Updated July 27, 2023

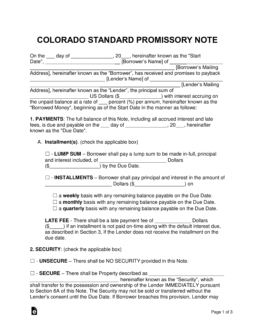

A Colorado promissory note template is a document designed to assist two parties in concreting details regarding a loan to help ensure the borrower pays the balance over time in an orderly fashion. Below are two different forms of the Colorado Promissory Note, one designed to give the lender security in the case of a default, and the other without security.

Table of Contents |

By Type (2)

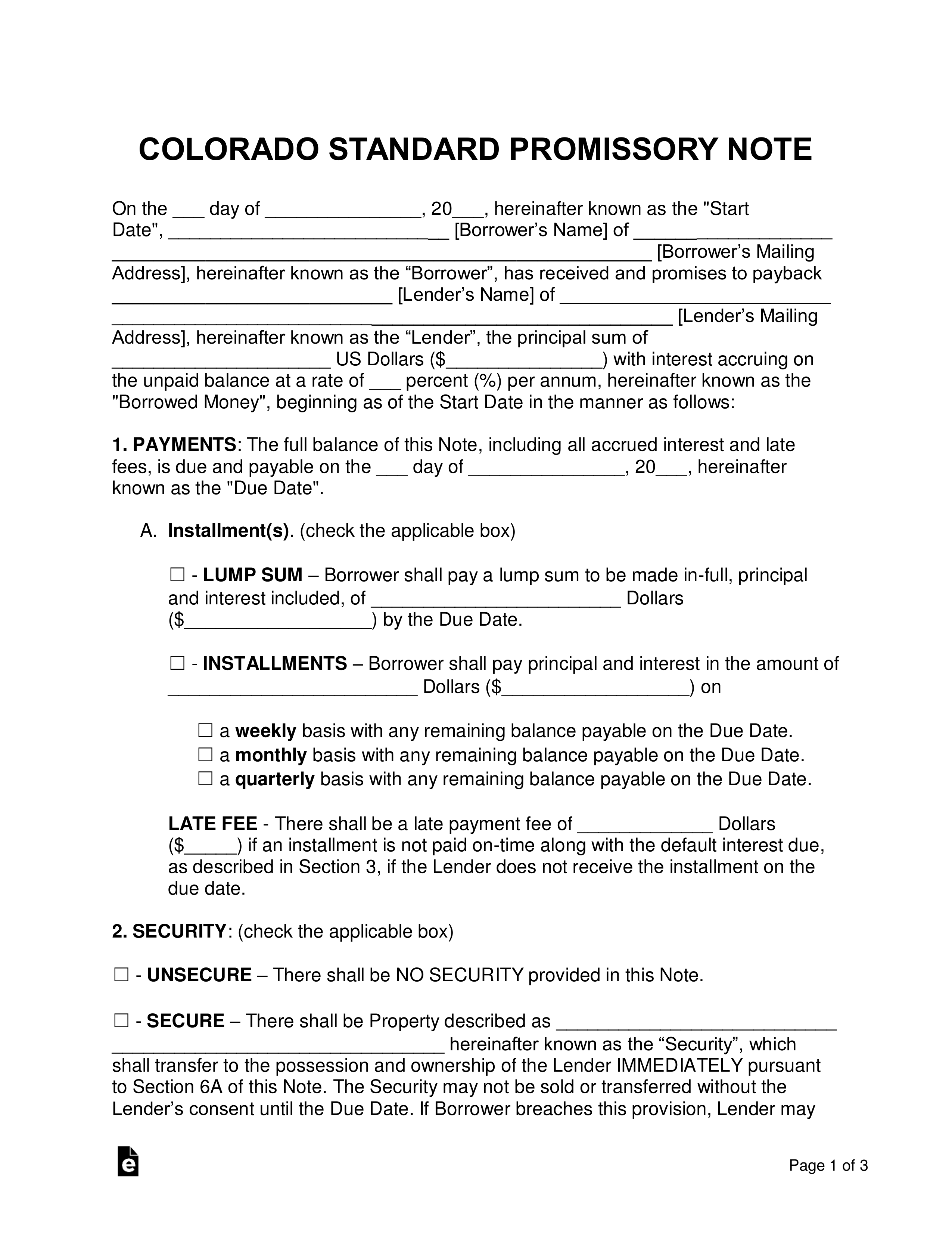

Secured Promissory Note – Incorporated in this note is the ability for the lender to recover lost financials in the case of a default on the balance.

Secured Promissory Note – Incorporated in this note is the ability for the lender to recover lost financials in the case of a default on the balance.

Download: PDF, MS Word, OpenDocument

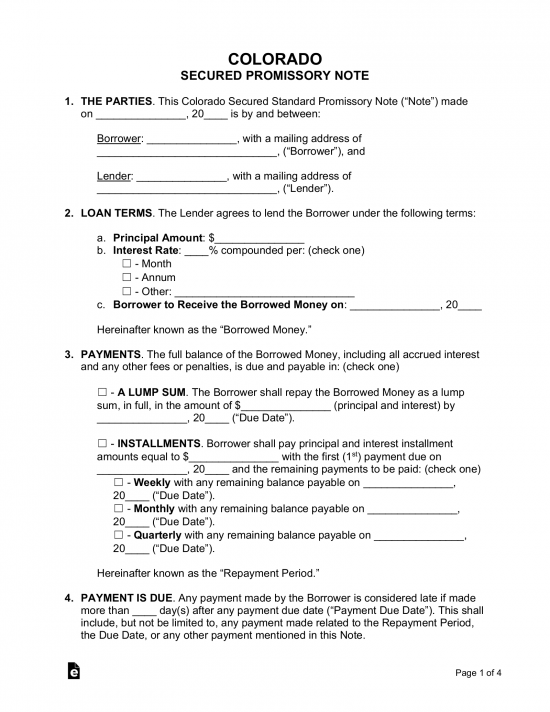

Unsecured Promissory Note – This note should mainly be used with a borrower that the lender trusts completely, as there is no built-in guarantee the lender will be paid.

Unsecured Promissory Note – This note should mainly be used with a borrower that the lender trusts completely, as there is no built-in guarantee the lender will be paid.

Download: PDF, MS Word, OpenDocument

Usury Statute

(1) The parties to any bond, bill, promissory note, or other instrument of writing may stipulate therein for the payment of a greater or higher rate of interest than eight percent per annum, but not exceeding forty-five percent per annum, and any such stipulation may be enforced in any court of competent jurisdiction in the state, except as otherwise provided in articles 1 to 6 of this title. The rate of interest shall be deemed to be excessive of the limit under this section only if it could have been determined at the time of the stipulation by mathematical computation that such rate would exceed an annual rate of forty-five percent when the rate of interest was calculated on the unpaid balances of the debt on the assumption that the debt is to be paid according to its terms and will not be paid before the end of the agreed term.(2) The term “interest” as used in this section means the sum of all charges payable directly or indirectly by a debtor and imposed directly or indirectly by a lender as an incident to or as a condition of the extension of credit to the debtor, whether paid or payable by the debtor, the lender, or any other person on behalf of the debtor to the lender or to a third party.

(3) The public policy of this state does not limit or prohibit contracting, agreeing, or stipulating in advance for the payment of interest on interest or compound interest.

(4) No law or public policy of this state limiting interest on interest, the adding of deferred interest to principal, or the compounding of interest shall apply to any promissory note secured by any mortgage or deed of trust or to one secured by a mortgage or deed of trust where periodic disbursement of part of the loan proceeds is made by a lender over a period of time as established by the mortgage or deed of trust, or over an expressed period of time, or ending with the death of the debtor, including, but not limited to, promissory notes secured by mortgages or deeds of trust having provisions for adding deferred interest to principal or otherwise providing for the charging of interest on interest.

(5) This section shall not apply to a commercial credit plan as defined in section 5-12-107(8) and extensions of credit made pursuant thereto, unless the bond, bill, promissory note, instrument, or other written agreement evidencing the plan expressly states that it is subject to this section.