Updated July 27, 2023

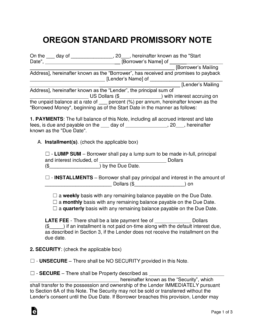

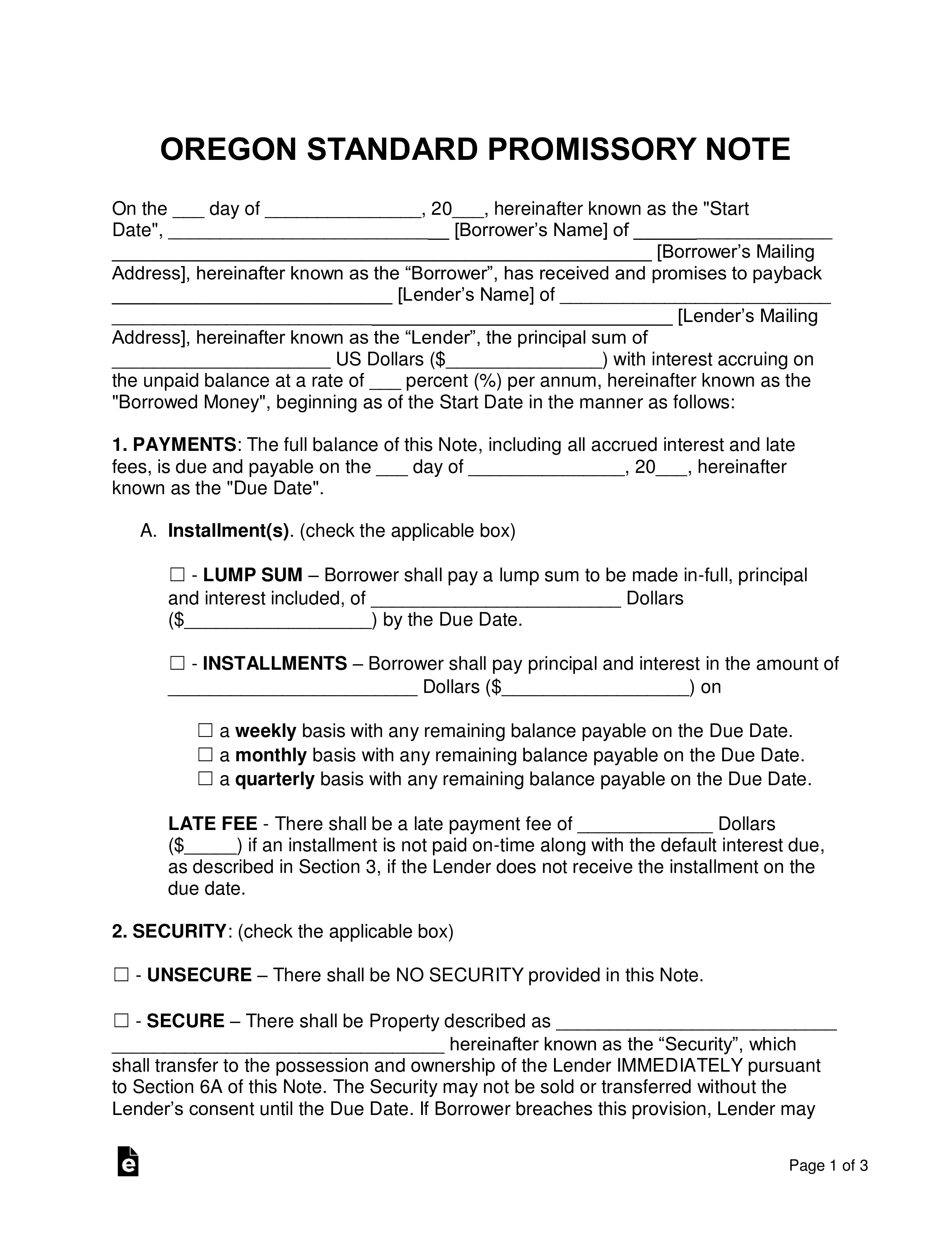

An Oregon promissory note template is a signed document completed in junction by both a lender and borrower that aids in structuring and detailing the various aspects of a money lending deal. Once the template has been signed, the borrower will be required to make timely and complete payments to the lender for the duration of the agreement.

Table of Contents |

By Type (2)

Secured Promissory Note – Includes security, which is a way for the lender to be more secure in the transaction. This is because the lender receives an item (such as a home, car, or boat) in the case of a default that the borrower cannot recover from to cover the unpaid balance.

Secured Promissory Note – Includes security, which is a way for the lender to be more secure in the transaction. This is because the lender receives an item (such as a home, car, or boat) in the case of a default that the borrower cannot recover from to cover the unpaid balance.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – Does not include security leading to an increase in liability for the lender in the transaction. To help prevent monetary loss for the lender, he or she should screen potential borrowers by ensuring they have a strong credit history. It is also recommended that the lender only lend to family or friends that he or she can trust.

Unsecured Promissory Note – Does not include security leading to an increase in liability for the lender in the transaction. To help prevent monetary loss for the lender, he or she should screen potential borrowers by ensuring they have a strong credit history. It is also recommended that the lender only lend to family or friends that he or she can trust.

Download: PDF, MS Word, OpenDocument

Usury Statute

(1) The rate of interest for the following transactions, if the parties have not otherwise agreed to a rate of interest, is nine percent per annum and is payable on:

(a) All moneys after they become due; but open accounts bear interest from the date of the last item thereof.

(b) Money received to the use of another and retained beyond a reasonable time without the owner’s express or implied consent.

(c) Money due or to become due where there is a contract to pay interest and no rate specified.

(2) Except as provided in this subsection, the rate of interest on judgments for the payment of money is nine percent per annum. The following apply as described:

…