Updated February 20, 2023

A secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. This type of note carries less risk to the lender and usually allows the borrower to pay a lesser interest rate.

Unsecured Promissory Note – Offers no collateral to the lender if the note is unpaid. The borrower is only personally liable to pay.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington, D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

What is a Secured Promissory Note?

A secured promissory note is an acknowledgment of debt that includes collateral (security) if the borrower defaults. The note will include when the payments are due and, if paid late, the security will be handed over to the lender as a replacement for the amount owed.

How to Make a Secured Promissory Note

Step 1 – What is being “Secured”?

Since most promissory notes are unsecured, there should be a good reason to want them secured. The reason is; a promissory note is more casual in nature whereas a loan agreement is used more frequently when coming to terms with a secured note. A good example for the use of a secured promissory note would be for a hefty principal amount to a potentially risky borrower that owns a luxury piano. The piano, in this case, is not prone to damage, retains its value, and can be used as a security instrument. If the buyer defaults on the principal, the lender can recoup their losses by claiming the piano.

There’s no use in having a promissory note being secure if there isn’t something of equal value to the loan principal. Therefore, it’s important to have a security instrument from the borrower that backs the principal amount loaned.

Step 2 – Set Out the Terms

What makes a secured promissory note successful are the terms set out in the agreement. Below highlights all the terms set out in a promissory note. All terms should be addressed before signing the promissory note.

- Payments – Details how the principal will be paid back.

- Installments or No-Installments (No-Installments recommended)

- Interest Only payments (monthly or weekly)

- Payment upon Due Date

- Interest Due in the Event of Default – If the borrower fails to make payment when due, the lender has the option to incur an interest rate not more than defined in the State’s Usury Laws.

- Late Fees – Lender can incur a late fee if the borrower fails to make payment on time.

- Acceleration – In the event the borrower defaults on the loan, the lender can demand the total amount to be paid in full. Because this is a secure promissory note, it also gives the lender the option to claim the security instrument immediately.

Step 3 – Execute

When executing a secured promissory note, it’s important to entail as many details about the security instrument that is being attached. For example, if a valuable piano is being used as a security instrument, include as many details about the object including the brand name, serial number, and all other identifiable information.

Lenders should also consider filing a UCC Financing Statement which makes public that they have an interest in the property being used as security in the promissory note.

Secured vs Unsecured

Both types often include the same key elements necessary for a promissory note. However, the unsecured promissory note doesn’t offer the same assurances and securities for the lender against defaults on the loan. In other words, the unsecured promissory note doesn’t include any form of collateral.

Unsecured promissory notes have a lot more risk associated with them. Because of that, they are often used in cases where the amount of the loan is less significant, the borrower is a high-worth client with a lot of good credit, or among parties that are quite familiar with each other (i.e., friends and family).

If the loan does go into default, the lender can still file a demand for repayment, collect what’s due through a debt collection service, or settle the repayment through a small claims court. However, these processes for repayment often don’t come without their own costs. Most lenders would prefer to avoid losing more money just to make back a part of their investment (which the borrower may be completely unable to pay back).

How To Write

Download: Adobe PDF, MS Word, OpenDocument

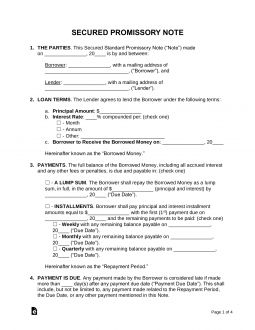

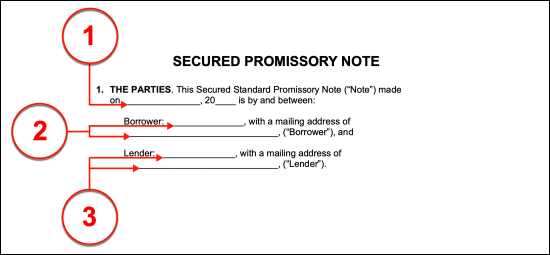

I. The Parties

(1) Date Of Secured Loan Conditions And Terms. The date that the Borrower and the Lender agree as the first day when this note will first obligate all the participating Signature Parties must be documented as part of this paperwork’s introduction.

(2) Borrower Of Secured Loan. The identity of the Person or Entity who will be lent money under the conditions of this note must be established. This task requires the Borrower’s legal name to be submitted to the first line in the statement labeled “Borrower” as well as this Party’s current mailing address.

(3) Lender Behind Secured Loan. The Lender who shall release a predetermined sum of money to the Borrower for a limited amount of time must be named. Dispense the legal name of the Party entering this agreement with the intent to supply the loan amount with the expectation of receiving repayment or seizing the security provided by the Borrower. Once done, supply the mailing address where this Lender can be contacted. Note that should the Lender be a Business or Company, then its entire name (as it is registered on the books) will be required by the “Lender” area.

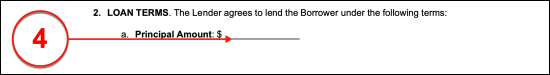

II. Loan Terms

(4) Principal Amount. The amount of money that will be lent to the Borrower by the Lender must be a predetermined dollar amount and solidified as such in the Second Section of this note. Locate the dollar symbol in Statement A of this section then, on the blank line that follows, produce the exact dollar amount the Lender shall loan to the Borrower under the condition that the Borrower’s property is used as security against nonpayment.

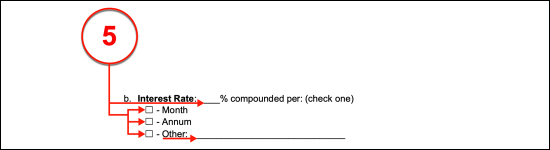

(5) Interest Rate. If the Lender and the Borrower agree that an interest rate shall be used to calculate an amount of money to be added to the loan payments, then Statement (B) must be used to establish this rate. Furnish the percentage of the owed amount that will be used in calculating the interest owed by the Borrower in Statement (B). The frequency by which this interest rate will be applied must also be presented by selecting the appropriate checkbox (“Month,” “Annum,” or “Other”). Note that if the interest rate will not be applied once a month or once a year, then the exact number of days, weeks, or months that define how often the interest rate will be applied to the owed amount should be documented in the space provided by the “Other” selection.

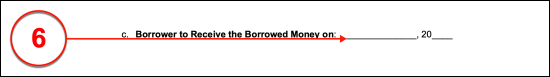

(6) First Date Of Secured Loan. The calendar date when this paperwork requires that the Borrower receive the funds making up the loan from the Lender must be furnished in Statement (C).

III. Payments

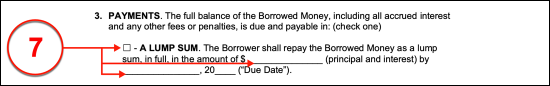

Select Item 7 Or Select Item 8

(7) A Lump Sum. Now that the delivery of the loan has been defined, the obligation of its repayment must be discussed. If the Borrower agrees to pay the full amount that was loaned including any compounded interest in full in one payment, then select the “Lump Sum” checkbox in Section III. Additionally, document the full amount that the Borrower must submit as full payment to the Lender and the calendar date when the Lender must receive it in the spaces provided by this option.

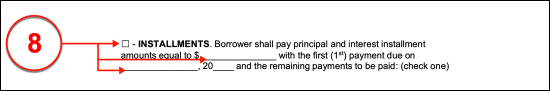

(8) Installments. If the Borrower agrees to submit several payments across a span of time at regular intervals, then select the “Installments” checkbox. To define this condition of repayment, the dollar amount of each installment must be submitted along with the calendar date marking when the Lender must receive this amount as the first installment payment.

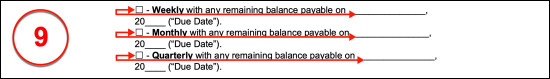

(9) Types Of Installment. If the Borrower shall make multiple scheduled payments until the loan has been paid, then the schedule of these payments must also be documented in this note. One of three checkboxes from the “Installments” option must be selected for this purpose and the date when the final payment will be expected documented. In this way, the Borrower’s installment payments may be scheduled to occur once a week, once a month, or once per quarter (every three months) by selecting the option labeled “Weekly,” “Monthly,” or “Quarterly.”

IV. Payment Is Due

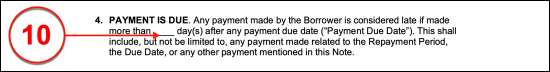

(10) Late Payment. The maximum number of days that the Lender shall allow to elapse before considering the Borrower’s payment late enough to violate the term of payment requires definition. Furnish this number of days, often referred to as a ‘grace period,’ on the blank line in Section IV.

V. Late Fee

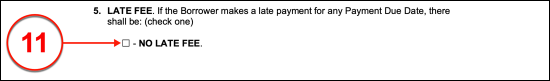

Select Item 11 Or Item 12

(11) No Late Fee. Section Five shall seek to set conditions upon late payments submitted by the Borrower. If the Lender will not set a late fee to be paid in addition to the owed payment then select the “No Late Fee” checkbox from this section.

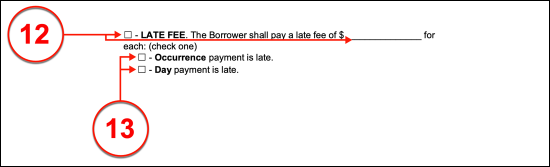

(12) Late Fee Amount. If the Lender will apply a late fee to any scheduled payment that is made after the expiration of the grace period defined earlier, then the second checkbox in Section Five must be selected and the dollar amount considered as the late fee must be defined on the blank space in the corresponding statement.

(13) Application Of Late Fee. If the late fee defined will only be applied once to a late payment then select the “Occurrence” checkbox however, if the late fee will be applied each day that it is not received then place a mark in the “Day” checkbox.

VI. Security

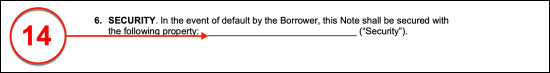

(14) Loan Security. As mentioned, the Lender will be given a guarantee from the Borrower that the loan shall be paid back because this note shall place a condition where the property of the Borrower will be transferred to the Lender’s ownership should the Borrower be unable to pay the loaned amount. Such property must be fully defined in Section Six on the space labeled “Security.”

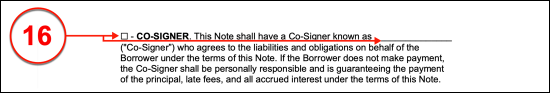

VII. Co-Signer

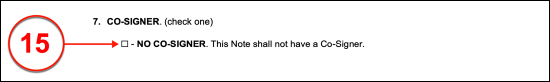

Select Item 15 Or Item 16

(15) No Co-Signer. If the Borrower was not obligated to find a Co-Signer to (further) guarantee that any default in repayment will be paid by the Co-Signer on his or her behalf, then the first checkbox in Section Seven must be marked.

(16) Co-Signer Identity. If the Borrower has obtained a Co-Signer that is approved by the Lender, then the second checkbox in Section Seven should be selected. Once this selection is made the legal name of the Co-Signer, who will be expected to sign this note, must be presented in the space provided.

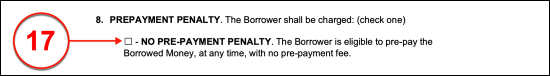

VIII. Prepayment Penalty

Select Item 17 Or Item 18

(17) No Pre-Payment Penalty. If the Lender does not intend to penalize the Borrower for an early partial or full loan payment then, Section Eight requires that the first checkbox displayed (“No Pre-Payment Penalty”) is selected.

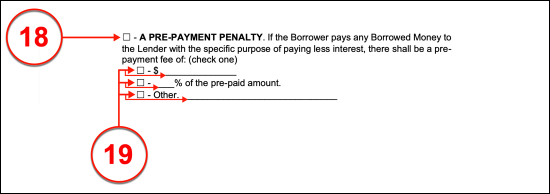

(18) Prepayment Penalty. If the Lender shall charge a penalty to the Borrower for an early installment payment or if the entire owed amount is paid prematurely, then the checkbox “A Pre-Payment Penalty” must be selected from Section Eight. Additional information regarding this penalty will need to be presented by one of the choices it presents.

(19) Penalty Amount. The pre-payment penalty can take the form of a flat dollar amount that the Borrower must pay the Lender, a percentage of the prepaid amount that must be added to the money owed by the Borrower, or some “Other” amount. If the penalty will be a flat dollar amount, then the first checkbox should be marked and the dollar amount the Borrower must pay should be documented whereas if the penalty will be a percentage then the second checkbox must be selected and the percentage of the prepaid amount must be submitted. Either of these choices may be selected so long as the information required is supplied to the content of the selection. If neither of these options are applicable then the third checkbox (“Other”) must be selected and a specific detail on how the penalty will be calculated should be recorded in the space provided.

IX. Governing Law

(20) State Of Note’s Effect. The State that will govern the Lender and the Borrower’s behavior in this matter as well as the legitimacy of the content of this note must be identified in Section Twenty.

X. Additional Terms & Conditions

(21) Record Of Additional Provisions. The above document will capture the most common agreements made between a Borrower and Lender when supporting a secured loan. If additional conditions or time frames have been agreed to by these two Parties that are considered legal but unpresented thus far, then use the area in Section Twenty-One to document each such provision or agreement. Only the conditions, terms, and provisions included this document at the time it is signed by its Signature Parties will be considered binding.

XI. Entire Agreement

(22) Lender Signature. The Lender will only be considered obligated by this paperwork if he or she signs it and prints his or her full name. These actions should only be taken after a careful review has been completed.

(23) Lender Signature Date. The date of the Lender’s signature should be submitted when he or she signs this paperwork.

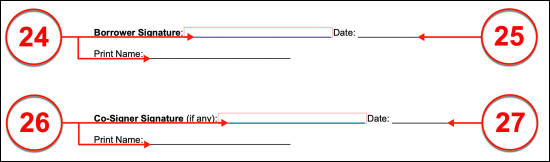

(24) Borrower Signature. The Borrower must sign this document to enter it. His or her signature and printed name should be presented after he or she has read through this paperwork and acknowledges the responsibilities it places on him or her.

(25) Borrower Signature Date. In addition to his or her signature execution of this document, the Borrower must submit the current date where requested.

(26) Co-Signer Signature. If a Co-Signer intends to commit to making sure that the loan is paid back to the Lender and will assume this financial responsibility if the Borrower defaults then the final signature area must be completed by the Co-Signer. This will prove that he or she accepts the conditions that the Borrower has agreed to above. In addition to his or her signature, the Co-Signer must print his or her name.

(27) Co-Signer Signature Date. The date when the Co-Signer has signed this document must be presented upon his or her completion of this signature area.