Updated July 27, 2023

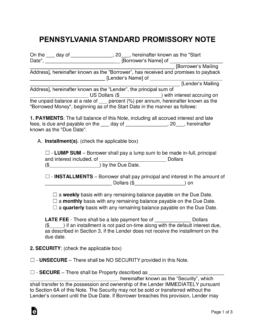

A Pennsylvania promissory note template is a signed promise stating that the borrower of a monetary balance will reimburse the lender of said monetary balance in a timely and structured fashion. The templates offered below also detail the penalties for missing or being late on payments, which should be clearly understood by the borrower to ensure payments are made correctly.

Table of Contents |

By Type (2)

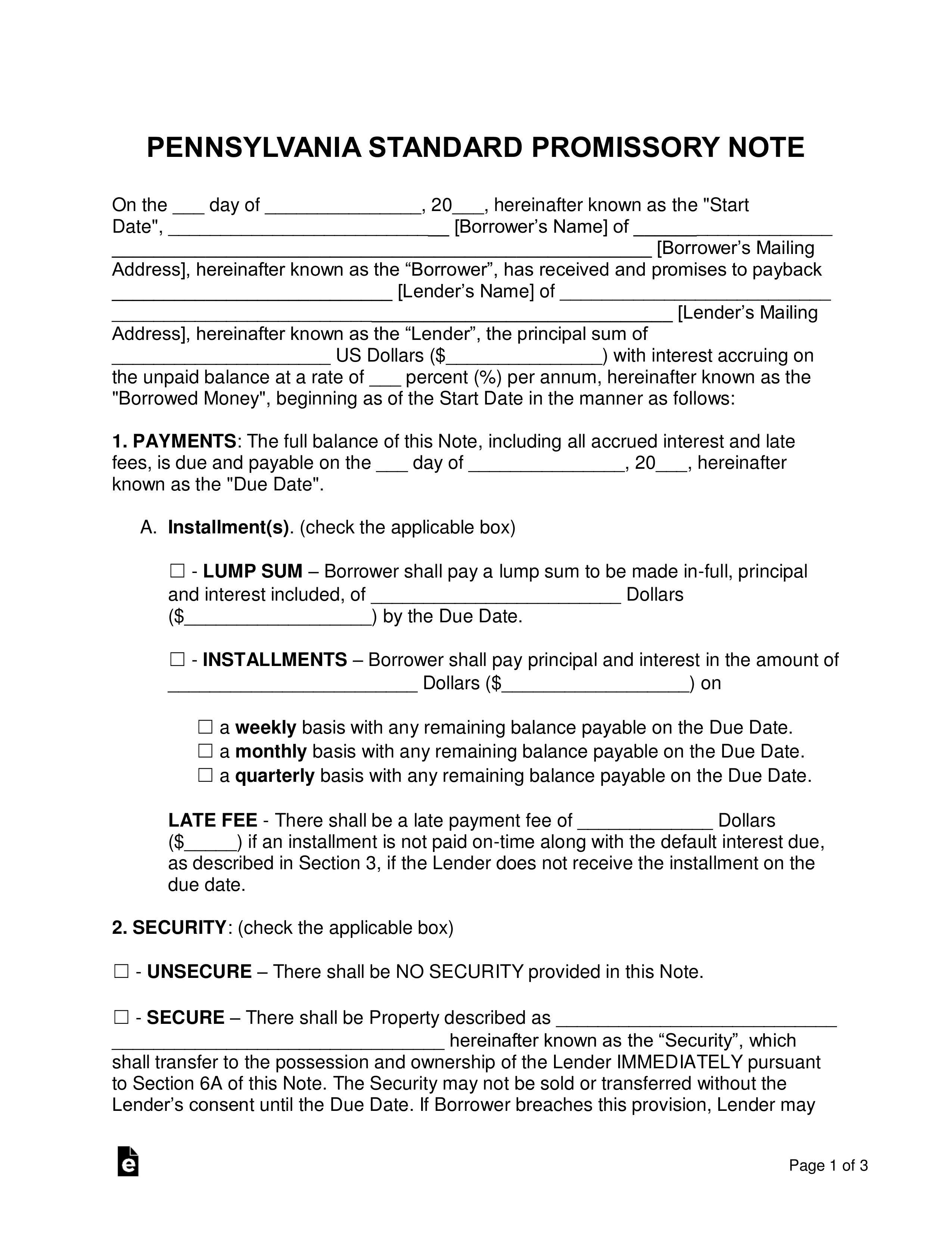

Secured Promissory Note – Includes a section called ‘security’ which protects the lender from serious financial loss by granting him or her an item previously put into security (by the borrower) if the borrower defaults on the note and cannot recover.

Secured Promissory Note – Includes a section called ‘security’ which protects the lender from serious financial loss by granting him or her an item previously put into security (by the borrower) if the borrower defaults on the note and cannot recover.

Download: PDF, MS Word, OpenDocument

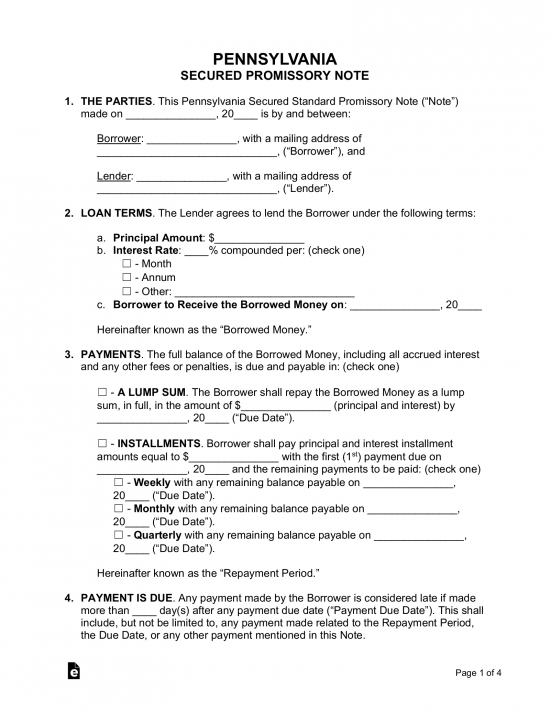

Unsecured Promissory Note – Does not include a section on security. The lender should have complete trust in the borrower’s payment abilities, as if the borrower defaults on the balance, the lender is not guaranteed a reimbursement on the loan.

Unsecured Promissory Note – Does not include a section on security. The lender should have complete trust in the borrower’s payment abilities, as if the borrower defaults on the balance, the lender is not guaranteed a reimbursement on the loan.

Download: PDF, MS Word, OpenDocument

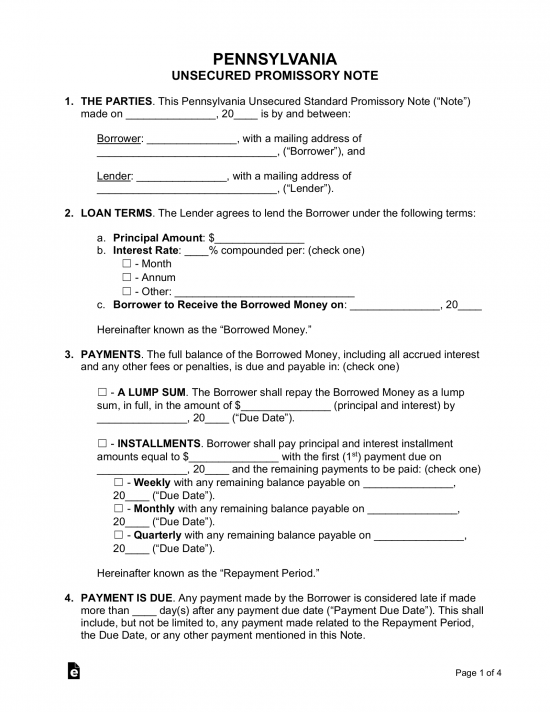

Usury Statute

(a) Except as provided in Article III of this act, the maximum lawful rate of interest for the loan or use of money in an amount of fifty thousand dollars ($50,000) or less in all cases where no express contract shall have been made for a less rate shall be six per cent per annum.

(b) The maximum lawful rate of interest set forth in this section shall not apply to:

(1) an obligation to pay a sum of money in an original bona fide principal amount of more than fifty thousand dollars ($50,000);

(2) an unsecured, noncollateralized loan in excess of thirty-five thousand dollars ($35,000); or

(3) business loans of any principal amount.