Updated August 14, 2023

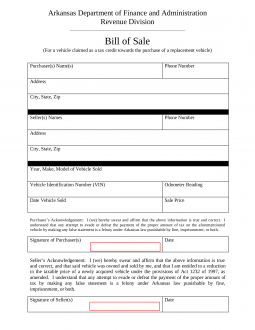

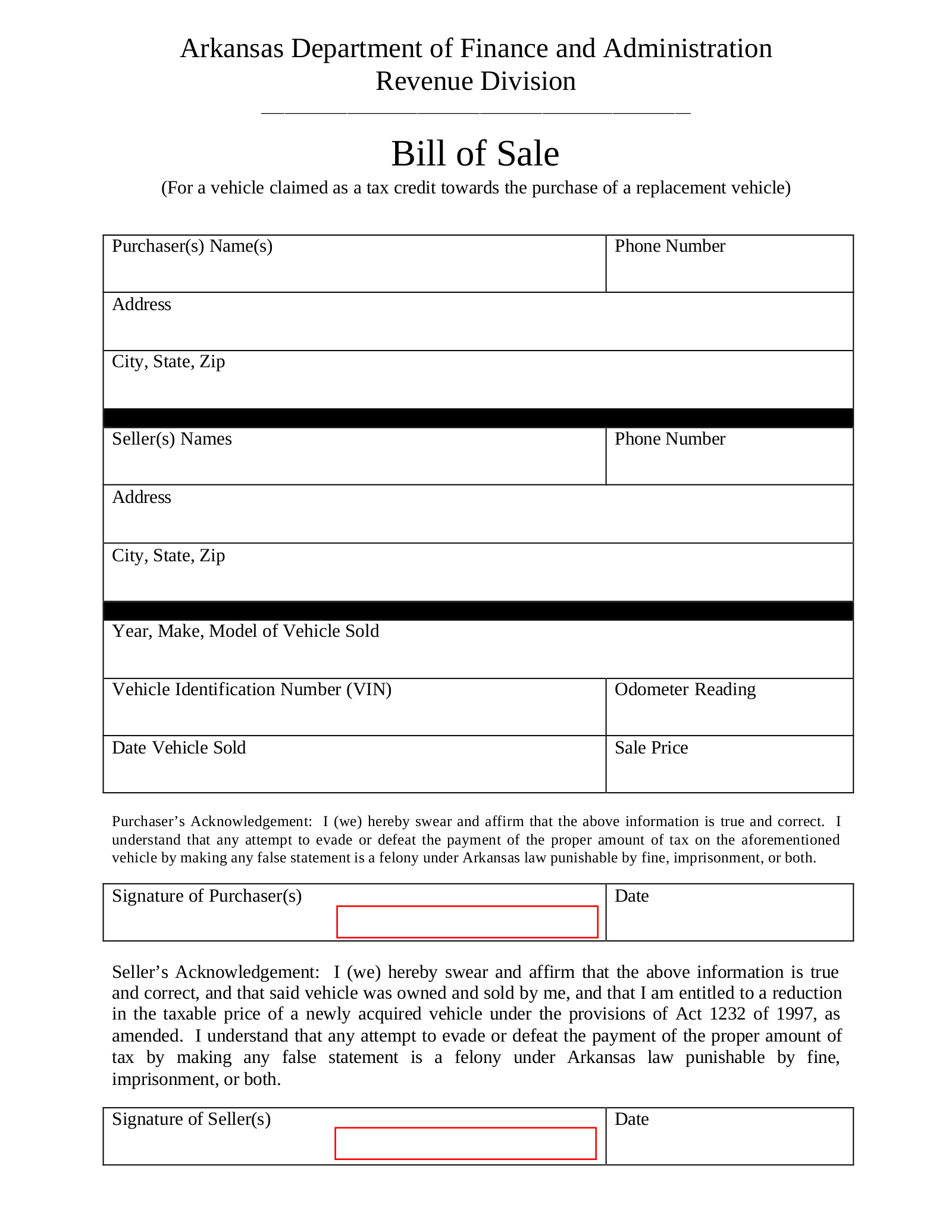

An Arkansas tax credit for replacement vehicle bill of sale is a legal document that allows an individual who has sold a vehicle and is now purchasing a different vehicle as a replacement to access a tax credit. The document must be completed within 45 days. After 45 days, the buyer will no longer be able to take advantage of this tax credit.