Updated February 25, 2024

A promissory note is a written promise made by a borrower to a lender to repay a specified sum of money with or without interest. Once signed by both parties, it becomes a legally binding document.

Requirements

- The Parties – Full names and addresses of the borrower and lender.

- Borrowed Amount ($) – The original amount of money owed.

- Interest Rate (%) – Percentage of the principal amount paid for the loan.

- Maturity Date – Final date when the principal + interest must be paid.

- Execution – Must be signed by both parties.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

By Type (2)

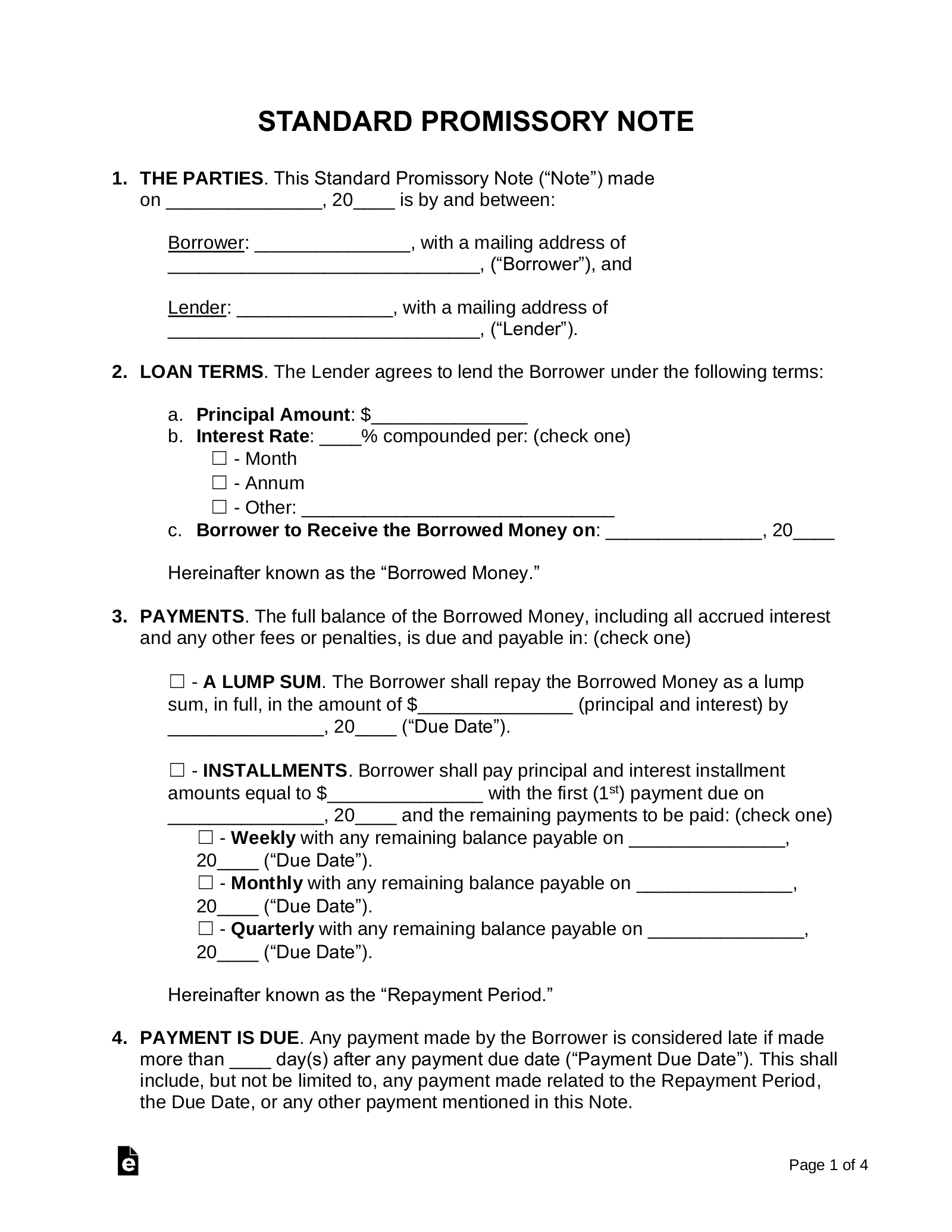

Secured Promissory Note – For the borrowing of money with an asset of value “securing” the amount loaned such as a vehicle or a home. If the borrower does not pay back the amount within the mandated timeframe, the lender will have the right to obtain the property of the borrower.

Secured Promissory Note – For the borrowing of money with an asset of value “securing” the amount loaned such as a vehicle or a home. If the borrower does not pay back the amount within the mandated timeframe, the lender will have the right to obtain the property of the borrower.

Download: PDF, MS Word, OpenDocument

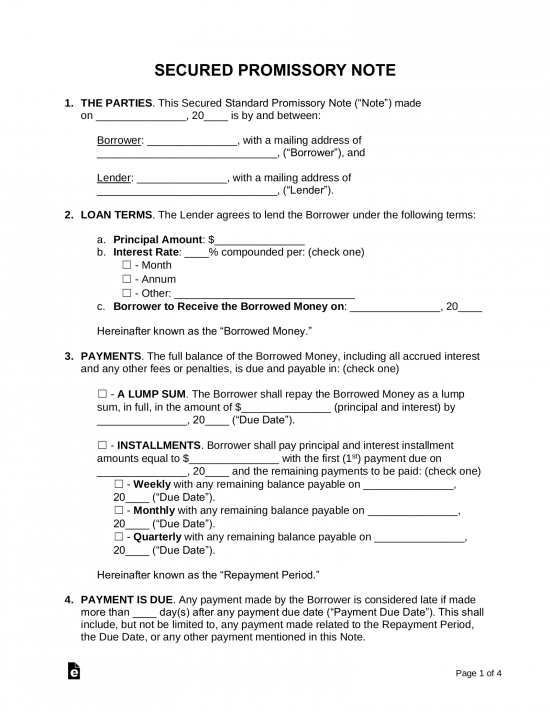

Unsecured Promissory Note – This does not allow the lender to secure an asset for money loaned. This means that if the payment is not made by the borrower, the lender would need to seek repayment in a small claims court or through other legal processes.

Unsecured Promissory Note – This does not allow the lender to secure an asset for money loaned. This means that if the payment is not made by the borrower, the lender would need to seek repayment in a small claims court or through other legal processes.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is a Promissory Note?

A promissory note is a written promise to pay back money owed within a specific timeframe. The borrower receives the funds after the note is signed and agrees to make payments under the terms and conditions of the note. The lender will collect interest which acts as a fee for lending the money.

How to Create a Promissory Note (5 steps)

1. Agree to Terms

Before both parties sit down to write an agreement, the following should be verbally agreed upon:

Before both parties sit down to write an agreement, the following should be verbally agreed upon:

- Amount ($) – The amount of money being borrowed.

- Due Date – When the borrowed money is supposed to be paid back in full.

- Interest Rate – In other words, the fee for borrowing the money (See How to Calculate). Make sure to check the Interest Rate Laws in your state (or “Usury Rate”). All states have a maximum amount of interest a lender is able to charge.

- First Payment Due Date – When the borrower will begin paying back the loan.

- Late Fee(s) – Penalties for late payment.

- Origination Date – The day when the borrower receives the funds from the lender.

- Security – Items such as vehicles or a second mortgage on a home are provided if the borrower does not repay the borrowed money. This is to assure the lender that their money will be paid back either in cash or assets.

- Terms of Repayment – Will the payments be made incrementally or as a lump sum?

- Default Clause – Provide terms for if the borrower never pays back the money.

- Co-Signer – If the borrower is not financially capable of borrowing the money, a second person should be named to pay back the loan if the borrower cannot do so themselves.

2. Run a Credit Report

It is always a good idea to run a credit report on any potential borrower as they may have outstanding debt unbeknownst to you. Especially if the debt is IRS or child support related, it will take precedence over this promissory note. Therefore, it is imperative that a credit report is run before making any type of agreement.

It is always a good idea to run a credit report on any potential borrower as they may have outstanding debt unbeknownst to you. Especially if the debt is IRS or child support related, it will take precedence over this promissory note. Therefore, it is imperative that a credit report is run before making any type of agreement.

Reporting Agencies – It is a good idea to use Experian, which is free to the lender and charges $14.95 to the borrower. Experian is known as the most sensitive credit agency usually providing the lowest score of the three credit bureaus (Experian, Equifax, and TransUnion).

Authorization Form – In order to run someone else’s credit, you must obtain written legal permission.

3. Security and Co-Signer(s)

If there are red flags that appear on the credit report the lender may want to have the borrower add security or a co-signer to the note. Common types of security include motor vehicles, real estate (provided as a first or second mortgage), or any type of valuable asset.

If there are red flags that appear on the credit report the lender may want to have the borrower add security or a co-signer to the note. Common types of security include motor vehicles, real estate (provided as a first or second mortgage), or any type of valuable asset.

This would mean that if the borrower does not repay the loan, the lender would be able to obtain full ownership of the security placed in the note. In the case of a co-signer, they would be liable for the full extent of the money owed along with associated penalties or late fees.

4. Writing the Note

After the main terms of the note have been agreed upon, the lender and borrower should come together to authorize the formal agreement.

After the main terms of the note have been agreed upon, the lender and borrower should come together to authorize the formal agreement.

Signing – The money should be exchanged only after the note has been signed. It is not required that a witness sign the form but is recommended. For excessive amounts (more than $10,000), a notary public is recommended.

5. Paying Back the Money

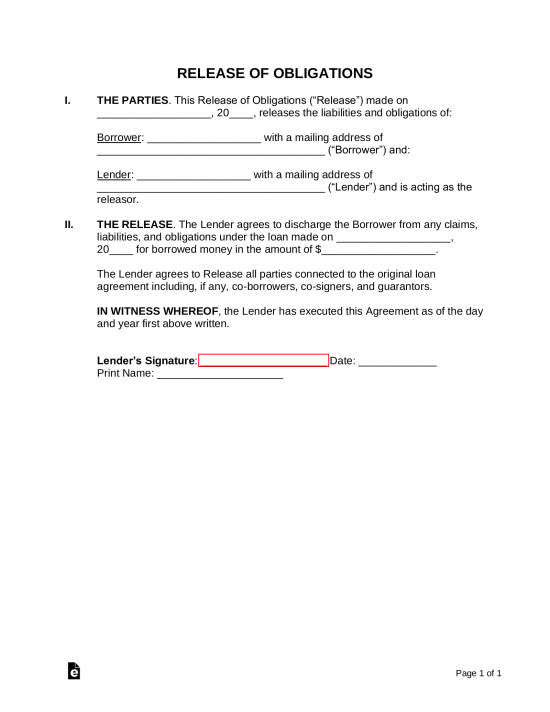

The borrower should pay back the borrowed money on time and in accordance with the note. If not, fees may be applied to the overall balance. Once all the money has been fully paid back to the lender, a loan release form is created and issued to the borrower relieving them from any liability from the note.

The borrower should pay back the borrowed money on time and in accordance with the note. If not, fees may be applied to the overall balance. Once all the money has been fully paid back to the lender, a loan release form is created and issued to the borrower relieving them from any liability from the note.

- If Payment is Late – If the payment is late the lender should issue a demand letter. This informs the borrower of the terms stated in the promissory note, such as penalty for late payment or how much time they have before the loan is defaulted.

- If Borrowed Money is Never Paid – If the borrower defaults on the note, the lender can collect by minimizing their costs by seeking the funds through small claims court, which is typically limited for loans with a value of $10,000 or less depending on the jurisdiction. If there was security placed in the note, the property or asset shall be turned over to the lender in accordance with the note. Otherwise, legal action will most likely be necessary for money owed in value of more than $10,000.

How to Calculate (3 ways)

1. Total Interest Owed

To calculate is as follows:

Money Borrowed X Annual Interest Rate = Total Interest Owed (per Year)

If less than one year – If the payment is monthly or quarterly, divide the total above by the fraction of the year it will take to repay the loan. Example: Payment due in three months would require you to divide the total by 4 since it’s only 1/4 of the year. Furthermore, each month would require dividing by 12 since it’s 1/12 of the year.

- Sample Calculation – You to borrow $1,000 for 3 months at an annual interest rate of 10%. First, you must calculate the interest rate over a year span, which would be $100 ($1,000 times 10%). Then, you would divide the $100 amount by 4 (as there are 4 three-month periods in a year). You would arrive at $25 as the total interest owed that you would need to pay over the course of three months for borrowing $1,000.

2. Total Repayment Amount

To calculate is as follows:

Money Borrowed + Total Interest Owed = Total Repayment Amount

- Sample Calculation – You want to borrow $1,000 for 3 months at an interest rate of 10%. First, you would want to calculate the interest rate over a year span which would be $100 ($1,000 times 10%). Then, you would divide the $100 amount by 4 (as there are 4 three-month periods in a year). You would arrive at $25 as the total interest owed that you would need to pay over the course of three months for borrowing $1,000. The final payment amount would be $1,025.

3. Monthly Payment Amount

To calculate is as follows:

(Money Borrowed + Total Interest Owed) / Number (#) of Months = Monthly Payment Amount

- Sample Calculation – You want to borrow $1,000 for 3 months at an interest rate of 10%. First, you would want to calculate the interest rate over a year span which would be $100 ($1,000 times 10%). Then, you would divide the $100 amount by 4 (as there are 4 three-month periods in a year) and arrive at $25 as the total interest owed. Then you would add the money borrowed of $1,000 to the $25 of interest due, which equals $1,025. Since there are three months of payments, you would divide $1,025 by 3, and the monthly payment amount would equal $341.67.

Usury Laws (Interest Rates)

Also known as the maximum rate of interest a lender can charge. It’s important that lenders do not charge a rate of interest more than what their state allows. The following are links to each state’s usury rate laws.

| State | Usury Rate | Laws |

| Alabama | 8% for written contracts, 6% for verbal agreements. | Ala. Code § 8-8-1 |

| Alaska | For loans less than $25,000, 5% above the 12th Federal Reserve District interest rate on the day the loan was made, or 10%, whichever is greater. If the amount is more than $25,000, there is no maximum rate. | Alaska Stat. § 45.45.010 |

| Arizona | No limit for loan agreements in writing. If not in writing, the rate shall be 10% per annum. | Ariz. Rev. Stat. Ann. § 44-1201 |

| Arkansas | Rate of interest may not exceed the maximum of 17% as established in the Arkansas Constitution, Amendment 89. | Ark. Code Ann. § 4-57-104 |

| California | Rate may not exceed 10% per year on loans for personal, family, or household purposes. For other loans for other purposes, the maximum is the higher of 10% or 5% over the amount charged by Fed. Res. Bank of San Francisco at the time loan was made. | Cal. Const. Article XV, § 1 |

| Colorado | For supervised loans general usury limit is 45%, and the maximum for unsupervised loans is 12%. | Colo. Rev. Stat § 5-12-103 and § 5-2-201 |

| Connecticut | The interest rate may not exceed 12%. | Conn. Gen. Stat. § 37-4 |

| Delaware | Not in excess of 5% over the Federal Reserve discount rate at the time the loan was made. | Del. Code. Ann. tit. 6, § 2301 |

| Florida | General usury limit is 18%, 25% on loans over $500,000. | Fla. Stat. § 687.03 and § 687.01 |

| Georgia | The default is 7% if no written contract is established. For written contracts, the maximum 16% on loans below $3,000, 5% per month on loans between $3,000 and $250,000, and no limit on loans above $250,000. | Ga. Code Ann. § 7-4-2 and § 7-4-18 |

| Hawaii | The default is 10% if no written contract is established, 12% is the general usury limit, and 10% is the limit on judgments. | Haw. Rev. Stat § 478-2, § 478-3, and § 478-4 |

| Idaho | Unless stipulated in a written agreement, the legal rate is 12%. The rate of interest on money due on court judgments is 5%. | Idaho Code Ann. § 28-22-104 |

| Illinois | The general usury limit is 9%. | 815 Ill. Comp. Stat 205/4 |

| Indiana | 8% in the absence of agreement, 25% for consumer loans other than supervised loans. | Ind. Code § 24-4.6-1-102 and § 24-4.5-3-201 |

| Iowa | The maximum interest rate is 5% unless otherwise agreed upon in writing, in which case, maximum is set by Iowa Superintendent of Banking (IA Usury Rates). | Iowa Code § 535.2(3)(a) |

| Kansas | The legal rate of interest is 10%; the general usury limit is 15%. | Kan. Stat. Ann. § 16-201 and §16-207 |

| Kentucky | The legal rate of interest is 8%, the general usury limit is 4% greater than the Federal Reserve rate or 19%, whichever is less. Any rate may be charged when identified in a contract in writing on a loan greater than $15,000. | Ky. Rev. Stat. Ann. § 360.010 |

| Louisiana | The general usury rate is 12%. | La. Rev. Stat. Ann. § 9:3500 |

| Maine | The legal interest rate is 6% (no usury limit mentioned in statutes). | Maine Rev. Stat., titl. 9-B, § 432 |

| Maryland | The legal interest rate is 6%, a maximum of 8% if a written contract is established. | Md. Code Ann., Com. Law § 12-102 – 103 |

| Massachusetts | The legal interest rate is 6% (unless a written contract exists); even if part of a contract, an interest rate over 20% is criminally usurious. | Mass. Gen. Law Ch. 107, § 3 and Ch. 271, § 49 |

| Michigan | 7% maximum if a written contract is established. Otherwise, the legal rate is 5%. | Mich. Comp. Laws § 438.31 |

| Minnesota | The legal rate of interest is 6%. For written contracts, the usury limit is 8%, unless for an amount over $100,000, in which case there is no limit. | Minn. Stat. § 334.01 |

| Mississippi | The legal rate of interest is 8%. Parties may contract for a rate of up to 10% or 5% above the Federal Reserve discount rate, whichever is greater. | Miss. Code Ann. § 75-17-1 |

| Missouri | The maximum interest rate is 10%, unless the market rate is greater at the time. | Mo. Rev. Stat. § 408.030 |

| Montana | 15% or 6% above the rate published by the Federal Reserve System, whichever is greater. | Mont. Code Ann. § 31-1-107 |

| Nebraska | The maximum interest rate is 16%. | Neb. Rev. Stat. § 45-101.03 |

| Nevada | Parties may contract for a rate up to the lesser of 36% or the maximum rate permitted under the federal Military Lending Act. | Nev. Rev. Stat. § 99.050 |

| New Hampshire | There is no legal limit on interest rates. It is unclear whether an exorbitant rate could be considered “unfair” under the New Hampshire Consumer Protection Act and hence unlawful. | N.H. Rev. Stat. Ann. § 336:1, § 358-A:2 |

| New Jersey | 6% without a written contract, 16% maximum if a written contract is established. | N.J. Stat. Ann. § 31:1-1 |

| New Mexico | 15% maximum in the absence of a written contract. | N.M. Stat. Ann. § 56-8-3 |

| New York | The legal rate of interest is 6%, the general usury limit is 11.25% | N.Y. Gen. Oblig. § 5-501 and N.Y. Banking § 14-A |

| North Carolina | For loans less for less than $25,000, the maximum is the amount announced on the 15th of each month by the North Carolina Commissioner of Banks. For loans greater than $25,000, the parties may agree in writing to any amount. | N.C. Gen. Stat. § 24-1.1 |

| North Dakota | For written contracts for loans less than $35,000, the maximum rate is 5.5% above the current maturity rate of Treasury Bills for the six months preceding the issuing of the loan, or 7%, whichever is greater. | N.D. Cent. Code § 47-14-09 |

| Ohio | The maximum interest for written contracts for loans of amounts less than $100,000 is 8%. | Ohio Rev. Code Ann. § 1343.01 |

| Oklahoma | The parties may agree in a written contract to any rate so long as it does not violate other applicable laws. | Okla. Stat. tit. 15, §266 |

| Oregon | The legal interest rate is 9%, but the parties may agree to different rates in a written agreement. Business and agricultural loans have a maximum of 12 percent or five percent greater than the 90-day discount rate of commercial paper. | Or. Rev. Stat. § 82.010 |

| Pennsylvania | For loans less than $50,000, the maximum rate is 6%. | 41 Pa. Cons. Stat. Ann. § 201 |

| Rhode Island | The maximum interest rate is the greater of 21%, or the domestic prime rate as published in the Wall Street Journal plus 9%. | R.I. Gen. Law § 6-26-2 |

| South Carolina | Unsupervised lenders may not charge a rate above 12%. No lender may charge a rate above 18%. | S.C. Code Ann. § 37-3-201 |

| South Dakota | No limit if a written agreement is established, 12% if no agreement exists. | S.D. Codified Laws § 54-3-4 and § 54-3-16(3) |

| Tennessee | The maximum rate is 10% unless otherwise expressed in a written contract. | Tenn. Code Ann. § 47-14-103 |

| Texas | The parties may agree in writing to a maximum rate up to the weekly ceiling as published in the Texas Credit Letter. If no agreement exists, then the maximum is 10%. | Tex. Fin. Code Ann. § 302.001(b), §303.002 |

| Utah | The maximum rate of interest is 10% unless the parties agree to a different rate in a written contract. | Utah Code Ann. § 15-1-1 |

| Vermont | The rate of interest is 12% except in certain circumstances as provided in subsection (b) of § 41a. | Vt. Stat. Ann. tit. 9, § 41a |

| Virginia | The legal rate of interest is 6%. With a contract in place, the maximum interest rate is 12%. | Va. Code Ann. § 6.2-301 and § 6.2-303 |

| Washington | The maximum rate of interest is 12% or 4% points above the average bill rate for 26-week treasury bills in the month before the loan was made. | Wash. Rev. Code § 19.52.020 |

| Washington D.C. | The maximum rate of interest is 24% for written contracts and 6% for verbal contracts. | D.C. Code, Title 29, Chapter 33 |

| West Virginia | The legal interest rate is 6% but parties may agree to a maximum of 8% in a written agreement. | W. Va. Code § 47-6-5 |

| Wisconsin | The legal rate of interest is 5%. Parties may agree to a different rate in a written agreement, subject to limitations that depend on the identity of the lender. | Wis. Stat. § 138.04 |

| Wyoming | The rate of interest is 7% if no agreement is established in a written contract. Otherwise, parties may agree to a higher rate. | Wyo. Stat. Ann. § 40-14-106 |

Key Terms & Clauses

- Allocation of Payments

- Acceleration

- Attorney’s Fees and Costs

- Conflicting Terms

- Co-Signer

- Execution

- Integration

- Non-Waiver

- Notice

- Pre-Payment

- Severability

- Waiver of Presentments

Allocation of Payments – Describes how payments shall be made in regard to late fees, interest, and the principle. In our free promissory note, payments shall first pay off any late fees and interest before the principal is credited.

Acceleration – In the event that a borrower defaults on the note or on a provision within the note and does not cure the default within the allotted time frame, the lender has the option to demand immediate payment of all outstanding dues from the borrower.

Attorney’s Fees and Costs – The borrower must pay all monies incurred if defaulting on the loan results in the involvement of attorneys and court proceedings. However, if the borrower ends up prevailing in court, no matter the issue, the lender must then pay for all court-related costs.

Conflicting Terms – That no other agreement shall have superior legality or control over the promissory note.

Co-Signer – Or “guarantor,” is a person that guarantees a loan if the borrower defaults. Typically if the lender suspects a borrower to be risky, the lender may require the borrower to obtain another credible person to co-sign on the note.

Execution – States that the borrower is the principal within the note and severally liable for all dues. If there is a co-signer, both the borrower and the co-signer are equally responsible for paying back the loan.

Integration – States that no other document can affect the terms or validity of your promissory note. Your promissory note can only be amended (edited) if both the lender and borrower sign a written agreement.

Non-Waiver – If for any reason the lender fails or delays to exercise their rights under the terms of the note, it does not signify or deem that they are waiving their rights.

Notice – Describes how notices should be delivered to the borrower. It is standard practice for notices to be written and to be delivered either in person or by certified mail with copies and receipts.

Pre-Payment – A clause detailing the rules of paying off the loan early, whether it’s the entire loan or individual payments. Some loans may require that the borrower pay a fee in order to “prepay” the loan.

Severability – A clause within a promissory note that states that if any provision within the note becomes void or unenforceable, it does not deem the entire note or any other provision within the note invalid.

Waiver of Presentments – This is a short clause that implies that the lender does not have to demand payment when payments are due. The borrower holds the responsibility to make certain that the payments are paid when due.

Sample

Download: PDF, MS Word, OpenDocument

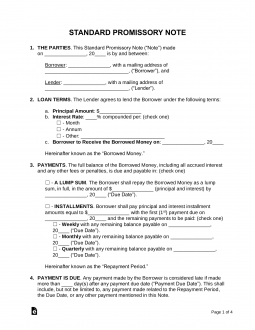

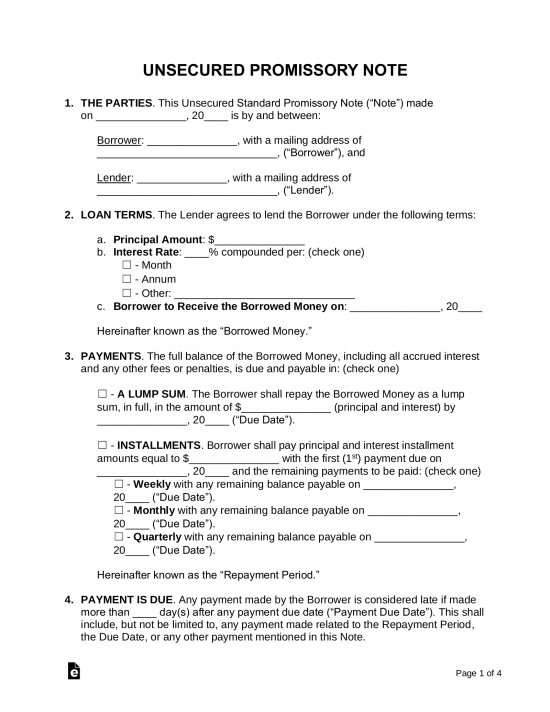

STANDARD PROMISSORY NOTE

I. THE PARTIES. This Standard Promissory Note (“Note”) made on [DATE], is by and between:

Borrower: [BORROWER’S NAME] with a mailing address of [MAILING ADDRESS] (“Borrower”), and

Lender: [LENDER’S NAME] with a mailing address of [MAILING ADDRESS] (“Lender”).

II. LOAN TERMS. The Lender agrees to lend the Borrower under the following terms:

- Principal Amount: $[AMOUNT BORROWED]

- Interest Rate: [INTEREST RATE]% compounded per: (check one)

- ☐ – Month

- ☐ – Annum

- ☐ – Other: [OTHER]

- Borrower to Receive the Borrowed Money on: [DATE]

Hereinafter known as the “Borrowed Money.”

III. PAYMENTS. The full balance of the Borrowed Money, including all accrued interest and any other fees or penalties, is due and payable in: (check one)

☐ – A LUMP SUM. The Borrower shall repay the Borrowed Money as a lump sum, in full, in the amount of $[AMOUNT] (principal and interest) by [DATE] (“Due Date”).

☐ – INSTALLMENTS. Borrower shall pay principal and interest installment amounts equal to $[AMOUNT] with the first (1st) payment due on [DATE] and the remaining payments to be paid: (check one)

☐ – Weekly with any remaining balance payable on [DATE] (“Due Date”).

☐ – Monthly with any remaining balance payable on [DATE] (“Due Date”).

☐ – Quarterly with any remaining balance payable on [DATE] (“Due Date”).

Hereinafter known as the “Repayment Period.”

IV. PAYMENT IS DUE. Any payment made by the Borrower is considered late if made more than [#] day(s) after any payment due date (“Payment Due Date”). This shall include, but not be limited to, any payment made related to the Repayment Period, the Due Date, or any other payment mentioned in this Note.

V. LATE FEE. If the Borrower makes a late payment for any Payment Due Date, there shall be: (check one)

☐ – NO LATE FEE.

☐ – LATE FEE. The Borrower shall pay a late fee of $[AMOUNT] for each: (check one)

☐ – Occurrence payment is late.

☐ – Day payment is late.

VI. SECURITY. This Note shall be: (check one)

☐ – UNSECURED. There shall be no security provided in this Note.

☐ – SECURED. There shall be property to secure this Note described as: [SECURITY DESCRIPTION] (“Security”).

The Security shall transfer to the possession and ownership of the Lender immediately pursuant to Section 11 of this Note. The Security may not be sold or transferred without the Lender’s consent until the Due Date. If Borrower breaches this provision, Lender may declare all sums due under this Note immediately due and payable, unless prohibited by applicable law. The Lender shall have the sole option to accept the Security as full payment for the Borrowed Money without further liabilities or obligations. If the market value of the Security does not exceed the Borrowed Money, the Borrower shall remain liable for the balance due while accruing interest at the maximum rate allowed by law.

VII. CO-SIGNER. (check one)

☐ – NO CO-SIGNER. This Note shall not have a Co-Signer.

☐ – CO-SIGNER. This Note shall have a Co-Signer known as [CO-SIGNER’S NAME] (“Co-Signer”) who agrees to the liabilities and obligations on behalf of the Borrower under the terms of this Note. If the Borrower does not make payment, the Co-Signer shall be personally responsible and is guaranteeing the payment of the principal, late fees, and all accrued interest under the terms of this Note.

VIII. PREPAYMENT PENALTY. The Borrower shall be charged: (check one)

☐ – NO PRE-PAYMENT PENALTY. The Borrower is eligible to pre-pay the Borrowed Money, at any time, with no pre-payment fee.

☐ – A PRE-PAYMENT PENALTY. If the Borrower pays any Borrowed Money to the Lender with the specific purpose of paying less interest, there shall be a pre-payment fee of: (check one)

☐ – $[AMOUNT]

☐ – [PERCENT]% of the pre-paid amount.

☐ – Other. [OTHER]

IX. INTEREST DUE IN THE EVENT OF DEFAULT. In the event the Borrower fails to pay the Note in full on the Due Date, the unpaid principal shall accrue interest at the maximum rate allowed by law until the Borrower is no longer in default.

X. ALLOCATION OF PAYMENTS. Payments shall be first (1st) credited to any late fees due, second (2nd) any to interest due, and any remainder will be credited to the principal.

XI. ACCELERATION. If the Borrower is in default under this Note or is in default under another provision of this Note, and such default is not cured within the minimum allotted time by law after written notice of such default, then Lender may, at its option, declare all outstanding sums owed on this Note to be immediately due and payable. This includes any rights of possession in relation to the Security described in Section 6.

XII. ATTORNEYS’ FEES AND COSTS. Borrower shall pay all costs incurred by Lender in collecting sums due under this Note after a default, including reasonable attorneys’ fees. If Lender or Borrower sues to enforce this Note or to obtain a declaration of its rights hereunder, the prevailing party in any such proceeding shall be entitled to recover its reasonable attorneys’ fees and costs incurred in the proceeding (including those incurred in any bankruptcy proceeding or appeal) from the non-prevailing party.

XIII. WAIVER OF PRESENTMENTS. Borrower waives presentment for payment, a notice of dishonor, protest, and notice of protest.

XIV. NON-WAIVER. No failure or delay by Lender in exercising Lender’s rights under this Note shall be considered a waiver of such rights.

XV. SEVERABILITY. In the event that any provision herein is determined to be void or unenforceable for any reason, such determination shall not affect the validity or enforceability of any other provision, all of which shall remain in full force and effect.

XVI. INTEGRATION. There are no agreements, verbal or otherwise that modify or affect the terms of this Note. This Note may not be modified or amended except by a written agreement signed by Borrower and Lender.

XVII. CONFLICTING TERMS. The terms of this Note shall control over any conflicting terms in any referenced agreement or document.

XVIII. NOTICE. Any notices required or permitted to be given hereunder shall be given in writing and shall be delivered (a) in person, (b) by certified mail, postage prepaid, return receipt requested, (c) by facsimile, or (d) by a commercial overnight courier that guarantees next day delivery and provides a receipt, and such notices shall be made to the parties at the addresses listed above.

XIX. EXECUTION. The Borrower executes this Note as a principal and not as a surety. If there is a Co-Signer, the Borrower and Co-Signer shall be jointly and severally liable under this Note.

XX. GOVERNING LAW. This note shall be governed under the laws in the State of [GOVERNING LAW].

XXI. ADDITIONAL TERMS & CONDITIONS. [ADDITIONAL TERMS & CONDITIONS]

XXII. ENTIRE AGREEMENT. This Note contains all the terms agreed to by the parties relating to its subject matter, including any attachments or addendums. This Note replaces all previous discussions, understandings, and oral agreements. The Borrower and Lender agree to the terms and conditions and shall be bound until the Borrower repays the Borrowed Money in full.

Lender Signature: ____________________________ Date: ____________

Print Name: ____________________________

Borrower Signature: ____________________________ Date: ____________

Print Name: ____________________________

Co-Signer Signature (if any): ____________________________ Date: ____________

Print Name: ____________________________

For the comprehensive document, please download the free form or hit “create document.”

Related Forms (2)

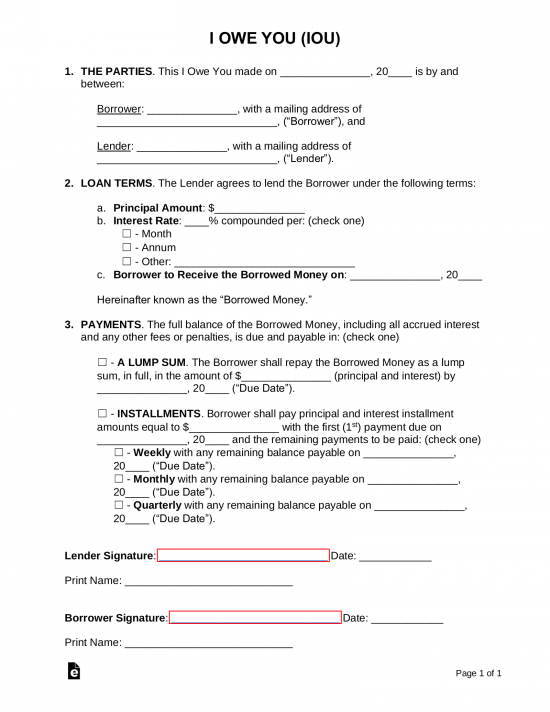

I Owe You (IOU) – A receipt acknowledging a debt that is owed with no timetable for payment.

I Owe You (IOU) – A receipt acknowledging a debt that is owed with no timetable for payment.

Download: PDF, MS Word, OpenDocument

Loan Release Form – When the note has been paid-in-full, the lender should set the borrower free of all liabilities by authorizing a release form.

Loan Release Form – When the note has been paid-in-full, the lender should set the borrower free of all liabilities by authorizing a release form.

Download: PDF, MS Word, OpenDocument