Updated July 27, 2023

A Washington D.C. promissory note template is a document used to record the details of a loan. These are legally binding contracts that obligate the borrower to certain terms and conditions, and can be used in a court of law should a dispute between borrower and lender arise.

Table of Contents |

By Type (2)

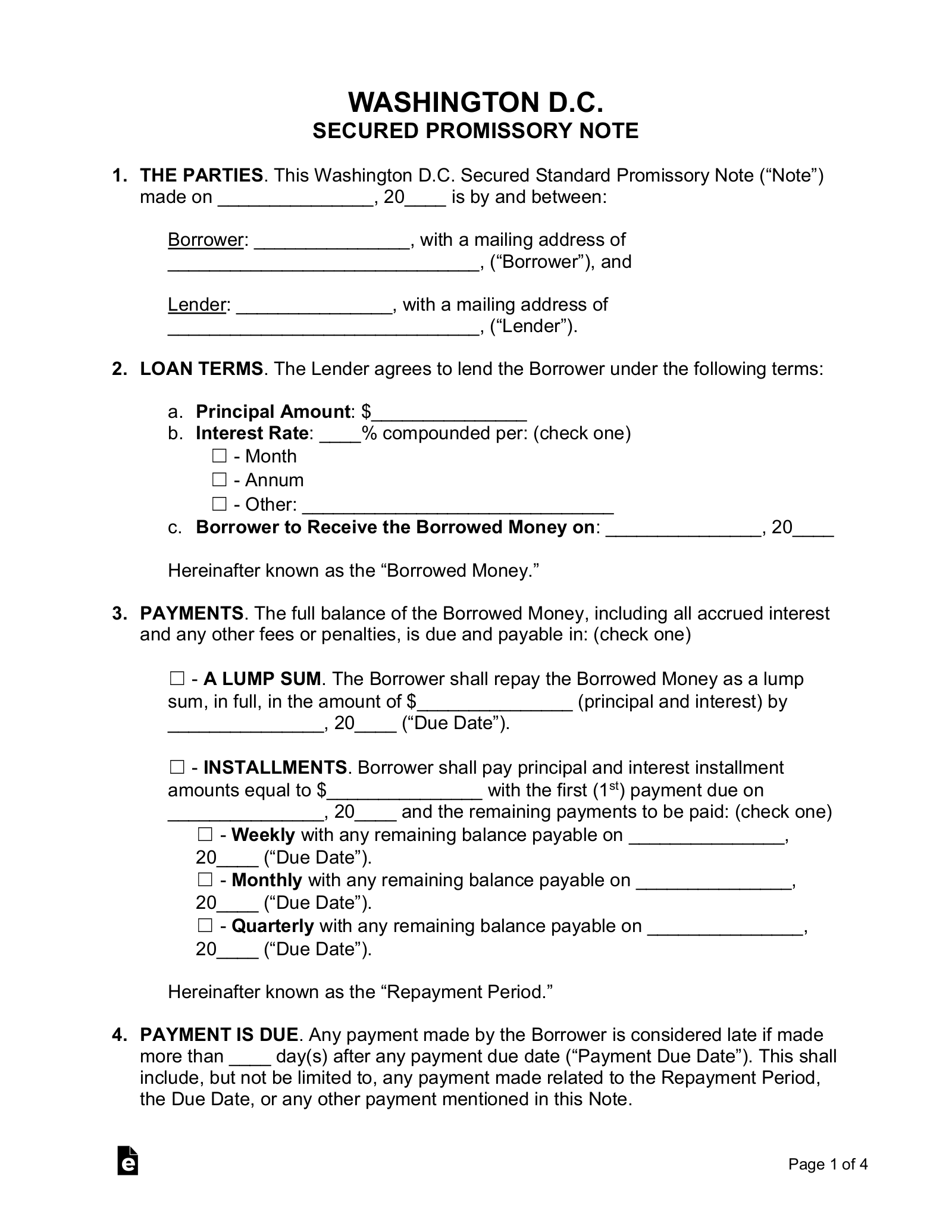

Secured Promissory Note – A secured promissory note secures an obligation to repay a loan with some type of property. The borrower offers up some property or asset as collateral, which a lender can seize should the borrower default on repaying the loan. Secured promissory notes are usually used to guarantee large loans.

Secured Promissory Note – A secured promissory note secures an obligation to repay a loan with some type of property. The borrower offers up some property or asset as collateral, which a lender can seize should the borrower default on repaying the loan. Secured promissory notes are usually used to guarantee large loans.

Download: PDF, MS Word, OpenDocument

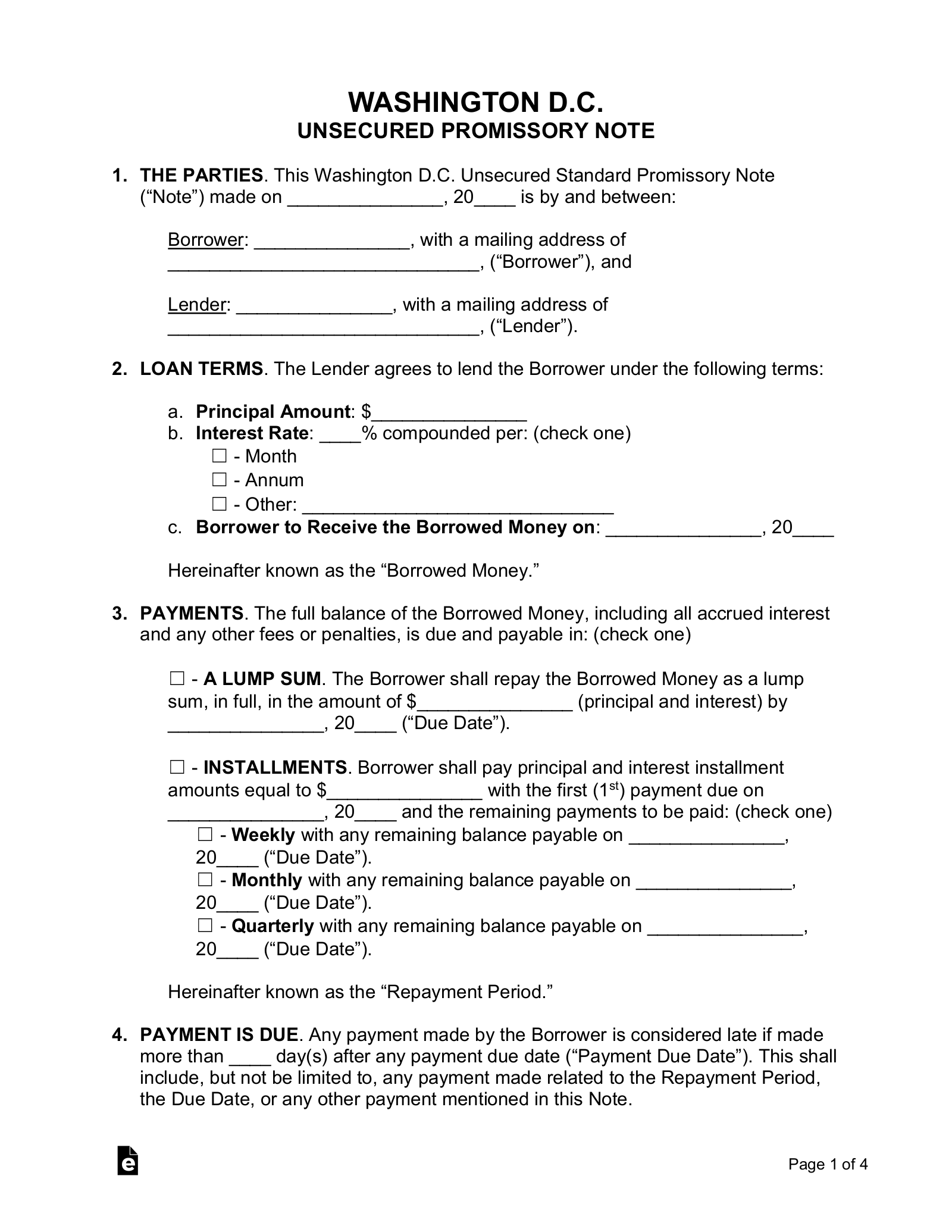

Unsecured Promissory Note – An unsecured promissory note is typically used when a relatively small sum is being loaned. Unlike a secured promissory note that secures some type of property as collateral, it is essentially just a legally binding promise.

Unsecured Promissory Note – An unsecured promissory note is typically used when a relatively small sum is being loaned. Unlike a secured promissory note that secures some type of property as collateral, it is essentially just a legally binding promise.

Download: PDF, MS Word, OpenDocument

Usury Statutes

(a) Except as otherwise provided in this section, section 28-3308, and chapter 36 of this subtitle, the parties to an instrument in writing for the payment of money at a future time may contract therein for the payment of interest on the principal amount thereof at a rate not exceeding 24% per annum.

…

(a) The rate of interest in the District upon the loan or forbearance of money, goods, or things in action in the absence of expressed contract, is 6% per annum.

(b) Interest, when authorized by law, on judgments or decrees against the District of Columbia, or its officers, or its employees acting within the scope of their employment, is at the rate of not exceeding 4% per annum.

…