Updated July 27, 2023

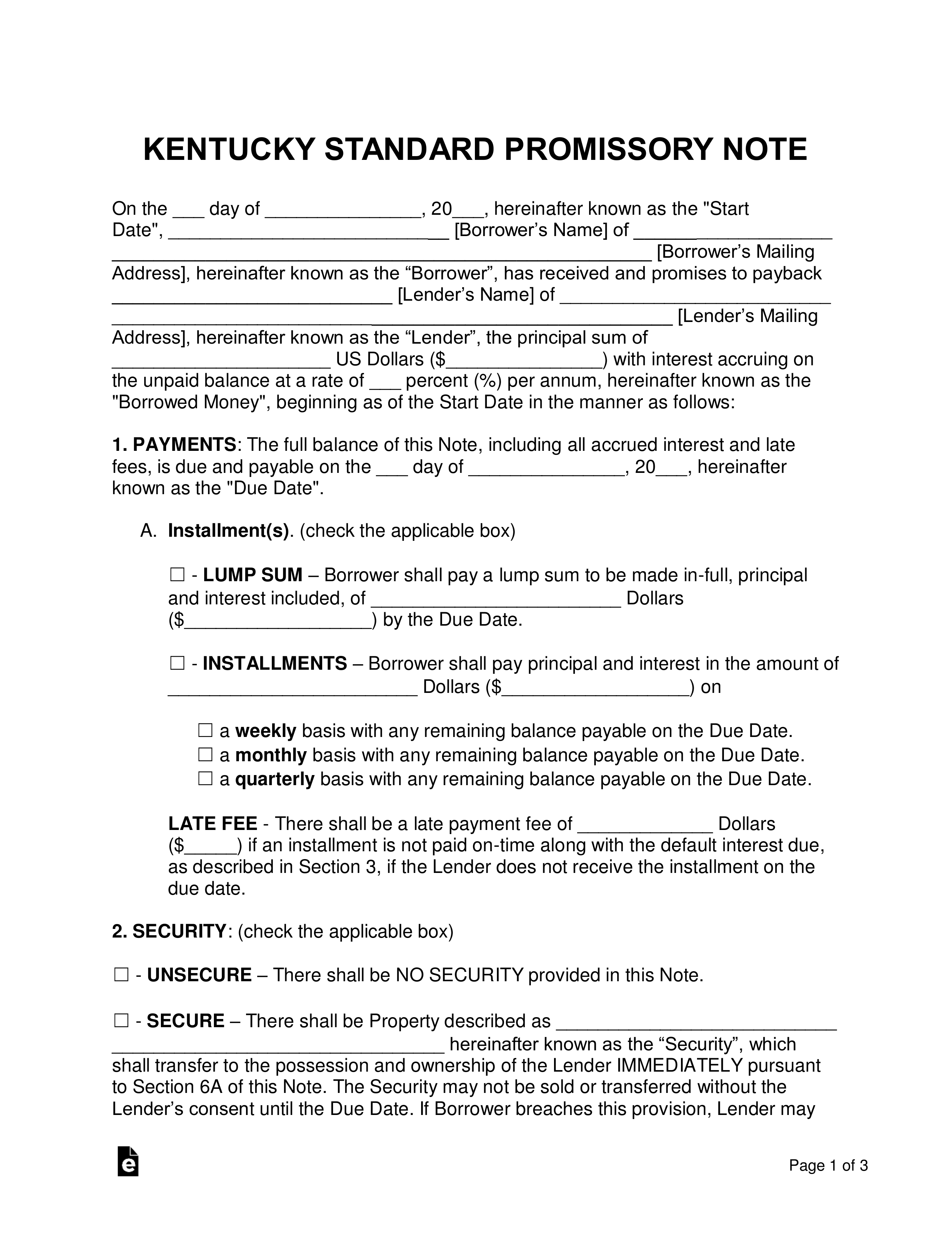

A Kentucky promissory note template is used in situations where a lender lends money to an individual (called a ‘borrower’) with the expectation that the original balance will be reimbursed with the addition of interest. For the note to be completed, both parties will need to come to terms on topics such as interest rates, late fees, and items that will be used as security.

Table of Contents |

By Type (2)

Secured Promissory Note – Includes security, which sets aside an item such as a home, vehicle, or boat that is given to the lender in the case of a default. The item chosen as security should be of equal monetary worth as the amount of money in the note.

Secured Promissory Note – Includes security, which sets aside an item such as a home, vehicle, or boat that is given to the lender in the case of a default. The item chosen as security should be of equal monetary worth as the amount of money in the note.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – Does not include security. Because of this, the lender is at a far greater financial risk. To help prevent monetary loss, the lender should only lend to those with worthy credit and/or family and friends.

Unsecured Promissory Note – Does not include security. Because of this, the lender is at a far greater financial risk. To help prevent monetary loss, the lender should only lend to those with worthy credit and/or family and friends.

Download: PDF, MS Word, OpenDocument

Usury Statute

(1) Except as provided in KRS 360.040, the legal rate of interest is eight percent (8%) per annum, but any party or parties may agree, in writing, for the payment of interest in excess of that rate as follows:

(a) At a per annum rate not to exceed four percent (4%) in excess of the discount rate on ninety (90) day commercial paper in effect at the Federal Reserve Bank in the Federal Reserve District where the transaction is consummated or nineteen percent (19%), whichever is less, on money due or to become due upon any contract or other obligation in writing where the original principal amount is fifteen thousand dollars ($15,000) or less; and

(b) At any rate on money due or to become due upon any contract or other obligation in writing where the original principal amount is in excess of fifteen thousand dollars ($15,000).

(2) Any party or parties to a contract or obligation described in subsection (1) of this section, and any party or parties who may assume or guarantee the contract or obligation, shall be bound, subject to KRS 371.190, for the rate of interest as is expressed in the contract, obligation, assumption, or guaranty, and no law of this state prescribing or limiting interest rates shall apply to the agreement or to any charges which pertain thereto or in connection therewith.

(3) The party entitled to be paid in any written contract or obligation specifying a rate of interest shall be entitled to recover interest after default at the rate of interest as is expressed in the contract or obligation prior to the default and that interest rate shall be the interest rate for the purpose of KRS 360.040(3). If the interest rate expressed in the contract or obligation is a variable rate, the interest rate after default and until judgment shall be calculated and adjusted as provided in the contract or obligation prior to the default.

(4) The party entitled to be paid in any written contract or obligation not specifying a rate of interest or to which no interest rate otherwise applies shall be entitled to recover interest after default and until judgment at the legal rate of interest.

(5) Nothing in this section shall be construed to amend, repeal, or abrogate any other law of this state pertaining to any particular types of transactions for which the maximum rate of interest is specifically prescribed or provided.

(6) Any state or national bank may charge ten dollars ($10) for any loan negotiated at the bank in this state, even if the legal interest does not amount to that sum.