Updated July 27, 2023

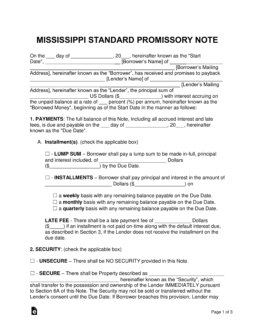

A Mississippi promissory note template is a document that structures and organizes the details regarding a loaned amount of money between two parties. Covered in the template are topics such as interest rates, payment types, late fees, and the parties’ personal information. The lender profits from the deal by earning interest on top of the original balance of the note.

Table of Contents |

By Type (2)

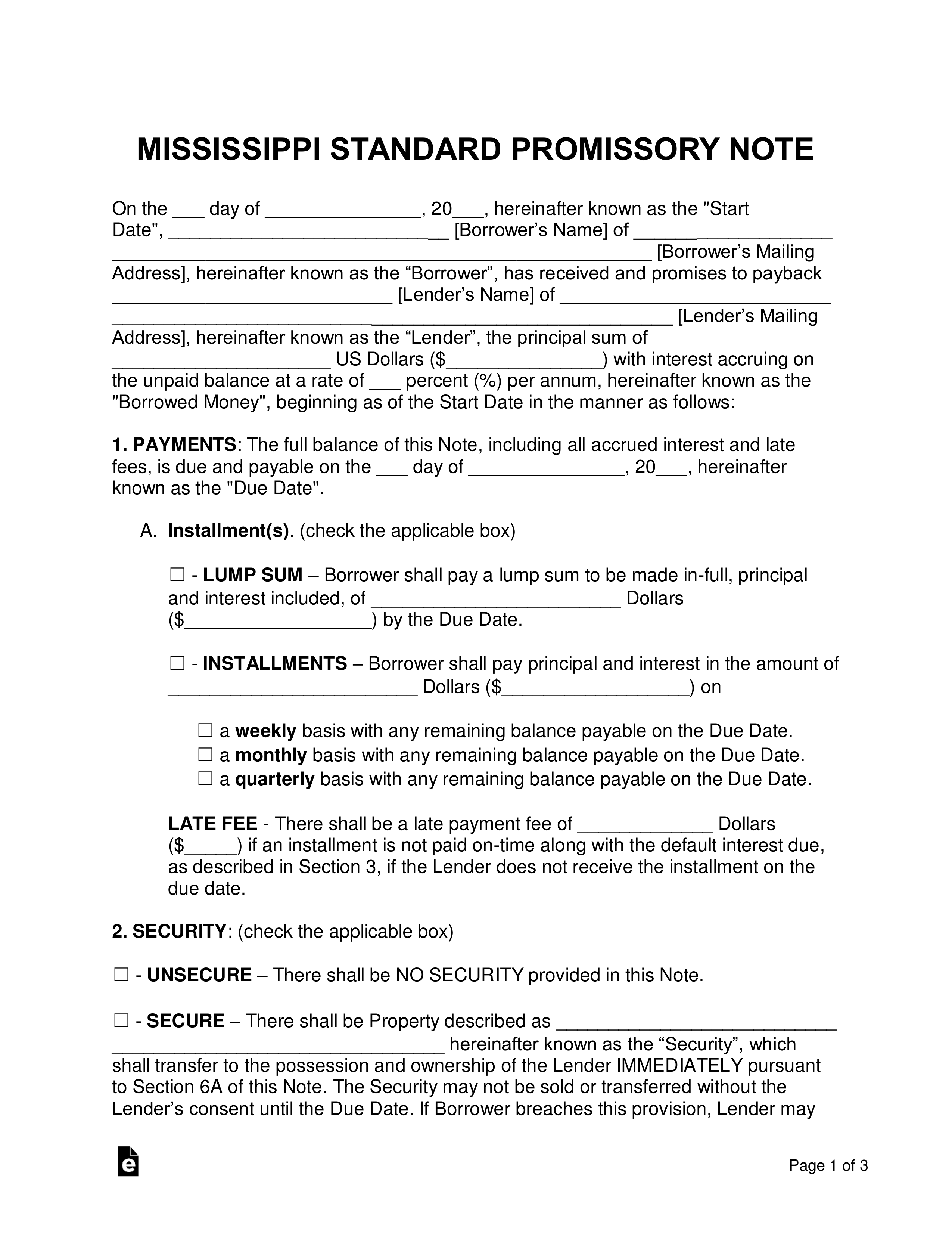

Secured Promissory Note – Protects the lender in the case of a default by allocating a possession of the borrower such as a home, vehicle, or boat to security. This item is guaranteed to the lender if the borrower cannot recover from the default.

Secured Promissory Note – Protects the lender in the case of a default by allocating a possession of the borrower such as a home, vehicle, or boat to security. This item is guaranteed to the lender if the borrower cannot recover from the default.

Download: PDF, MS Word, OpenDocument

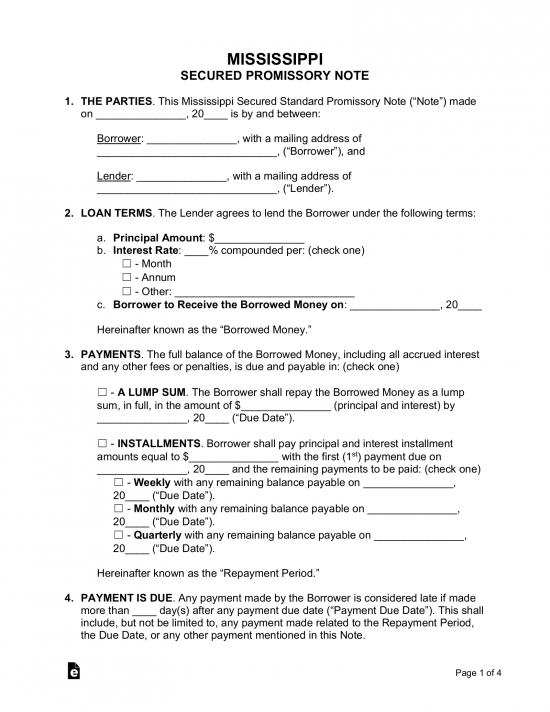

Unsecured Promissory Note – Includes all of the aspects of the secured version, but is different in the fact that there is no security section for the parties to complete. This adds considerable risk to the lender, as he or she is not guaranteed a return of the original balance if the borrower defaults on the note.

Unsecured Promissory Note – Includes all of the aspects of the secured version, but is different in the fact that there is no security section for the parties to complete. This adds considerable risk to the lender, as he or she is not guaranteed a return of the original balance if the borrower defaults on the note.

Download: PDF, MS Word, OpenDocument

Usury Statute

(1) The legal rate of interest on all notes, accounts and contracts shall be eight percent (8%) per annum, calculated according to the actuarial method, but contracts may be made, in writing, for payment of a finance charge as otherwise provided by this section or as otherwise authorized by law.

(2) Any borrower or debtor may contract for and agree to pay a finance charge for any loan or other extension of credit made directly or indirectly to a borrower or debtor which will result in a yield not to exceed the greater of ten percent (10%) per annum or five percent (5%) per annum above the discount rate, excluding any surcharge thereon, on ninety-day commercial paper in effect at the Federal Reserve bank in the Federal Reserve district where the lender is located, each calculated according to the actuarial method. The rate of finance charge authorized under this subsection (2) shall be known as the “contract rate” …