Updated July 27, 2023

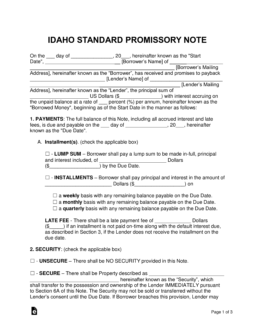

An Idaho promissory note template is a document used for transactions involving loans between two parties. The documents require both the lender and borrower to agree on payment types, late fees, security, and other areas of the agreement.

Table of Contents |

By Type (2)

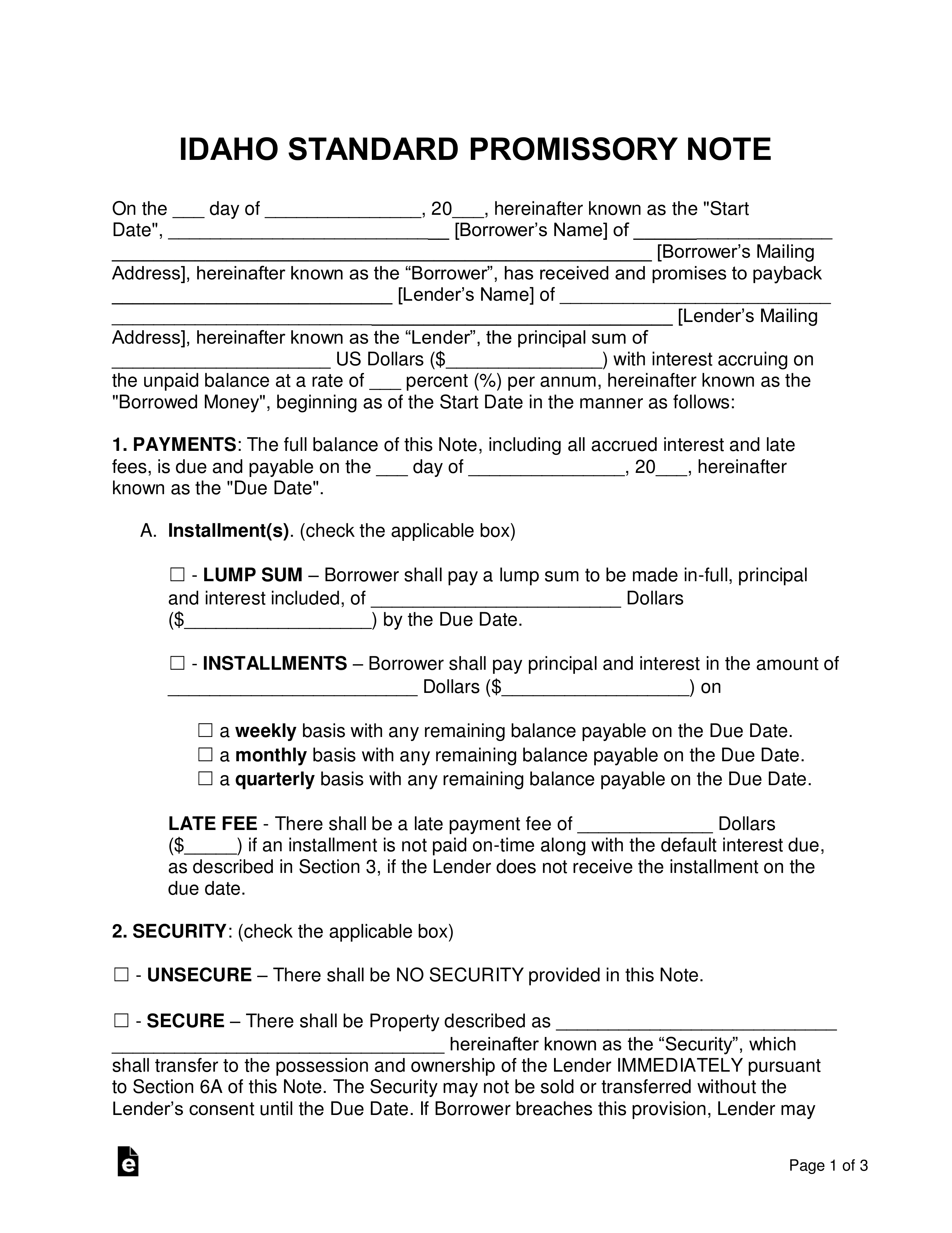

Secured Promissory Note – This version of the agreement includes security for the lender. Security helps reimburse the lender in the case of a default on the balance. Both the lender and the borrower will agree on items to be used for security before the signing of the agreement.

Secured Promissory Note – This version of the agreement includes security for the lender. Security helps reimburse the lender in the case of a default on the balance. Both the lender and the borrower will agree on items to be used for security before the signing of the agreement.

Download: PDF, MS Word, OpenDocument

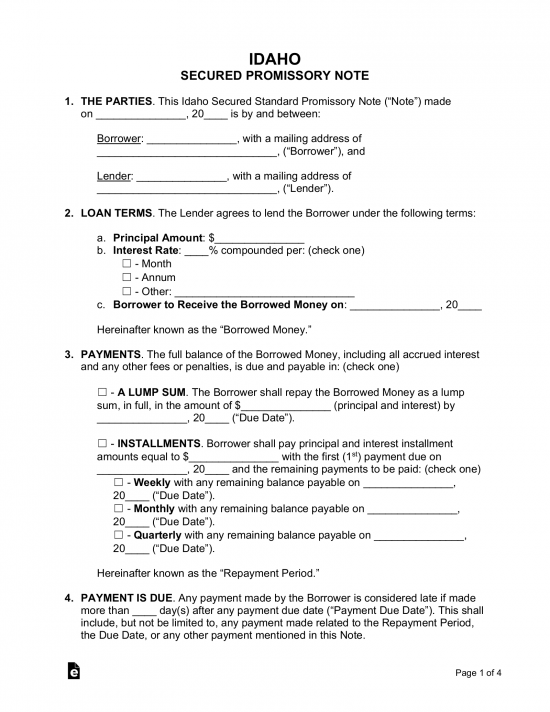

Unsecured Promissory Note – There is no security included in this version, which adds greater risk to the transaction for the lender. To help combat this, the lender should ensure the borrower is a trustworthy individual.

Unsecured Promissory Note – There is no security included in this version, which adds greater risk to the transaction for the lender. To help combat this, the lender should ensure the borrower is a trustworthy individual.

Download: PDF, MS Word, OpenDocument

Usury Statute

(1) When there is no express contract in writing fixing a different rate of interest, interest is allowed at the rate of twelve cents (12¢) on the hundred by the year on:

1. Money due by express contract.

2. Money after the same becomes due.

3. Money lent.

4. Money received to the use of another and retained beyond a reasonable time without the owner’s consent, express or implied.

5. Money due on the settlement of mutual accounts from the date the balance is ascertained.

6. Money due upon open accounts after three (3) months from the date of the last item.

(2) The legal rate of interest on money due on the judgment of any competent court or tribunal shall be the rate of five percent (5%) plus the base rate in effect at the time of entry of the judgment. The base rate shall be determined on July 1 of each year by the Idaho state treasurer and shall be the weekly average yield on United States treasury securities as adjusted to a constant maturity of one (1) year and rounded up to the nearest one-eighth percent (1/8%). The base rate shall be determined by the Idaho state treasurer utilizing the published interest rates during the second week in June of the year in which such interest is being calculated. The legal rate of interest as announced by the treasurer on July 1 of each year shall operate as the rate applying for the succeeding twelve (12) months to all judgments declared during such succeeding twelve (12) month period. The payment of interest and principal on each judgment shall be calculated according to a three hundred sixty-five (365) day year.