Updated March 25, 2024

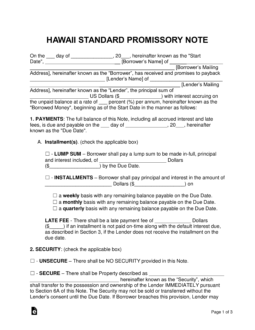

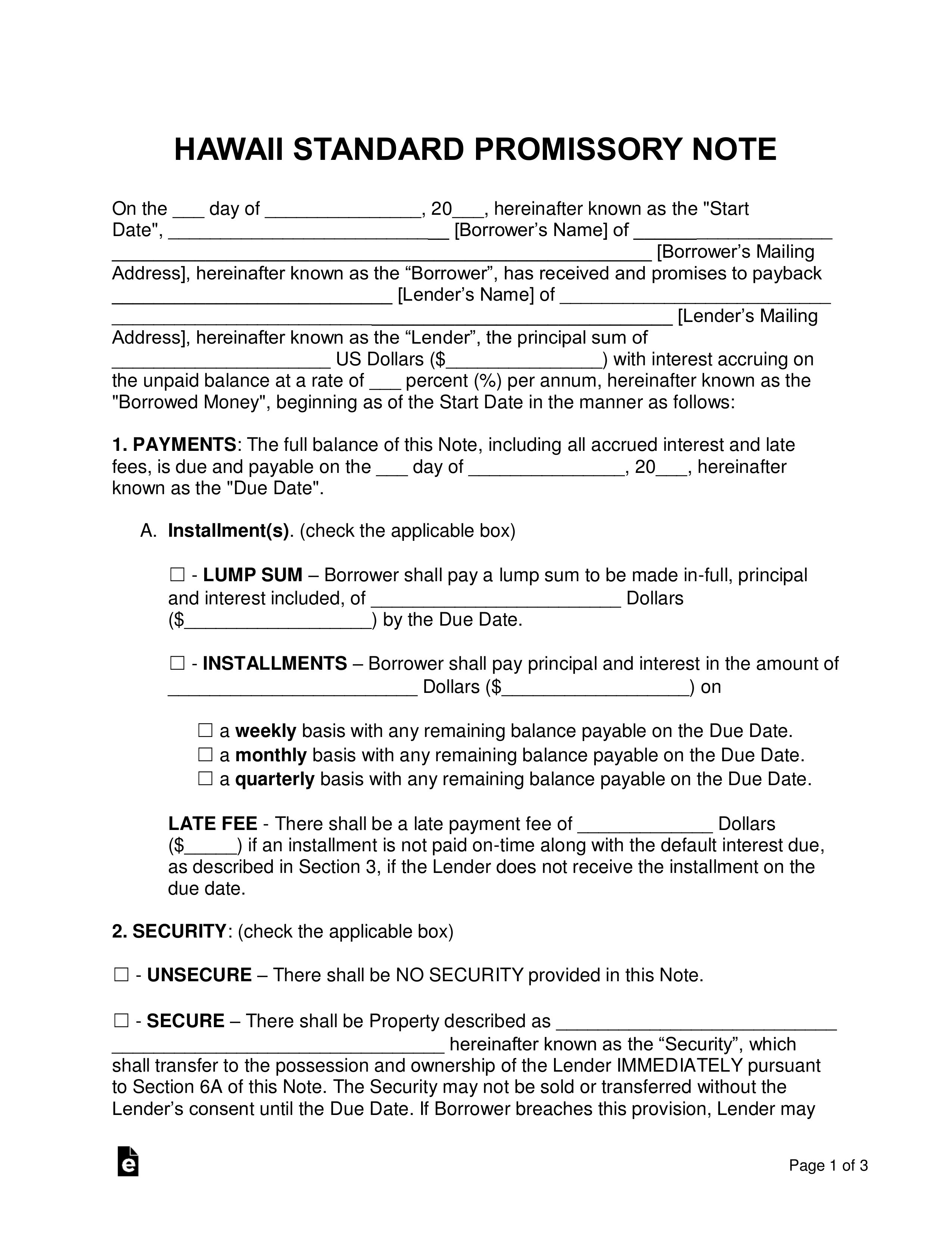

Hawaii promissory note templates are a set of documents purposed for two parties and used for the loaning of money between a lender and borrower. The document has sections that cover interest rates, late fees, payment types, and other important areas.

Table of Contents |

By Type (2)

Secured Promissory Note – Gives the lender security in the case of a default on the balance. The borrower and lender will determine item(s) that will be used as security before the signing of the agreement. Items that are typically used are homes, vehicles, or any other physical object with monetary value.

Secured Promissory Note – Gives the lender security in the case of a default on the balance. The borrower and lender will determine item(s) that will be used as security before the signing of the agreement. Items that are typically used are homes, vehicles, or any other physical object with monetary value.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – Lender has no sure way to be reimbursed for the money loaned to the borrower, and has to resort to small claims court to report the borrower’s default. Lenders that utilize this document should ensure the borrower they are loaning to can be completely trusted with his or her payments.

Unsecured Promissory Note – Lender has no sure way to be reimbursed for the money loaned to the borrower, and has to resort to small claims court to report the borrower’s default. Lenders that utilize this document should ensure the borrower they are loaning to can be completely trusted with his or her payments.

Download: PDF, MS Word, OpenDocument

Usury Statute

When there is no express written contract fixing a different rate of interest, interest shall be allowed at the rate of ten per cent a year, except that, with respect to obligations of the State, interest shall be allowed at the prime rate for each calendar quarter but in no event shall exceed ten per cent a year, as follows:

(1) For money due on any bond, bill, promissory note, or other instrument of writing, or for money lent, after it becomes due;

(2) For money due on the settlement of accounts, from the day on which the balance is ascertained;

(3) For money received to the use of another, from the date of a demand made; and

(4) For money upon an open account, after sixty days from the date of the last item or transaction.

As used in this section, “prime rate” means the prime rate as posted in the Wall Street Journal on the first business day of the month preceding the calendar quarter.

Interest at the rate of ten per cent a year, and no more, shall be allowed on any judgment recovered before any court in the State, in any civil suit.

(a) It shall in no case be deemed unlawful, with respect to any consumer credit transaction (except a credit card agreement) and any home business loan to stipulate by written contract, for any rate of simple interest not exceeding one per cent per month or twelve per cent a year or, in the event the creditor is a financial institution regulated under chapter 412 (other than a trust company or a credit union), for any rate of simple interest not exceeding two per cent per month or twenty-four per cent a year.