Updated July 27, 2023

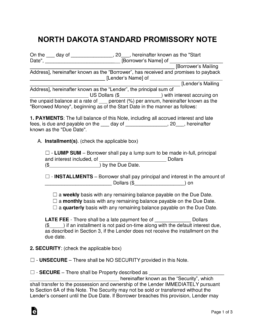

A North Dakota promissory note template is a document used for money-lending transactions in which a lender has reimbursed a loaned balance plus interest from a borrower in a timely and structured fashion. In addition to the documents detailing the structure of the agreement, the documents can also be used in a court of law once all required signatures have been recorded on the template.

Table of Contents |

By Type (2)

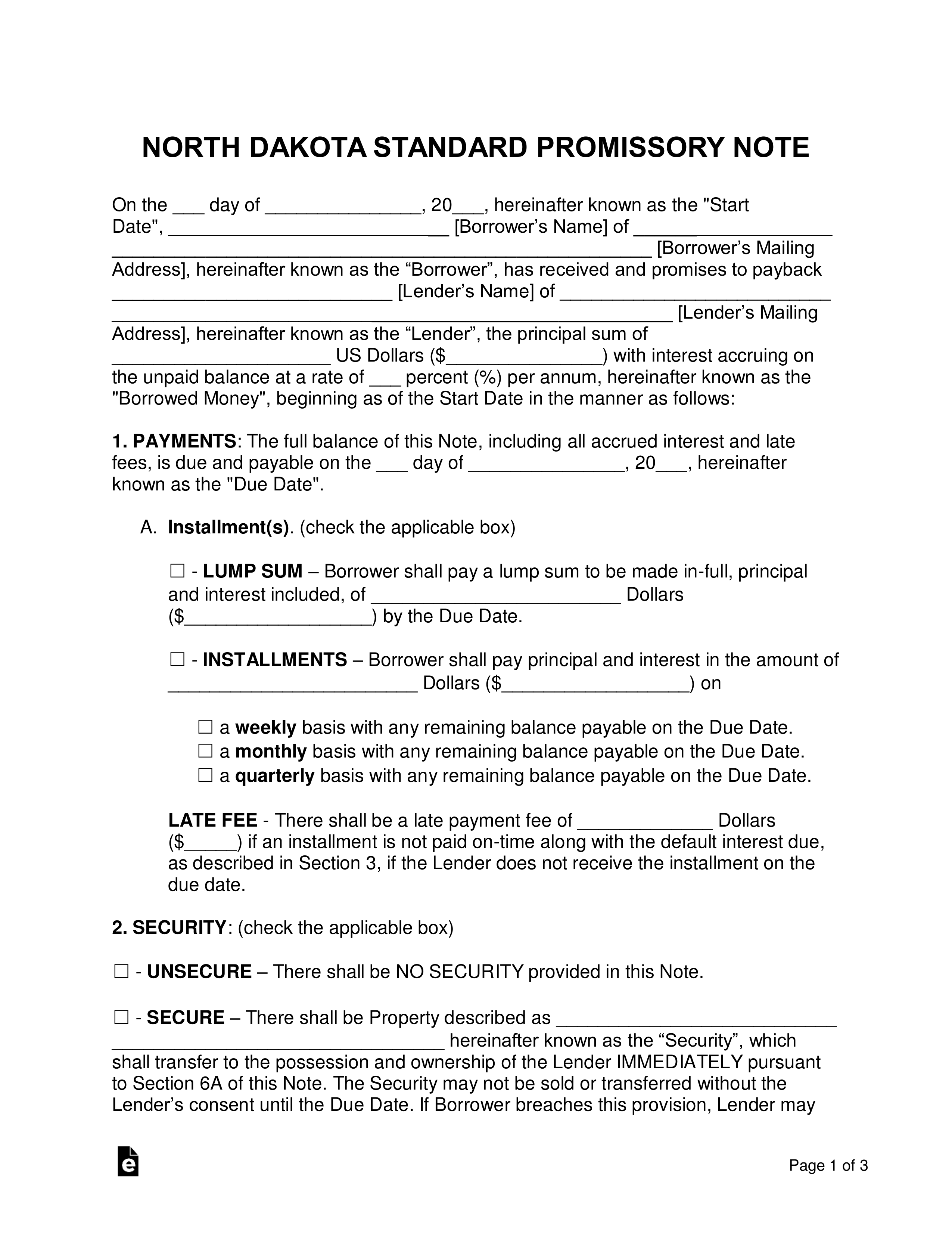

Secured Promissory Note – The secured version requires the borrower to set aside an item that is roughly similar in value to the amount of the balance. If the borrower cannot make payments on the balance, the item in security will be given to the lender to help cover the unpaid balance.

Secured Promissory Note – The secured version requires the borrower to set aside an item that is roughly similar in value to the amount of the balance. If the borrower cannot make payments on the balance, the item in security will be given to the lender to help cover the unpaid balance.

Download: PDF, MS Word, OpenDocument

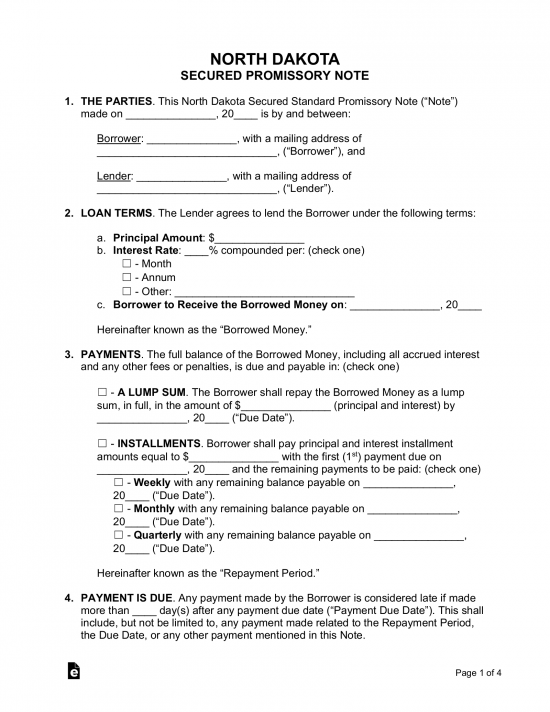

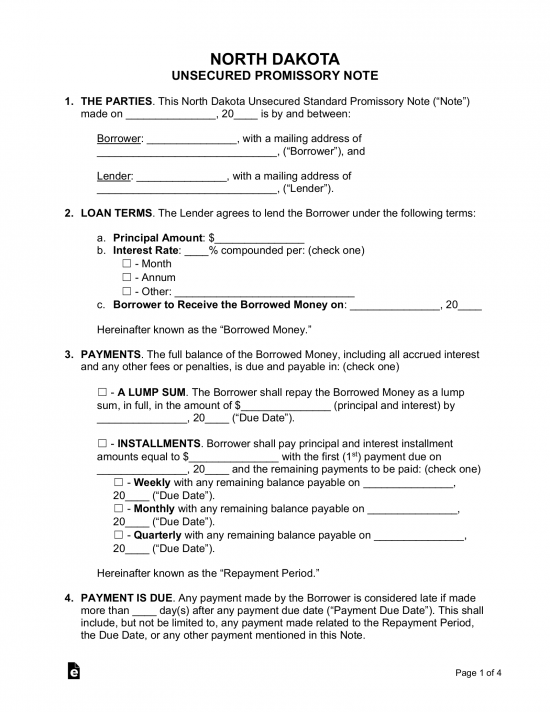

Unsecured Promissory Note – The unsecured version does not include security. This adds a considerable amount of risk to the transaction for the lender as he or she would need to rely on taking the borrower to a small claims court to recover the unpaid balance.

Unsecured Promissory Note – The unsecured version does not include security. This adds a considerable amount of risk to the transaction for the lender as he or she would need to rely on taking the borrower to a small claims court to recover the unpaid balance.

Download: PDF, MS Word, OpenDocument

Usury Statute

1. Except as otherwise provided by the laws of this state, a person, either directly or indirectly, may not take or receive, or agree to take or receive, in money, goods, or things in action, or in any other way, any greater sum or greater value for the loan or forbearance of money, goods, or things in action than five and one-half percent per annum higher than the current cost of money as reflected by the average rate of interest payable on United States treasury bills maturing in six months in effect for North Dakota for the six months immediately preceding the month in which the transaction occurs, as computed and declared on the last day of each month by the state banking commissioner, but that in any event the maximum allowable interest rate ceiling may not be less than seven percent, and in the computation of interest the same may not be compounded; provided, however, that a minimum interest charge of fifteen dollars may be made. A contract may not provide for the payment of interest on Page No. 1 interest overdue, but this section does not apply to a contract to pay interest at a lawful rate on interest that is overdue at the time such contract is made. Any violation of this section is deemed usury …