Updated March 25, 2024

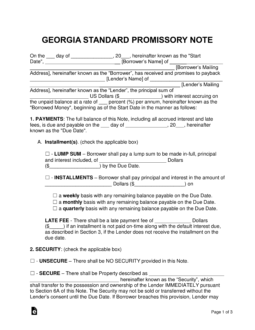

Georgia promissory note templates are a pair of documents structured to add legality and cohesiveness to a loan transaction between two parties. The documents are completely jointly by both the lender and borrower in the transaction. In the document, the parties will be required to agree on sections regarding payment types, due dates, late fees, and other areas of the agreement.

Table of Contents |

By Type (2)

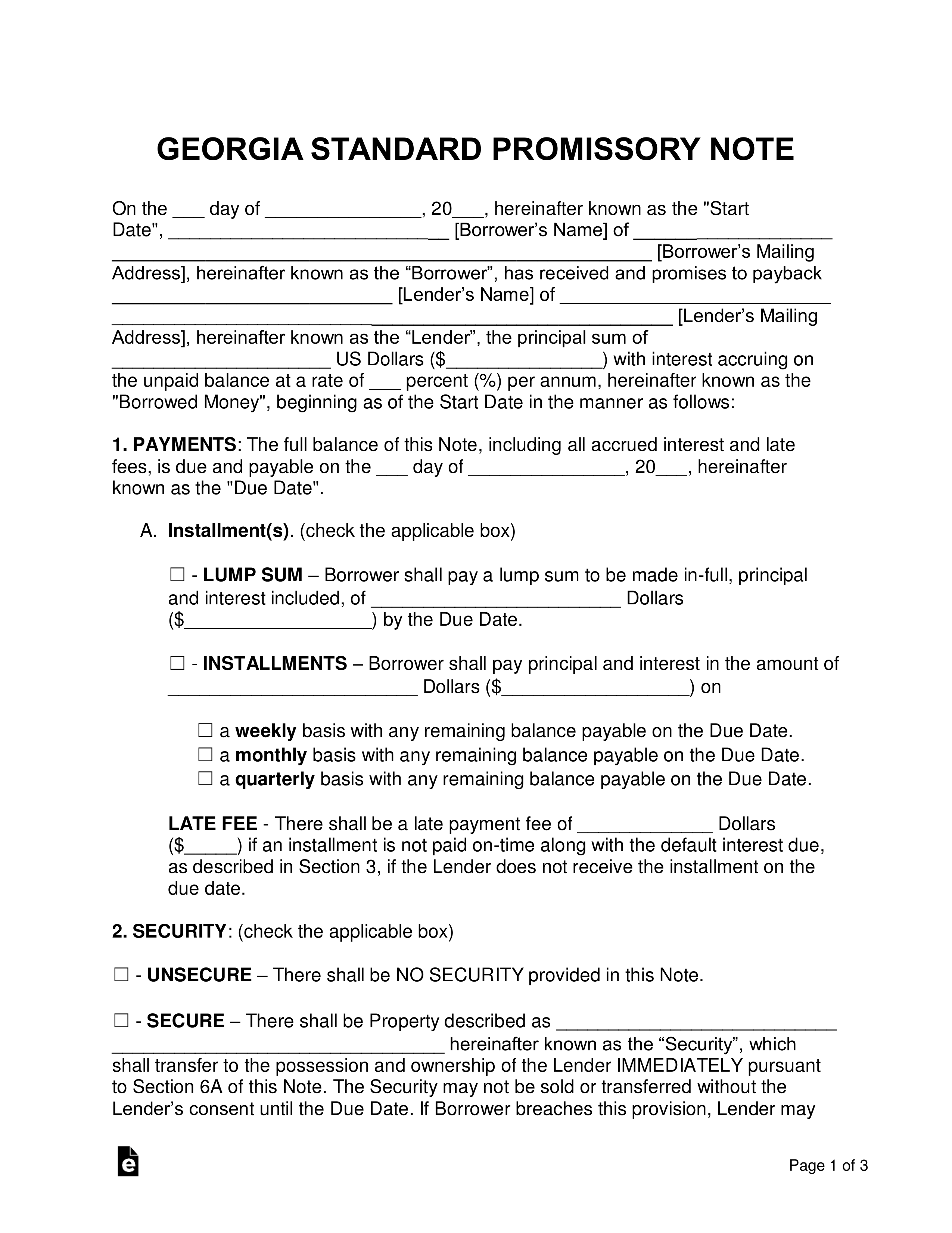

Secured Promissory Note – Gives the lender security in the case of a default on the balance. The borrower is required to set aside a possession such as a home, vehicle, or another worthy physical item. If the borrower ends up defaulting, the items in security will be given to the lender.

Secured Promissory Note – Gives the lender security in the case of a default on the balance. The borrower is required to set aside a possession such as a home, vehicle, or another worthy physical item. If the borrower ends up defaulting, the items in security will be given to the lender.

Download: PDF, MS Word, OpenDocument

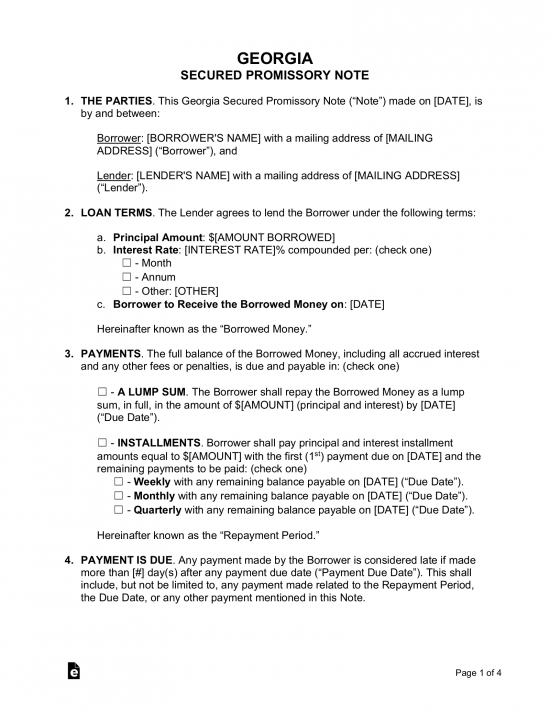

Unsecured Promissory Note – This document is very similar to the secured version, but differs in the amount of financial protection the lender has in the agreement. If the borrower defaults, the lender will have no immediate way to receive his or her money.

Unsecured Promissory Note – This document is very similar to the secured version, but differs in the amount of financial protection the lender has in the agreement. If the borrower defaults, the lender will have no immediate way to receive his or her money.

Download: PDF, MS Word, OpenDocument

Usury Statute

(A) The legal rate of interest shall be 7 percent per annum simple interest where the rate percent is not established by written contract. Notwithstanding the provisions of other laws to the contrary, except Code Section 7-4-18, the parties may establish by written contract any rate of interest, expressed in simple interest terms as of the date of the evidence of the indebtedness, and charges and any manner of repayment, prepayment, or, subject to the provisions of paragraph (1) of subsection (b) of this Code section, acceleration, where the principal amount involved is more than $3,000.00 but less than $250,000.00 or where the lender or creditor has committed to lend, advance, or forbear with respect to any loan, advance, or forbearance to enforce the collection of more than $3,000.00 but less than $250,000.00.

(a) Any person, company, or corporation who shall reserve, charge, or take for any loan or advance of money, or forbearance to enforce the collection of any sum of money, any rate of interest greater than 5 percent per month, either directly or indirectly, by way of commission for advances, discount, exchange, or the purchase of salary or wages; by notarial or other fees; or by any contract, contrivance, or device whatsoever shall be guilty of a misdemeanor; provided, however, that regularly licensed pawnbrokers, as defined in Code Section 44-12-130, are limited in the amount of interest they may charge only by the limitations set forth in Code Section 44-12-131.