Updated March 25, 2024

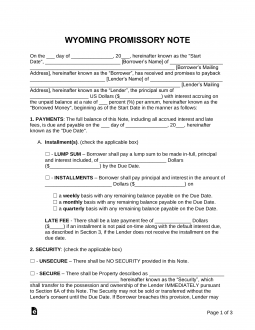

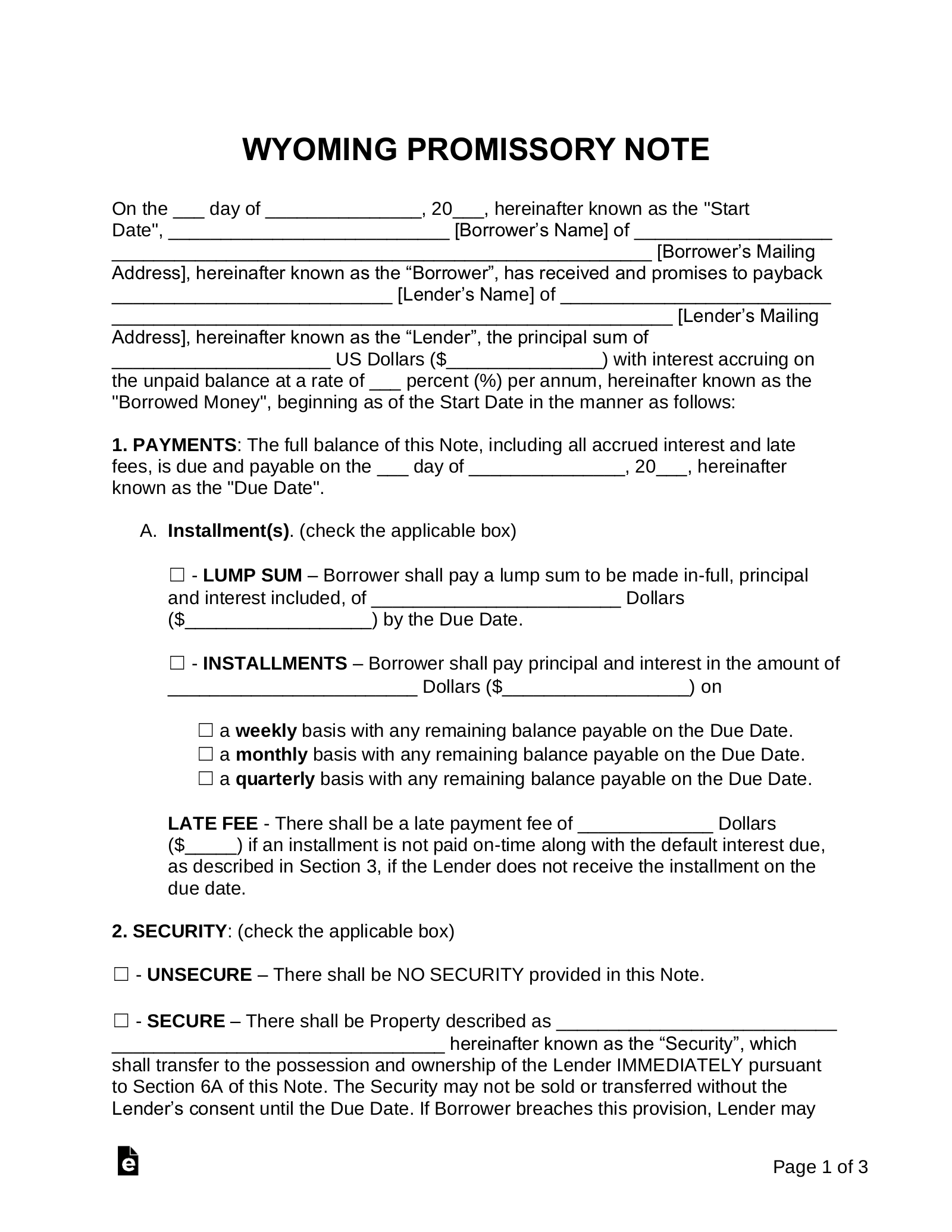

Wyoming promissory notes are signed promises that organize and add legal validity to transactions where one individual (called the ‘lender’) lends money to another individual (called the ‘borrower’). The documents include a section where a witness’ signature is written; this gives the template weight in a court of law if the document needs to be used for such use.

Table of Contents |

By Type (2)

Secured Promissory Note – Protects the lender from losing the loaned balance by requiring the borrower to set aside an item (such as a home, vehicle, or boat) that is automatically given to the lender in the case of a default. This item is used to cover the amount of balance that has been left unpaid by the borrower and should be of similar value as to the amount of the note.

Secured Promissory Note – Protects the lender from losing the loaned balance by requiring the borrower to set aside an item (such as a home, vehicle, or boat) that is automatically given to the lender in the case of a default. This item is used to cover the amount of balance that has been left unpaid by the borrower and should be of similar value as to the amount of the note.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – Does not include a section where security can be stated. If the borrower enters into default and is unable to recover, the lender does not receive an item to help cover the remaining balance. The lender can only resort to taking the borrower to a small claims court filing to recover the lost balance.

Unsecured Promissory Note – Does not include a section where security can be stated. If the borrower enters into default and is unable to recover, the lender does not receive an item to help cover the remaining balance. The lender can only resort to taking the borrower to a small claims court filing to recover the lost balance.

Download: PDF, MS Word, OpenDocument

Usury Statute

(a) Except as otherwise provided in this act, a buyer, lessee, or debtor may not waive or agree to forego rights or benefits under this act.

(b) A claim by a buyer, lessee, or debtor against a creditor for an excess charge, other violation of this act, or civil penalty, or a claim against a buyer, lessee, or debtor for default or breach of a duty imposed by this act, if disputed in good faith, may be settled by agreement.

(c) A claim, whether or not disputed, against a buyer, lessee, or debtor may be settled for less value than the amount claimed.

(d) A settlement in which the buyer, lessee, or debtor waives or agrees to forego rights or benefits under this act is invalid if the court as a matter of law finds the settlement to have been unconscionable at the time it was made. The competence of the buyer, lessee, or debtor, any deception or coercion practiced upon him, the nature and extent of the legal advice received by him, and the value of the consideration are relevant to the issue of unconscionability.

(e) If there is no agreement or provision of law for a different rate, the interest of money shall be at the rate of seven percent (7%) per annum.

(f) The Financial Technology Sandbox Act shall apply to this act. [NOTE: This section will be effective 1/1/2020.]