Updated July 27, 2023

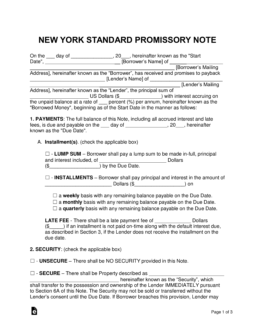

A New York promissory note template is a document designed to assist the lender in being reimbursed a loaned amount of money in addition to interest from a borrower. The documents include many sections to ensure the parties are clear on the terms and conditions, as well as sections that clarify the fallout to the borrower if payments are not paid-in-full or are paid late.

Table of Contents |

By Type (2)

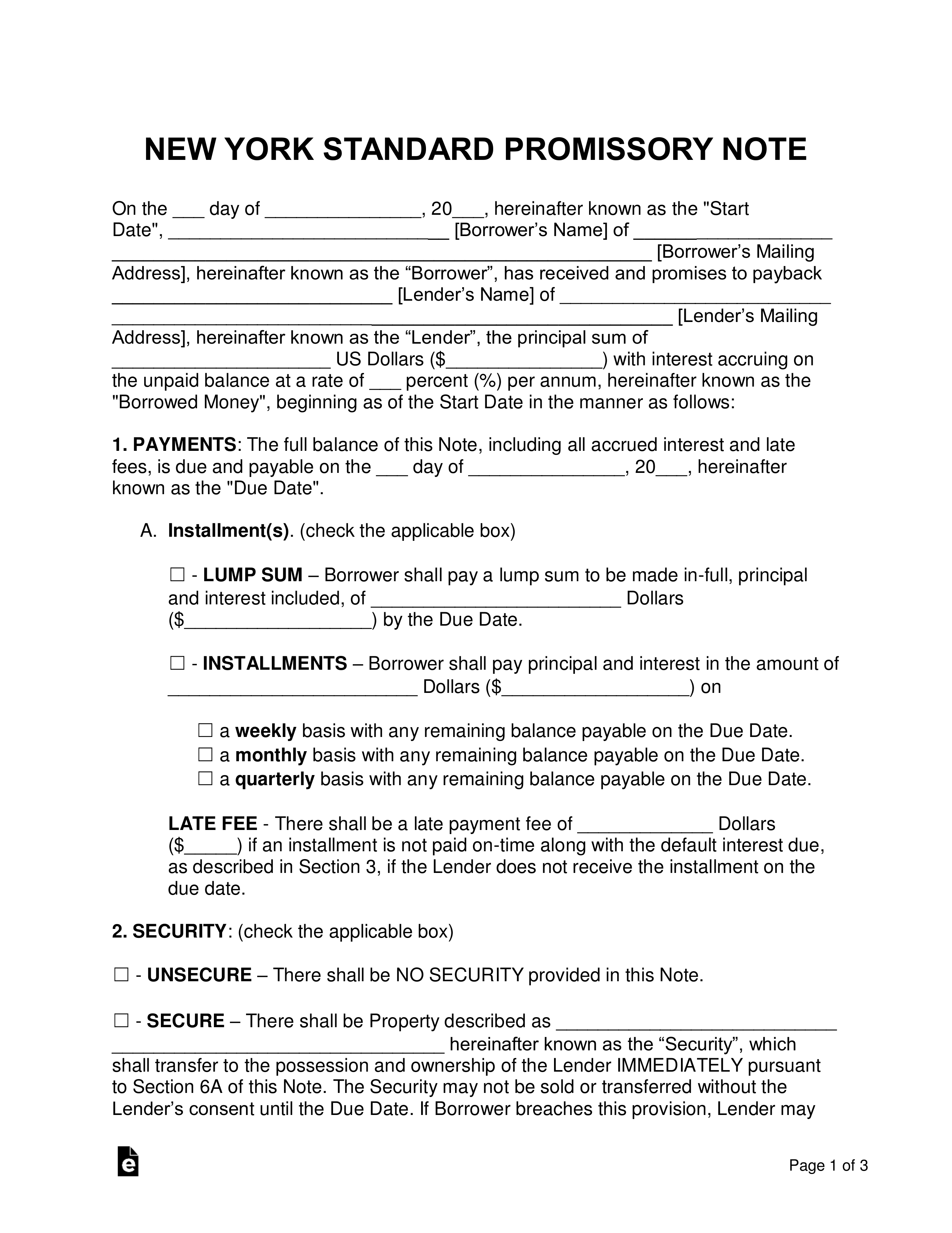

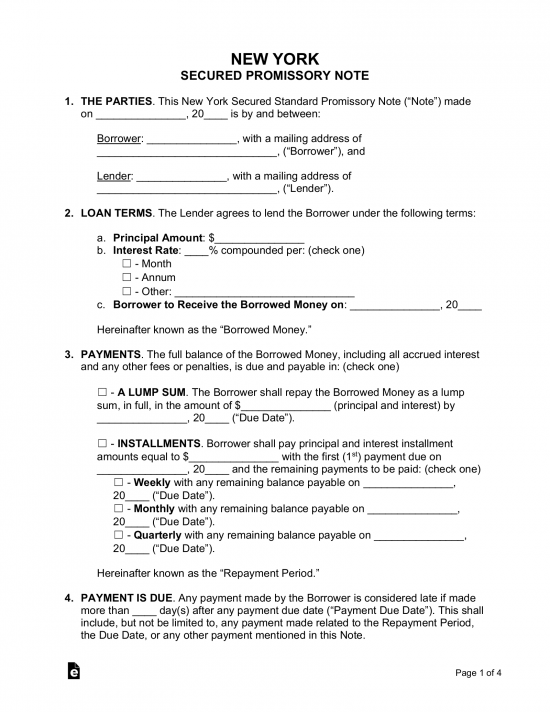

Secured Promissory Note – Includes a section on security. Security is an item set aside at the start of the agreement and is used if the borrower enters into default and cannot make the remaining payments. The item in security (previously owned by the borrower) is then given to the lender to help cover the outstanding balance.

Secured Promissory Note – Includes a section on security. Security is an item set aside at the start of the agreement and is used if the borrower enters into default and cannot make the remaining payments. The item in security (previously owned by the borrower) is then given to the lender to help cover the outstanding balance.

Download: PDF, MS Word, OpenDocument

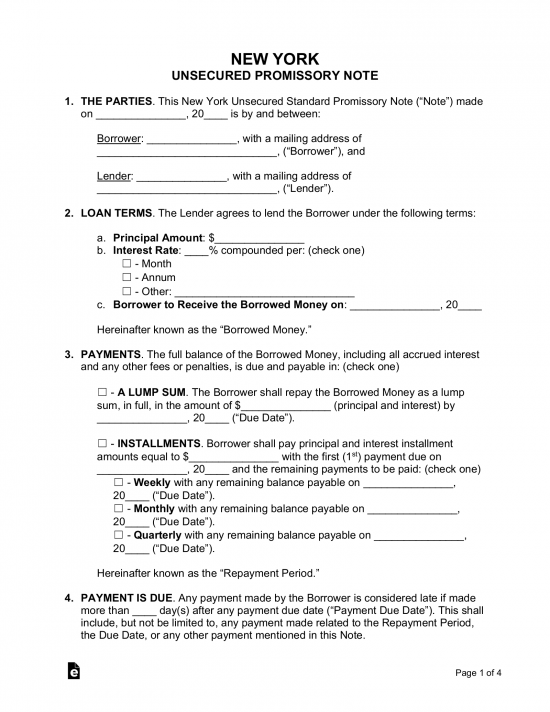

Unsecured Promissory Note – Does not include security. This version is typically used between family and friends as there is a considerable amount of added risk for the lender. This is because the lender has no immediate solution for being reimbursed the loaned amount if the borrower cannot/does not repay the balance.

Unsecured Promissory Note – Does not include security. This version is typically used between family and friends as there is a considerable amount of added risk for the lender. This is because the lender has no immediate solution for being reimbursed the loaned amount if the borrower cannot/does not repay the balance.

Download: PDF, MS Word, OpenDocument

Usury Statutes

1. The rate of interest, as computed pursuant to this title, upon the loan or forbearance of any money, goods, or things in action, except as provided in subdivisions five and six of this section or as otherwise provided by law, shall be six per centum per annum unless a different rate is prescribed in section fourteen-a of the banking law …

1. The maximum rate of interest provided for in section 5-501 of the general obligations law shall be sixteen per centum per annum.

2. The rate of interest as so prescribed under this section shall include as interest any and all amounts paid or payable, directly or indirectly, by any person, to or for the account of the lender in consideration for the making of a loan or forbearance as defined by the superintendent pursuant to subdivision three of this section …