Updated July 27, 2023

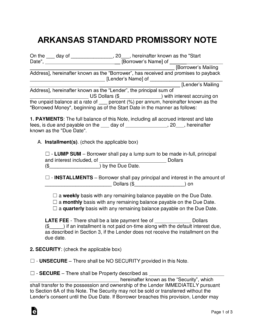

An Arkansas promissory note template is a document used to record loan-based deals between two parties. The documents consist of several sections where information regarding interest rates, payment types, late fees, etc are open to utilization by the lender.

Table of Contents |

By Type (2)

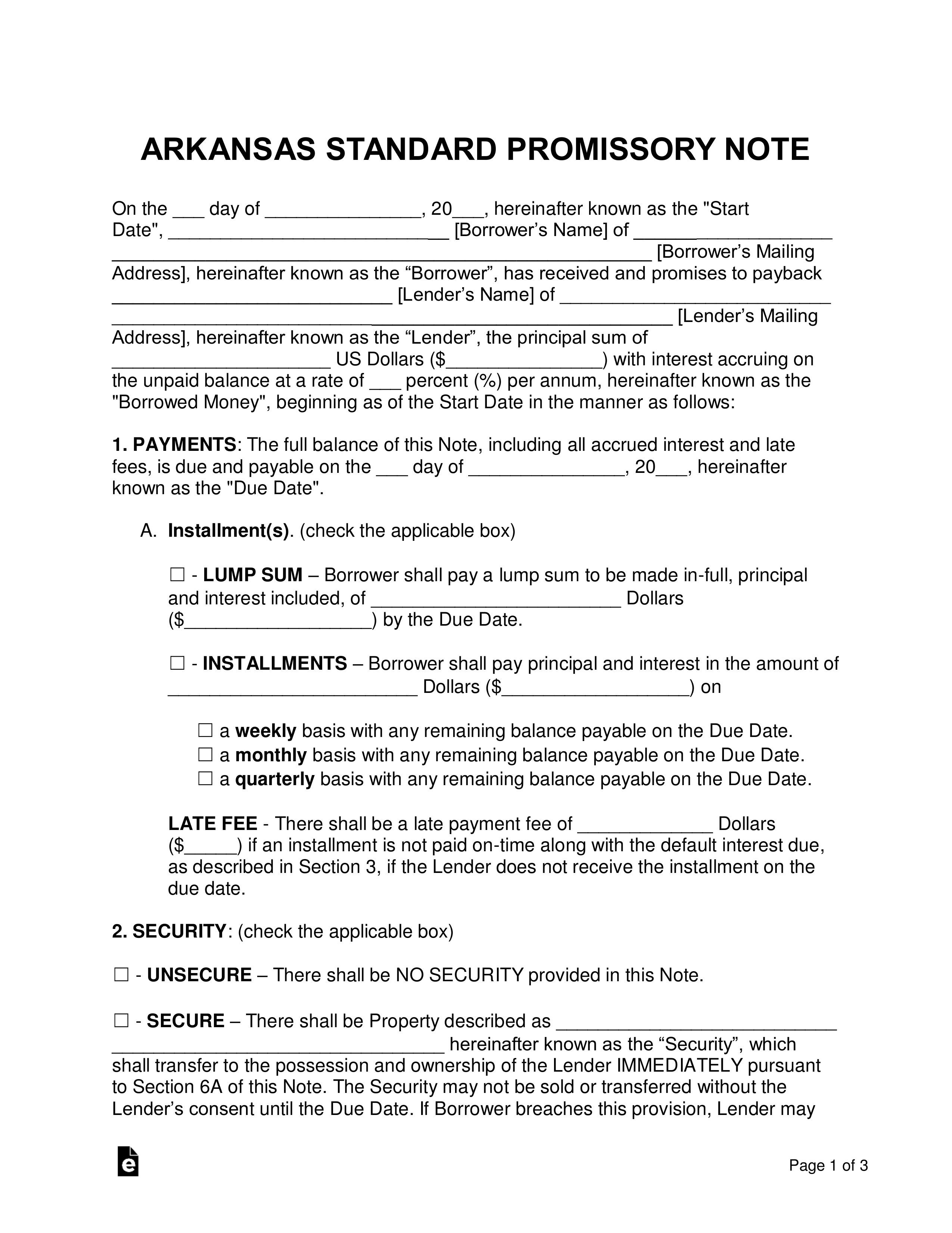

Secured Promissory Note – For lenders that want to ensure they are as protected as possible in the event of a default from the borrower. Before the signing of the document, the lender and borrower agree on physical item(s) that are automatically given to the lender if the loaned amount cannot be paid off.

Secured Promissory Note – For lenders that want to ensure they are as protected as possible in the event of a default from the borrower. Before the signing of the document, the lender and borrower agree on physical item(s) that are automatically given to the lender if the loaned amount cannot be paid off.

Download: PDF, MS Word, OpenDocument

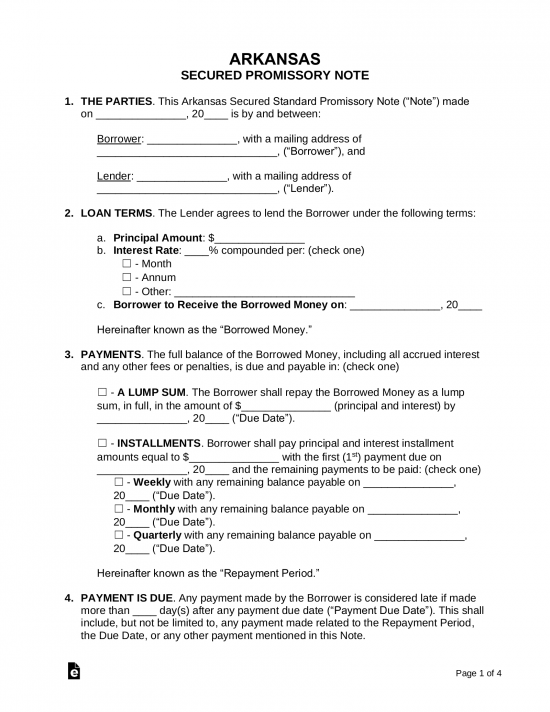

Unsecured Promissory Note – Contains more risk than the secured note solely because of the absence of any security for the lender. In the case of a default, the lender has to resort to a small claims court or report the default to a credit agency.

Unsecured Promissory Note – Contains more risk than the secured note solely because of the absence of any security for the lender. In the case of a default, the lender has to resort to a small claims court or report the default to a credit agency.

Download: PDF, MS Word, OpenDocument

Usury Statute

The maximum lawful rate of interest on loans or contracts not described in Sections 1 and 2 shall not exceed seventeen percent (17%) per annum. (Arkansas Constitution, Amendments, Amendment 89)