Updated July 27, 2023

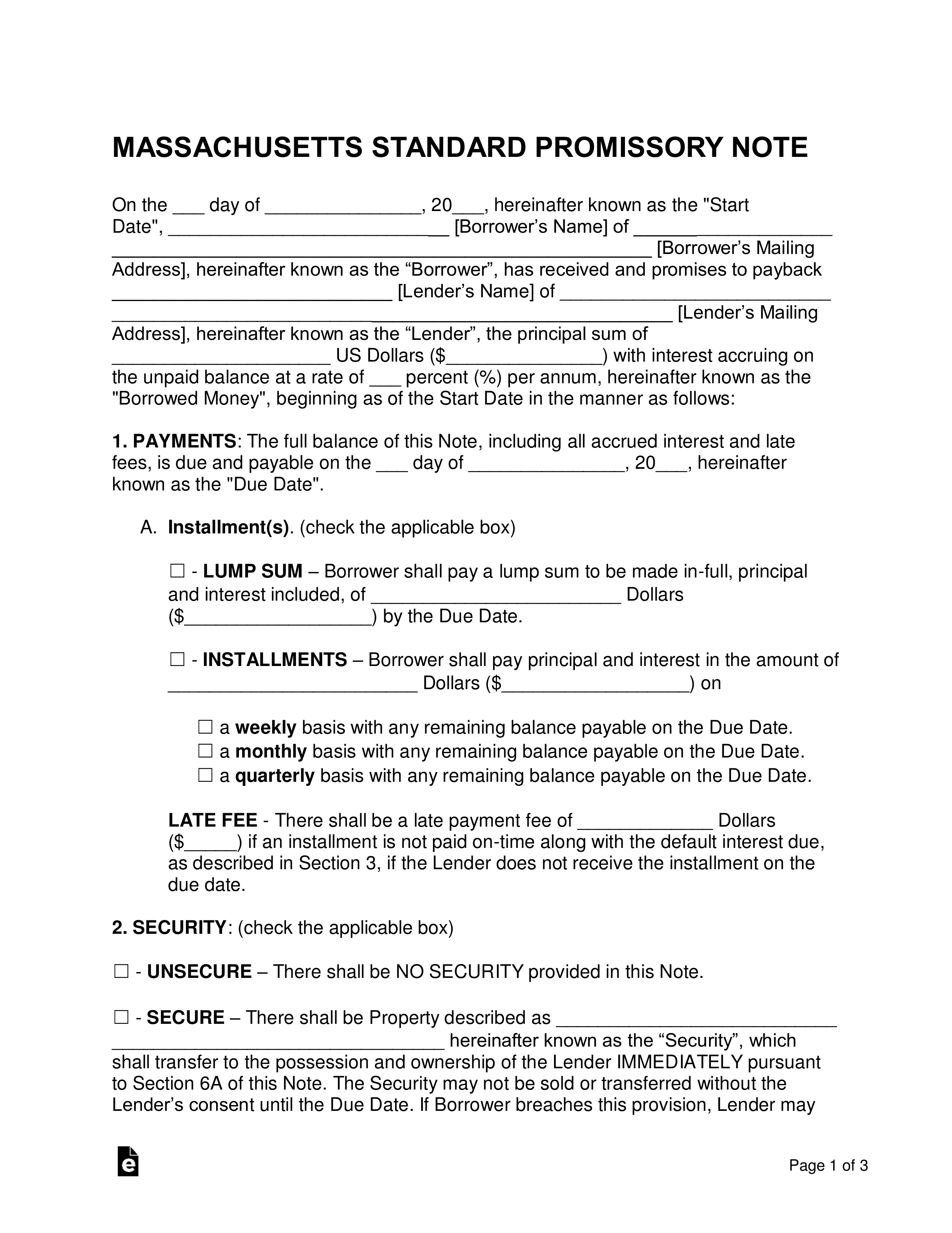

Massachusetts promissory note templates outline the specifics of an agreement between a lender and a borrower of a monetary balance. The templates also add legality to the deal and help to ensure the borrower makes timely payments to the lender. Both parties should complete the document together to ensure everyone is on the same page.

Table of Contents |

By Type (2)

Secured Promissory Note – This version includes a security section. Security is an item (or items) that typically consists of a home, vehicle, or boat that is in possession of the borrower. The secured items are given to the lender in the case of a default that the borrower cannot recover from.

Secured Promissory Note – This version includes a security section. Security is an item (or items) that typically consists of a home, vehicle, or boat that is in possession of the borrower. The secured items are given to the lender in the case of a default that the borrower cannot recover from.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – This version poses a far greater risk on the lender, as there is no built-in security for the lender. In the case of a default, the lender would be left resorting to small claims court and reporting the default to the borrower’s credit.

Unsecured Promissory Note – This version poses a far greater risk on the lender, as there is no built-in security for the lender. In the case of a default, the lender would be left resorting to small claims court and reporting the default to the borrower’s credit.

Download: PDF, MS Word, OpenDocument

Usury Statutes

If there is no agreement or provision of law for a different rate, the interest of money shall be at the rate of six dollars on each hundred for a year, but, except as provided in sections seventy-eight, ninety, ninety-two, ninety-six and one hundred of chapter one hundred and forty, it shall be lawful to pay, reserve or contract for any rate of interest or discount. No greater rate than that before mentioned shall be recovered in a suit unless the agreement to pay it is in writing.

(a) Whoever in exchange for either a loan of money or other property knowingly contracts for, charges, takes or receives, directly or indirectly, interest and expenses the aggregate of which exceeds an amount greater than twenty per centum per annum upon the sum loaned or the equivalent rate for a longer or shorter period, shall be guilty of criminal usury and shall be punished by imprisonment in the state prison for not more than ten years or by a fine of not more than ten thousand dollars, or by both such fine and imprisonment. For the purposes of this section the amount to be paid upon any loan for interest or expenses shall include all sums paid or to be paid by or on behalf of the borrower for interest, brokerage, recording fees, commissions, services, extension of loan, forbearance to enforce payment, and all other sums charged against or paid or to be paid by the borrower for making or securing directly or indirectly the loan, and shall include all such sums when paid by or on behalf of or charged against the borrower for or on account of making or securing the loan, directly or indirectly, to or by any person, other than the lender, if such payment or charge was known to the lender at the time of making the loan, or might have been ascertained by reasonable inquiry.

…