Updated July 27, 2023

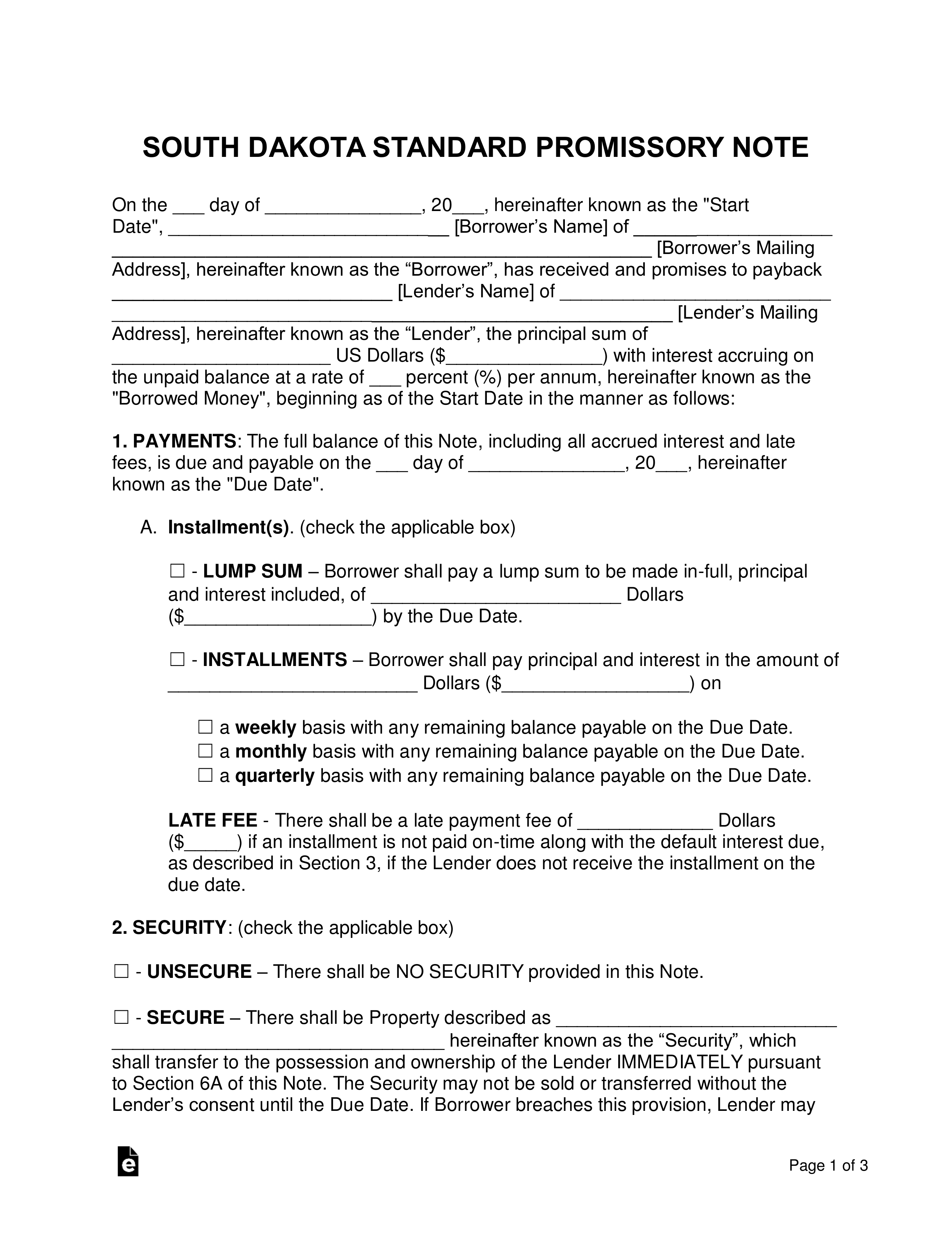

A South Dakota promissory note template binds a borrower and a lender into a legal deal requiring the borrower of a monetary balance to reimburse the lender in a scheduled and complete fashion. The lender in the transaction makes a profit by receiving interest on top of the original balance.

Table of Contents |

By Type (2)

Secured Promissory Note – Includes a section where the borrower sets aside an item such as a home, vehicle, or boat. This item is given to the lender to help cover the unpaid balance if the borrower is unable to recover after entering into default.

Secured Promissory Note – Includes a section where the borrower sets aside an item such as a home, vehicle, or boat. This item is given to the lender to help cover the unpaid balance if the borrower is unable to recover after entering into default.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – Does not include a section on security. This adds financial risk to the transaction for the lender; it is recommended that the lender is careful in selecting a borrower by ensuring the potential borrower has a strong credit score and positive referrals.

Unsecured Promissory Note – Does not include a section on security. This adds financial risk to the transaction for the lender; it is recommended that the lender is careful in selecting a borrower by ensuring the potential borrower has a strong credit score and positive referrals.

Download: PDF, MS Word, OpenDocument

Usury Statutes

Under an obligation to pay interest, no rate being specified, interest is payable from date of incurrence of debt, unless the parties have otherwise agreed, at a maximum rate of the Category C rate of interest as established in § 54-3-16, and in the like proportion for a longer or shorter term. In the computation of interest for less than a year, three hundred sixty days are deemed to constitute a year.

The official state interest rates, as referenced throughout the South Dakota Codified Laws, are as follows:

(1) Category A rate of interest is four and one-half percent per year;

(2) Category B rate of interest is ten percent per year;

(3) Category C rate of interest is twelve percent per year;

(4) Category D rate of interest is one percent per month or fraction thereof;

(5) Category E rate of interest is four percent per year;

(6) Category F rate of interest is fifteen percent per year; and

(7) Category G rate of interest is five-sixth percent per month or fraction thereof.