Updated July 27, 2023

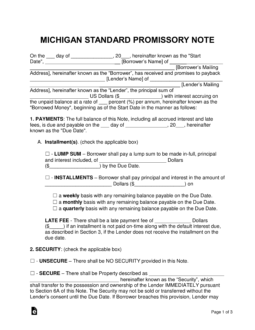

A Michigan promissory note template is a form used to help ensure a lender of a monetary balance is reimbursed the amount plus interest in a timely and orderly fashion. To motivate the borrower for making payments, both parties will agree on details regarding late fees, default interest rates, acceleration time frames, and items for security.

Table of Contents |

By Type (2)

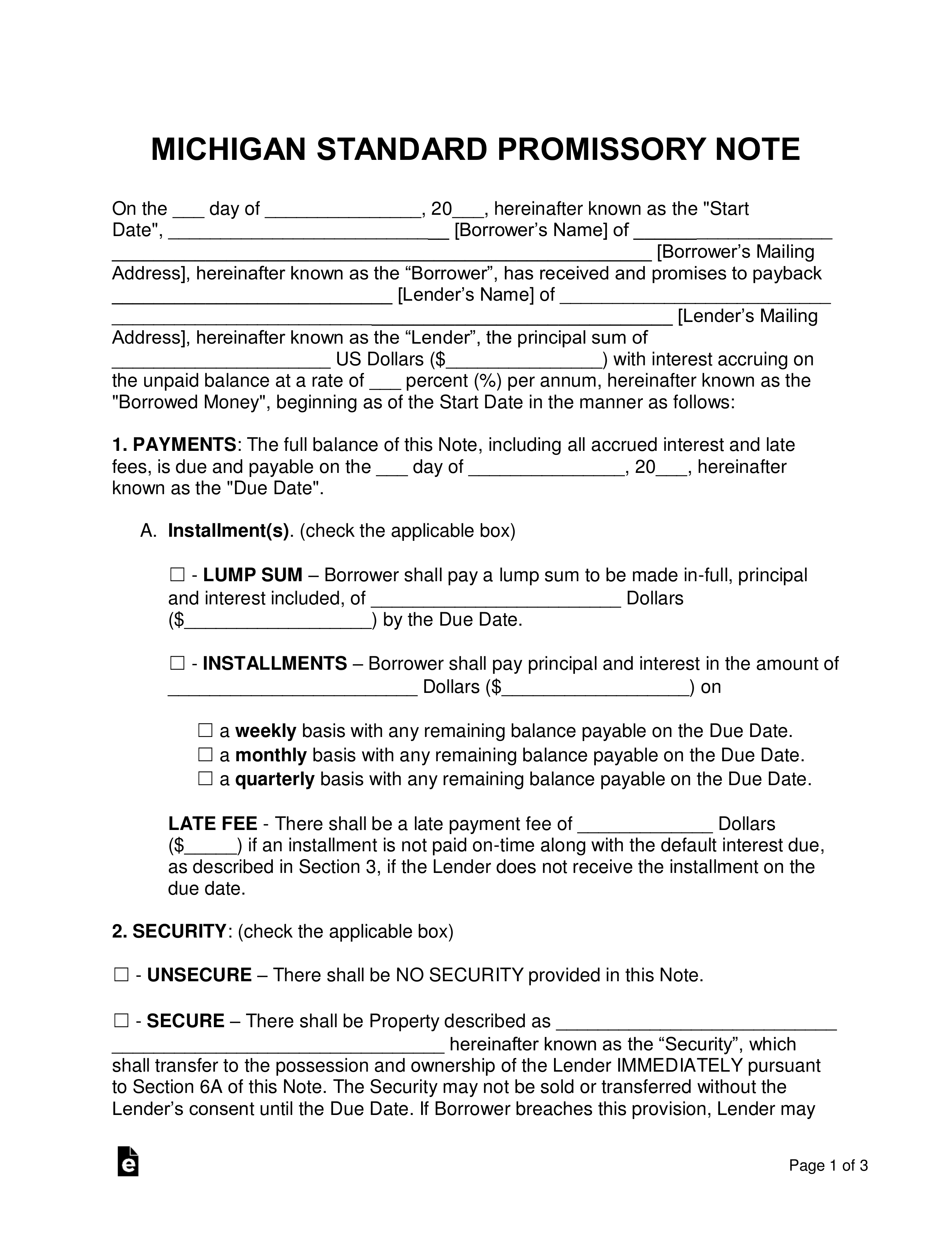

Secured Promissory Note – Incorporated with security, which means the lender is guaranteed an item such as a home, vehicle, boat, etc. if the borrower cannot reimburse the loaned amount.

Secured Promissory Note – Incorporated with security, which means the lender is guaranteed an item such as a home, vehicle, boat, etc. if the borrower cannot reimburse the loaned amount.

Download: PDF, MS Word, OpenDocument

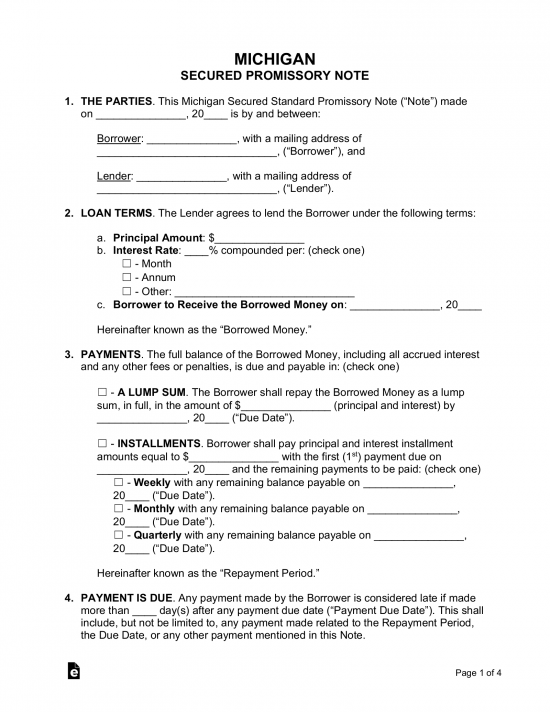

Unsecured Promissory Note – Does not include security; if the borrower were to go into default on the balance, the lender would only be able to take the borrower to small claims court. To prevent this situation, the lender should only enter into an agreement with family, a friend, or an individual with great credit.

Unsecured Promissory Note – Does not include security; if the borrower were to go into default on the balance, the lender would only be able to take the borrower to small claims court. To prevent this situation, the lender should only enter into an agreement with family, a friend, or an individual with great credit.

Download: PDF, MS Word, OpenDocument

Usury Statute

The interest of money shall be at the rate of $5.00 upon $100.00 for a year, and at the same rate for a greater or less sum, and for a longer or shorter time, except that in all cases it shall be lawful for the parties to stipulate in writing for the payment of any rate of interest, not exceeding 7% per annum. This act shall not apply to the rate of interest on any note, bond or other evidence of indebtedness issued by any corporation, association or person, the issue and rate of interest of which have been expressly authorized by the public service commission or the securities bureau of the department of commerce, or is regulated by any other law of this state, or of the United States, nor shall it apply to any time price differential which may be charged upon sales of goods or services on credit. This act shall not be construed to repeal section 78 of Act No. 327 of the Public Acts of 1931, as amended, being section 450.78 of the Compiled Laws of 1948. This act shall not render unlawful, the purchase of any note, bond or other evidence of indebtedness theretofore issued by any borrower not then domiciled in this state, which bear any rate of interest which is lawful under the law of the domicile of the borrower at the date of issue thereof, and in such case any such rate of interest may be charged and received by any person, firm, corporation or association in this state.