Updated July 27, 2023

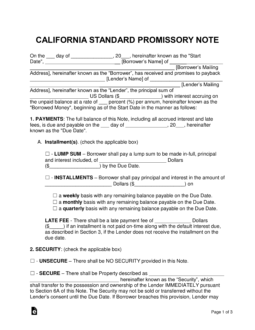

A California promissory note template is a document designed to add security and structure to agreements involving the lending of money between two parties. Included in the document are sections that address late fees, interest rates, details on both parties, and other sections involving pertinent information. Once the agreement has been completed and both parties sign the agreement the lender can start the collection of money from the borrower.

Table of Contents |

By Type (2)

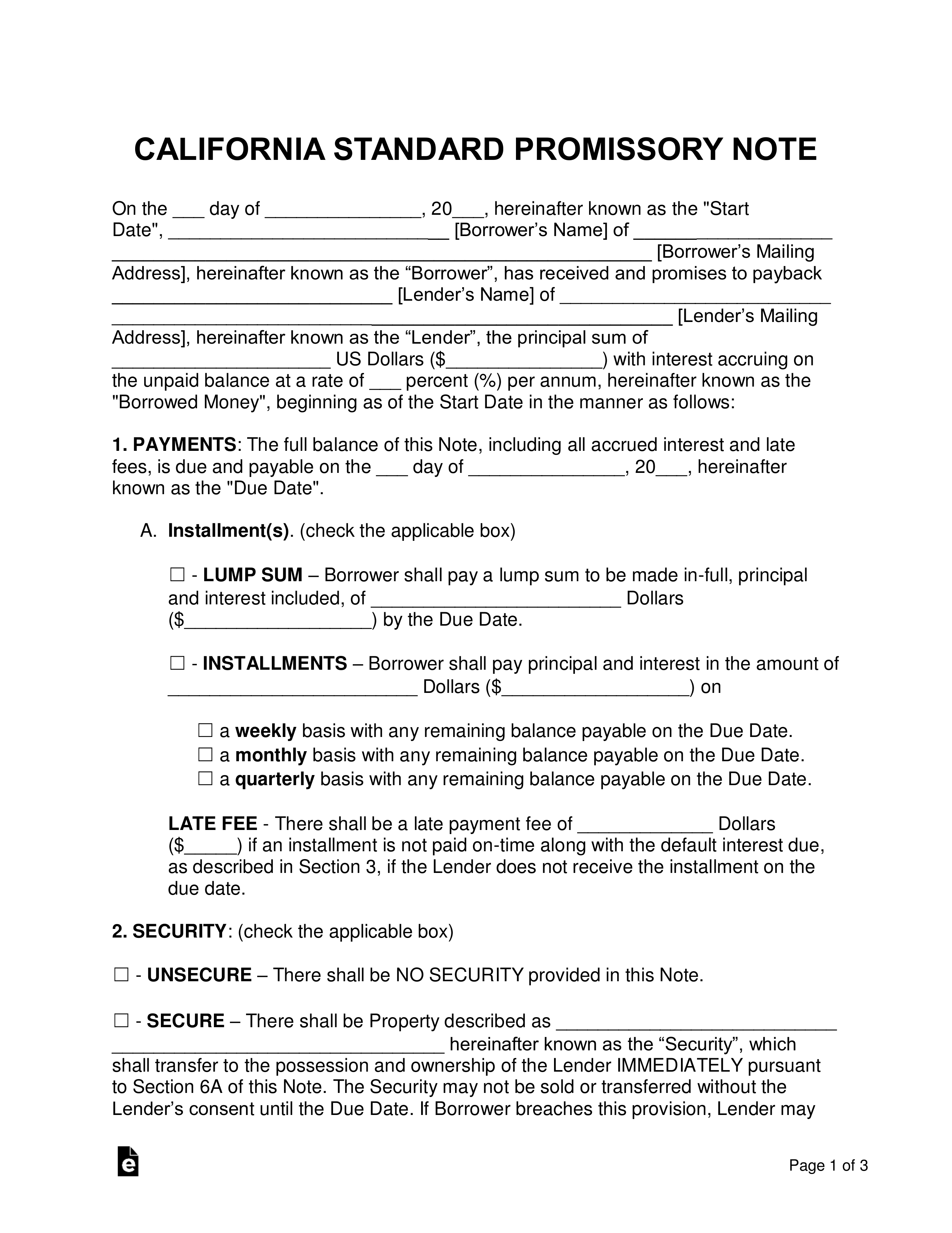

Secured Promissory Note – Provides a greater amount of security for the lender, as the borrower is required to layout an item or items that the lender receives in the case of a default.

Secured Promissory Note – Provides a greater amount of security for the lender, as the borrower is required to layout an item or items that the lender receives in the case of a default.

Download: PDF, MS Word, OpenDocument

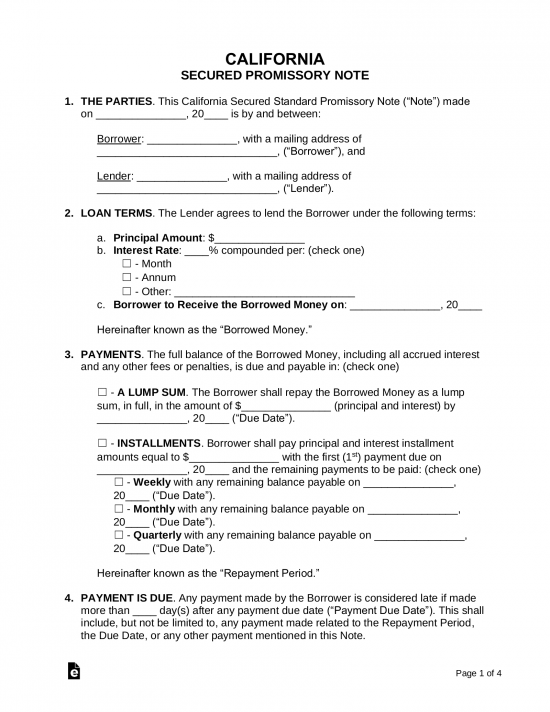

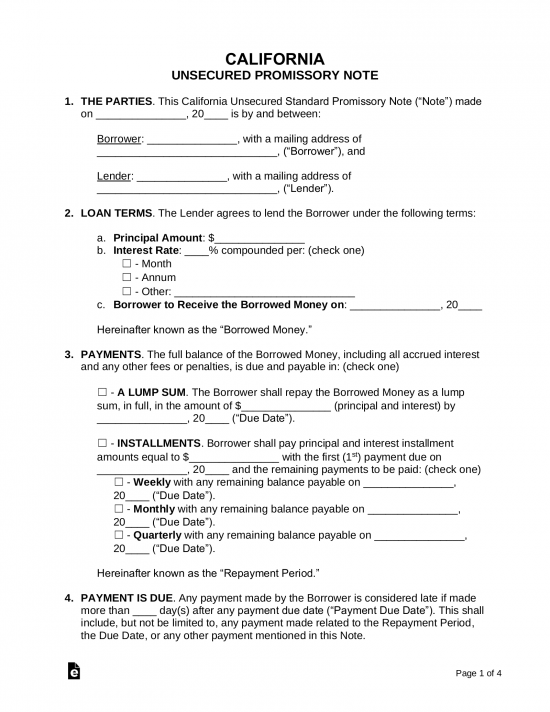

Unsecured Promissory Note – Preferred by close friends or family because of the lack of security, this unsecured promissory note should only be used when the borrower can be trusted to the highest degree.

Unsecured Promissory Note – Preferred by close friends or family because of the lack of security, this unsecured promissory note should only be used when the borrower can be trusted to the highest degree.

Download: PDF, MS Word, OpenDocument

Usury Statute

The rate of interest upon the loan or forbearance of any money, goods, or things in action, or on accounts after demand, shall be 7 percent per annum but it shall be competent for the parties to any loan or forbearance of any money, goods or things in action to contract in writing for a rate of interest:

(1) For any loan or forbearance of any money, goods, or things in action, if the money, goods, or things in action are for use primarily for personal, family, or household purposes, at a rate not exceeding 10 percent per annum; provided, however, that any loan or forbearance of any money, goods or things in action the proceeds of which are used primarily for the purchase, construction or improvement of real property shall not be deemed to be a use primarily for personal, family or household purposes; or

(2) For any loan or forbearance of any money, goods, or things in action for any use other than specified in paragraph (1), at a rate not exceeding the higher of (a) 10 percent per annum or (b) 5 percent per annum plus the rate prevailing on the 25th day of the month preceding the earlier of (i) the date of execution of the contract to make the loan or forbearance, or (ii) the date of making the loan or forbearance established by the Federal Reserve Bank of San Francisco on advances to member banks under Sections 13 and 13a of the Federal Reserve Act as now in effect or hereafter from time to time amended (or if there is no such single determinable rate of advances, the closest counterpart of such rate as shall be designated by the Superintendent of Banks of the State of California unless some other person or agency is delegated such authority by the Legislature).

No person, association, copartnership or corporation shall by charging any fee, bonus, commission, discount or other compensation receive from a borrower more than the interest authorized by this section upon any loan or forbearance of any money, goods or things in action.

However, none of the above restrictions shall apply to any obligations of, loans made by, or forbearances of, any building and loan association as defined in and which is operated under that certain act known as the “Building and Loan Association Act,” approved May 5, 1931, as amended, or to any corporation incorporated in the manner prescribed in and operating under that certain act entitled “An act defining industrial loan companies, providing for their incorporation, powers and supervision,” approved May 18, 1917, as amended, or any corporation incorporated in the manner prescribed in and operating under that certain act entitled “An act defining credit unions, providing for their incorporation, powers, management and supervision,” approved March 31, 1927, as amended or any duly licensed pawnbroker or personal property broker, or any loans made or arranged by any person licensed as a real estate broker by the State of California and secured in whole or in part by liens on real property, or any bank as defined in and operating under that certain act known as the “Bank Act,” approved March 1, 1909, as amended, or any bank created and operating under and pursuant to any laws of this State or of the United States of America or any nonprofit cooperative association organized under Chapter 1 (commencing with Section 54001) of Division 20 of the Food and Agricultural Code in loaning or advancing money in connection with any activity mentioned in said title or any corporation, association, syndicate, joint stock company, or partnership engaged exclusively in the business of marketing agricultural, horticultural, viticultural, dairy, live stock, poultry and bee products on a cooperative nonprofit basis in loaning or advancing money to the members thereof or in connection with any such business or any corporation securing money or credit from any federal intermediate credit bank, organized and existing pursuant to the provisions of an act of Congress entitled “Agricultural Credits Act of 1923,” as amended in loaning or advancing credit so secured, or any other class of persons authorized by statute, or to any successor in interest to any loan or forbearance exempted under this article, nor shall any such charge of any said exempted classes of persons be considered in any action or for any purpose as increasing or affecting or as connected with the rate of interest hereinbefore fixed. The Legislature may from time to time prescribe the maximum rate per annum of, or provide for the supervision, or the filing of a schedule of, or in any manner fix, regulate or limit, the fees, bonuses, commissions, discounts or other compensation which all or any of the said exempted classes of persons may charge or receive from a borrower in connection with any loan or forbearance of any money, goods or things in action.

The rate of interest upon a judgment rendered in any court of this State shall be set by the Legislature at not more than 10 percent per annum. Such rate may be variable and based upon interest rates charged by federal agencies or economic indicators, or both.

In the absence of the setting of such rate by the Legislature, the rate of interest on any judgment rendered in any court of the State shall be 7 percent per annum.

The provisions of this section shall supersede all provisions of this Constitution and laws enacted thereunder in conflict therewith.

(Sec. 1 amended Nov. 6, 1979, by Prop. 2. Res.Ch. 49, 1979.)