Updated July 27, 2023

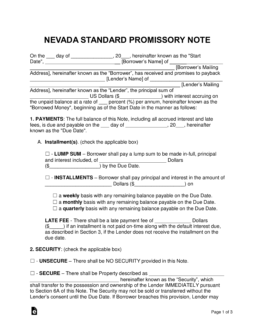

A Nevada promissory note template helps to ensure a lender is returned a loaned amount of money with the addition of interest from a borrower. The templates also ad legal backing to the agreement by requiring the signatures of all involved parties as well as a witness.

Table of Contents |

By Type (2)

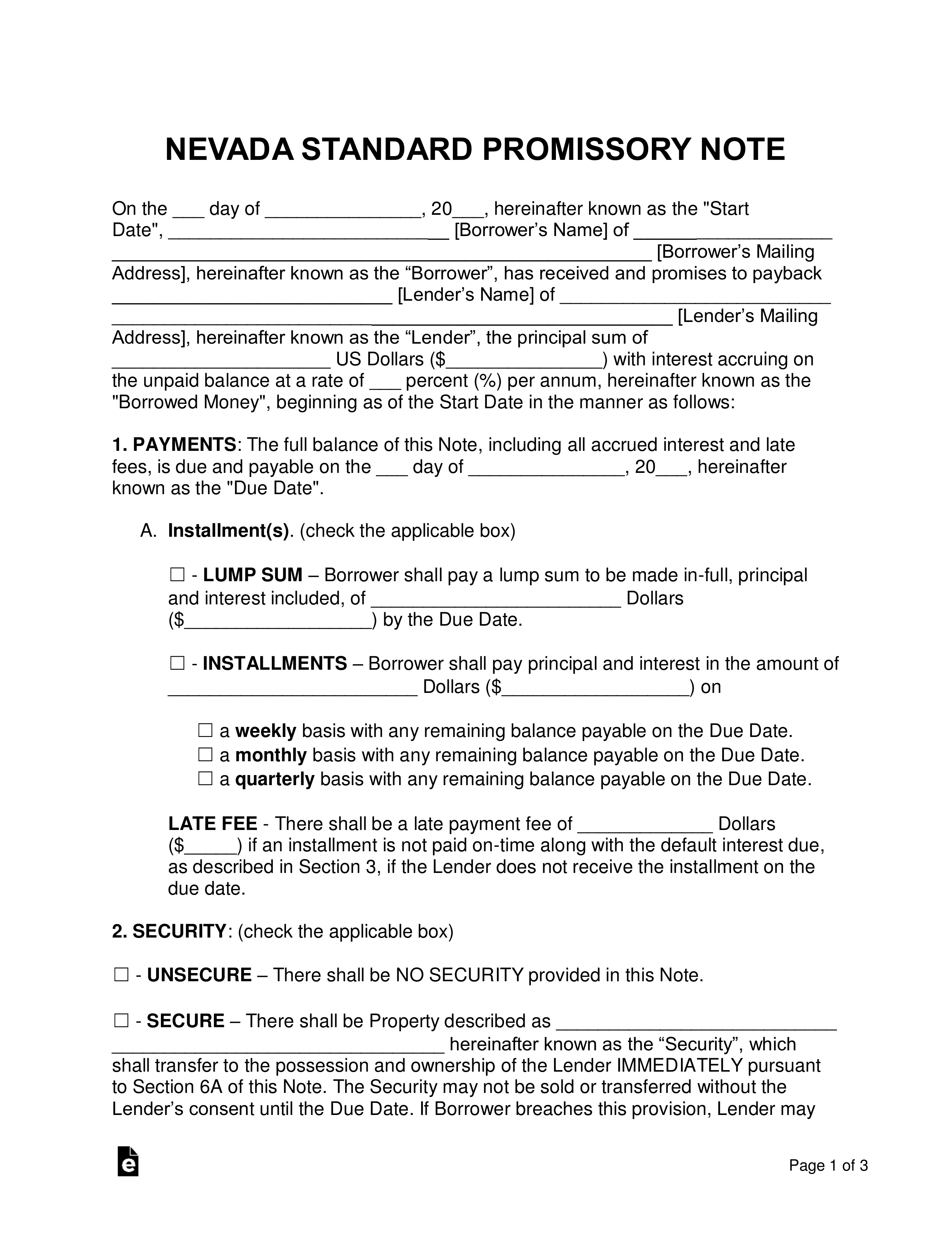

Secured Promissory Note – Helps protect the lender by being incorporated with a section on security. Security requires that an item be selected with close value to that of the loaned balance; if the borrower defaults and cannot repay the balance, the item in security is transferred to the lender.

Secured Promissory Note – Helps protect the lender by being incorporated with a section on security. Security requires that an item be selected with close value to that of the loaned balance; if the borrower defaults and cannot repay the balance, the item in security is transferred to the lender.

Download: PDF, MS Word, OpenDocument

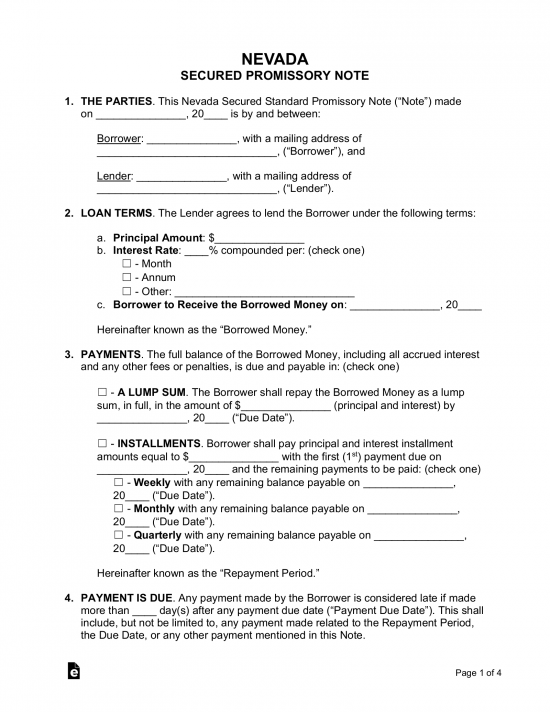

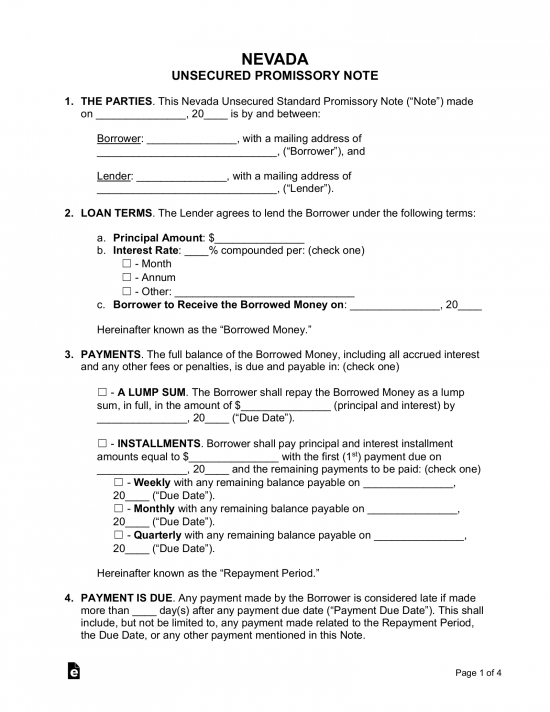

Unsecured Promissory Note – Does not include security. Because of this, the lender has the potential of losing the loaned amount of money if the borrower defaults on the balance.

Unsecured Promissory Note – Does not include security. Because of this, the lender has the potential of losing the loaned amount of money if the borrower defaults on the balance.

Download: PDF, MS Word, OpenDocument

Usury Statute

1. Except as otherwise provided in subsection 2, parties may agree for the payment of any rate of interest on money due or to become due on any contract, for the compounding of interest if they choose, and for any other charges or fees. The parties shall specify in writing the rate upon which they agree, that interest is to be compounded if so agreed, and any other charges or fees to which they have agreed.

2. A creditor shall not charge an annual percentage rate that is greater than the lesser of 36 percent or the maximum annual percentage rate authorized under any federal law or regulation with respect to the consumer credit extended to a covered service member or a dependent of a covered service member. Any contract or agreement in violation of this subsection is void and unenforceable …