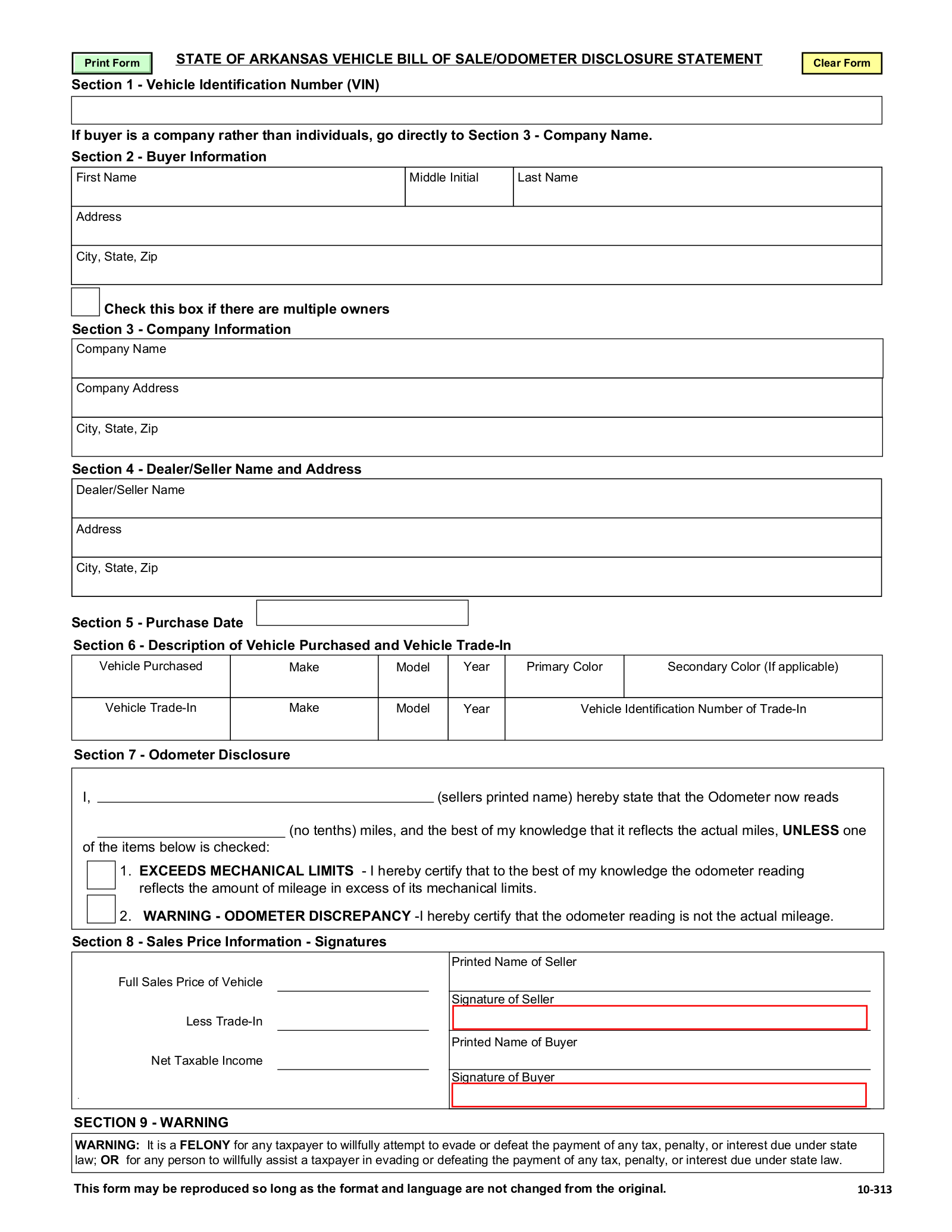

Motor Vehicle Bill of Sale – This document will record the sale and purchase of a motor vehicle. As well, it will provide legitimacy to the reading of the odometer on a vehicle being purchased. Motor Vehicle Bill of Sale – This document will record the sale and purchase of a motor vehicle. As well, it will provide legitimacy to the reading of the odometer on a vehicle being purchased.

Download: PDF

|

Boat Bill of Sale – To be used in the selling and acquiring of a watercraft sold and purchased between two parties. Boat Bill of Sale – To be used in the selling and acquiring of a watercraft sold and purchased between two parties.

Download: PDF, MS Word, OpenDocument

|

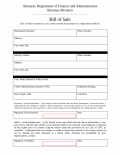

General Bill of Sale – Is used for an individual to provide proof of sale and purchase of a personal property between two parties. General Bill of Sale – Is used for an individual to provide proof of sale and purchase of a personal property between two parties.

Download: PDF, MS Word, OpenDocument |

Gun Bill of Sale – Should be used while conducting the sale and purchase of a firearm. Gun Bill of Sale – Should be used while conducting the sale and purchase of a firearm.

Download: PDF, MS Word, OpenDocument

|

|

Download: PDF |

Motor Vehicle Registration Forms

- Bill of Sale & Odometer Disclosure Statement;

- Certificate of Title;

- Valid driver’s license;

- Registration fees;[1]

- Proof of insurance with the following minimum requirements:

- $25,000 bodily injury per person

- $50,000 per accident

- $25,000 property damage

You might also need:

- Personal Property Tax Number (PPAN) assigned from your county assessor

- Lien Contract/Security Agreement

- Current Year County Tax Assessment

- Proof of paid tax receipt

Boat/Vessel Registration Forms

- Bill of Sale;

- Legible Pencil Rubbing or Printed Photograph of the HIN;

- Assessment from AR County Assessor;

- Valid Driver’s License or Photo ID;

- Receipt from County Tax Collector, stating personal taxes were paid (alternatively, a certification of payment stamped on the assessment papers will be accepted);

- Registration fees;[2] and

- Proof of insurance with the following minimum requirement (only boats powered by engines of 50 horsepower):

- $50,000 or more of liability coverage per occurrence.

Tax Credit for Replacement Vehicle Bill of Sale

Tax Credit for Replacement Vehicle Bill of Sale