Updated July 27, 2023

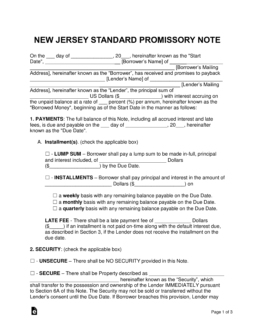

A New Jersey promissory note template is used when one individual (called the ‘lender’) plans on lending money to another individual (called the ‘borrower’). The lender profits from the deal by earning interest on top of the original balance of the note.

Table of Contents |

By Type (2)

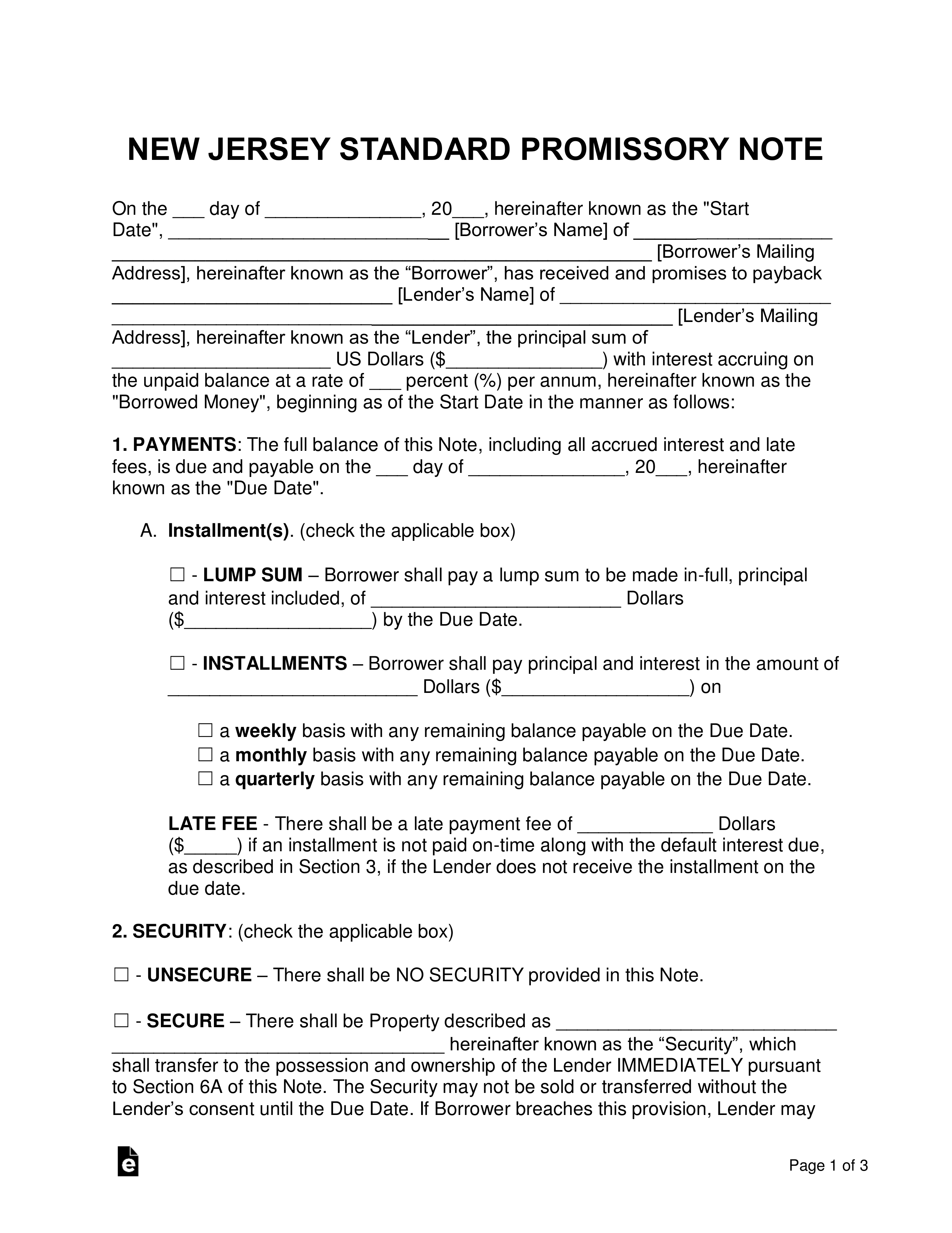

Secured Promissory Note – Includes a section that requires the parties to agree on an item to be put into security. If the borrower enters into default on the balance and cannot recover, the item in security will be given to the lender to aid in recovering the remaining balance on the note.

Secured Promissory Note – Includes a section that requires the parties to agree on an item to be put into security. If the borrower enters into default on the balance and cannot recover, the item in security will be given to the lender to aid in recovering the remaining balance on the note.

Download: PDF, MS Word, OpenDocument

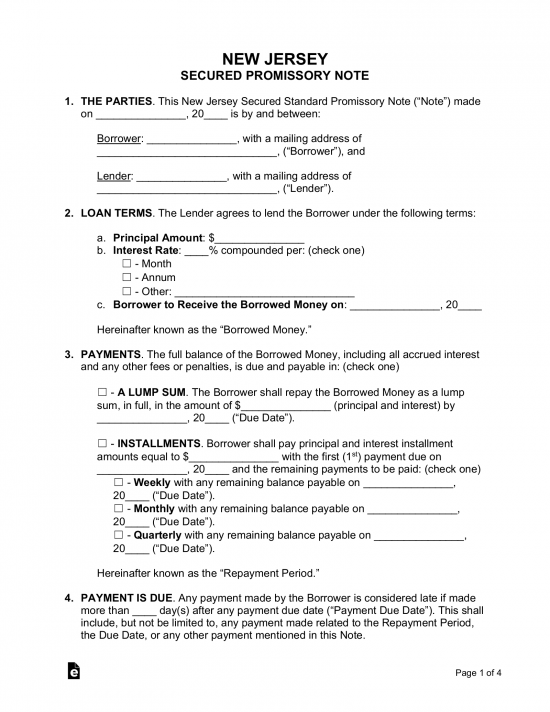

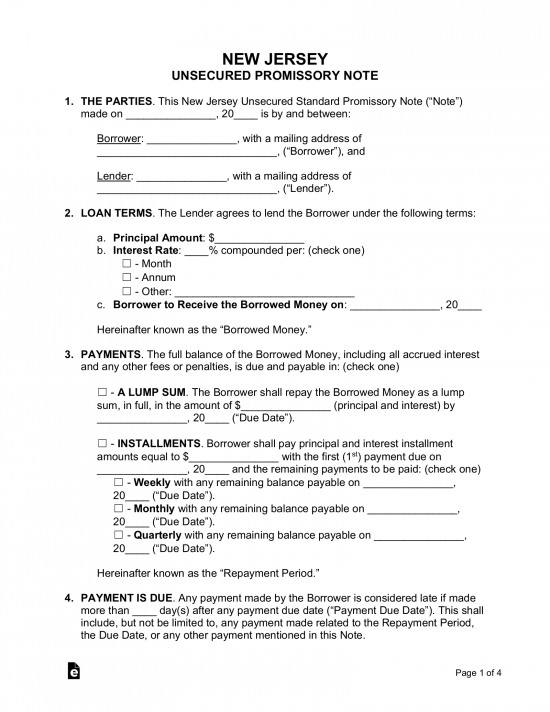

Unsecured Promissory Note – This type of form does not include a section on security. The lender is at a far greater financial risk when using this version because there is no regimented plan for being reimbursed if the borrower cannot make payments on the note. Lenders are strongly recommended to ensure a trustworthy and financially secure borrower is chosen.

Unsecured Promissory Note – This type of form does not include a section on security. The lender is at a far greater financial risk when using this version because there is no regimented plan for being reimbursed if the borrower cannot make payments on the note. Lenders are strongly recommended to ensure a trustworthy and financially secure borrower is chosen.

Download: PDF, MS Word, OpenDocument

Usury Statute

(a) Except as herein and otherwise provided by law, no person shall, upon contract, take, directly or indirectly for loan of any money, wares, merchandise, goods and chattels, above the value of $6.00 for the forbearance of $100.00 for a year, or when there is a written contract specifying a rate of interest, no person shall take above the value of $16.00 for the forbearance of $100.00 for a year.

(b) Notwithstanding the limitations of subsection (a) of this section, the Commissioner of Banking may by regulations adopted, amended and rescinded from time to time, provide that the value which may be taken for any loan secured by a first lien on real property as described in paragraph (1) of this subsection shall be a value more than $6.00 but not more than the Monthly Index of Long Term United States Government Bond Yields, compiled by the Board of Governors of the Federal Reserve System and as published by said Board of Governors in the monthly Federal Reserve Bulletin, for the second preceding calendar month plus an additional 8% per annum rounded off to the nearest quarter of 1% per annum. Within the limits as provided by this subsection, and if he finds it to be in the best interests of the citizens and economy of this State, the commissioner may establish: …