Updated August 04, 2023

Or use ContractsCounsel to hire an attorney!

An IOU, or “I Owe You“, is a written acknowledgment of debt to another party and is a simple form when two parties engage in a loan. An IOU is commonly used between trustworthy people such as business partners, friends, or family members.

Interest Rate

Due to an IOU commonly being amongst family members or close friends, interest is not usually charged to the borrower. Although it can be added.

Sample

I OWE YOU (IOU)

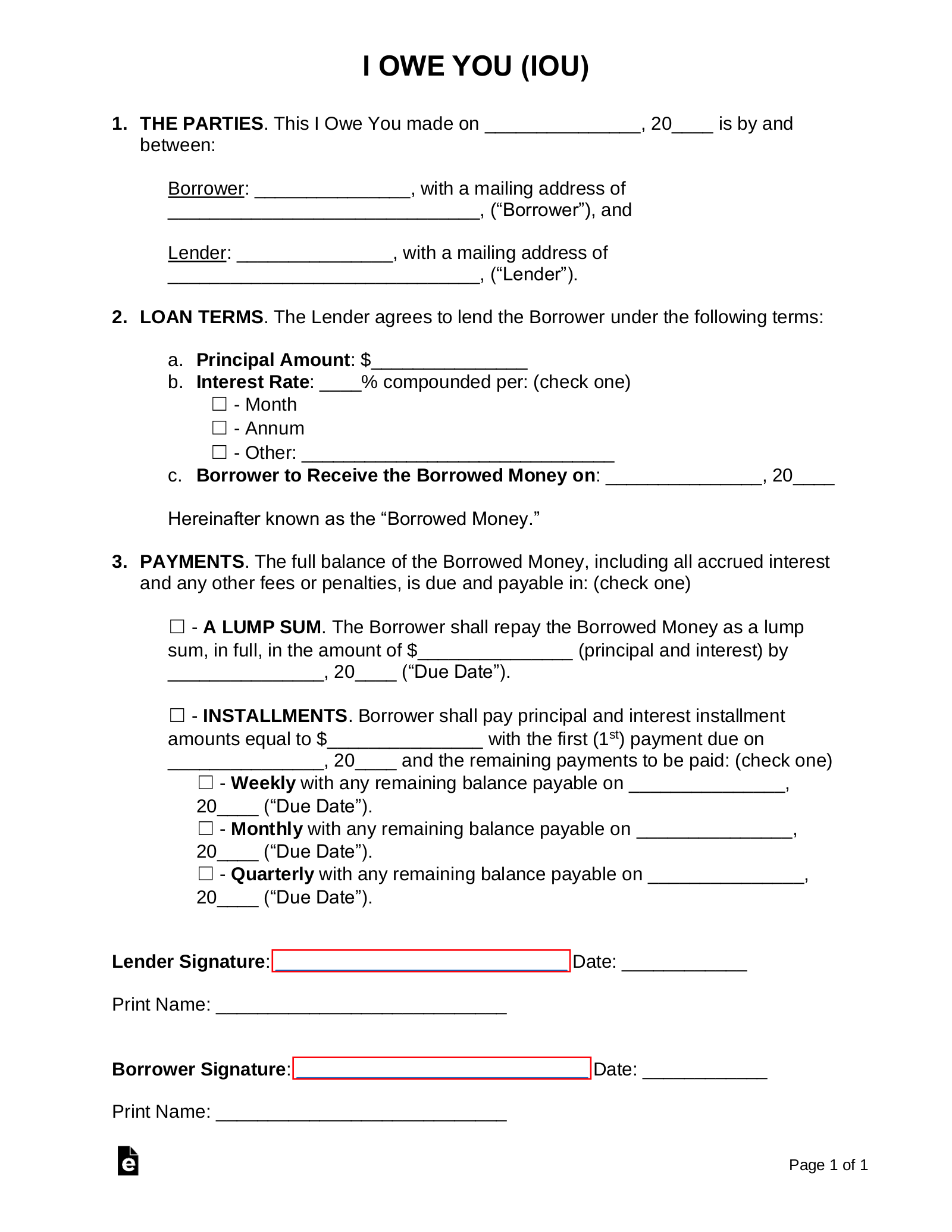

I. THE PARTIES. This I Owe You made on [DATE], is by and between:

Borrower: [BORROWER’S NAME] with a mailing address of [MAILING ADDRESS] (“Borrower”), and

Lender: [LENDER’S NAME] with a mailing address of [MAILING ADDRESS] (“Lender”).

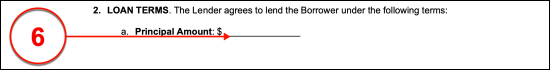

II. LOAN TERMS. The Lender agrees to lend the Borrower under the following terms:

Principal Amount: $[AMOUNT BORROWED]

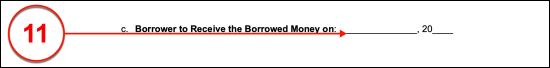

Borrower to Receive the Borrowed Money on: [DATE]

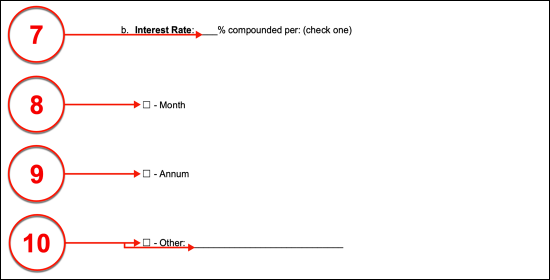

Interest Rate: [INTEREST RATE]% compounded per: (check one)

☐ – Month

☐ – Annum

☐ – Other: [OTHER]

Hereinafter known as the “Borrowed Money.”

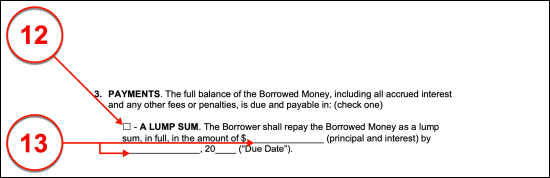

III. PAYMENTS. The full balance of the Borrowed Money, including all accrued interest and any other fees or penalties, is due and payable in: (check one)

☐ – A LUMP SUM. The Borrower shall repay the Borrowed Money as a lump sum, in full, in the amount of $[AMOUNT] (principal and interest) by [DATE] (“Due Date”).

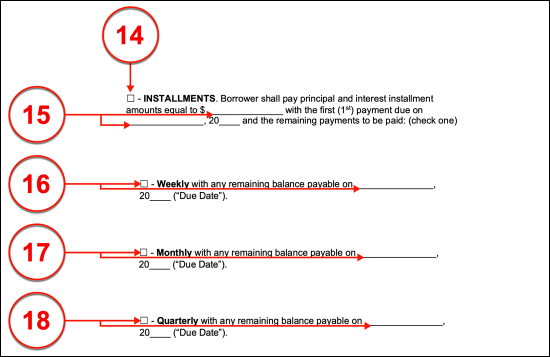

☐ – INSTALLMENTS. Borrower shall pay principal and interest installment amounts equal to $[AMOUNT] with the first (1st) payment due on [DATE] and the remaining payments to be paid: (check one)

☐ – Weekly with any remaining balance payable on [DATE] (“Due Date”).

☐ – Monthly with any remaining balance payable on [DATE] (“Due Date”).

☐ – Quarterly with any remaining balance payable on [DATE] (“Due Date”).

Lender Signature: ____________________________ Date: ____________

Print Name: ____________________________

Borrower Signature: ____________________________ Date: ____________

Print Name: ____________________________

Video

How to Write

Download: PDF, MS Word, OpenDocument

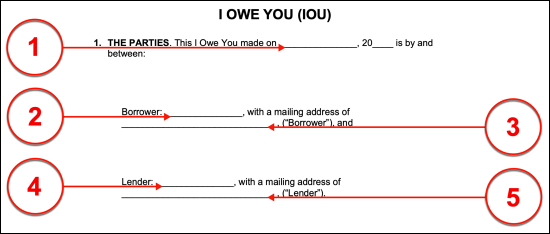

I. The Parties

(1) Date Of IOU Effect. The date when this IOU becomes active will require definition. Therefore record the calendar date when this document first becomes effective using the first two lines in the First Section.

(2) Borrower Name. The Party who shall receive and repay the loaned amount according to the conditions of this agreement must be identified as the Borrower. The first line of the “Borrower” statement in this section should be supplied with his or her full name. Bear in mind, that while this type of loan can occasionally be engaged between two informal Parties, this agreement is a legal document and will require the full name of the Borrower as it appears on his or her Government-issued identification (i.e. Passport, Driver’s License, State I.D., etc.).

(3) Borrower Mailing Address. Submit the mailing address where the Borrower receives his or her mail on the second line of the “Borrower” statement.

(4) Lender Name. The Party who will lend money on the conditions defined by this paperwork should be named in the “Lender” statement. Use the first line in the “Lender” statement to display his or her identity by submitting his or her entire legal name as requested in this space. If the Lender is a Company that has been registered as a Business Entity with the State of its formation, then the full name of the Lending Company should be displayed here.

(5) Lender Mailing Address. The Lender’s full mailing address is required on the last line presented in Section I.

II. Loan Terms

(6) Principal Amount. The loan that the Lender shall provide the Borrower must be documented in the space provided by Statement (A) (found in Section II). This must be the exact dollar amount that the Lender shall loan to the Borrower and should not include any expected interest revenue.

(7) Interest Rate. So long as the State’s usury laws are obeyed, virtually any Lender may require interest payments to be assessed on the principal loan amount. If the Lender and the Borrower agree that an interest rate may apply, then use the space in Statement (B) to document the interest rate that shall be compounded on the owed amount of the loan.

Select Item 8 Or Select Item 9 Or Select Item 10

(8) Per Month. Naturally, the percent of the owed amount being used as interest must be applied on a regular schedule. To this end, one of the three periods displayed in Statement (B) must be selected to solidify how often the interest rate above will be compounded. Commonly, a Lender will charge interest on a monthly basis. If this is the case and the Lender will apply and charge the above interest rate once a “Month” then select the first checkbox in Statement (B).

(9) Per Annum. If the Lender prefers to apply the interest rate to the amount owed once a year, then select the “Annum” checkbox from Statement (B).

(10) Compounded Per. Some Lenders may prefer that interest payment be calculated and applied to the owed amount for a period that cannot be considered monthly or yearly. If so, select the checkbox holding the “Other” label, then use the blank space available to detail precisely how often the interest rate above will be compounded on the owed amount of the loan made.

(11) Borrower Receive Date. The precise date when the Borrower expects the borrowed money making up this loan to be received from the Lender should be established on the blank spaces available in Statement (C).

III. Payments

Select And Complete Item 12 Or Select And Complete Item 14

(12) Lump Sum Payment. If this IOU must require that the Borrower repay the full loan amount (“Borrowed Money”) plus any owed interest in one payment as “A Lump Sum” then select the first checkbox found in Section III.

(13) Single Payment Details. If the Borrower will be obligated to repay the full principal amount of the loan as well as the applicable interest as one lump sum, then a record of this single payment’s dollar amount must be submitted to the space attached to the dollar symbol and the exact date when it is due across the final two lines of this statement.

(14) Payment Installments. If the Borrower will be required to submit equal payments for the loan amount across a span of time as “Installments,” then select the second checkbox of Section III. This selection will require that some clarification is provided by selecting one of the installment plans it defines.

If Applicable, Select And Complete Item 15 Or Item 16 Or Item 17 Or Item 18

(15) First Installment. To set an installment plan for payments on the concerned IOU loan, several details will be needed beginning with the dollar amount of the Borrower’s first payment to the Lender. This should be produced on the first blank space available in the “Installments” option while the date when this first payment is due should be documented across the two spaces following the phrase “…Payment Due On”

(16) Weekly Installment. Now that the first installment has been defined, the schedule detailing when the payments the Borrower must submit should be established. If the Borrower must make one payment every week consisting of the principal and interest installment amount defined by the “Installments” option, then select the “Weekly” checkbox. Additionally, a record of the date when the final payment will be due must be documented on the space available.

(17) Monthly Installment. If the Lender and Borrower intend to follow a “Monthly” payment schedule where the Borrower must submit the installment amount once a month, then select the second checkbox presented by the “Installments” option. The date when the final monthly payment will be due must be furnished to the formatted area provided.

(18) Quarterly Installment. If the Borrower must pay the installment amount once every three months, then the “Quarterly” checkbox should be selected. Additionally, document the calendar date when the final quarterly installment will be due where requested.

Party Execution

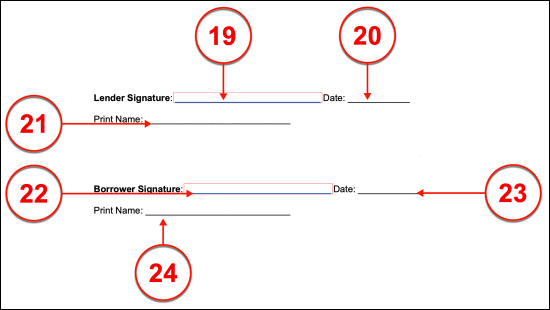

(19) Lender Signature. The Lender should review the details provided in the agreement above. Upon agreement, the Lender must sign the “Lender’s Signature” line to formally accept the conditions defined by the IOU above. If the Lender is a formal Company, then its Signature Representative may sign his or her name and complete the remaining execution requirements of this paperwork on behalf of the Lending Company.

(20) Date Of Lender Signature. Immediately after executing his or her signature, the Lender must define the current date on the adjacent line.

(21) Printed Name Of Lender. To complete the signature process the Lender must submit his or her full name in print.

(22) Borrower Signature. Once the Borrower has reviewed the above paperwork to satisfaction, he or she must sign the “Borrower’s Signature” line to officially execute this agreement.

(23) Date Of Borrower Signing. The calendar date when the Lender’s signature was submitted should be documented at the time of signing as required by the adjacent line (“Date”).

(24) Printed Name Of Borrower. The execution of this paperwork will require that the Borrower print his or her name below the signature provided.