Updated July 27, 2023

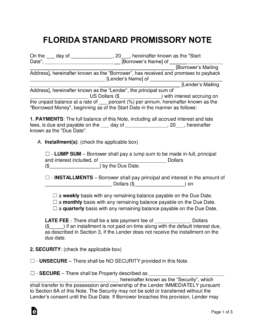

A Florida promissory note template is a set of documents utilized by two (2) parties and is designed to ad structure and security to a loan transaction. Built into the documents include sections that allow the parties to decide on payment types, late fees, the final due date, and several other options. For the agreement to go into effect, a witness will need to watch the signing of the document by the lender and borrower.

Table of Contents |

By Type (2)

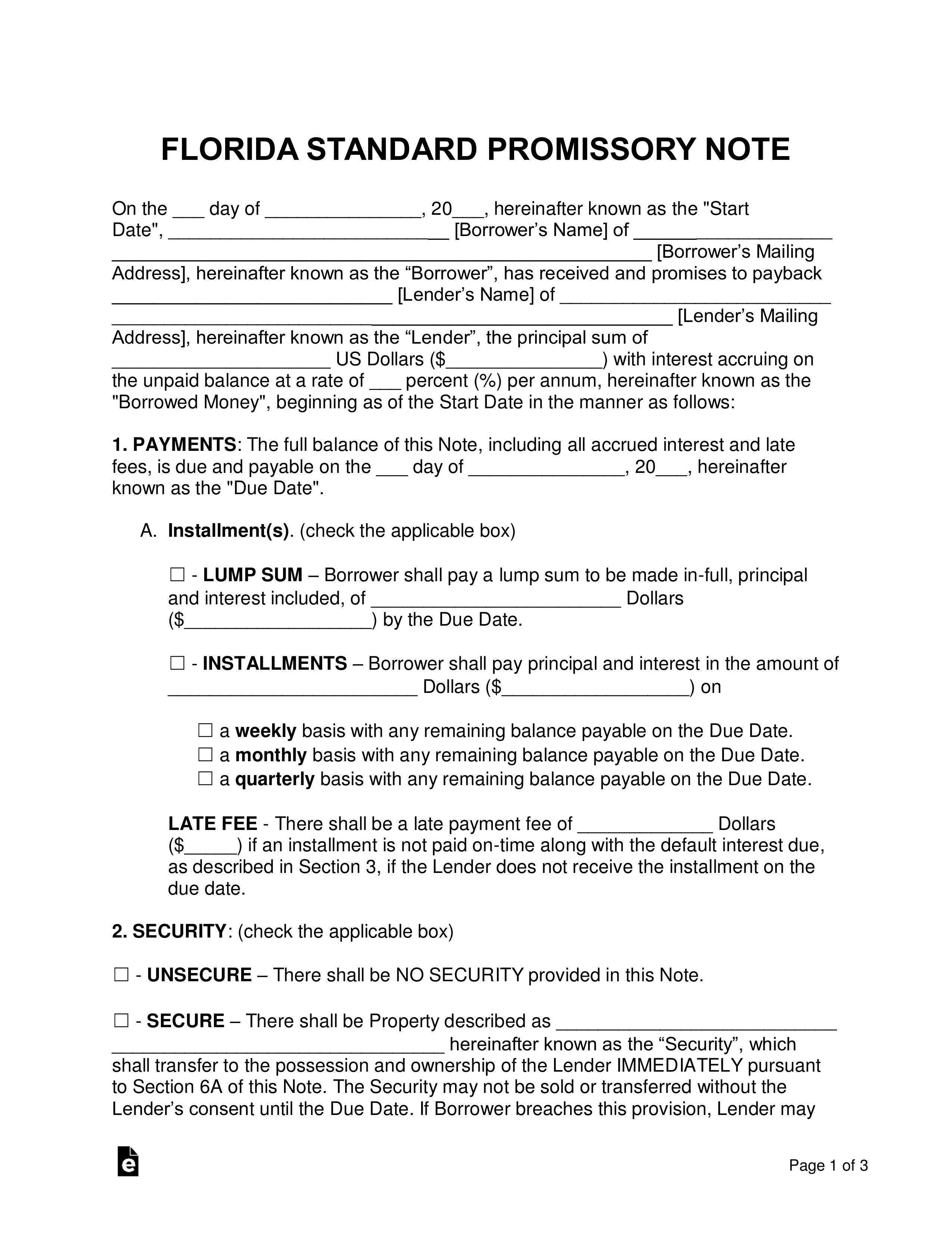

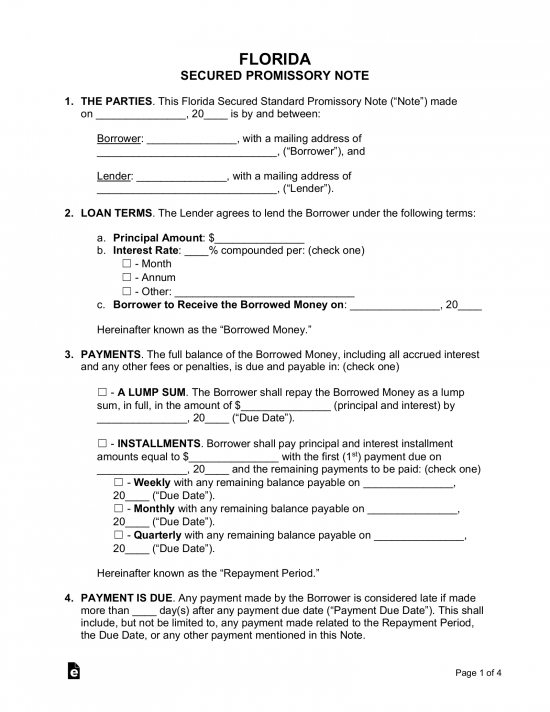

Secured Promissory Note – Includes security, which grants the lender the borrower’s property, a vehicle, or another worthy object if the borrower defaults on the balance.

Secured Promissory Note – Includes security, which grants the lender the borrower’s property, a vehicle, or another worthy object if the borrower defaults on the balance.

Download: PDF, MS Word, OpenDocument

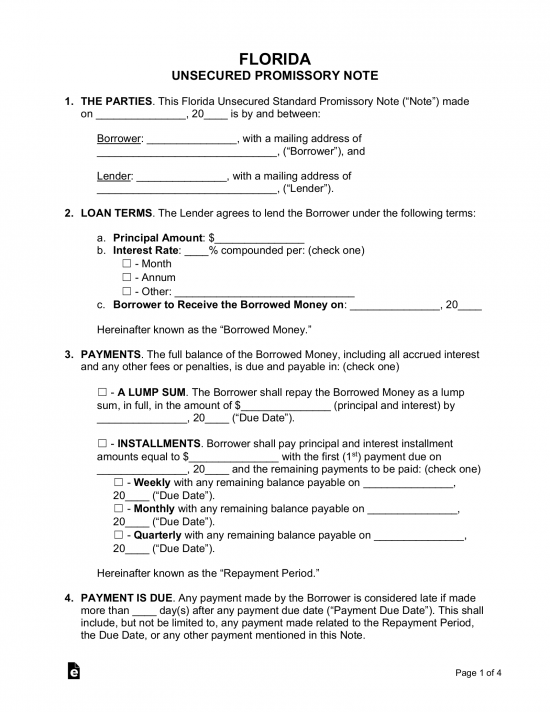

Unsecured Promissory Note – Does not include security, hence the word ‘unsecured’. If the borrower were to default on the balance, the lender has no direct way to be reimbursed his or her money but has to resort to bringing the borrower to small claims court and/or filing the default on the borrower’s credit.

Unsecured Promissory Note – Does not include security, hence the word ‘unsecured’. If the borrower were to default on the balance, the lender has no direct way to be reimbursed his or her money but has to resort to bringing the borrower to small claims court and/or filing the default on the borrower’s credit.

Download: PDF, MS Word, OpenDocument

Usury Statute

(1) Except as provided herein, it shall be usury and unlawful for any person, or for any agent, officer, or other representative of any person, to reserve, charge, or take for any loan, advance of money, line of credit, forbearance to enforce the collection of any sum of money, or other obligation a rate of interest greater than the equivalent of 18 percent per annum simple interest, either directly or indirectly, by way of commission for advances, discounts, or exchange, or by any contract, contrivance, or device whatever whereby the debtor is required or obligated to pay a sum of money greater than the actual principal sum received, together with interest at the rate of the equivalent of 18 percent per annum simple interest. However, if any loan, advance of money, line of credit, forbearance to enforce the collection of a debt, or obligation exceeds $500,000 in amount or value, it shall not be usury or unlawful to reserve, charge, or take interest thereon unless the rate of interest exceeds the rate prescribed in s. 687.071. The provisions of this section shall not apply to sales of bonds in excess of $100 and mortgages securing the same, or money loaned on bonds.