Updated July 27, 2023

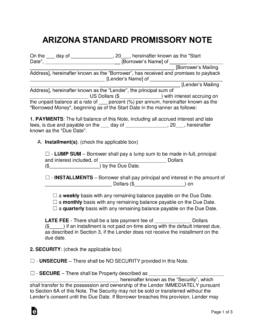

An Arizona promissory note templates are documents that solidify the act of a loan being offered by the lender to the borrower. Both the secured and unsecured versions record the parties’ personal information such as their names and addresses as well as the specifics of the agreement such as interest rates, final due dates, and installment options.

Table of Contents |

By Type (2)

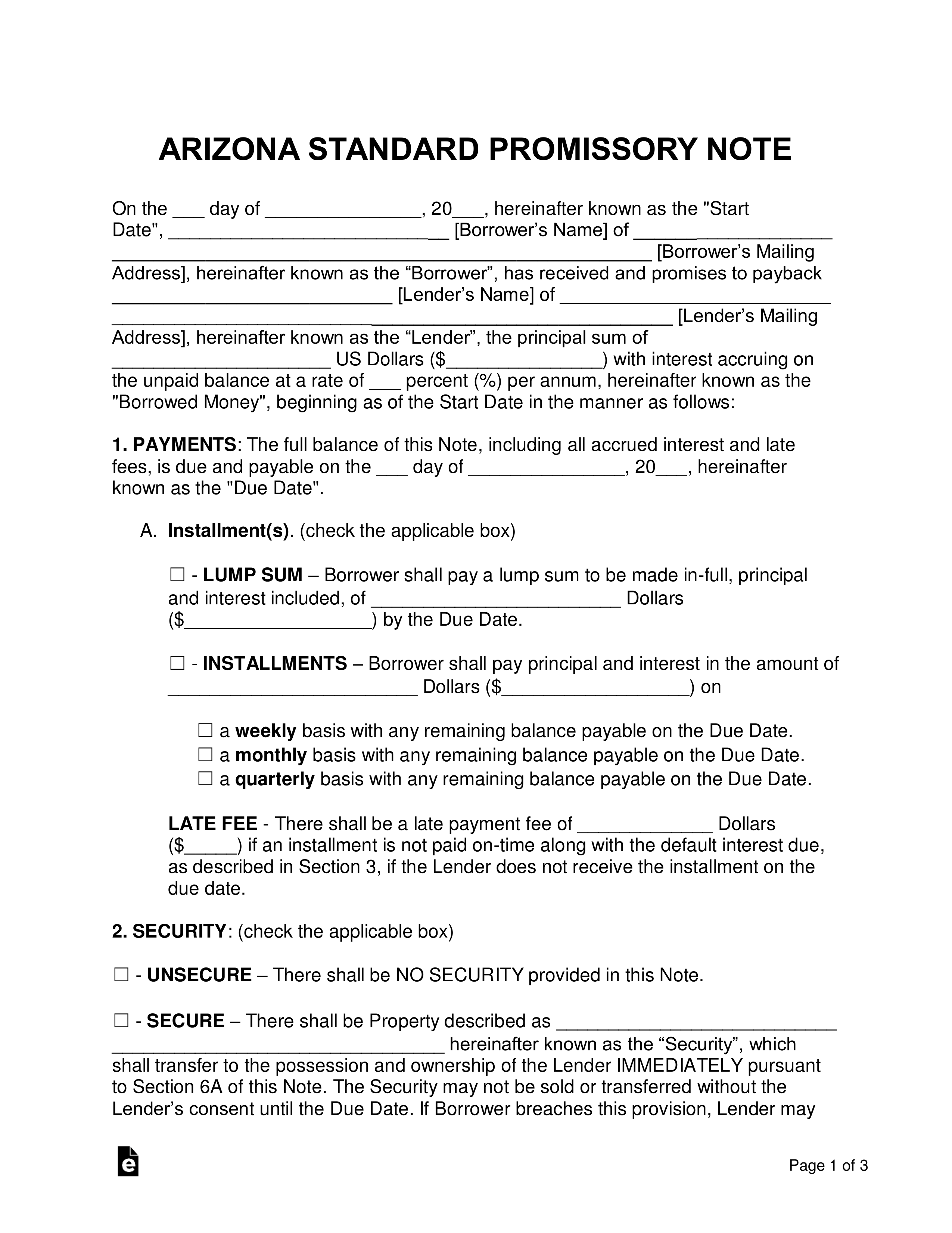

Secured Promissory Note – This version requires the borrower to relinquish a predetermined item to the lender if a default occurs.

Secured Promissory Note – This version requires the borrower to relinquish a predetermined item to the lender if a default occurs.

Download: PDF, MS Word, OpenDocument

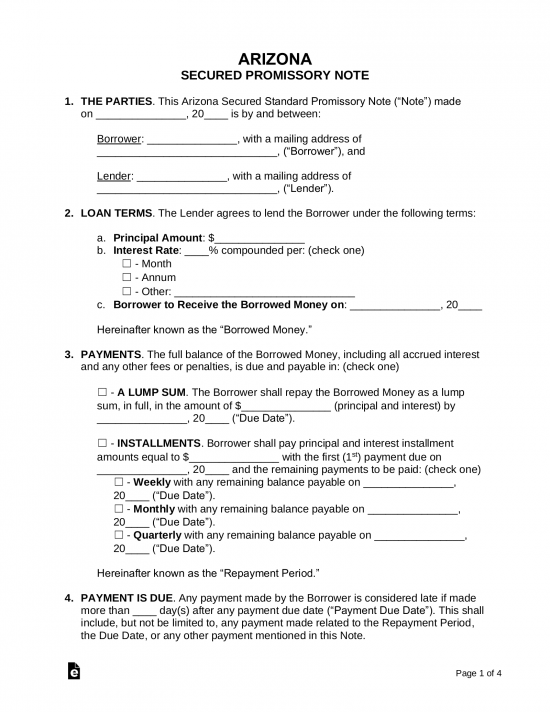

Unsecured Promissory Note – This note requires an elevated level of trust between the two parties, as the lender does not receive any securities if the loan results in a default.

Unsecured Promissory Note – This note requires an elevated level of trust between the two parties, as the lender does not receive any securities if the loan results in a default.

Download: PDF, MS Word, OpenDocument

Usury Statute

A. Interest on any loan, indebtedness or other obligation shall be as follows:

Interest on any loan, indebtedness, or other obligation other than medical debt, shall be at the rate of ten per cent per annum, unless a different rate is contracted for in writing, in which event any rate of interest may be agreed to. Interest on any judgment, other than a judgment on medical debt, that is based on a written agreement evidencing a loan, indebtedness or obligation that bears a rate of interest not in excess of the maximum permitted by law shall be at the rate of interest provided in the agreement and shall be specified in the judgment.

The maximum interest rate on medical debt shall be the lesser of the following:

(i) The annual rate equal to the weekly average one-year constant maturity treasury yield, as published by the board of governors of the federal reserve system, for the calendar week preceding the date when the consumer was first provided with a bill, or

(ii) Three percent a year.

B. Unless specifically provided for in statute or a different rate is contracted for in writing, interest on any judgment shall be at the lesser of ten per cent per annum or at a rate per annum that is equal to one per cent plus the prime rate as published by the board of governors of the federal reserve system in statistical release H.15 or any publication that may supersede it on the date that the judgment is entered. The judgment shall state the applicable interest rate and it shall not change after it is entered.

C. Interest on a judgment on a condemnation proceeding, including interest that is payable pursuant to section 12-1123, subsection B, shall be payable as follows:

1. If instituted by a city or town, at the rate prescribed by section 9-409.

2. If instituted by a county, at the rate prescribed by section 11-269.04.

3. If instituted by the department of transportation, at the rate prescribed by section 28-7101.

4. If instituted by a county flood control district, a power district or an agricultural improvement district, at the rate prescribed by section 48-3628.

D. A court shall not award either of the following:

1. Prejudgment interest for any unliquidated, future, punitive or exemplary damages that are found by the trier of fact.

2. Interest for any future, punitive or exemplary damages that are found by the trier of fact.

E. For the purposes of subsection D of this section, “future damages” means damages that will be incurred after the date of the judgment and includes the costs of any injunctive or equitable relief that will be provided after the date of the judgment.

F. If awarded, prejudgment interest shall be at the rate described in subsection A or B of this section.