Updated July 27, 2023

A Utah promissory note template is a fillable document designed to ensure both parties are clear on the terms and conditions of the note. The documents can also serve in a court of law once all required signatures have been recorded.

Table of Contents |

By Type (2)

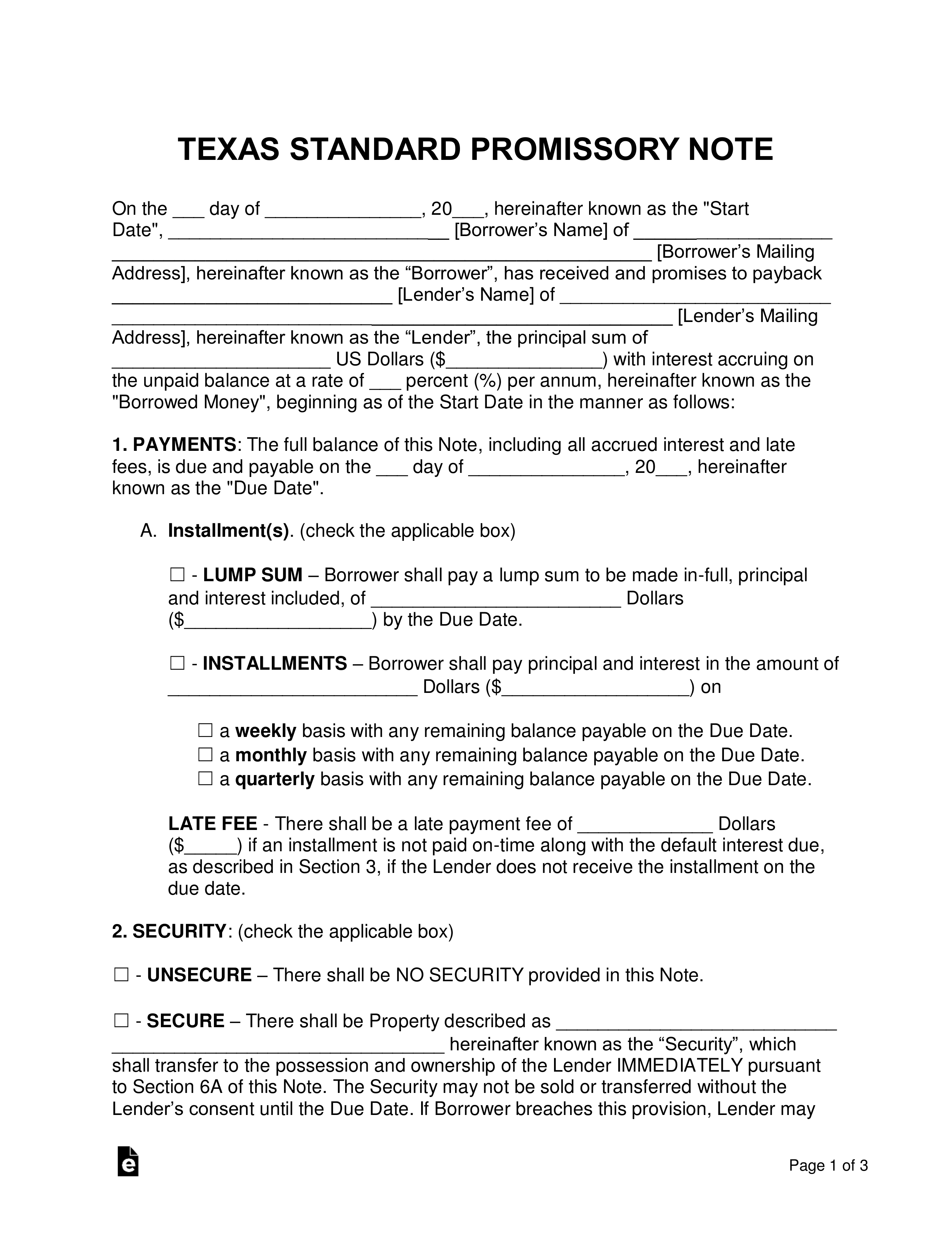

Secured Promissory Note – Offers the lender a form of financial protection by having the borrower put an item into security that will be automatically given to the lender if the borrower cannot pay the remaining balance.

Secured Promissory Note – Offers the lender a form of financial protection by having the borrower put an item into security that will be automatically given to the lender if the borrower cannot pay the remaining balance.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – Does not include security. This leaves the lender at an increased risk of losing the loaned balance. To help prevent this, lenders should be cautious when deciding who to lend money to.

Unsecured Promissory Note – Does not include security. This leaves the lender at an increased risk of losing the loaned balance. To help prevent this, lenders should be cautious when deciding who to lend money to.

Download: PDF, MS Word, OpenDocument

Usury Statute

(1) The parties to a lawful written, verbal, or implied contract may agree upon any rate of interest for the contract, including a contract for services, a loan or forbearance of any money, goods, or services, or a claim for breach of contract.

(2) Unless the parties to a lawful written, verbal, or implied contract expressly specify a different rate of interest, the legal rate of interest for the contract, including a contract for services, a loan or forbearance of any money, goods, or services, or a claim for breach of contract is 10% per annum.

(3) Nothing in this section may be construed in any way to affect any penalty or interest charge that by law applies to delinquent or other taxes or to any contract or obligations made before May 14, 1981.