Updated July 27, 2023

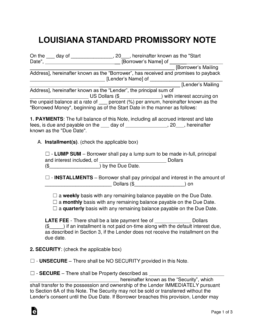

Louisiana promissory note templates are documents designed specifically for the state of Louisiana and helps to ensure a lender gets reimbursed a loaned amount of money from a borrower in a predetermined set of time. Both parties will need to agree on various aspects of the note before it can go into effect, such as payment types, interest rates, and late fees.

Table of Contents |

By Type (2)

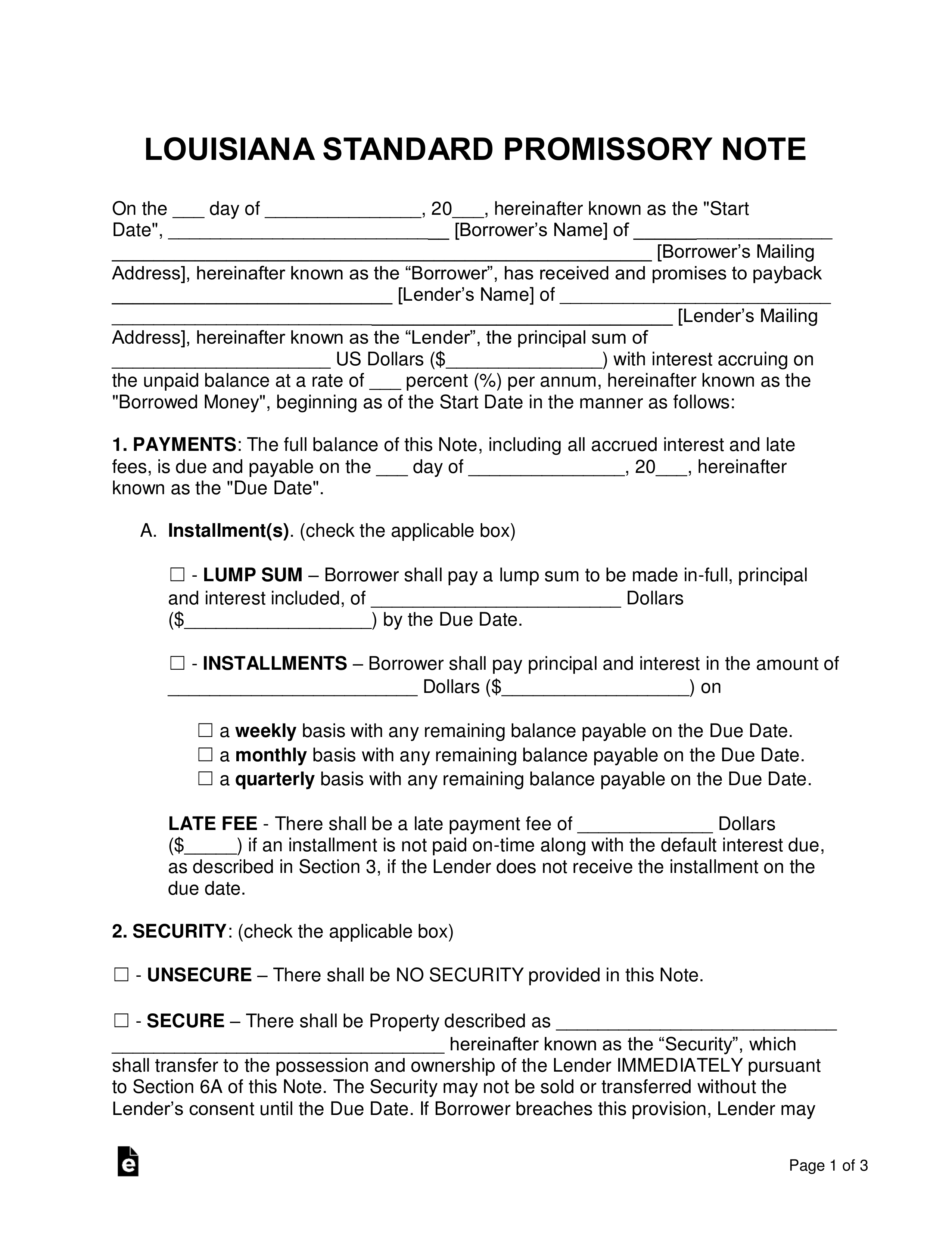

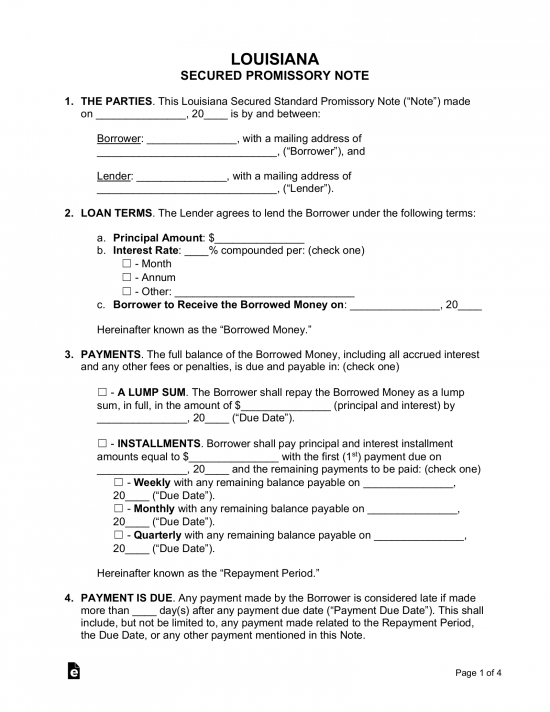

Secured Promissory Note – Includes security, which is an item or items that are given to the lender in the case of a default on the note. Items typically used as security include homes, vehicles, or boats.

Secured Promissory Note – Includes security, which is an item or items that are given to the lender in the case of a default on the note. Items typically used as security include homes, vehicles, or boats.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – Does not include security, which puts the lender at a far greater financial risk. To help combat this, the lender should personally know the borrower and ensure he or she has worthy credit.

Unsecured Promissory Note – Does not include security, which puts the lender at a far greater financial risk. To help combat this, the lender should personally know the borrower and ensure he or she has worthy credit.

Download: PDF, MS Word, OpenDocument

Usury Statute

A. Interest is either legal or conventional.

B. Legal interest is fixed at the following rates, to wit:

(1) At the rate fixed in R.S. 13:4202 on all sums which are the object of a judicial demand, whence this is called judicial interest; and

(2) On sums discounted at banks at the rate established by their charters.

C.(1) The amount of the conventional interest cannot exceed twelve percent per annum. The same must be fixed in writing; testimonial proof of it is not admitted in any case.

(2) Except in the cases herein provided, if any person shall pay on any contract a higher rate of interest than the above, as discount or otherwise, the same may be sued for and recovered within two years from the time of such payment.

…