Updated July 27, 2023

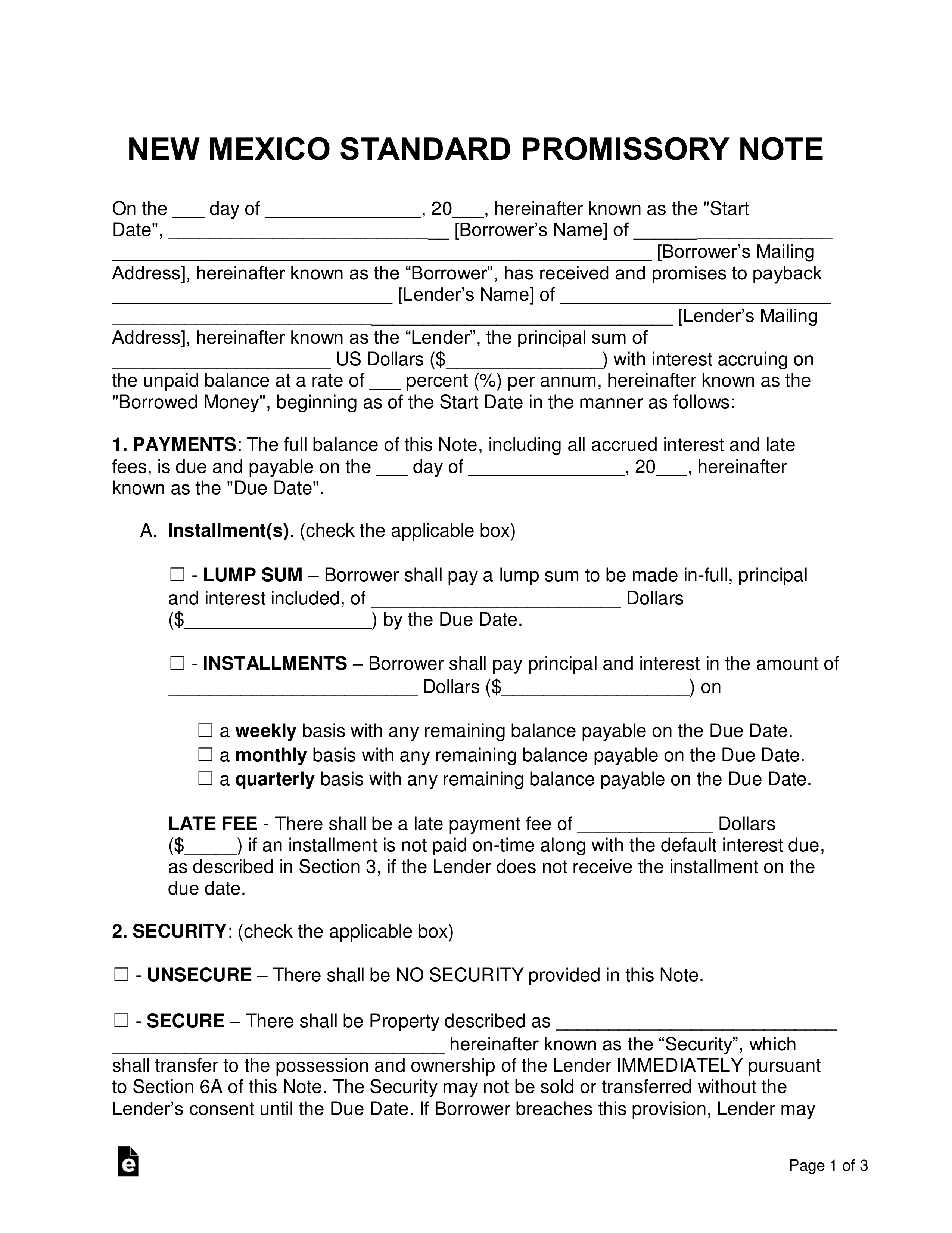

A New Mexico promissory note template is a document that outlines the important aspects of a money-lending transaction between two individuals. In a money-lending deal, the lender of the balance makes a profit by receiving interest on top of being reimbursed the original balance given to the borrower. For New Mexico, we offer two versions of the agreement, which are briefly described below.

Table of Contents |

By Type (2)

Secured Promissory Note – Because this agreement is ‘secured’, it includes a section that requires the borrower to set aside a physical item (such as a home, vehicle, or boat) that is given to the lender in the case of default to help cover the remaining unpaid balance.

Secured Promissory Note – Because this agreement is ‘secured’, it includes a section that requires the borrower to set aside a physical item (such as a home, vehicle, or boat) that is given to the lender in the case of default to help cover the remaining unpaid balance.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – This version does not include a section on security creating an additional financial risk for the lender. To help lessen this risk, it is highly recommended that the lender only enter into a deal with family/friends and those with an exceptional credit score.

Unsecured Promissory Note – This version does not include a section on security creating an additional financial risk for the lender. To help lessen this risk, it is highly recommended that the lender only enter into a deal with family/friends and those with an exceptional credit score.

Download: PDF, MS Word, OpenDocument

Usury Statute

The rate of interest, in the absence of a written contract fixing a different rate, shall be not more than fifteen percent annually in the following cases:

A. on money due by contract;

B. on money received to the use of another and retained without the owner’s consent expressed or implied; and

C. on money due upon the settlement of matured accounts from the day the balance is ascertained.