Updated September 15, 2023

An Oklahoma bill of sale records a transaction for property between 2 parties (buyer and seller). It must include the parties’ details, cash or trade, a description of the property sold, and the date of sale. Afterward, the buyer can use the bill of sale to register the property with the state (if needed).

Forms (4)

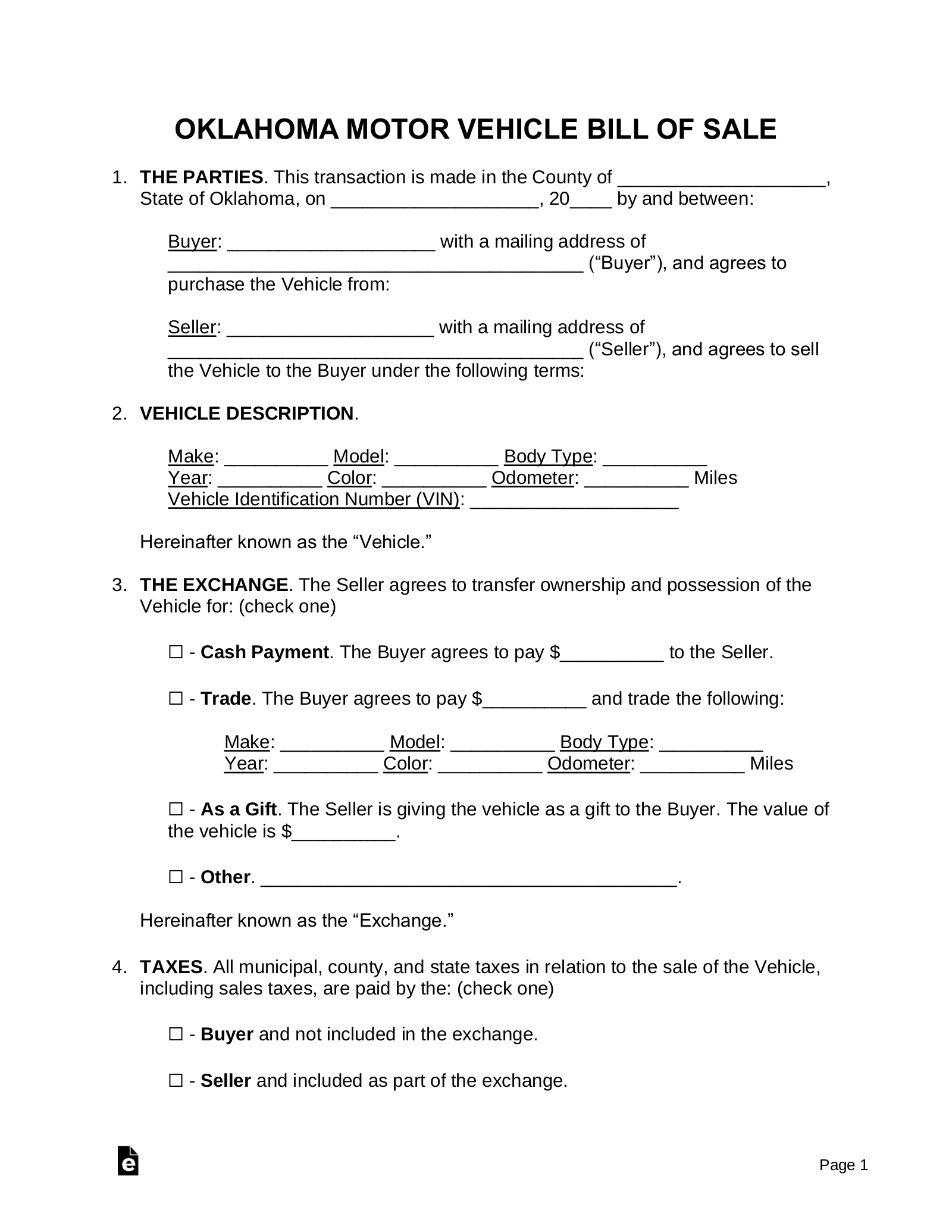

Vehicle Bill of Sale – This form will show that a motor vehicle in Oklahoma has been legally sold and purchased, and there has been a change of ownership. This form is often required as a part of the registration process and will require notarization. Vehicle Bill of Sale – This form will show that a motor vehicle in Oklahoma has been legally sold and purchased, and there has been a change of ownership. This form is often required as a part of the registration process and will require notarization.

Download: PDF, MS Word, OpenDocument |

Boat Bill of Sale – Used to prove the legal sale and purchase of a motorboat, sailboat, or other watercraft. Boat Bill of Sale – Used to prove the legal sale and purchase of a motorboat, sailboat, or other watercraft.

Download: PDF, MS Word, OpenDocument

|

Firearm Bill of Sale – This document will be provided to prove the legal sale and purchase as well as change of ownership of a firearm Firearm Bill of Sale – This document will be provided to prove the legal sale and purchase as well as change of ownership of a firearm

Download: PDF, MS Word, OpenDocument |

General Bill of Sale – To be used by two private parties that buy and sell personal property. General Bill of Sale – To be used by two private parties that buy and sell personal property.

Download: PDF, MS Word, OpenDocument |

Vehicle Registration Forms

- A Bill of Sale drafted by agreement between the buyer and the seller, or a notarized Declaration of Vehicle Purchase Price;

- If seeking an original Oklahoma title:

- The manufacturer’s certificate of origin, if a new vehicle purchased in-state, or the out-of-state title if a used vehicle purchased from another state;

- If the vehicle has been purchased from another state, it will need proof of inspection from an Oklahoma Tag Agent.

- A completed Application for Oklahoma Certificate of Title for a Vehicle (Form 701-6);

- The manufacturer’s certificate of origin, if a new vehicle purchased in-state, or the out-of-state title if a used vehicle purchased from another state;

- If seeking a transfer of Oklahoma title, such as with a used vehicle purchased in-state, the current title has been transferred to you.

- Odometer Disclosure Statement. Note that this may not be necessary if the vehicle being sold is at least ten (10) years old;

- A valid driver’s license;

- Lien documentation, if the vehicle is subject to a lien, such as one being purchased with financing or one that was previously purchased with financing:

- The Lien Section of the Motor Vehicle Division can enter, release and verify a lien on a vehicle;

- If a lien is not released, it will follow the vehicle and be reflected in the buyer’s new title;

- If the lienholder is releasing the lien, two signed copies of a Release of Lien form are needed: one to be sent to the State Tax Commission, the other to be given to the debtor;

- For more information about motor vehicle liens, see Form FL-21;

- Verification of liability insurance.[1] Check verification status.

- Excise and sales taxes[2] and applicable title and registrations fees in addition to any delinquent taxes, fees, interest, and penalty associated with the plate.

- If an agent is purchasing the vehicle on the new owner’s behalf, then a Motor Vehicle Power of Attorney is needed;

- Registration Fees; and

- Title Fees.

Boat Registration Forms

- A completed Application for Certificate of Title for a Boat or Outboard Motor (Form BM-26);

- A Bill of Sale;

- If the boat was previously titled in Oklahoma, a Boat or Outboard Motor Serial Number Confirmation (Form BM-10), completed by the seller;

- If the boat was previously titled in another state, the out-of-state title, and proof of inspection by an Oklahoma tag agent;

- If the boat was purchased new from a dealer, a manufacturer’s statement of origin (MSO) if the boat has been purchased new; and

- Payment of excise tax,[3] titling fee, registration fee, and, if applicable, other miscellaneous fees.