Updated July 27, 2023

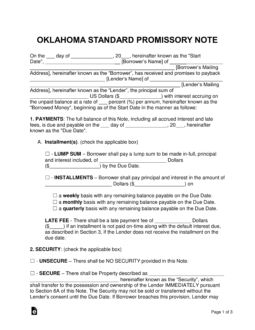

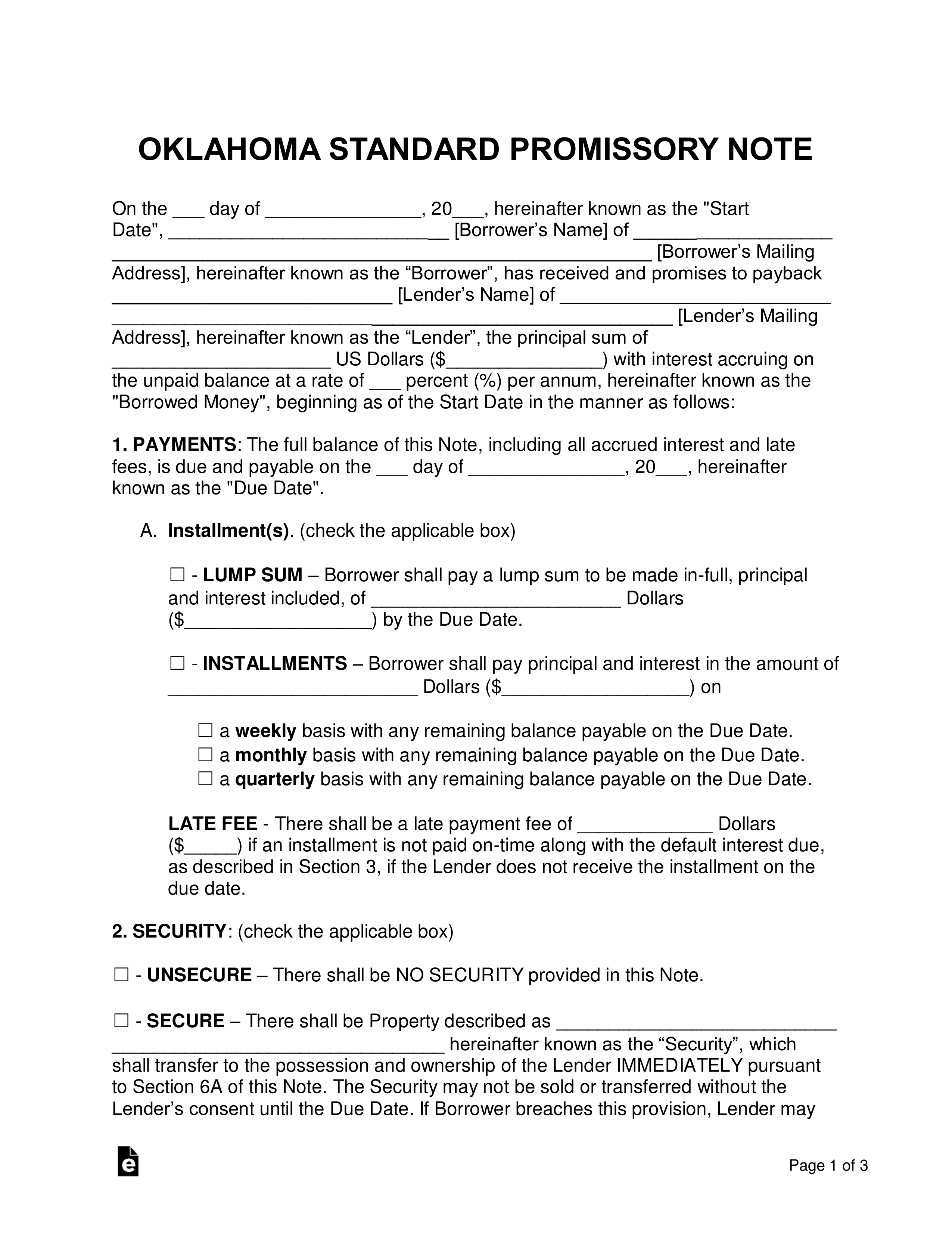

An Oklahoma promissory note template is a signed document stating the borrower of a monetary balance will reimburse the lender of said balance in a scheduled time frame. The amount of interest the borrower will be required to pay will be based upon the Usury Rate chosen for the agreement. Check with Oklahoma’s laws regarding legal interest rates found at the bottom of this page.

Table of Contents |

By Type (2)

Secured Promissory Note – Sets aside a physical item such as a home, vehicle, or boat that is given to the lender if the borrower enters into default and cannot recover. The item in security should be in similar value to that of the balance to minimize loss to the lender.

Secured Promissory Note – Sets aside a physical item such as a home, vehicle, or boat that is given to the lender if the borrower enters into default and cannot recover. The item in security should be in similar value to that of the balance to minimize loss to the lender.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – Does not include a section on security. This results in the lender being far more vulnerable, as he or she has the possibility of losing the loaned balance. The lender should take the time to screen potential borrowers to ensure they have a strong credit history.

Unsecured Promissory Note – Does not include a section on security. This results in the lender being far more vulnerable, as he or she has the possibility of losing the loaned balance. The lender should take the time to screen potential borrowers to ensure they have a strong credit history.

Download: PDF, MS Word, OpenDocument

Usury Statute

The legal rate of interest shall be six percent (6%) in the absence of any contract as to the rate of interest, and by contract parties may agree to any rate as may be authorized by law, now in effect or hereinafter enacted.