Updated February 01, 2024

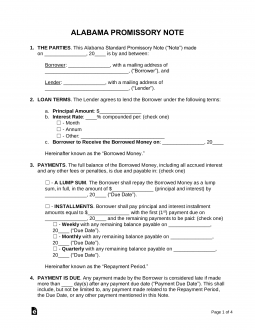

An Alabama promissory note template is a document that verifies a loan was given to an individual for the purpose of repayment over a period of time. The time period and interest rate are to be negotiated by the parties along with any security to be provided (if any) by the borrower.

Table of Contents |

By Type (2)

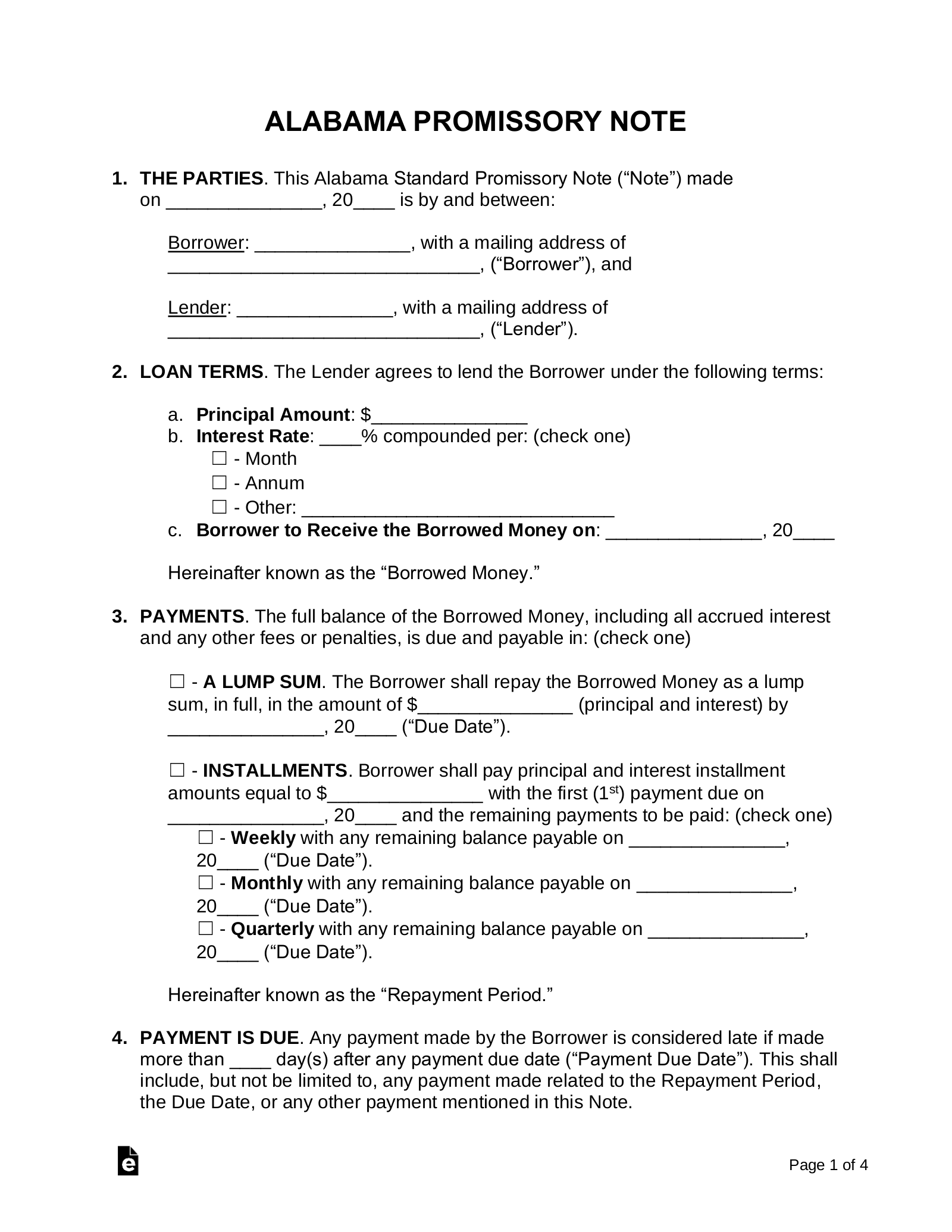

Secured Promissory Note – This allows the lender to hold something of value if the borrower does not pay back the amount loaned.

Secured Promissory Note – This allows the lender to hold something of value if the borrower does not pay back the amount loaned.

Download: PDF, MS Word, OpenDocument

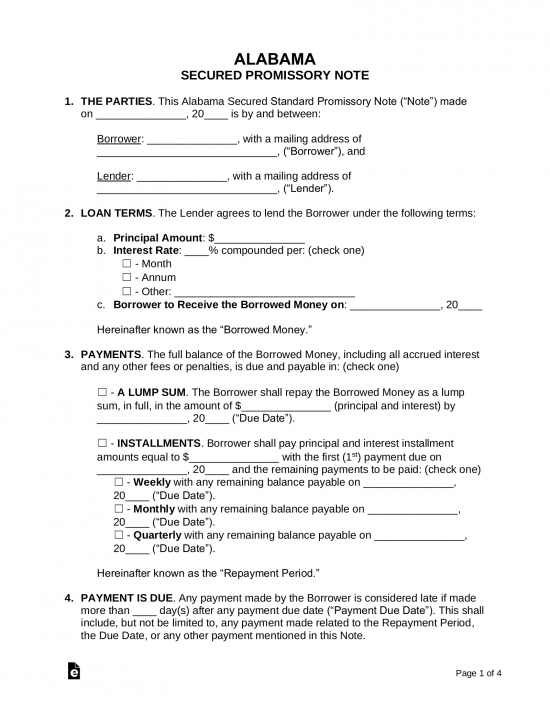

Unsecured Promissory Note – Usually for family, friends, or those with a high level of credit. There is no property that is guaranteed if the note becomes in default.

Unsecured Promissory Note – Usually for family, friends, or those with a high level of credit. There is no property that is guaranteed if the note becomes in default.

Download: PDF, MS Word, OpenDocument

Usury Statute

Except as otherwise provided by law, the maximum rate of interest upon the loan or forbearance of money, goods, or things in action, except by written contract is $6 upon $100 for one year, and the rate of interest by written contract is not to exceed $8 upon $100 for one year and at that rate for a greater or less sum or for a longer or shorter time.