Updated July 27, 2023

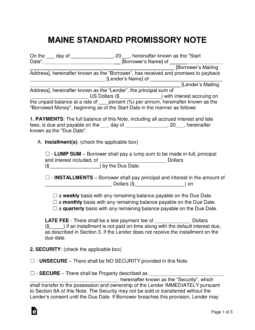

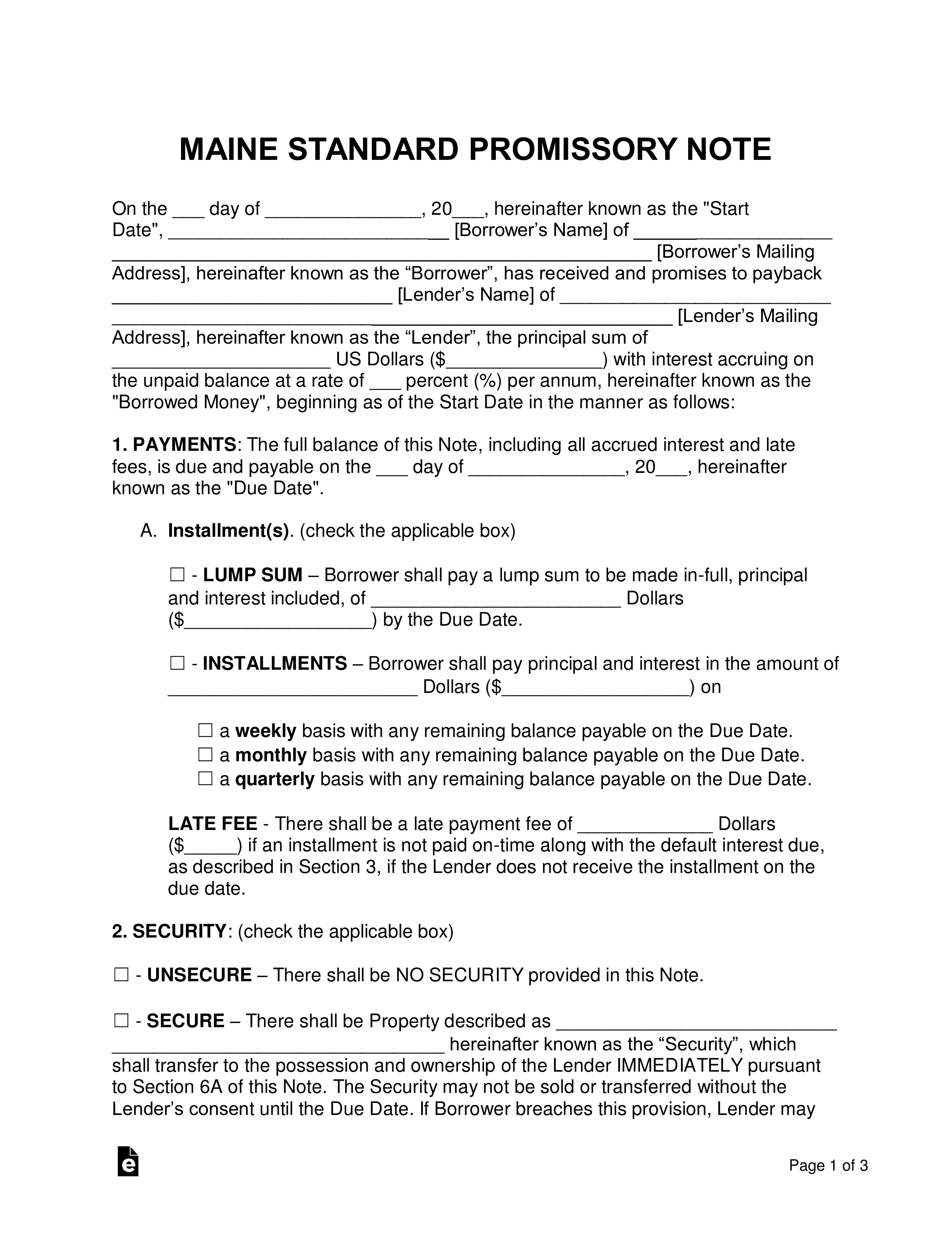

A Maine promissory note is a formal ‘promise’ for a borrower of a monetary balance to reimburse a lender the loaned amount of money in addition to interest. The maximum interest rate (usury rate) that can be charged by the lender is 6%.

Table of Contents |

By Type (2)

Secured Promissory Note – The lender and borrower agree on an item/items that will be used as security in the case of a default on the balance. Items typically used as security are homes, vehicles, and boats.

Secured Promissory Note – The lender and borrower agree on an item/items that will be used as security in the case of a default on the balance. Items typically used as security are homes, vehicles, and boats.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – This version does not include security. Because of this, the lender is at an increased risk of losing the loaned balance. The lender should ensure the borrower has worthy credit and/or is a well-known friend or family member.

Unsecured Promissory Note – This version does not include security. Because of this, the lender is at an increased risk of losing the loaned balance. The lender should ensure the borrower has worthy credit and/or is a well-known friend or family member.

Download: PDF, MS Word, OpenDocument

Usury Statute

1. Interest absent in writing. The maximum legal rate of interest on a loan made by a financial institution, in the absence of an agreement in writing establishing a different rate, shall be 6 percent per year.[PL 1975, c. 500, §1 (NEW).]

2. Interest: noncommercial or consumer loans.

A. The legal rate of interest, whether set forth in writing or not, on a noncommercial or consumer loan, shall be established in accordance with and subject to the limitations set forth in Title 9-A.