Updated July 27, 2023

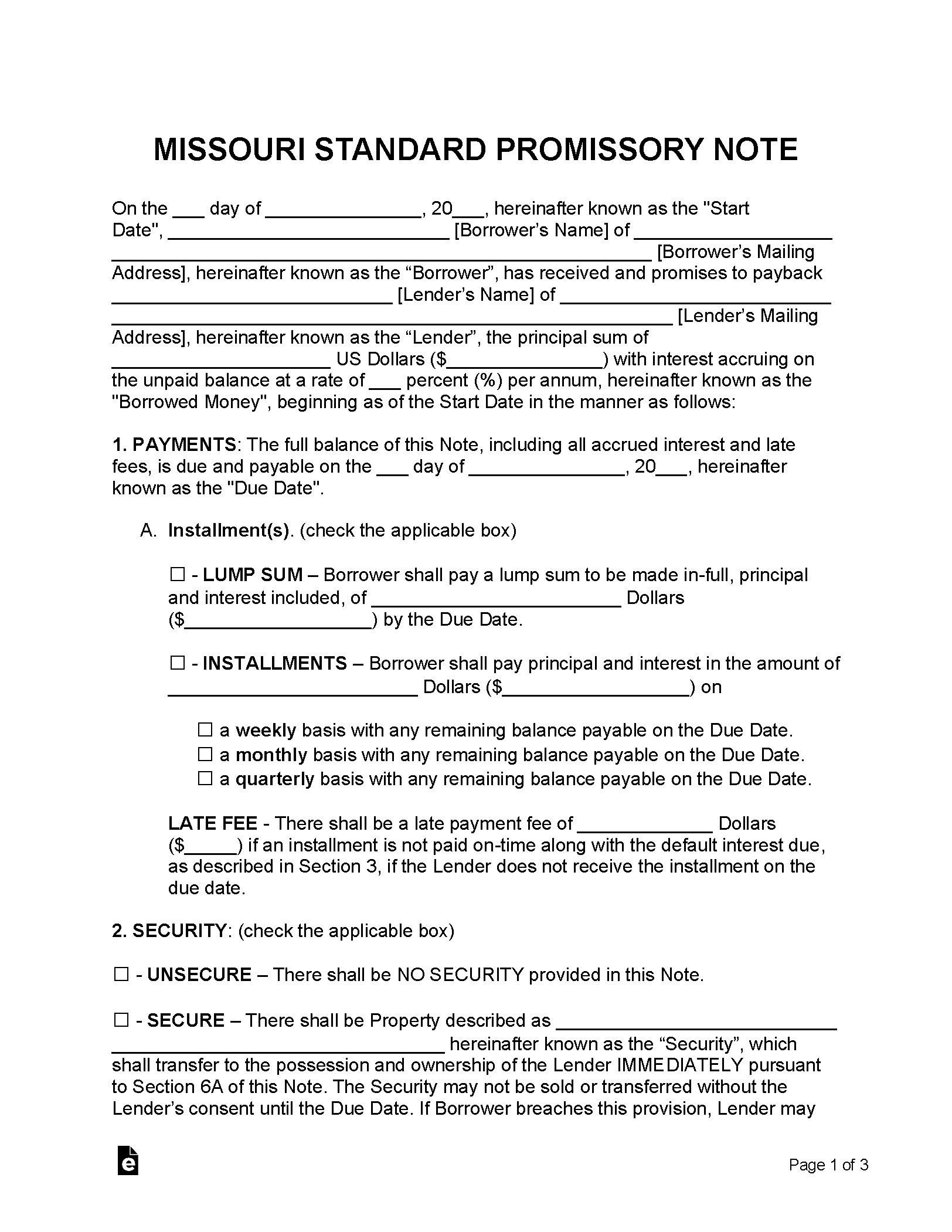

A Missouri promissory note template is completed in conjunction by two parties consisting of a lender and a borrower. Once completed, the agreement helps to motivate the borrower to make timely payments and keep both parties on the same page.

Table of Contents |

By Type (2)

Secured Promissory Note – Has a section on ‘security’, which sets aside an item such as a home, vehicle, or boat that is given to the lender if the borrower cannot recover from a default on the balance.

Secured Promissory Note – Has a section on ‘security’, which sets aside an item such as a home, vehicle, or boat that is given to the lender if the borrower cannot recover from a default on the balance.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – Does not include security. If the borrower were to enter into default, the lender would not be guaranteed a return on his or her loaned money.

Unsecured Promissory Note – Does not include security. If the borrower were to enter into default, the lender would not be guaranteed a return on his or her loaned money.

Download: PDF, MS Word, OpenDocument

Usury Statute

1. Parties may agree, in writing, to a rate of interest not exceeding ten percent per annum on money due or to become due upon any contract, including a contract for commitment; except that, when the “market rate” exceeds ten percent per annum, parties may agree, in writing, to a rate of interest not exceeding the “market rate”. A contract for commitment to lend money shall not exceed the maximum lawful rate in effect on the date of such contract. A loan entered into pursuant to a valid contract for commitment shall not exceed the maximum lawful rate in effect on the date of such commitment. The “market rate” for any calendar quarter shall be equal to the monthly index of long term United States government bond yields for the second preceding calendar month prior to the beginning of the calendar quarter plus an additional three percentage points rounded off to the nearest tenth of one percent. Calendar quarters begin on January first, April first, July first, and October first.

2. If a rate of interest greater than permitted by law is paid, the person paying the same or his legal representative may recover twice the amount of the interest thus paid, provided that the action is brought within five years from the time when said interest should have been paid. The person so adjudged to have received a greater rate of interest shall also be liable for the costs of the suit, including a reasonable attorney’s fee to be determined by the court.

3. On or before the twentieth day of the last month of each calendar quarter the director of the division of finance shall determine the monthly index of long term United States government bond yields for the second month of that quarter and shall determine the market rate for the next succeeding quarter. The director of the division of finance shall cause such market rate to be posted pursuant to section 361.110 and to be published in appropriate publications; such market rate to be effective on the first day of the next succeeding calendar quarter.

4. Any bank, trust company or savings and loan association may purchase any note, bill of exchange, or other evidence of debt, payable in installments or otherwise, regardless of where payable, at a price that may be agreed upon.